Summer 2022 was an epic ‘24 – 7’ party for owners of BESS capacity in the GB market. The party rolled on into Q4 2022 but with the jukebox volume starting to fade. So far in 2023 the party is on hold and it’s back to work.

“BESS revenues are starting to return to earth after a couple of exceptional years”

The exceptional period of BESS returns in 2022 was driven by (i) extreme market tightness in a year of energy crisis and (ii) a structural shortage of BESS capacity to meet demand for system flexibility.

In Q3 2022 we flagged the risk of imminent BESS saturation of ancillary services. We set out evidence today to show how that has now happened as BESS capacity on the system has grown. Energy arbitrage returns now dominate the revenue stack, but we also explore how these have started to return to more normal levels so far in 2023.

These events by no means threaten the BESS investment case in GB but represent a maturing market. The UK still requires enormous investment in flexible capacity to support wind & solar deployment. But market conditions do point to BESS revenues returning to earth after a couple of exceptional years.

1. DC saturation has now occurred

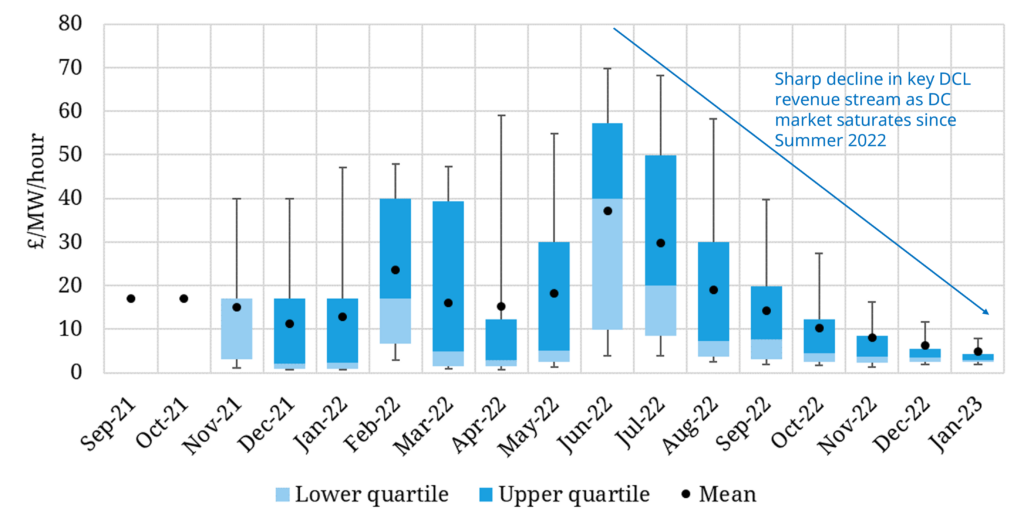

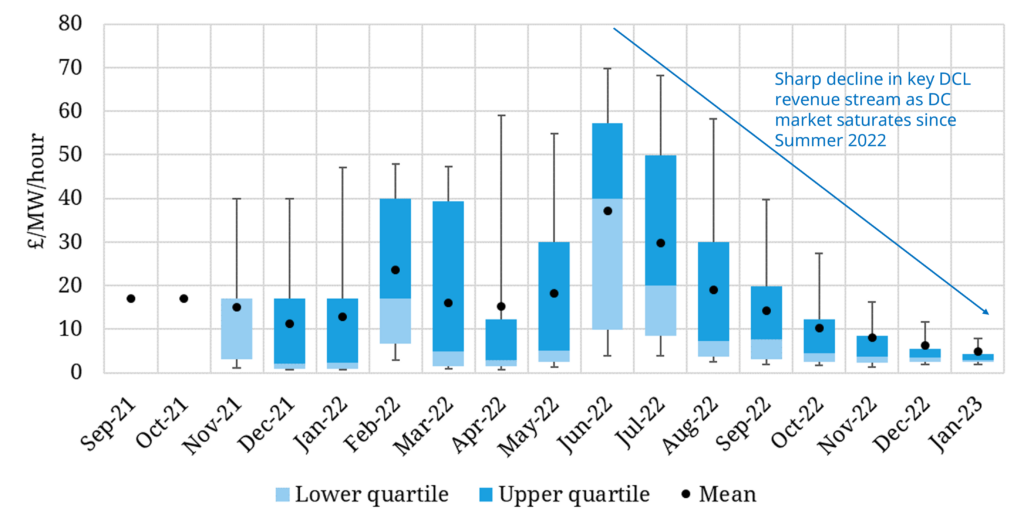

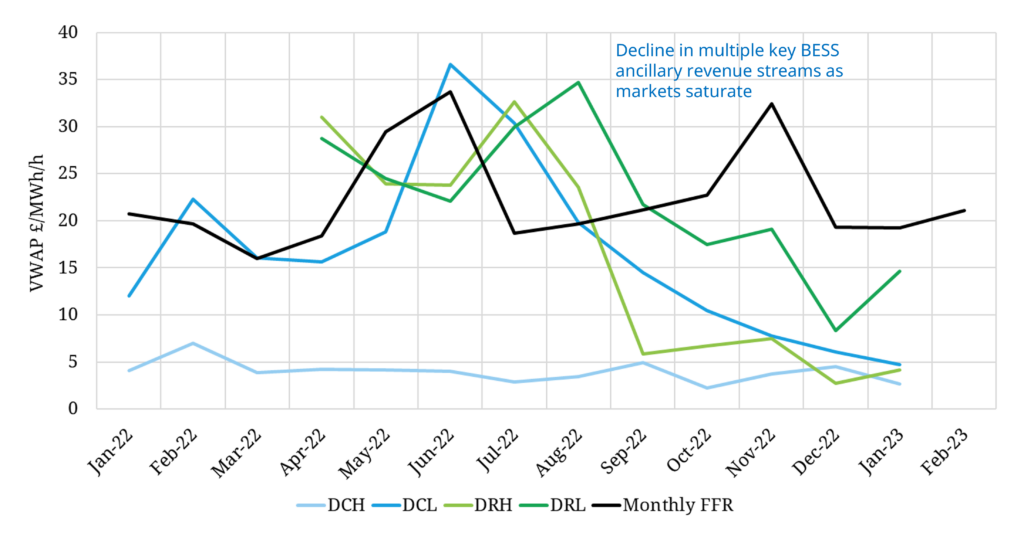

Dynamic Containment (DC) ancillary service revenue has underpinned the GB BESS revenue stack for the last 3 years. Chart 1 illustrates the rapid saturation of the DC market since Sep 2022.

Chart 1: Evolution of Dynamic Containment (L) pricing dynamics

Source: Timera Energy, NGESO

Revenues from the key DCL service have fallen from above 15.0 £/MW/h (150 £/kW/yr equivalent) across summer 2022 to 4.5-5.0 £/MW/h (50-60 £/kW/yr) across recent weeks.

BESS optimisers have transitioned significant BESS volumes out of DC as a result, in what is anyway a lower seasonal demand period for the service across winter. DC will remain an important part of BESS revenue stack optimisation, particularly for shorter duration BESS. But with capacity now above 2GW the market has clearly hit permanent saturation i.e. BESS capacity is structurally higher than DC demand.

