Spain has set out its policy vision to replace coal, gas and nuclear by supporting investment in renewables & storage. The recently announced capacity market will underpin Spain’s transition to a decarbonised power market.

“Batteries and existing CCGTs are likely to dominate price setting”

The blueprint for the capacity market includes two key differences to similar mechanisms in other European countries: (i) a zero emissions limit on new capacity excludes the development of gas plants and (ii) ‘paid as bid’ pricing (vs the usual ‘paid as cleared’). Existing assets can bid for 1 year contracts, new build assets for 5 year contracts.

Spanish policy announcements across the last year have fueled a surge in investor interest. Spain has been a key area of focus for us in 2021 given aggressive renewables and storage targets and a capacity market to support flexible asset investment.

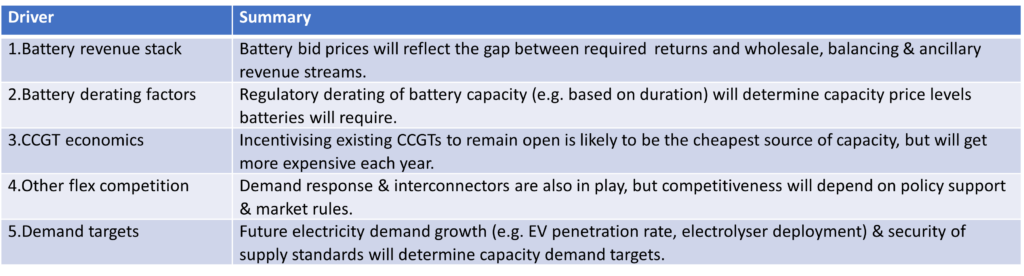

One area that everyone is focused on is capacity pricing dynamics. In the Table 1 below we summarise 5 key drivers which we explore in today’s article.

1.Battery revenue stack

Spain has set a zero carbon emissions limit on new build capacity. This limit, alongside the aggressive 2030 storage target, effectively underpins a key role for batteries in the capacity market.

Bid prices for batteries in the capacity market will reflect the gap between:

- required return on capital (e.g. 10-12% unlevered IRR) and

- returns across the rest of the battery revenue stack.

Battery revenues are underpinned by intraday price shape and spot price volatility in the wholesale power market. Historically wholesale returns have fallen short of required levels to invest in batteries. But revenues are set to increase across the 2020s, as thermal capacity closes and wind & solar volumes rapidly rise.

Balancing markets are another key source of battery revenue, but regulatory reform is required for batteries to access the Spanish balancing market. This is likely to happen relatively quickly but creates uncertainty around the level of balancing revenues.

There is also regulatory uncertainty around the roll out of specific storage focused frequency response products (e.g. as Italy has deployed), which may provide important support across the front years of battery revenue stacks while wholesale market volatility is increasing.

As things stand in Spain, batteries will need a significant boost from capacity prices to fill the gap above wholesale, balancing & ancillary revenue streams. The ‘pay as bid’ structure of the capacity market can help battery assets achieve this.

2.Battery derating factors

Batteries may be very flexible, but they are constrained by relatively short duration response (e.g. a 1 to 4 hours discharge range). This is typically reflected in batteries having more penal capacity derating factors than thermal units. However these derating factors vary widely across European capacity markets.

For example in Italy, all batteries are derated at a relatively generous 50% (i.e. they receive 50% of the capacity clearing price). In the UK derating factors depend on battery duration but are as low as 24.8% for 1 hour duration batteries.

The combination of battery revenue stack dynamics (1. above) and derating factors will determine how competitive batteries are for example vs CCGTs in Spanish capacity auctions.

3.CCGT economics

Spain has historically had an overhang of CCGT units, supported by targeted capacity payments that have now been discontinued. CCGT owners have also faced regulatory constraints preventing them from closing assets.

The new capacity market represents a lifeline for Spanish CCGTs which have struggled to cover fixed costs over the last 3 – 5 years. Incentivising existing CCGTs to remain open is likely to be the cheapest source of capacity in the near term.

However CCGT generation margins are set to fall in the 2020s with increasing renewable penetration. Start costs will also become a bigger issue as CCGTs are required to run more flexible profiles. And as CCGTs reach 20-25 year in age, units typically require major maintenance capex investment to remain open.

All of these factors are set to see the competitiveness of CCGTs decline over time, with the capacity market delivering new flexible assets as CCGTs close.

CCGT fixed costs range from 15 – 25 €/kW, depending on the asset and the way utilities allocate overhead costs. As in other European capacity markets, CCGT fixed cost recovery will likely provide important medium term price support in the Spanish capacity market.

4.Other flex competition

New build batteries and existing CCGTs are likely to dominate price setting in the Spanish capacity market across the 2020s, but there will also be other technologies competing for contracts.

The rules and policy support that will apply for demand response remain unclear, but embedded flex could be a competitor for batteries in Spain (e.g. as we have seen in the UK). Behind the meter gas peakers and batteries have been a key source of demand response in other markets. The rules around how behind the meter flex can be aggregated to provide capacity in Spain will determine how much demand response will play a role.

Interconnectors are a large potential source of capacity, but economics are challenging without further policy support. Interconnector investments need to be underpinned by either a structural price spread between markets, or substantial policy support. It is hard to raise capital based on expectations of extrinsic value from price spread volatility. Spanish interconnector projects face a challenge here, given structural price spreads to European neighbours have been eroded over time.

5.Demand targets

So far we’ve focused on supply, but demand also plays a key role in determining how much capacity will be required and at what price. The rate of future electricity demand growth will drive capacity requirements, with rising demand from:

- Electrification of transport (particularly EV penetration rate acceleration from the mid 2020s)

- Electrolyser deployment, given Spain’s aggressive targets (e.g. 4GW by 2030)

- Electrification of heat over time.

Regulatory security of supply standard calculations will also play an important role in determining capacity market demand targets. For example the derating factor assumptions on renewable and flexible capacity types and capacity margin thresholds (e.g. ‘loss of load’ probabilities).

The way forward

Spain is planning to implement the capacity market across the next two years, given EU approval timelines. But the government is targeting transitional auctions in the meantime to secure capacity into the mid 2020s and test the mechanism.

Italy is evidence of how these transitional auctions can be very lucrative for the right assets in the right location. That is why the Spanish market is firmly in the crosshairs for flexible asset investors, particularly battery projects.