An accelerating UK energy transition is good news for battery investment. Renewable targets are rising fast. Coal, nuclear and CCGT capacity is retiring.

“Dynamic Containment is grabbing battery headlines…

but increasing energy market returns are a much more important story for investors”

Cold weather, low wind & nuclear outages has seen Grid issuing six electricity margin notices across Winter 2020-21, with market price signals responding accordingly. As renewable volumes grow and firm capacity retires, there is set to be a structural increase in these periods of tightness, resulting in rising returns for flexible assets.

UK battery returns have been off the charts across the winter, primarily due to high revenues from the new Dynamic Containment (DC) frequency response service.

In today’s article we look at the factors set to erode the DC party enthusiasm. We also backtest battery returns from wholesale & balancing markets and set out why this is a much more important story for battery investors.

Dynamic Containment is changing

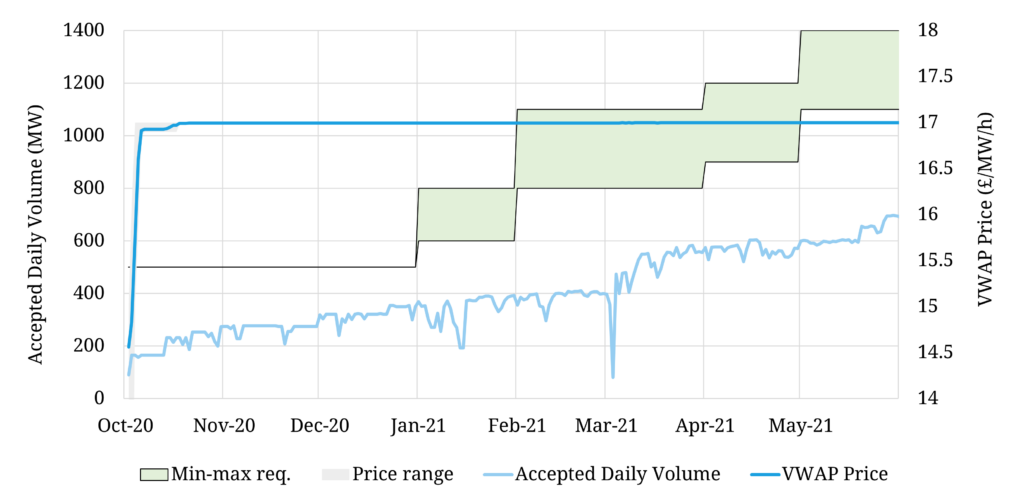

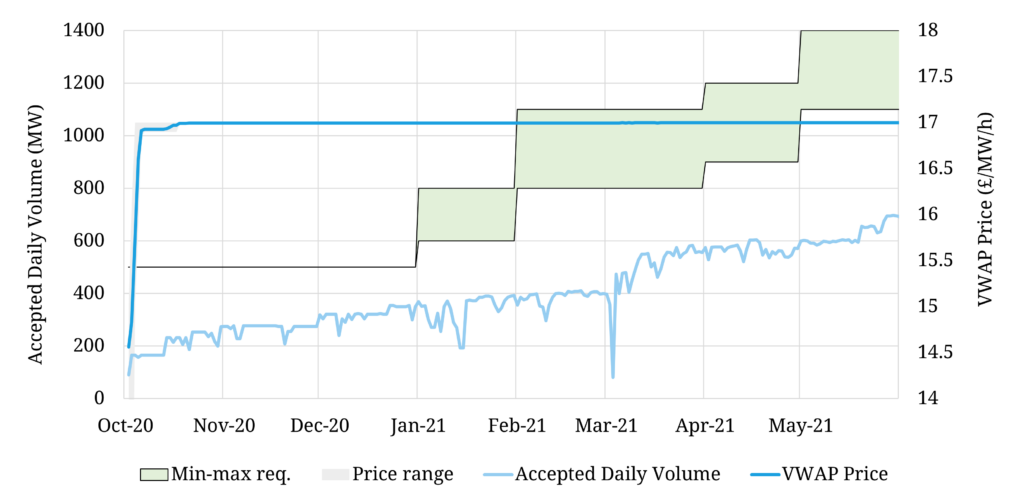

National Grid introduced a new Dynamic Containment (DC) frequency response service in Q4 2020 which has substantially increased UK battery revenues. Chart 1 shows Grid’s demand for this service (shaded in green – up to 1.4GW) which currently significantly outstrips battery capacity able to supply DC (the light blue line – around 0.7GW).

Chart 1: Dynamic Containment volume & pricing

Source: National Grid ESO

This means for the time being the DC market is structurally short capacity and is clearing at an unofficial price cap around 17 £/MW/h, the equivalent of 150 £/kW/year in annualised revenue terms. DC revenues at these levels are significantly higher than both:

- revenues required to earn a viable return on battery investment

- revenues available in wholesale & balancing markets.

As a result it currently pays for battery operators to focus on DC versus energy market alternatives, although we are starting to see more cross market optimisation.

