2020 is vying for the prize as the most turbulent year in the history of hydrocarbon markets.

“Spot cargos are floating past China and India at 2 $/mmbtu. That is an 80% discount on two years ago and it incentivises demand response.”

Oil demand has plunged as Covid-19 spread globally. Data is pointing to a more than 25% year-on-year decline in global oil demand in Apr-2020. Across the full 2020 year, demand could fall more than 10%, a huge hit compared with any historic precedents. The impact of Covid-19 on oil demand has been particularly acute because of the sudden stop in transport related demand, particularly in the aviation sector.

The virus impact on global gas demand is different in nature. Residential gas demand is quite resilient to economic shocks, compared to industrial demand which is closely linked to economic growth. Power sector gas demand depends on relative fuel pricing and the level of power demand (also linked to economic activity).

The IEA is forecasting a more than 5% decline in global gas demand across 2020, although this is guesswork at best given current economic uncertainty. But would a decline in global gas demand pull down LNG demand by a similar proportion?

In today’s article we focus on the impact of Covid-19 on LNG demand. Specifically we focus on Asian demand as the primary driver of the evolution of LNG market balance. We look at 5 charts that illustrate the evolution of actual demand data so far in 2020.

These charts paint a very different picture to the oil market. They also hint at LNG demand being more resilient than global gas demand in the face of the current economic shock… at least so far.

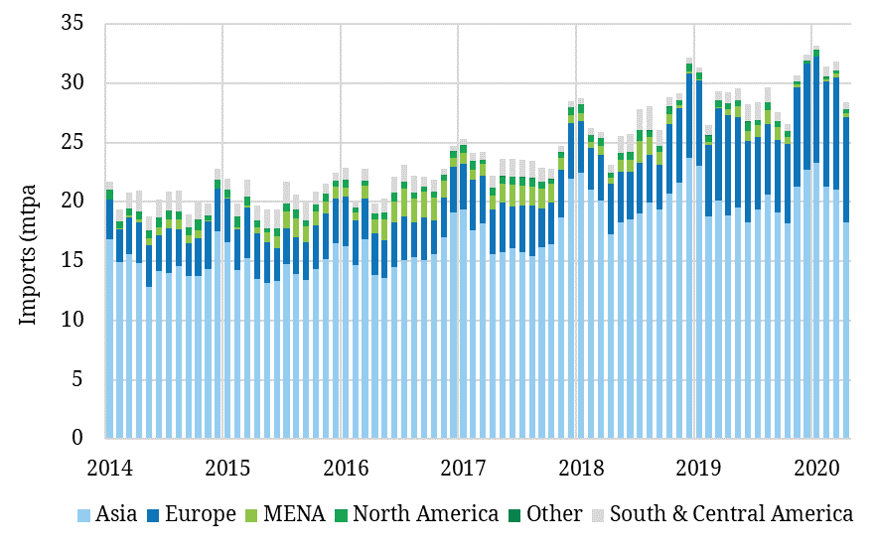

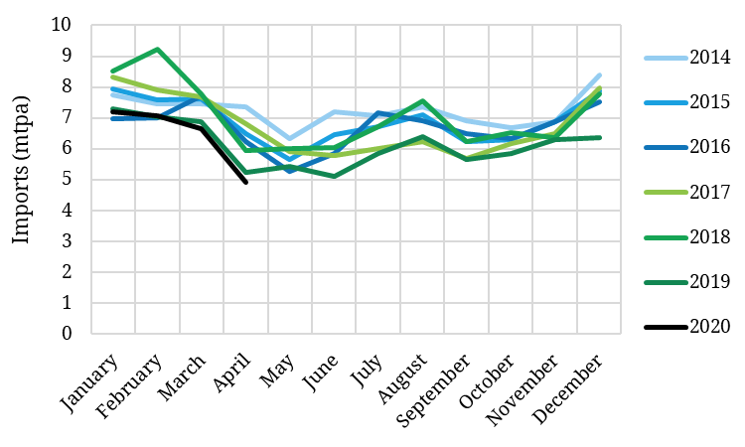

Chart 1: Global LNG demand in a 5 year context

Source: LNG Unlimited, Timera Energy

Asia has been the main driver of growth in global LNG demand across the 2015-18 period. However Asian demand growth ground to a halt in 2019. 2019 was also the peak year of supply growth from the current wave of new LNG liquefaction projects.

By the end of 2019, the combination of large volumes of new supply and negligble demand growth, had already pushed the LNG market in a state of pronounced oversupply and declining prices. The 2020 demand impacts of Covid-19 need to be considered in this context.

