2019 may be the breakthrough year for merchant battery investment in the UK. Battery developers have re-focused investment cases on wholesale market returns, given declining ancillary revenues, cuts to embedded benefits and the slashing of battery capacity derating factors.

As other sources of margin recede, the UK battery investment case has shifted to focus on merchant value capture from price volatility. Batteries have unparalleled stealth in responding to price fluctuations. But there are some important practical constraints around value capture.

It is one thing to forecast lofty battery returns in a spreadsheet. It is quite another thing to turn those forecasts into cold hard cash.

We published our 1st article in a series on UK battery investment in early September looking at the transition in UK battery business models. In today’s 2nd article in the series, we look at how merchant batteries capture value in the wholesale market and Balancing Mechanism (BM). Then in a 3rd article to follow we consider the challenges that investors face in quantifying battery returns and building a robust investment case.

No need to reinvent the wheel

The challenge battery owners face in capturing merchant value may appear to be unique at first glance.

But there are two other energy assets that have very similar value capture dynamics:

- Fast cycle gas storage: A salt cavern gas storage facility is essentially a gas battery. Value is focused on short term (day-ahead & within-day) cycling to capture price volatility.

- Pump hydro: Pump storage is a water battery. It typically has longer duration than lithium-ion batteries. But the cycling constraint dynamics driving value are very similar.

A short duration battery has the same valuation characteristics as these other storage assets. It is just faster cycling and can store a relatively small volume of energy.

The storage value of a battery is driven by relative differences in short term prices. The battery essentially gives the owner a very granular strip of ‘time spread’ options (the option to capture price spreads between different time periods).

As with all storage assets the variable cost of cycling is key to capturing value. As long as a price spread exceeds this variable cycling cost hurdle, positive margin can be generated by charging & discharging.

In the case of a battery, the variable cycling cost hurdle is a function of:

- Full cycle efficiency costs (i.e. energy loss from cycle)

- Variable supplier/grid charges

- Market transaction costs (there can be significant bid-offer spread & liquidity costs in securing illiquid prompt prices)

- Variable degradation cost of cycling (i.e. an explicit charge to reflect impact of cycling on reducing battery life).

Some of the techniques currently being applied to value & optimise merchant batteries are ignoring a huge depth of expertise that already exists on valuing and monetising other types of energy storage assets.

Merchant battery value capture

Wholesale market & BM value capture can account for 50-80% of required returns for a merchant battery project (depending on business model adopted). To access this value, it is hard to side step significant exposure to market price risk. This is because there are no liquid products that allow an owner to hedge battery optionality on a forward basis.

A small portion of ‘arbitrage value’ can be hedged at the day-ahead stage. For example a 1 hour duration battery can buy the lowest price hour and sell the highest price hour in the day-ahead auction. But this arbitrage value for a short duration battery only represents a very small portion of required returns.

The lion’s share of battery returns is generated by optimising cycling to capture value from responding to volatility across cascading day-ahead, within-day and BM prices.

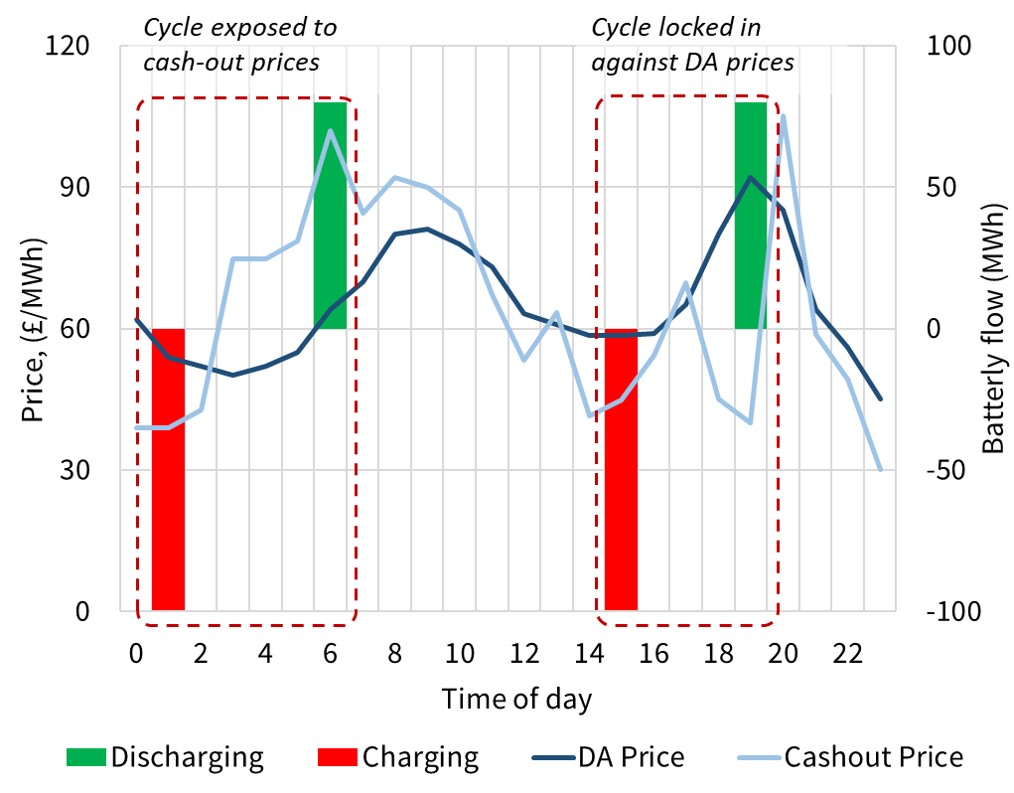

Chart 1 provides a simple illustration of battery value capture across a 24 hour period. It shows Day-Ahead (DA) wholesale price and BM cashout price evolution and two cycling examples.

The 1st cycle shows dynamic response to capture a cashout price spread. In reality a battery may be cycled multiple times within a day to capture cashout price differentials that exceed the battery variable cost hurdle.

The 2nd cycle shows value that can be hedged at the day-ahead stage (e.g. via N2EX prices).