Before racing out to invest in batteries to harvest these returns, there are some changes coming to the DC market that are important to digest. Grid has flagged a set of DC rule adjustments to take effect from late this summer. These include:

- moving to procuring DC by EFA block (currently daily)

- Shifting to a ‘pay as cleared’ auction (currently ‘pay as bid’).

The aim of these changes is to incentivise battery operators to bid to marginal cost of service provision, better target requirements and reduce overall costs. The changes will also likely push more batteries into the energy market in evening peaks, which are generally a period of lower frequency response demand, increasing cross revenue stream optimisation.

It is past midnight at the ancillary services party

Dynamic Containment is underwriting very healthy battery returns in 2021. But revenues at current levels are a temporary phenomenon. The rollout of new battery capacity in the UK is set to quickly outstrip Grid’s demand for DC services (which is likely to remain relatively stable).

At the point of saturation, premium returns in the DC market will be eroded away and this is likely to happen relatively quickly. There is currently just over 1 GW of battery capacity online. Another GW will go a long way to draining the DC punch bowl.

Once DC saturation is reached, the pricing of DC (and its cousin FFR) will be driven by the risk adjusted expectations of revenues in the much deeper energy market (i.e. wholesale & balancing markets). This doesn’t mean that frequency response revenues disappear altogether, but they are set to be relegated to ‘side show’ status relative to energy market returns in the revenue stack.

The DC party may be raging at the moment, but the smart investor money is looking beyond DC to the wholesale & balancing revenues that drive battery investment cases. So let’s take a look at how energy market revenues have been evolving behind the excitement of DC.

Backtesting battery energy market revenues

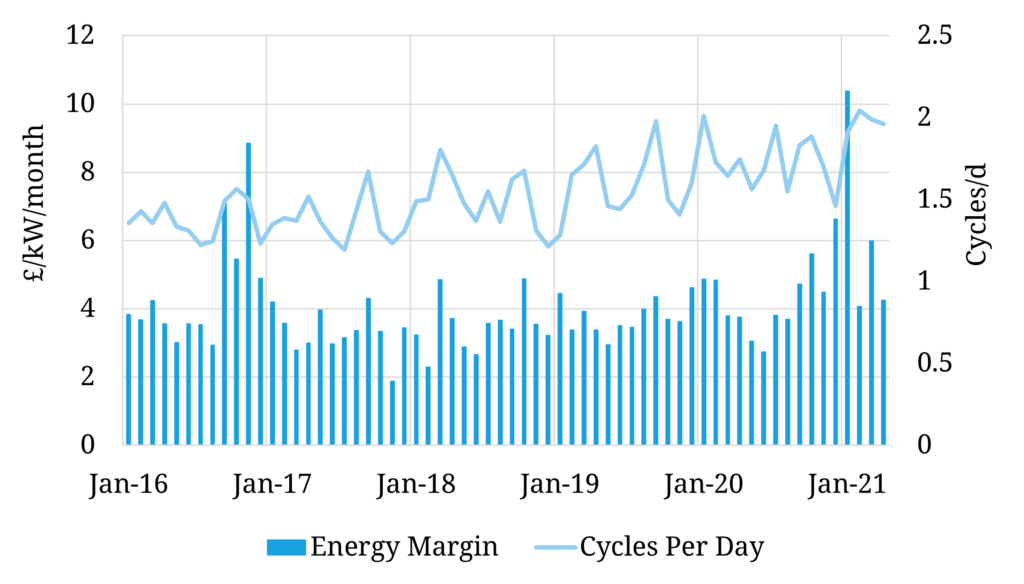

Chart 2 shows our analysis of achievable battery revenues, assuming optimisation against historical wholesale & Balancing Mechanism (BM) prices across the last 5 years for a 1.5 hour duration battery.

This analysis is run using Timera’s stochastic battery dispatch optimisation model. This model has supported investment in dozens of battery projects across Europe. It’s unique feature is it replicates the practical decision making process that a trader faces when dispatching a battery (e.g. capturing price uncertainty & imperfect foresight). We know this because we work directly with several trading desks dispatching batteries.

The backtesting analysis involves optimising dispatch of the battery against historical prices. Our approach sequentially steps through Day-Ahead, Within-Day and BM optimisation (+ final re-optimisation following BM dispatch). At each point in time, decisions are made based on available market information (not perfect foresight).

The most often quoted historical benchmark for high flexible asset margins is Winter 2016-17, driven by French nuclear outages. 2018-19 was a more difficult period for flex asset returns in the UK, with warm & windy conditions and a robust capacity reserve margin.

Battery revenues rose significantly in 2020 and have been structurally higher across Winter 2020-21, surpassing levels of Winter 2016-17. As a benchmark, battery energy margin averaged 6.8 £/kW/month in Q1 2021 (82 £/kW/year on an annualised basis).

This reflects the tightening UK market balance (with closure & mothballing of coal, CCGT & nuclear plants) as well as a rapidly rising penetration of renewables. These trends are set to define the evolution of the UK power market for many years to come.

DC is grabbing battery headlines in 2021, but structurally increasing energy market returns are a much more important story for investors.