Welcome back to our first feature article for 2019. As has become tradition we start the year with five surprises to watch for on your radar screens. Usual caveat: these are not forecasts or predictions but cover areas were we think it is worth challenging prevailing market consensus.

1.UK capacity payments reinstated

The sudden suspension of the UK capacity market was one of the major surprises of 2018. It has left many asset owners with gaping holes in their business plans, in some cases resulting in an inability to cover fixed costs.

The UK government was caught completely off guard by the European Court of Justice (ECJ) ruling. BEIS (the government department responsible) has been scrambling to reassure capacity owners that the situation is under control. But industry confidence is understandably low given the scale of uncertainty set against a chaotic backdrop of Brexit politics.

Given these conditions, it is easy to build a ‘train wreck’ scenario. BEIS is pushing plans for an extra T-1 auction to cover next winter, but the timelines & complexity of delivering that solution appear to be uncomfortably optimistic. Adding to confusion is a lack of clarity as to (i) whether previous capacity payments may be recovered or (ii) what capacity owners and investors will face beyond next winter.

Wouldn’t it be surprise is some form of common sense prevails, even if initially via a messier ‘stop gap’ solution. The capacity market has underpinned security of supply in the UK. The ECJ ruling may accelerate some market reforms that were already underway, but it is very unlikely that it will derail the capacity market.

BEIS appears to be aware of the urgency to reinstate some form of capacity payments before next winter in order to avoid accelerated asset closures. They are also looking at solutions that could ‘backfill’ halted payments. Ultimately, some form of reserve mechanism payments via Grid (the TSO) could provide an initial emergency backstop. Our first surprise for the year is that the issue of capacity payment reinstatement is substantively resolved in 2019.

2. Merchant battery investment takes off

Battery storage projects to date have been underpinned by ancillary services revenues, particularly for frequency response. But this business model is being rapidly undermined by falling ancillary services revenues. Over the last two years, frequency response prices have plunged in both the UK and Germany (Europe’s two leading markets for battery deployment). This is forcing battery developers to change tack and focus on merchant revenue models.

The merchant business model for batteries is a very different proposition. Most value is captured very close to delivery, by optimising battery flexibility from the day-ahead stage through to real time balancing. This means that owners and investors need to bear substantial market risk, relying on projections of extrinsic revenue to support investment decisions. We recently set out some of the challenges facing merchant battery investors.

Despite the headwinds described above, the pick up in investment momentum behind merchant battery projects may be a surprise in 2019. Developers are focusing on short duration lithium batteries where cost declines are currently fastest. There also appears to be strong investor interest in the scaling potential of merchant batteries despite the associated market risk. What has been missing to date has been a clear track record of bankable projects. That could change this year.

3. Gas demand shock

Global LNG demand has had a strong run since 2016, underpinned by Chinese annual demand growth of around 40%. European gas demand has also recovered significantly over the last 3 years, helped by stronger economic growth and power sector demand.

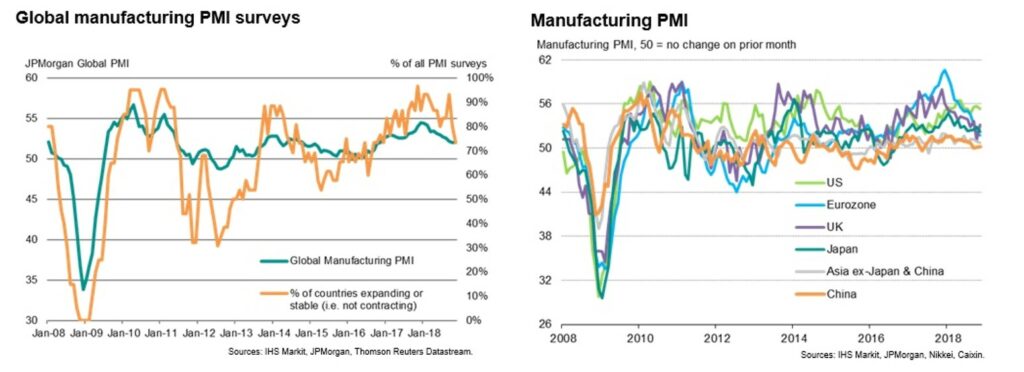

Global gas demand growth was driven by buoyant economic conditions across 2016-17, tagged by economists as ‘synchronised global growth’. As 2018 drew to a close this had transitioned to ‘synchronised global slowdown’. The 2018 slowing of growth in Chinese and European manufacturing data (as shown in Chart 1) is a particularly important warning sign for global gas demand.

The global economy is now entering its 11th year of consecutive economic expansion since the financial crisis. An expansion of this length is unprecedented in modern times. It raises the risk of a sharper slowdown or recession in 2019. Sharp declines in oil prices and global stockmarkets in Q4 2018 are flagging the risk of a weaker economic outlook.

Strong gas demand in Asia & Europe has seen large volumes of new LNG supply absorbed with relative comfort across 2016-18. This has diminished the risk of a prolonged supply glut. But a gas demand shock in 2019 would come at a time when the largest volumes of the current wave of new LNG supply are coming onto the market.

Gas prices surprised to the upside in 2018. But a major demand shock in 2019 could cause a temporary slump in TTF & Asian spot prices, particularly if accompanied by falling coal & carbon prices dragging down power sector switching levels.