Battery investment is accelerating across European power markets. But the role of batteries to date has been focused on short duration balancing & ancillary services. Battery project investment has been firmly focused on battery durations of 1 to 2 hours of charge.

Market tightness and bouts of extreme price volatility in 2021 are highlighting the requirement for longer duration flexibility as renewable penetration increases and thermal assets retire. This is needed to support periods of low wind & solar output, cold fronts and major asset outages.

Longer duration flexibility has traditionally been provided by gas, coal & hydro plants. Coal plant closures are accelerating. Many ageing gas plants are also being retired, with new gas investment a major challenge given carbon footprint. And incremental hydro deployment is typically difficult given major site, planning & cost hurdles.

Sourcing longer duration flex with a low carbon footprint is one of the key challenges on the path to decarbonising power markets. This is a focus area for Timera as we support flexible asset investors understand market evolution and its impact on asset margins.

Today’s article is the first in a series addressing investment in longer duration flexibility. We start by looking at developments (& limitations) in the deployment of Lithium-ion (Li-on) batteries.

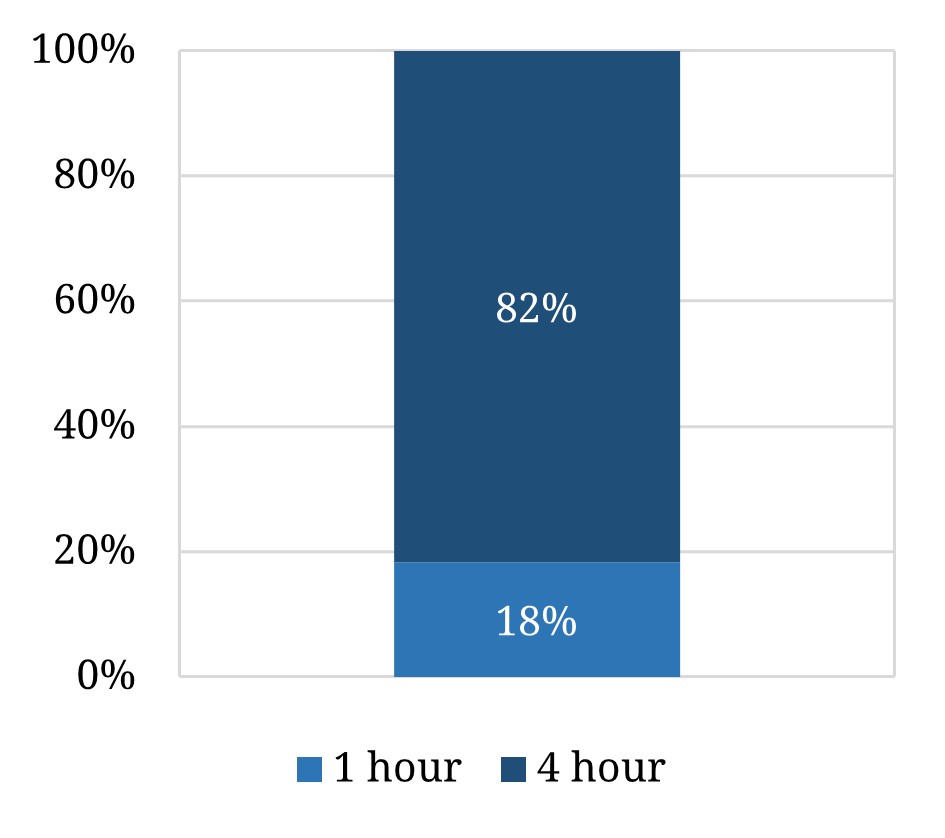

“82% of successful battery capacity in the auction was 4 hour duration”

