Batteries create value from harvesting price volatility. The real time Balancing Mechanism (BM) has the most volatile prices in the GB market yet until now battery (BESS) assets have captured very limited BM value.

That is changing in 2023 with a more than 5 x increase in BM volume capture in Summer 2023 vs pre 2023 average levels.

In today’s article we explore why BESS assets have struggled to capture BM value, how this is changing and the value growth opportunity going forward.

BESS BM volumes are rising & so are negative prices

Historically BESS activity in the BM has been low and restricted to a few assets. But BESS utilisation in the BM is improving rapidly in 2023 as shown in Chart 1.

Bid Offer Acceptance (BOA) volumes for BESS in the BM have historically averaged in the 1-2 GWh per month range (i.e. very low). BESS BOA volumes have increased steadily in 2023, rising to 10-18 GWh per month across Summer 2023, an at least 5x increase.

Chart 1: BESS Bid Offer Acceptance volumes

Source: Timera Energy, National Grid ESO

There are several factors behind this increase in volumes:

- more optimisers actively participating in the BM

- a rapidly growing BESS asset base

- larger & longer duration assets that are easier for Grid to dispatch.

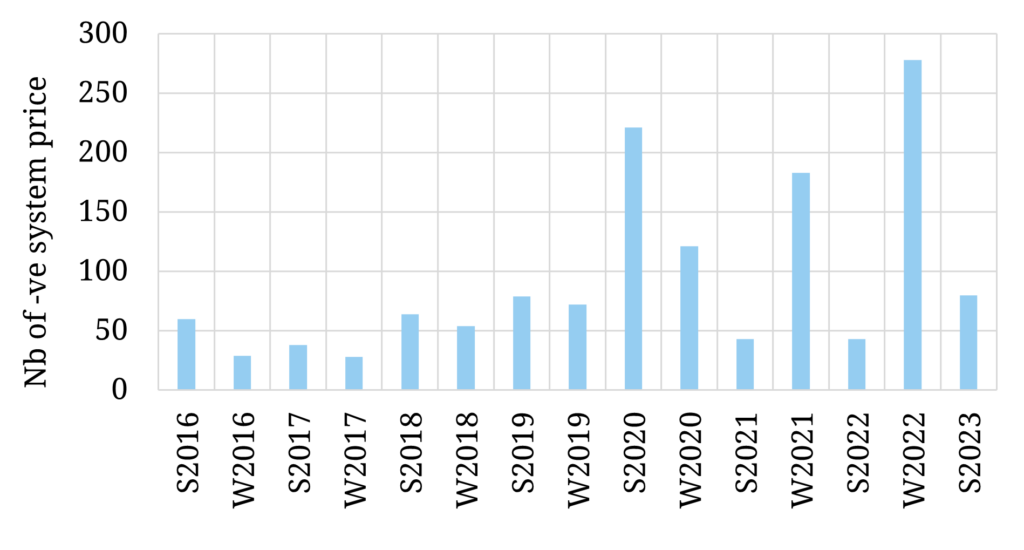

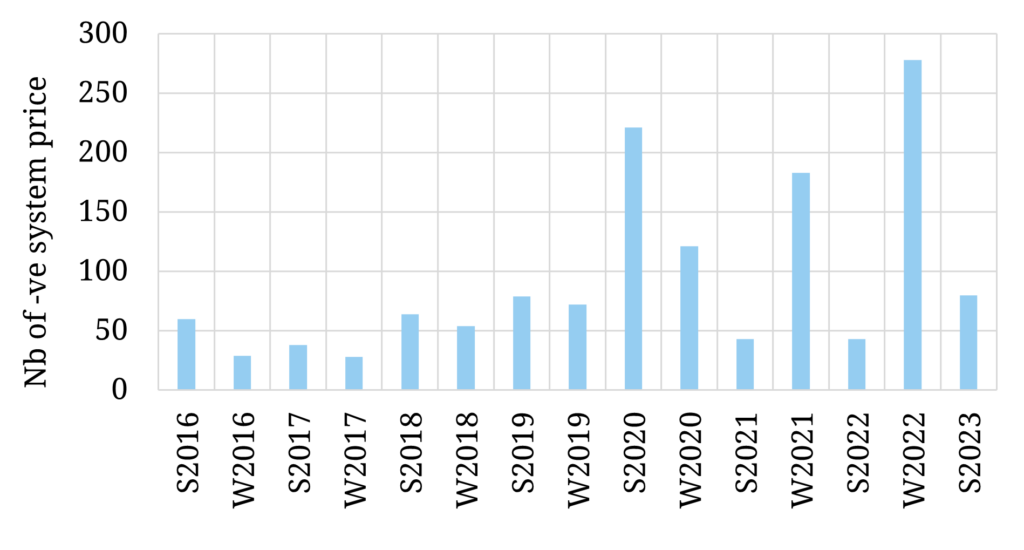

The other factor that is increasing both intraday and BM value for BESS assets across the last year is a significant growth in the incidence of negative prices, as shown in Chart 2. These are creating value capture opportunities where BESS assets are effectively being paid to charge.

Chart 2: Incidence in negative system prices in GB market

Source: Timera Energy, BMRS

The increasing capture of value from low prices is consistent with the growth in accepted BESS BM bid volumes in Chart 1. Across 2021-22, BM offer volumes for BESS are significantly larger than bid volumes. However in 2023 the bid volumes are similar to offer volumes as an increase in low price periods increases BESS charging opportunities in the BM.

Rising BESS BM participation reflects erosion of alternative revenue sources

Habitat & Limejump pioneered BM participation. Across the last 12 – 18 months they have been joined by a number of the other larger BESS optimisers e.g. EDF & Tesla.

BESS optimiser focus on the BM has been supported by rapid erosion of ancillary service revenue in 2023 (due to saturation).

Net Imbalance Volume (NIV) chasing has historically been an alternative to BM value capture. This strategy involves optimisers trying to forecast system imbalance direction and then running asset imbalances in the opposite direction to benefit from cashout price revenue. However NIV chasing returns have also been eroded by greater competition as BESS volumes have grown (increasing imbalance forecast error and risk of losses), pushing optimisers to focus more on BM value capture.

