The sharp decline in gas hub prices in 2016 is starting to reshape the landscape for flexible supply infrastructure in European gas and power markets. CCGT load factors are on the rise as coal plants are being displaced from the merit order. Spot gas price volatility is also showing early signs of recovery despite an oversupplied European gas market.

2016 may mark the start of an evolving relationship between CCGT load factors and gas price volatility. Falling CCGT load factors have been the main driver of the slump in European gas demand this decade. So increasing gas plant competitiveness is starting to support a recovery in power sector gas demand.

In addition as gas prices fall CCGTs play a more prominent role in setting marginal power prices. This means CCGTs provide more of the marginal flexibility required to back up short term swings in intermittent renewable output. So swings in CCGT gas demand are in turn supportive of higher prompt gas price volatility.

In today’s article we explore whether a recovery in CCGT load factors across Europe could support a more structural recovery in gas price volatility.

The UK leading a 2016 CCGT recovery

As gas hub prices fall, CCGT load factors are increasing significantly in 2016 versus last year. This is particularly the case in markets where gas plants play a more important role in setting marginal prices e.g. in the UK and Italy.

We like to focus on the UK power market as a barometer for gas vs coal switching in Europe. It plays the role of ‘canary in the coal mine’ for increasing gas plant competitiveness given:

- The dominance of CCGT plants in setting power prices

- The UK carbon price floor policy that acts to disadvantage coal plants

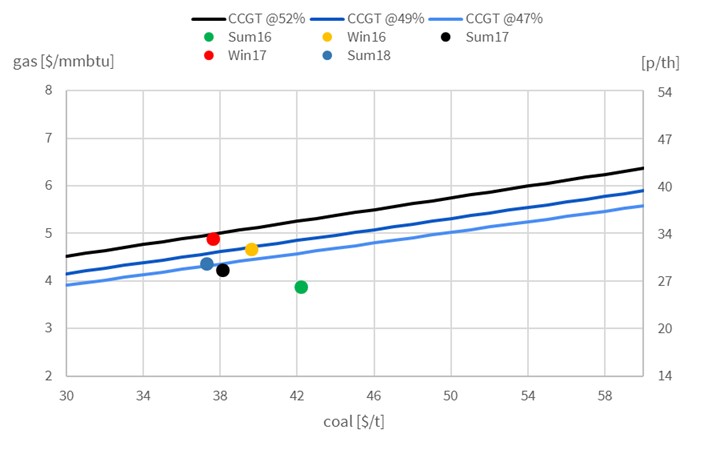

Chart 1 provides a snapshot of gas vs coal plant competitiveness in the UK power market based on current forward curve pricing for power, gas, coal and carbon. A few notes on the chart:

- The chart shows different combinations of gas (vertical axis) and coal (horizontal axis) prices

- The coloured dots show current forward curve combinations of gas and coal prices for different seasonal forward contracts from 2016-18

- The sloping lines mark the gas vs coal switching boundaries between CCGT plants with different efficiencies (47%, 49% and 52% HHV efficiency) and coal plants (with 36% efficiency)

- When a coloured dot sits below the gas vs coal switching boundary it means over that time horizon, CCGTs are displacing coal plant in the merit order (at current forward prices)

The chart shows the UK’s top tranche of newer CCGTs (@52% efficiency) displacing coal plants (@36% efficiency) to run baseload. The second tranche of CCGTs (@49% efficiency) are also displacing coal plants in summer periods. The third tranche of CCGTs (@47% efficiency and below) are providing peaking flexibility.

Falling gas prices are pointing towards the majority of the UK CCGT fleet coming back into merit during summer 2016. The impact of this CCGT displacement of coal plants is likely to be a materially higher UK gas demand in 2016.

The effect of lower gas prices on CCGT load factors is not isolated to the UK. Baseload spark spreads have also been positive in Italy this winter (partly due to relatively low hydro levels), causing a step up in CCGT load factors. Despite mild and windy weather in North-West Europe, there has also been a recovery in gas plant load factors in markets such as France, Belgium and the Netherlands (although baseload spark spreads remain in negative territory).

But gas vs coal switching is still an evolving story in Europe. Hub prices remain under heavy pressure into the coming summer. European gas storage inventories remain at unseasonably high levels into the spring, which will reduce gas demand for storage injection over the summer. European hubs also face a ramp up in LNG imports as Asian spot prices have again slumped under 5 $/mmbtu. These factors point to higher CCGT load factors and gas demand as the year progresses.

Why this is important for gas flexibility value

CCGT load factors form an important source of demand for gas flexibility services. Falling CCGT load factors across the first half of this decade have been the primary cause of an almost 20% fall in European gas demand. The decline in power sector gas demand has contributed to a slump in spot gas price volatility, the market price signal for gas supply flexibility.

A recovery in CCGT load factors across Europe should support spot gas price volatility and the value of supply flexibility. This is particularly true for the rapid response gas deliverability required to support sharp swings in CCGT load factors (e.g. from fast cycle storage).

CCGTs are a key transmission mechanism for prompt price volatility from the power to the gas market. As CCGTs come back into merit, gas swing demand rises to support the ramping up and down of CCGTs in response to shorter term swings in market conditions.

The role of CCGTs in providing flexibility is also set to be supported by the closure of many of Europe’s less efficient coal plants over the next five years. Lower gas prices are rapidly eroding coal plant margins to levels below plant fixed costs. This will be reinforced by German nuclear plant closures early next decade.

Uncertainty remains around the timing and pace of an increase in spot gas price volatility and the value of supply flexibility. But watch for a resurgence in CCGT load factors as an indicator of the start of a structural recovery.

Article written by David Stokes, Olly Spinks & Emilio Viudez