Li-ion costs declining, but at a slowing rate

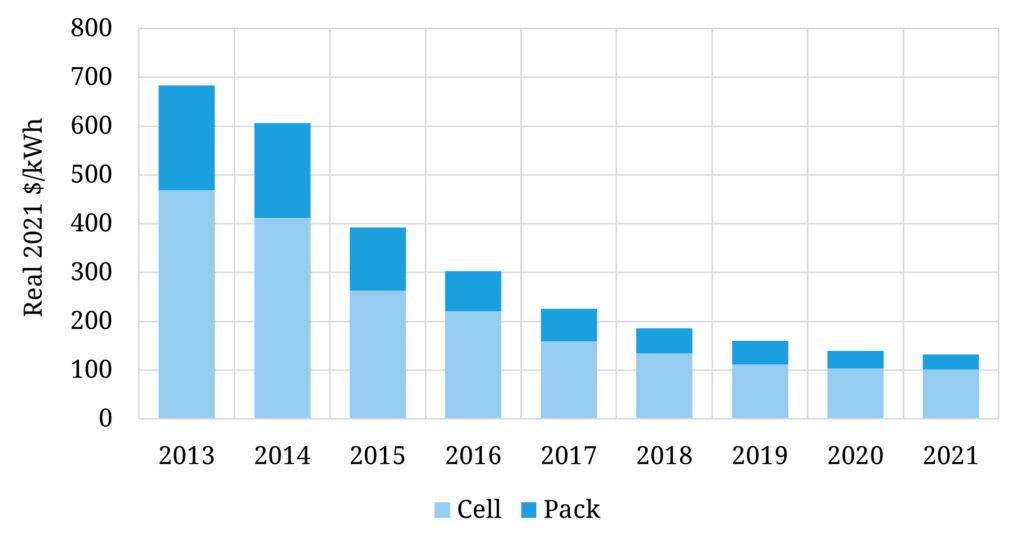

BNEF published its widely followed battery cost report last week. It estimated current Li-on cell + pack costs of 132 $/kWh (82% of which is cell cost).

To put current costs in perspective, these have fallen 89% in real terms since 2010 (from 1200 $/kWh).

This rapid decline (illustrated in Chart 1) is being driven by parallel scaling of deployment across EVs and power grids.

Chart 1: BNEF Li-on battery cost estimates

However, the pace of scaling in a supply chain constrained post Covid world is starting to impact costs. The BNEF survey estimates average annual cell + pack costs have fallen only 6% since 2020. Costs have actually risen 10% between Q1 and Q4 2021.

Supply chain issues are having a material impact on batteries, particularly via input commodity costs e.g. lithium. This has at least temporarily interrupted the decline in nominal cell costs, although pack costs have continued to decline (decreasing their proportion of overall battery costs to under 20% from 25%+ historically).

Despite the 2021 supply chain issues there is a clear trend towards increasing duration in Li-on batteries being deployed as costs are falling. This is consistent with the fact that longer duration battery projects are achieved with a greater volume of cells. We look at a couple of market case studies that illustrate this trend.