Despite growth in value capture in 2023, BESS remains significantly underutilised in the BM. Why is this?

BM hurdles for BESS and value growth opportunities

Three important factors have hindered BESS value capture growth in the BM:

- 15 min rule – BESS BOAs are currently effectively limited at 15 mins of duration, given National Grid (NG) has no visibility of state of charge beyond this. This restricts BESS access to the majority of accepted BM volumes.

- Manual dispatch – Current NG systems are manual which disadvantages smaller asset dispatch vs larger thermal & hydro assets e.g. BMU search is manual & each unit individually instructed.

- Skip rates – NG has consistently chosen higher priced assets over BESS in the BM. This reflects issues 1. & 2. above. But it also reflects real constraints that NG needs to account for in dispatching assets e.g. locational issues & thermal asset constraints.

The good news for BESS asset owners is that the issues above are steadily being addressed. NG’s investment in its Open Balancing Platform should start to improve BESS dispatch into 2024 (although full implementation may take 2-3 years). There is a working group focused on the state of charge constraint issues, considering introduction of new measures more suited to capturing the real time value of BESS flex.

BESS value capture in the intraday market and BM is underpinned by strong structural forces in play. As wind & solar output is growing rapidly, there are increasingly large swings in RES output between the Day-Ahead auction and real time delivery.

It is these fluctuations in output that underpin growth in the requirement for BESS balancing flexibility. And value capture from the BM represents an important component of the GB BESS investment case.

Interested in more on BESS value & investment case drivers?

We have just released the Q3 2023 Timera Battery Report. This forms part of our GB BESS subscription service and is widely used across the industry to support investment & financing of GB BESS assets (our client base includes funds, developers, banks, traders & utilities).

Our Q3 report has 2 special feature sections focused on:

- Impact of the gas market on GB BESS revenue stack

- Growth in value capture in the Balancing Mechanism

It also has all the regular content including BESS revenue backtesting, forward revenue stack projections & detailed analysis of market value drivers.

If you would like a sample of our report or more details on the service, feel free to reach out to our Power Director Steven Coppack (steven.coppack@timera-energy.com).