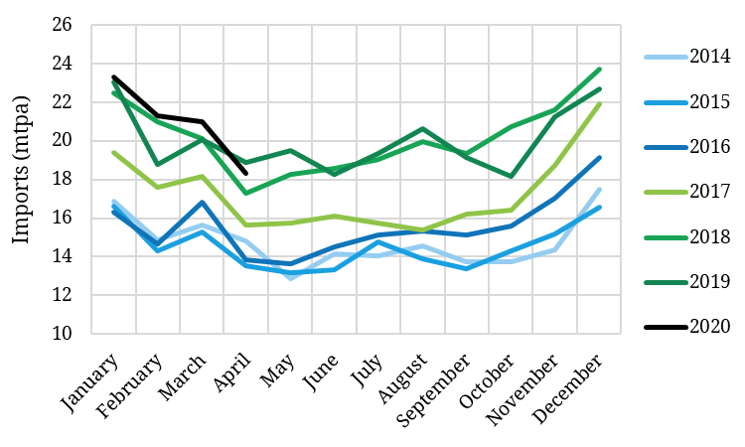

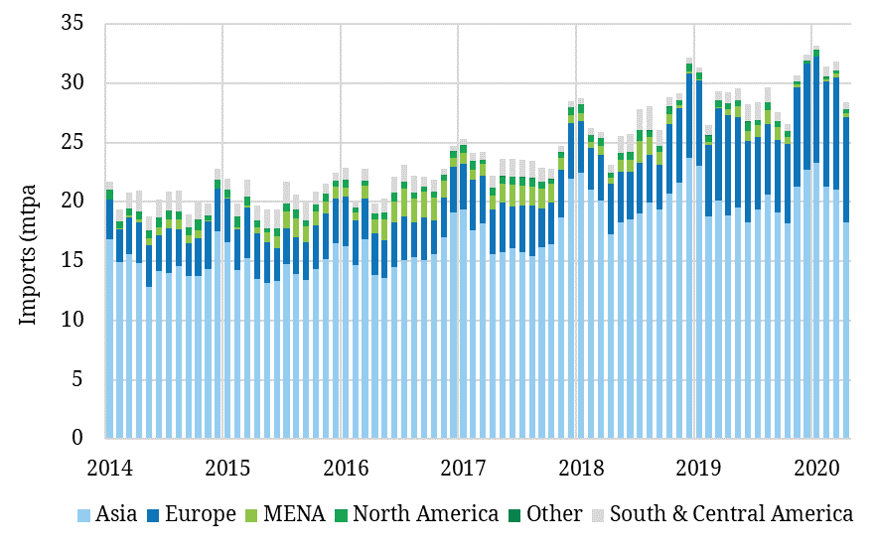

Chart 2: Monthly Asian LNG demand growth (year on year)

Source: LNG Unlimited, Timera Energy

The black line shows the path of Asian LNG demand so far in 2020. Demand is actually running 4% above the first four months of 2019, despite the impact of Covid-19. On first observation this seems somewhat implausible. But there are some important factors in play behind the headline numbers.

There is considerable LNG supply chain & contractual inflexibility within a 2-3 month horizon that means LNG cargo deliveries may be locked in, even against a backdrop of sharply falling gas demand. As a result, large Asian buyers have been filling available storage capacity, as well as trying to divert deliveries where possible (e.g. PetroChina’s attempts to call force majeure on some LNG contract volumes).

So considerable uncertainty remains as to the path of Asian LNG demand across the remainder of 2020, but so far the data has been pretty resilient to the Covid-19 shock.

