Welcome back to our first feature article of 2021! As usual we are starting the year with 5 surprises to look out for on the radar screen.

“The perception of decarbonisation is rapidly shifting from problem to solution.”

Standard caveat: these are not forecasts or predictions, but cover areas where we think it is worth challenging prevailing consensus views.

1. Decarbonisation accelerates beyond all expectations

It is clear from 2020 that the current economic downturn is accelerating decarbonisation momentum, rather than inhibiting it. But could the steady progress we have seen over the last 5 years shifts gears in 2021 to an all out ‘war on carbon’?

The green new deal has gone global, with the US set to reassume a climate leadership role. A Democrat sweep and surging US investment focus on climate will see the full force of US policy and business innovation unleashed this year.

Across the Atlantic, Europe is set to turn its new 55% emissions target for 2030 into a raft of new policy actions, supported by large fiscal stimulus. Key Asian countries e.g. Japan, Korea and China are also accelerating decarbonisation related policy agendas.

The perception of decarbonisation is rapidly shifting from problem to solution. Two key enablers of a rapid acceleration are:

- Covid unlocking massive fiscal stimulus to invest in clean infrastructure as a path to economic & employment recovery

- A broad range of businesses swinging behind decarbonisation to drive growth and appease shareholders.

What is a reasonable measure for all expectations being surpassed? A major inflection point and structural step change in action compared to anything we’ve seen across the last 5 years.

2. Energy price surge

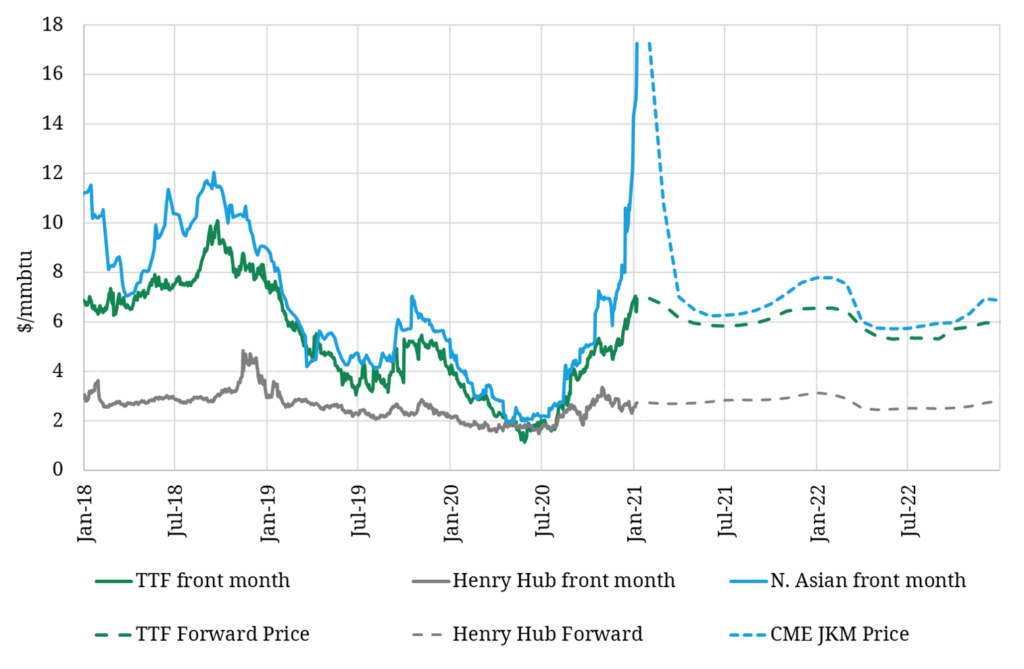

It is less than nine months since oil, gas & power prices slumped to historical lows in Q2 2020. Prices embarked on a V-shaped recovery in H2 2020, as illustrated for LNG and gas markets in Chart 1. The recent jump in the JKM Asian LNG price benchmark has been particularly sharp given a tight winter (although forward prices show this is a short term issue).

Could we see a broader surge in energy prices in 2021? Rapidly rising fossil fuel prices seem somewhat counterintuitive against the backdrop of our first surprise (accelerating decarbonisation). But it is a reality supported by market supply and demand balances and a longer lead-time for many decarbonisation measures. The key catalyst for a potential 2021 price surge is rapid demand growth pushing up relatively inelastic (price insensitive) supply curves.

The force behind demand growth is the 20 $trillion (& counting…) of global fiscal & monetary stimulus since Covid hit. As the vaccine is rolled out and the world reopens across 2021, economic growth is likely to be strong (at least in the near term). Unprecedented fiscal stimulus, particularly targeted at infrastructure spend, is set to support global demand for commodities including energy.

Supply dynamics vary by market. But there is a common theme across oil & gas markets, where investors and balance sheets are reeling from the double blows of:

- The near term impacts of recent price declines

- The long term threats of accelerating decarbonisation

These factors are set to increase the cost of investment capital and retard the flow of capital into new production, supporting higher prices.

The LNG market faces a substantial decline in new supply in 2021. Russia’s ability to provide gas supply response to Europe may be impacted by Nordstream 2 delays. Even US shale response in the crude market may be sluggish given the impact of the 2020 shock.

