The EU has set an aggressive 40GW target for electrolyser deployment by 2030. The majority of this volume is now backed by individual country targets. But there is a big difference between announcing lofty targets and deploying capital to achieve them.

“A green hydrogen investment case is driven by integrated system economics…

..not standalone electrolyser economics”

It is still early days in the definition of viable investment cases and business models for green hydrogen. But things are moving quickly and there are some large & committed companies focused on making it happen.

In todays’ article we set out some insights from the work we are doing supporting the development of a range of green hydrogen project investment cases. We focus on 5 factors likely to impact how capital will be deployed into green hydrogen across the next few years.

1. Investment cases are built on an integrated flexible system

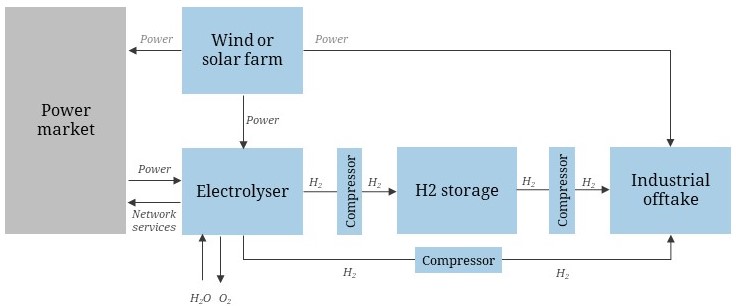

A green hydrogen investment case is not just about an electrolyser. It is built on the economics of an integrated flexible energy system as illustrated in Chart 1.

Chart 1: Illustration of an integrated green hydrogen energy system

Source: Timera Energy (note: compression stages are illustrative & depend on the electrolyser, storage pressure & pressure needed for offtake).

A typical system is likely to consist of the following core components:

- Power production: a co-located renewable power production source e.g. PV or wind farm

- Grid connection: enabling power market access e.g. to export surplus power, import supplemental low cost power & earn incremental revenue from providing flex services to the grid

- Electrolyser: enabling flexible H2 production

- H2 storage: buffering H2 demand vs production

- H2 & power offtake: a local source of H2 & power demand, typically with a unique set of offtake requirements.

The electrolyser is an integral asset within this flexible system. But a green hydrogen investment case is driven by integrated system economics not standalone electrolyser economics. In this sense it is similar to a co-located battery project, but more complex because of the interaction with hydrogen storage and offtake requirements.

2. Credible hydrogen investment starts with high value offtake

Hydrogen is substantially more expensive to produce than alternative fuels. Even before you consider infrastructure capex, high costs are a reality driven by:

- The cost of input energy (electricity in the case of green hydrogen)

- Conversion efficiency losses (current electrolyser efficiencies are mostly in a 60-70% range depending on tech)

- Other losses e.g. from compression, storage & transportation.

High costs drive the requirement for high value offtake. The most promising initial applications include specialty steel & chemical processes and the displacement of existing grey hydrogen demand. Hydrogen usage is supported by the fact that these processes are very difficult to electrify.

Hydrogen usage may broaden to cover other industrial process heat applications, heavy transport and peak power generation, to the extent that these cannot be more effectively by dealt with via electrification.

Even with a high value offtake source, investment economics currently depend on significant policy support, as was the case for wind & solar 20 years ago. Clarity around the structure of this support is currently the biggest hurdle preventing larger scale deployment of capital. But that is changing fast in some areas of Europe, particularly where governments have set tangible 2025 and 2030 electrolyser targets.

3. Green hydrogen value is as much about storage as it is about electrolysers

There is no hydrogen market where production can be sold, something that will remain the case for many years. This means that a local source of hydrogen offtake is usually an integral part of a green hydrogen project.

Offtake requirements are typically complex, with a specific set of costs & constraints e.g. driven by industrial process requirements. These dictate key factors such as hydrogen demand volume flexibility and the cost of interruption (which is usually high).

Hydrogen storage is typically a very valuable part of a green hydrogen system as it breaks the direct linkage between production & offtake and acts as outage insurance. In other words storage facilitates the separation of timing & volume decisions for production, from those required by the offtaker.

Another factor that supports the value of storage is that it is substantially cheaper to store hydrogen than power. Given green hydrogen economics depend on accessing low cost power (e.g. during periods of surplus renewables), the ability to store this ‘cheap energy’ as hydrogen can be a big advantage.