2. Other ancillary services also saturated

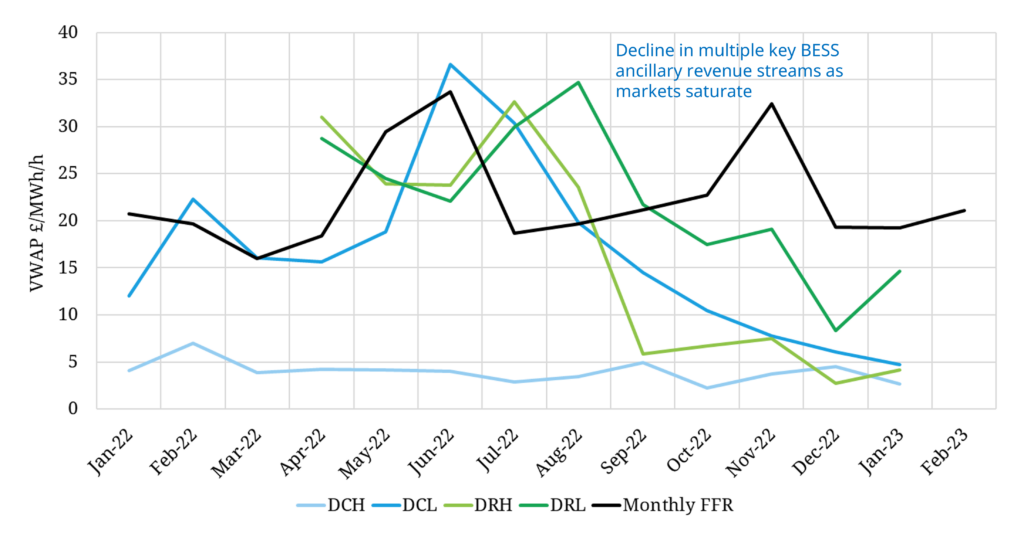

Chart 2 shows revenue declines since last summer across a broader range of ancillary services targeted by BESS. Revenue declines since Q3 2022 are what we mean by ‘volume fading on the jukebox’.

Chart 2: Evolution of key BESS ancillary service revenue streams

Source: Timera Energy, NGESO

The monthly contracted Firm Frequency Response (FFR) market has held up a bit better than DC as ancillary saturation has gathered pace. But this needs to be balanced against several considerations:

- FFR is a relatively small market (350-450 MW demand range)

- FFR and DC revenues can’t be compared on a like for like basis as FFR has a significantly higher ‘servicing cost’ vs DC given inability to stack with other revenue streams & higher degradation costs

- FFR is now in terminal decline as a service and will be phased out fully by Oct 2023.

Dynamic Regulation (DR), one of the newer ancillary services will benefit from the removal of FFR. DR is designed to slowly correct deviations in frequency – it has a slower response time but higher energy delivery requirement than DC.

DRL volumes will increase marginally (~100MW) as a result of the phase out of FFR. But even after this DR will remain a very small volume market (~200 MW demand) and as a result has little relevance in driving BESS investment cases.

As with DC, all of these ancillary service markets will in aggregate remain an important part of BESS revenue optimisation, but it is now wholesale energy arbitrage that is underpinning the BESS revenue stack. We discuss the BESS investment case impact of ancillary saturation in our recent webinar.

3. Energy arbitrage revenues dominant but returning to earth

The substantial decline in ancillary revenues was cushioned in Q4 2022 by very high energy arbitrage revenues as the GB market remained very tight. For example the GB market recorded its highest ever Day-Ahead price in Dec 22 (2,585 £/MWh).

It is still early days in 2023 but so far both:

- Power prices and gas prices have declined across Europe helped by mild weather, high LNG imports and high storage inventories

- Day-Ahead price spreads and volatility have declined as GB power market tightness has eased.