Rising gas prices feed directly into higher European power prices. 2020 was a case study in the importance of gas hubs in driving power markets. A continued rise in carbon prices may reinforce power price uplift, as gas vs coal switching levels rebalance and demand rises.

What do we mean by price surge? How about for example Brent hitting 80 $/bbl, the TTF gas curve above 7.5 $/mmbtu (20 €/MWh), JKM above 20 $/mmbtu, German power above 65 €/MWh and carbon above 40 €/t?

But one caveat to this surprise: inelastic supply curves typically mean high price volatility. Watch out for air pockets & turbulence.

3. Flexibility crunch comes into focus

‘Brussels we have a problem!’. 2020 saw a growing recognition of the flexibility issues facing European power markets. Is 2021 the year that policy makers step up their response to support investment in flexible capacity?

The gathering pace of decarbonisation is impacting the requirement for power market flexibility in 3 important ways:

- Increasing power demand – due to faster electrification of other sectors (particularly EVs) and aggressive new electrolyser targets

- Increasing intermittency – due to accelerating deployment of wind and solar capacity (driven by new RES & electrolyser targets)

- Decreasing conventional flexibility – due to the accelerating closure of thermal power plants, particularly coal and nuclear.

In 2020, we published a briefing paper on the flexibility crunch across European power markets. This set out the case for a rapidly evolving flexible capacity deficit from 2022-23. Our latest analysis shows the size of this flexibility shortfall rising sharply from the mid 2020s, based on current policy mechanisms. Investment in flexibility is not scaling at anything near the pace required to support the orderly operation of decarbonising power markets.

The challenge with most types of flexible low carbon capacity (e.g. electricity storage technologies, hydrogen fired power plants & demand side flex) is that current policy mechanisms are inadequate to support rapid scaling.

2021 could be the year when infrastructure investors get the policy green light to plough capital into low carbon flex. This would require introduction of new mechanisms (e.g. feed in tariffs or CfDs to support hydrogen deployment) as well as adaption of existing mechanisms (e.g. broadening renewable support to cover electricity storage).

4. Upswing in LNG portfolio value

LNG portfolios create value from the ability to optimise exposures and flexibility in response to changing market dynamics. The value of many LNG portfolios has suffered in 2019-20. Weak demand, a well supplied market and US shut ins have weighed on price levels, spreads and volatility.

This backdrop has seen some LNG players looking to exit the market e.g. Iberdrola, Orsted & Centrica. But conditions are set to change in 2021.

After 5 consecutive years of net supply growth, the LNG market is entering a 4 – 5 year period of net demand growth. This is driven by relatively low volumes of new supply coming online across the 2021 – 24 horizon. And the pace of the transition from a well supplied 2020 to a tighter 2021 could catch the market by surprise.

The key unknown factor is the rate of Asian demand growth. This has been relatively low for the last two years but is picking up rapidly across the current winter, partly due to seasonal weather effects. Robust winter demand and soaring vessel charter costs are driving the recent jump in the Asian JKM price marker above 15 $/mmbtu that can be seen in Chart 1.

The LNG market looks a bit like a coiled spring, where rapid demand growth pushing up an inelastic supply curve could cause a sharp regime shift. This does not just mean higher LNG prices, but rising inter-regional price spreads, falling correlations and rising volatility. Those dynamics may trigger a structural rise in the value of optionality in flexible LNG portfolios.

5. Gas asset ownership transition

Do gas assets face the same future as coal? This question is increasingly gaining prominence amongst energy investors as decarbonisation accelerates. The answer in our view is ‘no’ or at least ‘not yet’. But a rapid transition in the business models and risk / return profiles of gas assets may trigger the start of a major change in ownership in 2021.

It is very difficult to drive gas out of the energy mix across the next 20 – 25 years, because of the 3 factors behind the flexibility deficit that we set out above (i.e. accelerating demand, intermittency & thermal plant closures). Even with heroic assumptions on the roll out of renewables, batteries & hydrogen, there is simply no alternative to gas over this time horizon.

That said, the decarbonisation risks associated with most gas assets have substantially increased over the last year, in line with accelerating policy action. Utilisation of many assets is likely to fall into the 2030s and the risks of stranded assets is increasing. The revenue uncertainty of many midstream asset owners is compounded by the expiry of long term contracts, struck at a significant premium to current market conditions.

Pipelines, storage, processing & regas assets have traditionally been the domain of infrastructure investors. Substantial capex requirements and relatively stable revenues have underpinned investment cases.

2021 may be the year that gas asset ownership starts to pivot to private equity investors and integrated trading companies. It is these companies that are better placed to absorb and manage increasing risks and to understand & price the evolving impact of hydrogen on the gas supply chain.

Forward into 2021

Those are our 5 surprises for the year – we’ll come back and revisit them in December to see how the year has unfolded. In the meantime we wish you all the best navigating what is a fascinating set up confronting energy markets in 2021.

The accelerating pace of the energy transition and the growing importance of flexibility has seen us busier than at the start of any previous year. As a result we are recruiting again, with a particular focus on analysts with 2-4 years industry experience. See here for more details on the roles we are looking to fill.

Just a reminder that we also publish regular ‘Snapshot’ articles in between our features. If you want to receive a weekly summary of new blog content in an email you can subscribe via the link on this page (it’s free). You can also receive content as it is published via our LinkedIn or Twitter feeds.