There is an acute and increasing capacity shortage in the UK power market caused by the retirement of older gas and coal plants. This is being driven by ongoing weakness in thermal generation margins, due in part to increasing volumes of renewable output.

In response to security of supply concerns, the UK government introduced a capacity market in 2014. The aim of this intervention was to provide a reliable stream of income to support the flexible thermal capacity required to backup intermittent renewable output. But so far the capacity market has had the opposite effect.

Low capacity prices have contributed to the closure of existing thermal plants. At the same time the capacity market has incentivised delivery of very little in the way of new capacity. So the UK’s system reserve margin, rather than stabilising, continues to fall.

Security of supply is instead being maintained by a stop gap secondary ‘market’ for capacity known as Supplemental Balancing Reserve (SBR). SBR was designed as a temporary measure for the system operator to acquire emergency reserve while the government implemented a real capacity market. But SBR is increasingly becoming the real UK capacity market, by default rather than design.

Round two of the official capacity market

Quite a bit of analysis on the second auction outcome has already been published. So we do not intend to do a detailed deconstruction here. But we highlight a few important headline facts:

Clearing price:

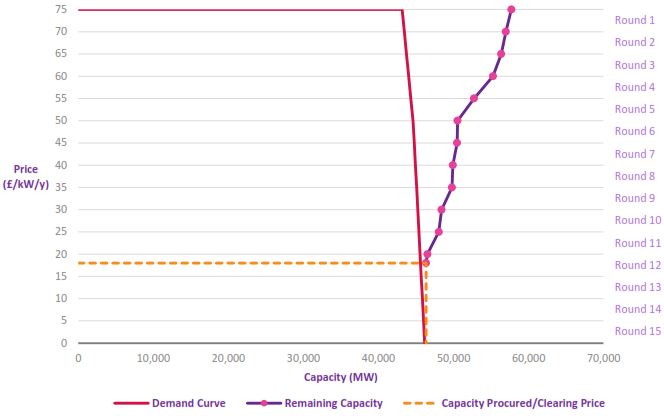

In the client briefing pack we published before the 2nd auction, we set out our expectations for the price to clear in the 10-15 £/kW range. We also set out a 20 £/kW upper bound driven by CCGT fixed costs and 5 £/kW lower bound driven by the risk adjusted value of waiting to the T-1 auction. The auction cleared at 18 £/kW towards our upper bound (as shown in Chart 1), driven by the bidding behaviour of older CCGTs. This was marginally below the 2014 auction but broadly in line with market expectations.

Capacity exit:

5.1 GW of older existing capacity was unsuccessful in getting capacity agreements. This consisted of 2GW CCGT and 3.1 GW coal plants. In many ways this is the most important outcome of the auction. Without capacity payments, the economics of these older plants is unviable, in the absence of other regulatory support.

New build:

Genuine new build capacity consisted of 1.1 GW of smaller scale peakers, with 0.5GW of DSR. A significant volume of this was in the form of diesel generator sets, causing the government some embarrassment from an emissions perspective. The 810MW Carrington CCGT was also successful in bidding for a one year ‘new build’ agreement, although this plant was only new build in a technical sense, given it is already close to completion.

Exited capacity:

A relatively high volume of capacity (around 8GW) exited the auction above 50 £/kW as can be seen in Chart 1. This included the larger scale new build CCGT projects in an indication that under the current market rules, the capacity price will need to rise significantly to incentivise CCGT new build. The new UK-Belgium NEMO Link interconnector project also failed to secure an agreement. This was unexpected given that the link will presumably be developed anyway given healthy economics & other regulatory support.