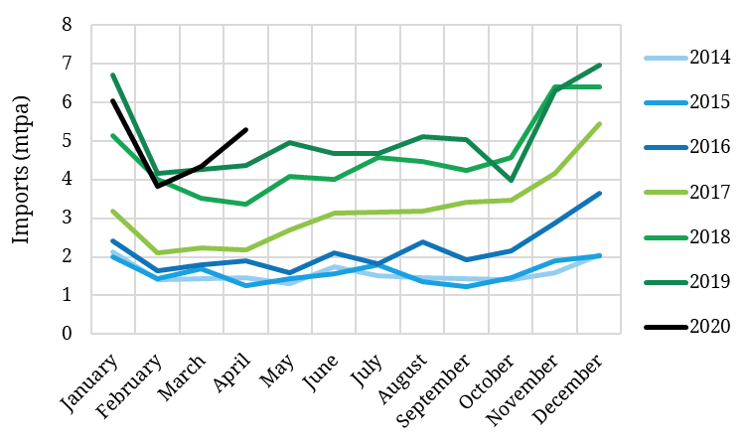

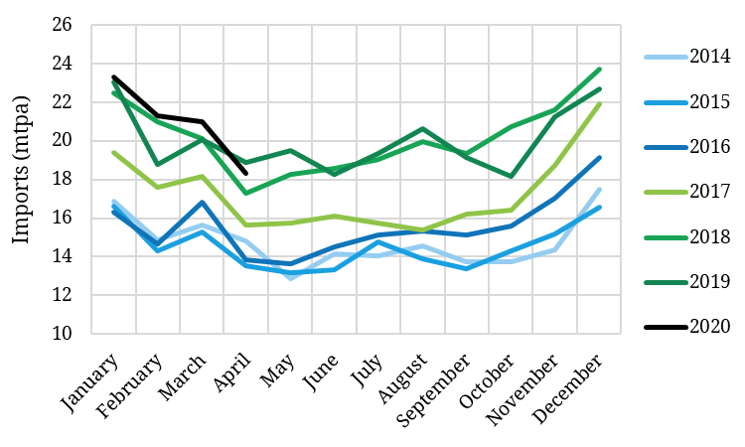

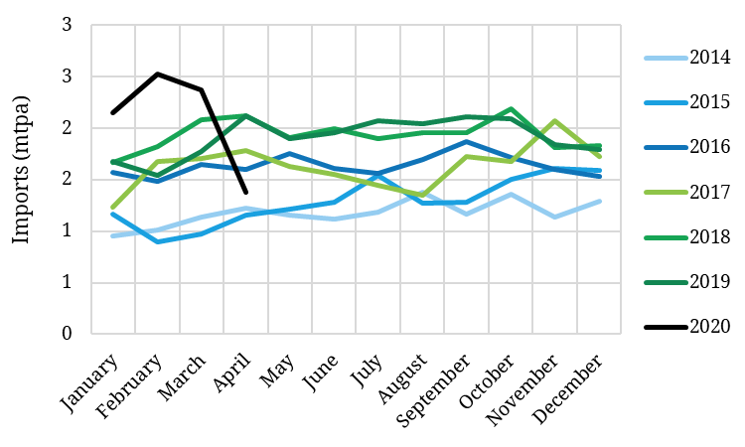

Chart 3: Has the China dip already happened?

Source: LNG Unlimited, Timera Energy

Chinese LNG demand is particularly important because China has (i) been the engine room of Asian LNG demand growth across the last 5 years and (ii) been impacted sooner and to a greater extent by Covid-19 than other Asian countries.

Chart 3 shows a Feb-2020 dip in demand coinciding with the peak shutdown period, followed by a recovery in volumes in Mar & Apr 2020. Across the first 4 months of 2020, Chinese LNG demand is similar to 2019, despite the impact of Covid-19.

Chinese buyers have also been in the market across the last 4 weeks purchasing spot cargoes. This points to price responsive demand given record low prices (JKM currently around 2.50 $/mmbtu).

Accurate data on Chinese gas demand and storage inventories is notoriously difficult to come by. But there is no doubt that behind these resilient LNG demand numbers, underlying Chinese gas demand has fallen and storage inventories are likely to be high. Gas demand growth is vulnerable to depressed economic activity in China’s manufactured goods export markets (dampening industrial sector gas demand).

The key uncertainty across the remainder of 2020 is how fast the Chinese economy bounces back to support incremental LNG demand growth. There are three factors that may help here:

- China’s current easing of shutdown restrictions should drive at least a sharp temporary recovery in GDP across Q2-Q3 2020

- The competitive dynamics of imported gas have improved significantly given very low spot LNG prices (even if domestic gas prices in China do not yet fully reflect this)

- China has reportedly taken a more open stance on liberalising gas market access, which should support second tier players to take advantage of lower LNG spot prices.

Estimates for Chinese GDP growth in 2020 are currently around 2.0-3.5% (vs 6.1% in 2019). That suggests an annual decline in Chinese gas demand of at least 5%. But the impact on LNG demand may be significantly less than this given the mitigating factors above.