The benefits of storage come both in terms of producing lower cost hydrogen and in providing flexibility services to power networks (e.g. balancing & congestion management in periods of high wind & solar output). Hydrogen storage represents a longer duration alternative to batteries for storing surplus renewable energy. Storage options range from small to large tanks/vessels to underground salt cavern storage.

4. Electrolysers have investment parallels to batteries

It is no coincidence that in many cases companies investing in batteries are also looking at green hydrogen. There are several parallels between the two technologies:

- Colocation of flexible assets with renewables (wind & solar)

- Optimisation of asset flexibility in the power market

- Revenue stacking e.g. from network & balancing services

- Challenges of configuring, sizing & optimising storage

- Similar trading & market access capability requirements.

From a market value driver perspective, both battery & green hydrogen projects have an important exposure to power price shape & volatility:

- Electrolysers: sourcing low cost power is key for project economics and depends on optimisation across co-located renewables & the power market (during low priced periods)

- Batteries: ability to move power between low & high priced periods is key (and is driven by power price shape & volatility).

The other interesting dynamic from an investment perspective is that both technologies have risk diversification benefits for renewable portfolios. These come via negative or anti-correlated returns to wind & solar assets e.g. price cannibalisation hurts wind & solar but benefits both batteries & electrolysers.

5. Robust analysis underpins a viable investment case

A robust green hydrogen investment case is underpinned by the effective quantification of value & risk from the flexible interaction between system components.

Traditional Base / High / Low scenario modelling of green hydrogen project margins does not work. It is a bit like trying to conduct brain surgery with a blindfold and an axe.

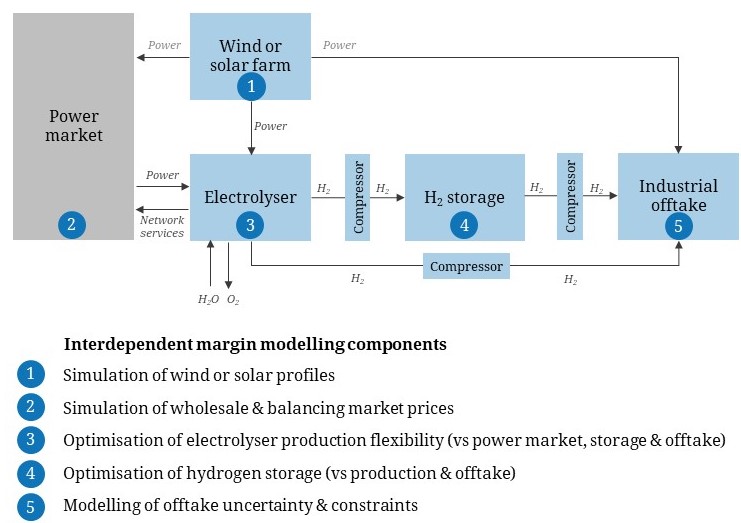

The reason for this is that green hydrogen project value is driven by the interaction between complex and interdependent components as shown in Chart 2.

These require a sophisticated analytical framework that includes (i) simulation of key sources of uncertainty (e.g. renewable output, power prices and H2 demand) & (ii) system optimisation under each simulation generate margin distributions.

For example electrolyser dispatch needs to be optimised against RES output and wholesale & balancing prices. It also needs to be optimised alongside hydrogen storage against offtake requirements.

Several of these factors are uncertain (e.g. RES output, power prices & even offtake requirements). Simulation based modelling (e.g. 500+ correlated sims) confronts this uncertainty and enables distribution analysis of asset margin over time.

The energy industry is a long way from defining a viable generic investment case for green hydrogen. But the type of analysis described above helps to optimise project component sizing & configuration, analyse risks and project value distributions. It is also key to defining the structure & level of policy support required to earn a viable return on what is still a very nascent technology.

Timera is recruiting We are actively looking for new people to join the Timera team across a range of roles. Two specific ones we are currently targeting:

- Senior Analyst (Power) – strong practical knowledge of European power markets and value drivers of flexible assets, particularly storage & batteries.

- Senior Analyst (LNG) – strong experience of LNG portfolio commercial & value drivers / risk / analytics.

We offer very competitive packages as well as the ability to directly participate in company value upside. We offer significantly more flexibility & autonomy than other companies, covering e.g. location, work hours & remuneration structure.

Timera has an open, innovative & entrepreneurial environment and we work on a variety of stimulating analytical challenges across the rapidly evolving energy industry.

See here for more details timera.sobold.dev/careers or email us at recruitment@timera-energy.com