European seasonal gas price spreads have been crushed over the last 5 years, falling towards 1 €/MWh. New sources of flexible supply, subdued demand and ample portfolio flexibility have driven the summer/winter price spread well below the level required to support construction of new seasonal storage capacity (7+ €/MWh).

But owners of seasonal flexibility (e.g. storage/swing) who are looking for a recovery in spreads will not take any comfort from the spread environment in the US. Indeed as the decade progresses, the US may start to export its underutilised seasonal flexibility, placing further pressure on summer/winter spreads in Europe.

Seasonal spreads … looking on enviously from across the Atlantic

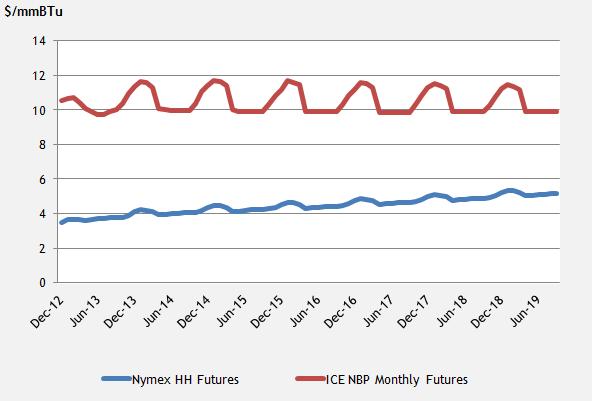

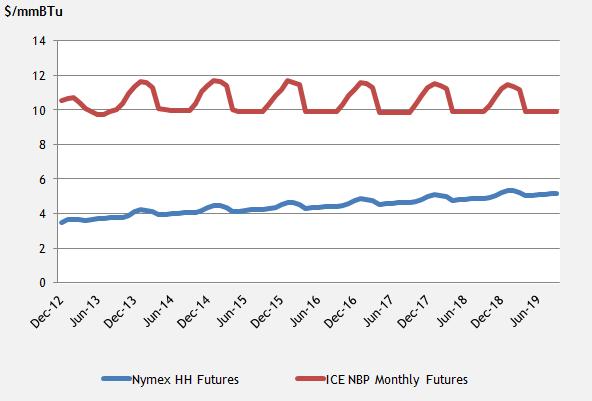

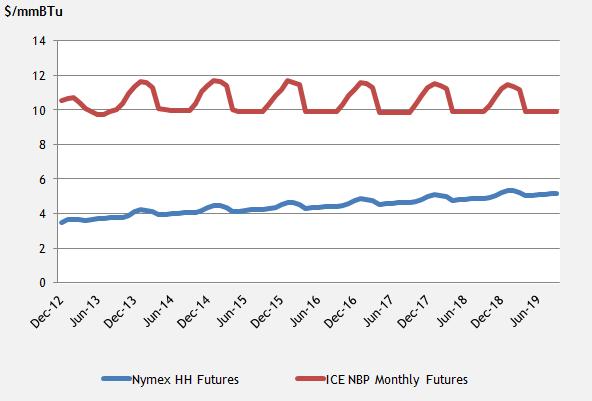

These are difficult times for European storage capacity owners, but life is even tougher in the US. The glut of gas that has flooded onto the US market since the evolution of unconventional gas production has driven virtually all shape out of the US forward price curve. A forward curve comparison of NBP vs Henry Hub price shapes is show in Chart 1.

Chart 1: Current US and UK gas forward curves

Source: ICE (NBP) and CME (Henry Hub).

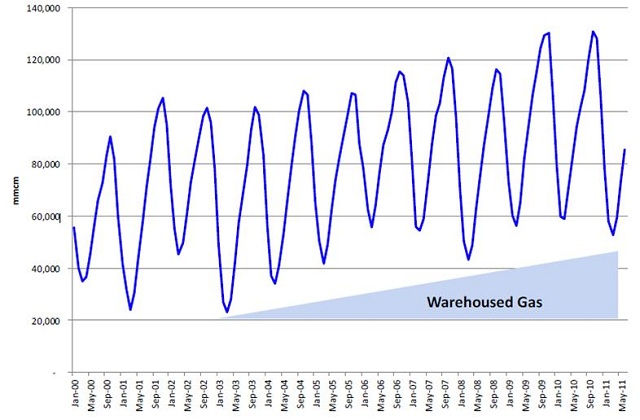

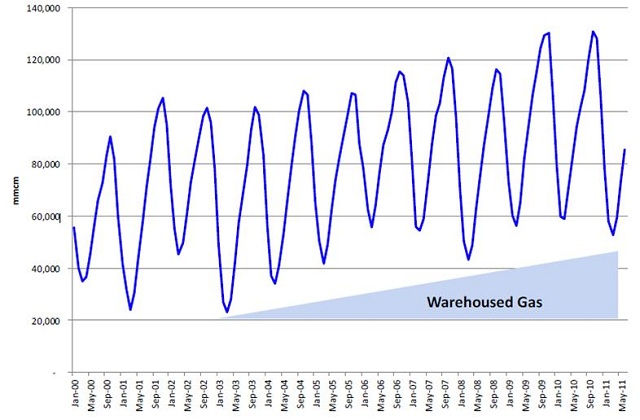

The value of seasonal storage capacity has fallen dramatically as a result. Indeed it has fallen to the point that storage capacity is being used to ‘warehouse’ gas (as an alternative to traditional seasonal cycling) as a bet on future price rises. Rising US natural gas prices are to an extent priced in, as can be seen by the relatively steep contango of the at Henry Hub gas curve in Chart 1. This is supported by an increasing production cost base for unconventional gas and the prospects of significant volumes of US LNG exports from the middle of the decade. Chart 2 illustrates the increasing trend in warehoused US gas volume.

Chart 2: North American Aggregated Gas Storage inventory

Source: The Impact of a Globalising Market on Future European Gas Supply and Pricing. Howard Rogers (OIES).

European spreads are close to historical lows, but US storage capacity owners would no doubt be looking at current NBP and TTF spread levels with envy.

Exporting seasonal flex from North America to Europe?

The transatlantic seasonal spread differential creates the interesting prospect of US storage capacity being used to provide seasonal flexibility to Europe via LNG exports. The seasonal profiling of US LNG exports to Europe is no forgone conclusion and a couple of key conditions would need to be satisfied for US exports to have a significant impact on seasonal spreads in Europe:

- Firstly, enough US liquefaction capacity would need to be approved and built to allow a significant seasonal export flow of gas out of the US in response to transatlantic price differentials

- Secondly, for gas to flow on a seasonal basis, the transatlantic price differential would need to converge towards the variable processing and transport costs to export gas to Europe (under the current NBP vs Henry Hub price spread, gas would flow baseload out of the US)

In other words US LNG export capacity would need to be unconstrained for it to be utilised for seasonal profiling of gas into Europe.

If the conditions are in place for transatlantic seasonal arbitrage, this will be driven by the within year price differentials between Europe and the US which may lead to changes in the utilisation of North American storage capacity. But the US gas market structure should ensure that any arbitrage value will be monetised given a liquid market providing sharp and responsive market signals and non discriminatory access to storage capacity at market prices.

Impact on the European market

It is important to note that transatlantic spread arbitrage would not have a meaningful impact until later in the decade, given the volume of new liquefaction capacity required to support profiled export flows. It is also likely that logistical complexities and shipping times will limit the role of US export profiling to the provision of seasonal flexibility. But if the right conditions fall in to place, the pent up flexibility in the US gas market could provide another blow to the value of existing seasonal flexibility in Europe as seasonal price differentials are further arbitraged away.