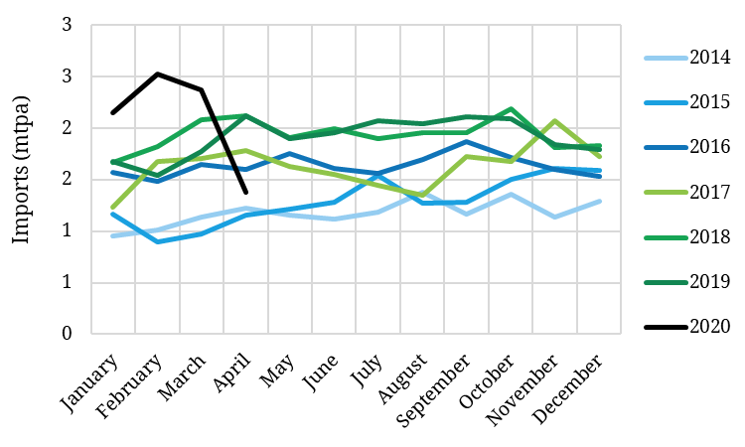

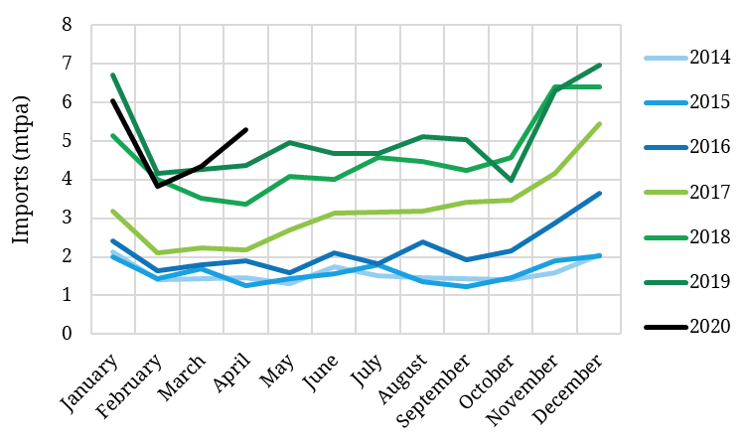

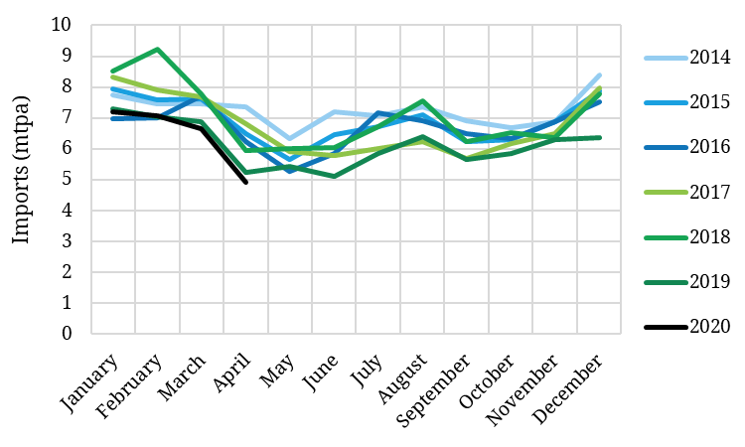

Chart 4: Evidence of Indian demand response to low prices

Source: LNG Unlimited, Timera Energy

Indian LNG demand surged in Q1 2020, up more than 40% y-o-y. There is again quite compelling evidence of demand response to low spot LNG prices behind this jump. For example, delivered cargo prices of around 2 $/mmbtu into India can drive genuine competitive substitution towards gas in the power sector.

The Indian virus lockdown started in late March. That is evident in the substantial monthly decline in Apr demand. The lockdown appears set to ease later in May which should support some demand recovery going forward.

But even in May, Indian buyers have been behind the recovery in Asian spot LNG prices across the last two weeks. Spot cargos are floating past China and India at 2 $/mmbtu. That is an 80% discount on two years ago and it incentivises demand response.

Chart 5: Japan demand surprisingly resilient (as is Sth Korea & Taiwan)

Source: LNG Unlimited, Timera Energy

Japan is the biggest of the traditional ‘JKT’ Asian markets. 2019 saw relatively weak Japanese demand for LNG. LNG demand across Q1 2020 was very similar to 2019, although a Japanese state of emergency was not declared until Apr.

It is likely that Japanese gas demand has been hit significantly harder than the LNG data shows. This is consistent with reports of very high tank storage levels as cargoes have flowed into inventory. This dynamic could flag further declines to come as Japanese buyers are forced to divert/defer deliveries given storage constraints. Japan is so far the weakest of the ‘big 5’ Asian buyers in 2020, but there is not yet any evidence of a substantial LNG demand shock.

The other two members of the JKT club, both saw increases in y-o-y demand in Q1 2020. South Korea was reportedly a big buyer of cheap spot cargoes in Q1, although with demand falling Apr. Taiwan (which has been less impacted by Covid-19) has also seen a small increase in year to date demand.

What to watch going forward

There are three factors we are watching to gauge the impact of Covid-19 on Asian LNG demand as 2020 progresses

- Lockdown easing: underlying gas demand should recover sharply as lockdown measures ease, even if levels are lower than pre-virus

- Price response: spot cargoes are very cheap – the level of competitive substitution and price responsive demand will be key

- Storage inventories: Part of the resilience on LNG demand so far has been the tank storage ‘shock absorber’ – this dynamic disappears when tanks are full so inventory levels bear watching closely

The data we show in the charts above only covers the first third of 2020. If the trend in Asian LNG demand resilience is to be disrupted, it will mostly likely occur across May to Jul 2020 as the economic impact of lockdown measures impact. Watch out for weak demand numbers across the next 3 months.

But Covid-19 is fuelling a pervasive bearishness around LNG market demand that may prove to be one of the factors underpinning the start of a multi-year price recovery this summer.