UK Capacity Market shows battery durations extending

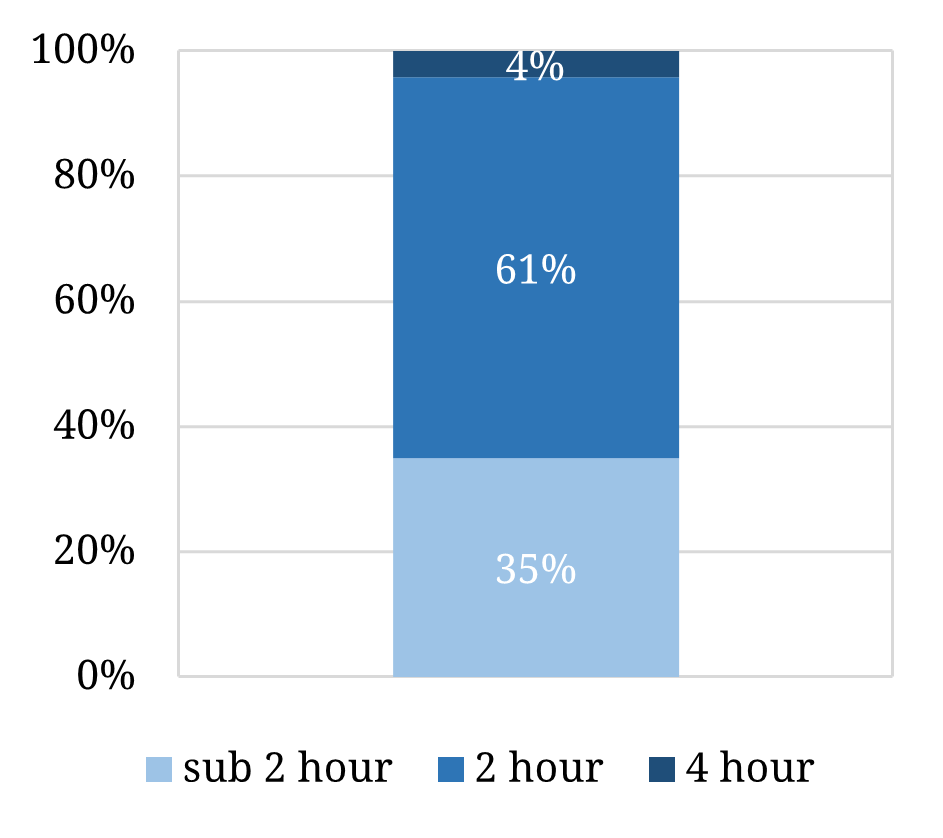

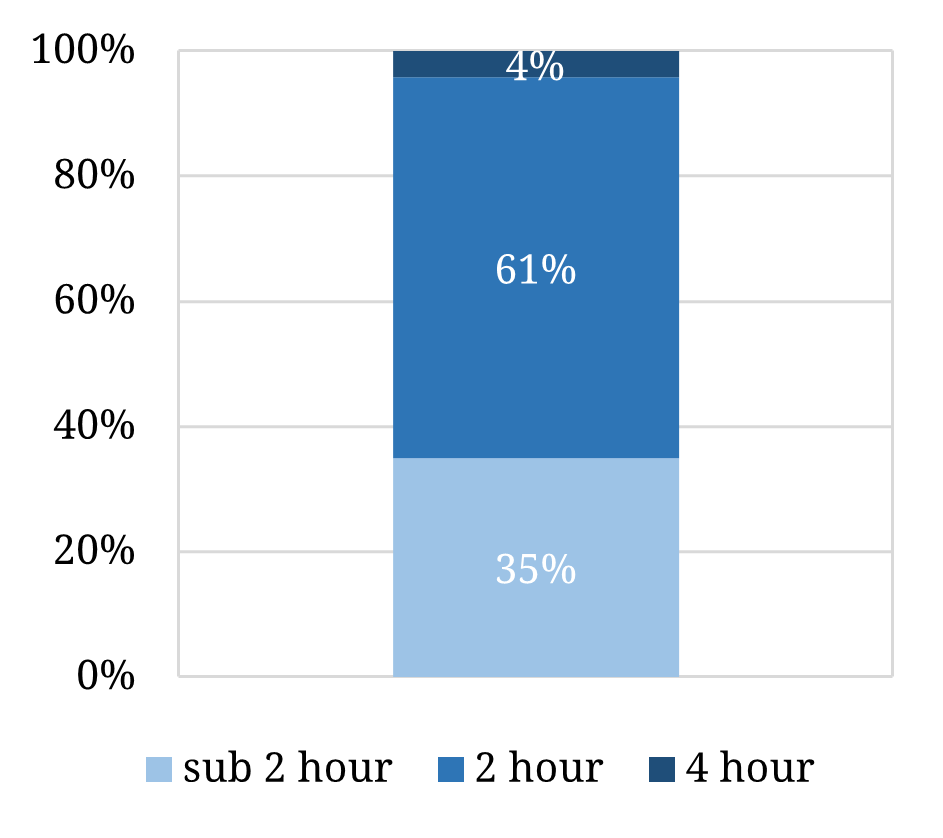

Prequalification results have recently been released for the UK’s next T-4 capacity auction (covering 2025-26 delivery period). These show a substantial 8.3GW of pre-qualified battery capacity (2.3GW on a derated capacity basis).

One hour duration batteries have dominated previous UK capacity auctions, but the majority of capacity in the latest auction is of 2 hour duration or longer, with 4 hour duration batteries making an appearance for the first time as shown in Chart 2.

Chart 2: Split of derated prequalified UK battery capacity by duration

Source: Timera Energy, EMR Delivery Body

The dominance of 2 hour batteries and prequalification of 180MW (nominal) of 4 hour duration batteries illustrates a couple of interesting points:

- Cell cost declines are supporting the trend towards extension of durations in battery projects

- Investor’s in targeting longer duration batteries are becoming more comfortable with structural returns from price shape & volatility in wholesale & balancing markets (which become more important as duration increases).

