The roll of Belgium in an interconnected NW European power market is often under-appreciated. The Belgian market is relatively small but has an important impact on interconnected markets e.g. France, Netherlands, Germany & UK.

“The Belgium market will become structurally more exposed to cross-border flows and renewable output swings”

Belgium’s generation mix has historically been anchored by 5.9GW of nuclear capacity. But these nuclear plants have had a series of major outages and reliability issues across the last 5 years and are scheduled to fully close by 2025 (with closures starting in 2022).

Nuclear outages have resulted in periods of substantial Belgian power price volatility, which has been exported to neighbouring markets. So investors and market players have closely watched the evolution of the new Belgian capacity mechanism as the driver of a path to a post nuclear future.

Results from the first Belgian capacity auction were released on the 30th Oct 2021. In today’s article we look at the auction results and their implications for power market evolution.

Capacity mechanism basics

The European Commission only approved the Belgian Capacity Remuneration Mechanism (CRM) in late August following a year long investigation on the grounds of discrimination against renewables & interconnectors.

The auction just held was a Year – 4 auction for the delivery of capacity in 2025-26. The auction excluded capacity receiving direct policy support, primarily renewable capacity. Belgium has separate renewable support mechanisms, targeting 5.8GW of offshore wind by 2030.

Successful new build capacity in the CRM is eligible for 15 year fixed price capacity agreements. Existing & upgraded capacity can access 1 year agreements. The auction is paid as bid (unlike e.g. the UK & Italian capacity markets which are paid as cleared).

There will also be a Year – 1 auction in 2024 that can procure up to another 2.5GW of capacity. The T-4 auction is focused on capacity located in Belgium, but the T-1 auction includes the potential to source capacity from neighbouring markets.

Auction results underpinned by CCGT new build

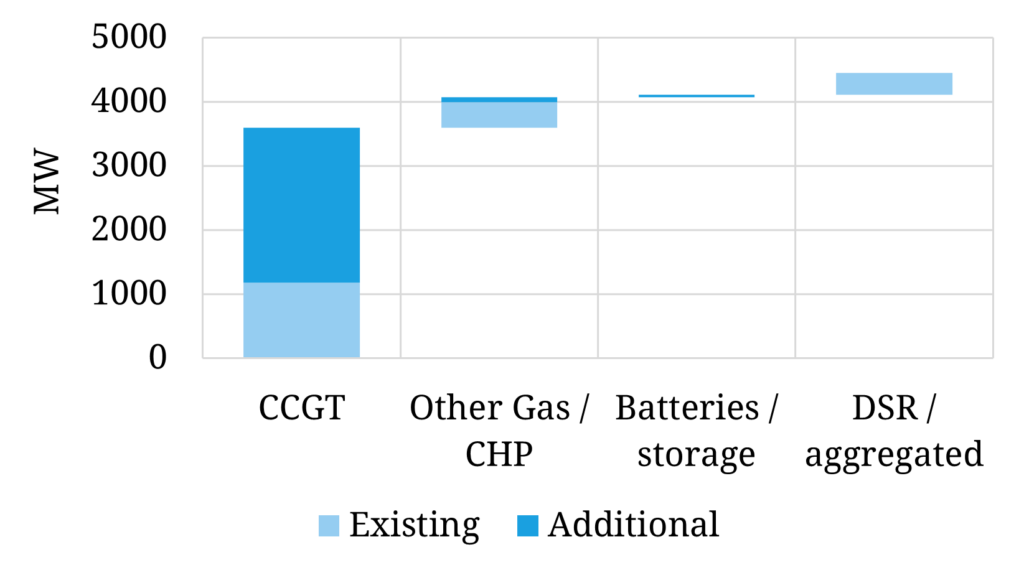

4.5GW of capacity was procured in the Y-4 auction. 2.5GW of this was ‘additional capacity’ split into two categories:

- New build – entirely new capacity e.g. new build CCGTs

- Other – capacity using existing grid connections e.g. thermal plant upgrades or additional storage.

Chart 1 shows a summary of successful existing & additional capacity by technology type.

CCGTs dominated the auction, making up 81% of awarded capacity. This was split across 1.2 GW of existing CCGTs, 1.6GW of new build plants (all from Engie owned Electrabel) and 0.8GW of capacity upgrades (mostly Electrabel also).

Gas-fired plants made up all of the successful additional capacity except for 0.1 GW of battery capacity (across several projects).

All existing & upgrade capacity that participated was successful. 40% of new build capacity was successful.

Given the CRM is paid as bid, there is no universal clearing price. But the overall volume weighted average price (VWAP) was 31.7 €/kW/yr.

Capacity bidding for 1 year agreements (subject to an intermediate price cap) cleared at a VWAP of 19.9 €/kW/yr, with new build capacity under 15 year contracts at a VWAP of 37.2 €/kW/yr.

The latter is an interesting benchmark for the capacity price required to deliver new CCGTs. It suggests an increasing premium required to incentivise CCGT investment given rising decarbonisation risks.

Implications & takeaways

The delivery period of this CM auction covers the post nuclear closure horizon (i.e. 2025-26). So the auction results provide some clarity as to the type and volume of additional capacity that will be developed across the next 4 years to help bridge nuclear closures.

However, this is far from the full story. The 2025 post nuclear capacity mix will also depend on the pace of renewables roll out, particularly offshore wind and on the contracting of additional capacity at the T-1 stage (some of which will come from outside Belgium).

Under any outcome, the Belgium market will become structurally more exposed to interconnector flows and renewable output swings across the next 4 years.

The other uncomfortable reality for Belgium from a decarbonisation perspective is that it is solving a significant portion of its nuclear problem with additional gas-fired capacity. This will bake in an incremental carbon footprint across the next two decades.

Belgium’s reliance on gas to plug the nuclear gap partly reflects constraints as to how much low carbon energy can be realistically delivered over a 4 year horizon. Belgium has increased its offshore wind target, but this does not go close to replacing the lost output from retiring nuclear plants.

However, these challenges do not excuse a disappointingly low volume of successful storage in the auction. Storage cannot plug the energy gap left by nuclear (given it is a net consumer of energy), but it can play a key role in providing system flexibility to firm renewable output.

There is a key takeaway here for Belgium and other European power markets: enabling storage investment is not just about a capacity price signal. It requires network charging reforms, viable access to balancing markets and targeted revenue streams that reward its contribution to system stability.