Carlton Power was the only bidder in the UK’s first power market capacity auction that secured a capacity agreement to build a new CCGT (in Dec 2014). Carlton Power’s Trafford CCGT, a 1520 MW project in Manchester, received a 15 year agreement at the clearing price of 19.40 £/kW.

But the Trafford plant was bid into the capacity auction without finance and without a long term tolling agreement to back it. An interview Carlton Power did with the Telegraph last week suggests that the project is struggling to secure an offtake contract and financing and may not be able to deliver against its 2018/19 capacity agreement.

The problems associated with Trafford highlight the challenges that CCGT developers face given current weakness in generation margins. A 19.40 £/kW annual capacity payment barely covers the direct fixed costs of a new CCGT. So making a Financial Investment Decision on a new plant means finding someone to take on the market risk around the substantial recovery in energy margin required to make the project profitable. It appears that lenders and tolling counterparties are reticent to take on that risk.

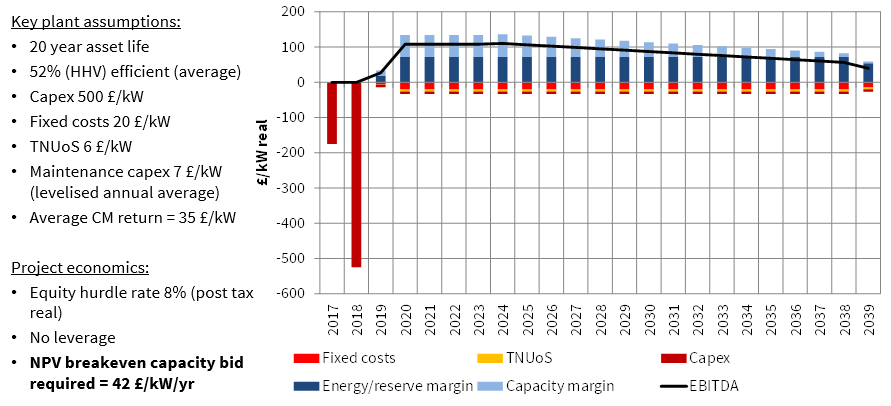

Challenging economics at £19 capacity price

It has not all been bad news for CCGT project developers. They have benefited from falling capex costs as turbine manufacturers slash unit costs and bulk up guarantees in order to try and recover sales. Whereas 5 years ago benchmark CCGT costs were around 700 £/kW, project developers are now claiming costs can be reduced to around 500 £/kW.

But even with capex this low, our analysis indicates a generic new build CCGT project needs more than 40 £/kW under a 15 year capacity agreement in order to be economic. Chart 1 provides an overview of this analysis. There may be some benefits that specific projects can claim to reduce this (e.g. locational reduction of TNUoS), but these are unlikely to mean more than a 5-10 £/kW reduction in required capacity payment.

Tough to get a toll & finance

The big six UK utilities are the natural buyers of tolling agreements. But most of these portfolios already have significant existing exposure to CCGT margins via their own generation fleet. A number of utilities are also sitting on their own CCGT development options.

Historically, banks and commodity traders have also been potential tolling counterparties. But these players are pulling back on long term power price exposure driven by balance sheet constraints and tougher regulatory measures. This is contributing to the shrinking availability of market participants even willing to discuss longer term tolling contracts.

Market players are also increasingly wary of taking on tolling contract exposure beyond a 5 year duration. This is due to a combination of:

- regulatory uncertainty (e.g. lack of clarity around SBR contracting, Capacity Market changes, abolition of LECs)

- the threat of other new entrant capacity (e.g. peakers, interconnectors)

- CCGT load factor erosion by renewables

That makes the financing of CCGT projects difficult. Lenders are looking for the security of a significant portion of net margin to be contracted over a 10-15 year horizon.

Capacity market issues

The Trafford experience has demonstrated a design issue with the UK Capacity Market. Developers can treat capacity agreements as an option to develop projects, contingent on securing finance & a toll. In the case of Trafford the cost of this option is around £8m which is quite small in the context of the scale of the project. The government has been quick to point out that there will be a range of new rules to discourage this in future.

If the Trafford project does not proceed, the UK market faces a 1.5GW capacity hole in 2018/19 that needs to be plugged via the year ahead (T-1) auction in 2017. The supply stack in this auction is likely to be considerably steeper given the limited number of options to deliver capacity at a year’s notice. It is also likely to favour peaker and DSR capacity providers.

But a more important issue is the closure of 5-10GW of coal and CCGT plants over the next 18 months as we have set out previously. Yet the Capacity Market is not sending a price signal that supports development of large scale new capacity this decade. This highlights the dependence of the Capacity Market outcome on government (& system operator) forecasting of the supply and demand balance in 4 years time. If they are wrong, then the second line of defence is the SBR mechanism (lacking transparency) and year ahead auction (limited supply).

The System Operator (National Grid) seems comfortable about the coming winter in their Winter Outlook published last week, despite noting a historically low system capacity margin of 5.1%. But that comfort comes from their ability to contract emergency reserve via the ill-favoured SBR mechanism.

We will come back to overview the outcome of this year’s capacity auction shortly. But like last year the capacity prequalification data shows the capacity market has more existing capacity than required by the government’s target level. So capacity prices are unlikely to provide much joy for new CCGT projects in December. Ultimately a lack of price signal from the Capacity Market is likely to play out in the form of sharper price signals in the wholesale energy and balancing markets.

Article written by David Stokes & Olly Spinks