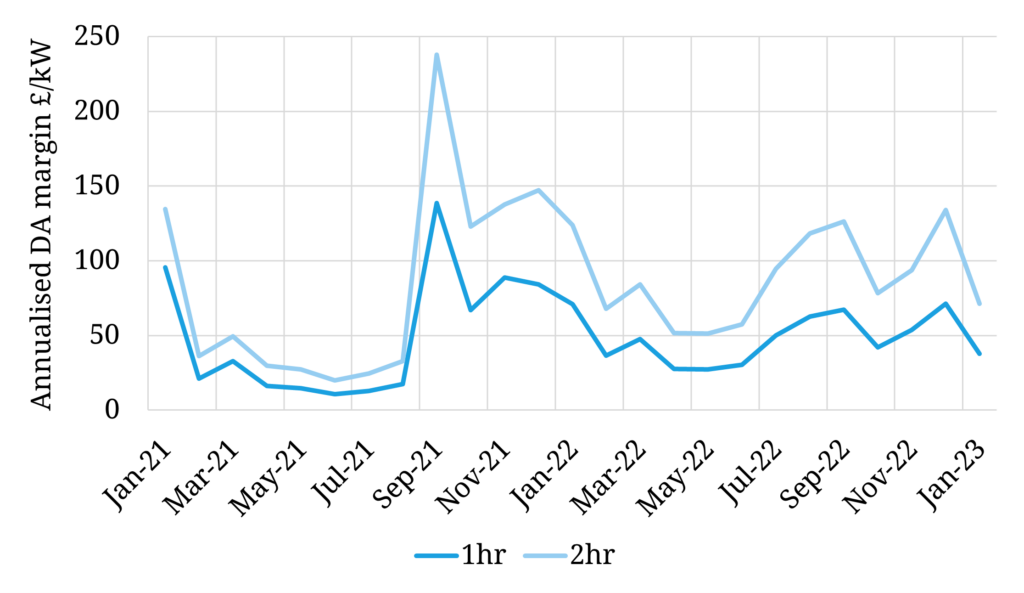

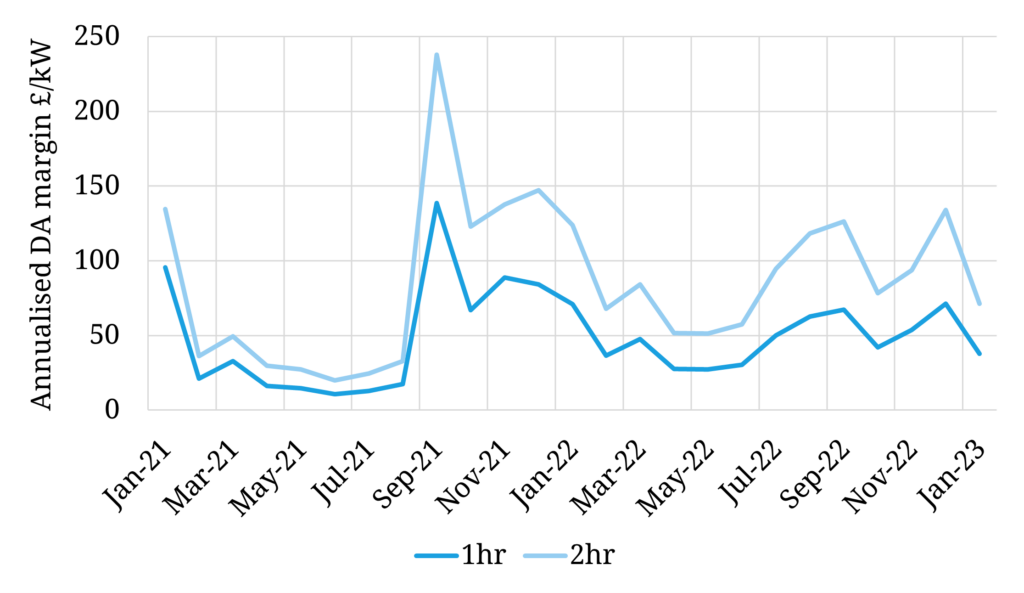

Chart 3 shows the impact of declining day-ahead price spreads on a simple cycle benchmark of Day-Ahead revenue capture for 1 and 2 hr BESS assets.

Chart 3: GB capturable DA spreads

Source: Timera Energy, Nord Pool

Day-ahead cycle revenue for 2-hour BESS has been ranging between 100-150 £/kW/yr across the second half of 2022. This fell to a more subdued 80 £/kW/yr in Jan 2023. But these levels of returns remain structurally higher than the pre-crisis period (i.e. across 2018-20).

Such a strong period of BESS returns across 2021-23 is setting up a very interesting T-4 capacity auction on 21-22nd Feb covering 2026-27 capacity delivery. More than 7GW of BESS capacity has prequalified for this auction. The auction results will provide an important insight into how the GB BESS competitive landscape will evolve through the mid-2020s. This will be a key topic we address in our Feb 2023 Storage Report.

We will be publishing our latest GB BESS subscription service Storage Report towards the end of Feb 2023. This will cover:

- EU investment landscape: how BESS investment focus is evolving from GB to Europe & which markets are attractive

- GB BESS competitive landscape: key players, pipelines & impact of 2023 T-4 auction

- Offtake & financing: how GB BESS asset financing & offtake deals are evolving fast

- REMA: implications of market design changes on BESS investors

- Backtest & projections: analysis quantifying 1, 2 & 4 hr BESS asset revenue stack back-test & revenue projections to 2050

For more details feel free to contact our Power Director steven.coppack@timera-energy.com.