Another signal of UK market focus on longer duration storage investment is the prequalification of a 200MW upgrade in the Ffestiniog pump storage hydro asset.

Belgium capacity auction batteries pre-dominantly 4 hour duration

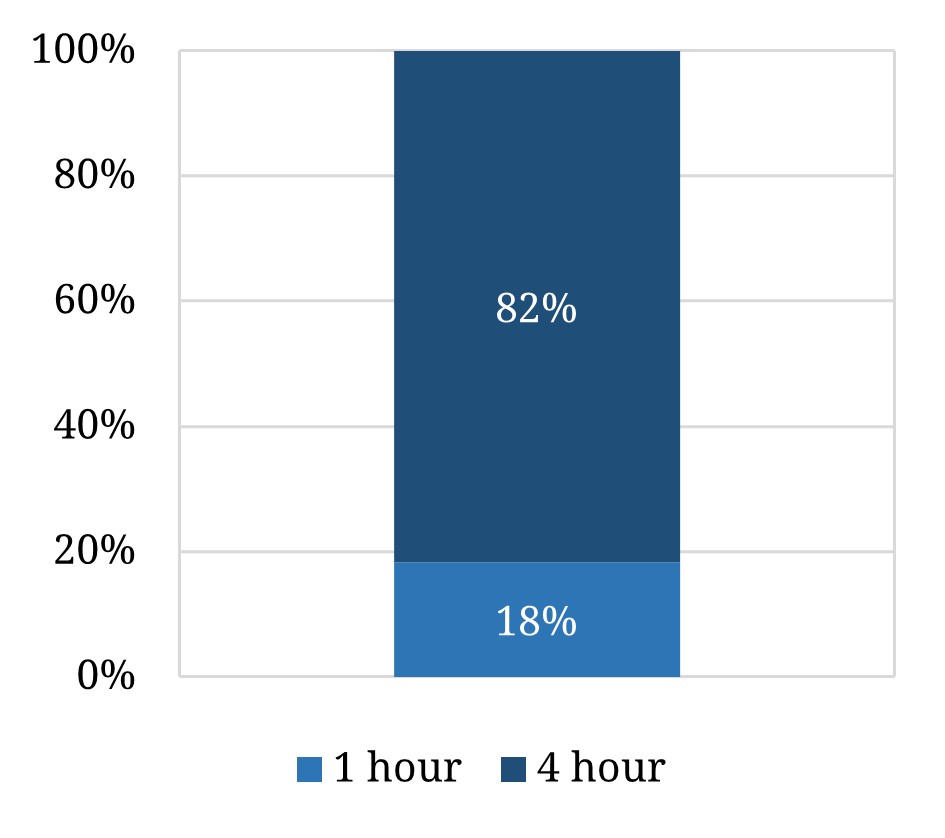

The Belgian power market is relatively small, but it has seen some pronounced volatility over recent years. Belgium faces a substantial emerging energy & flexibility gap as it closes its nuclear fleet as we recently set out.

Belgium recently held its first capacity auction (for 2025-26 delivery). 130MW of nominal battery capacity was successful in the auction, with 4 hour duration batteries making up 82% of this capacity across 3 projects (Storm, Nala & Ruien) as shown in Chart 3.

Chart 3: Split of nominal successful Belgian battery capacity by duration

Source: Timera Energy, Elia

Although the absolute volumes of 4 hour duration batteries remain small so far, their appearance in both the Belgian and UK capacity markets is an interesting indication of investors targeting duration extension.

The limitations of Lithium-ion

Cell and pack costs are projected to decline below 100 $/kWh by the mid-2020s (at least in real 2021 terms). Cost declines are likely to support the further lengthening of battery project duration.

However, unless there are some transformational breakthroughs in Li-on technology, it is difficult to envisage Li-on batteries being deployed in large volumes beyond 4-6 hours of duration, at least in this decade.

That means there remains a huge gap for low carbon flexibility provision in the 4 hour to 1 week duration range. It is this horizon where gas is currently dominant. An accelerating technology race is taking place to find an investable low carbon alternative(s). We will come back with more on this in a subsequent article.