As 2024 takes shape, there are two questions attracting a lot of focus for our battery investor clients:

- Why did BESS revenues fall significantly in 2023?

- Which European countries offer the most attractive BESS returns?

In this article we look at both questions via an empirical analysis of ranked day-ahead arbitrage returns across European markets in 2022 vs 2023. We also set out 5 key takeaways from the analysis to feed into BESS investment case development.

Day-Ahead arbitrage anchors BESS returns

The BESS revenue stack over an investment horizon is underpinned by price spread capture in Day-Ahead (D-A) auctions. This involves for example for a one hour duration battery, buying the lowest priced hour in the D-A auction and selling the highest priced hour.

D-A arbitrage is just one component of the revenue stack driving BESS investment cases. Other components include:

- Intraday & balancing revenue – just as important as D-A and more so in some markets e.g. Germany which features a liquid & volatile 15 min granularity within-day market

- Capacity revenue – the size of which is impacted by duration & degradation factors

- Ancillaries and other forms of network revenue support.

We focus in this article on D-A arbitrage returns because they represent the component that is the cleanest objective benchmark for BESS value capture opportunities. But you can see forward analysis & backtesting of the full BESS revenue stack in many of our other articles & webinars.

Let’s look at some numbers.

2022 – BESS arbitrage returns in a very tight market

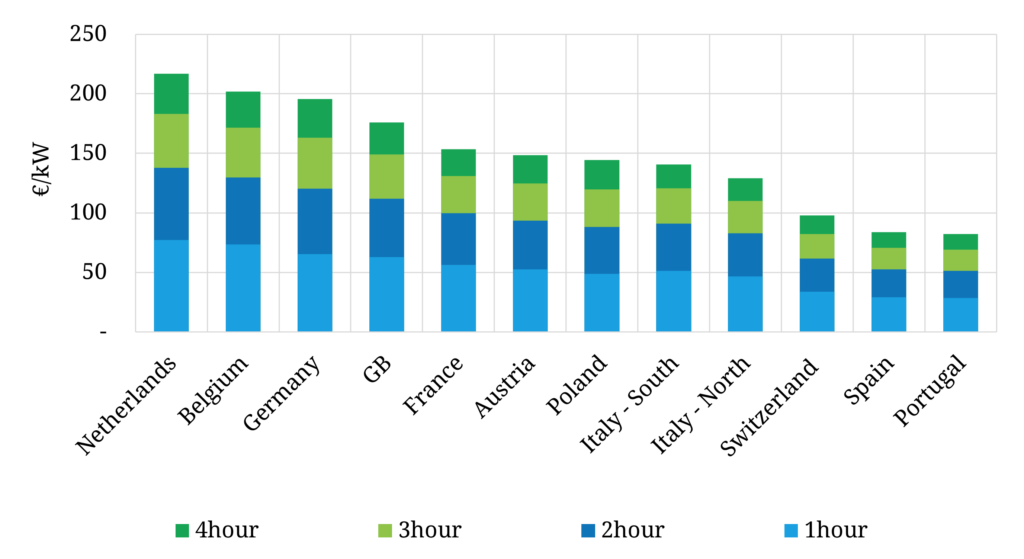

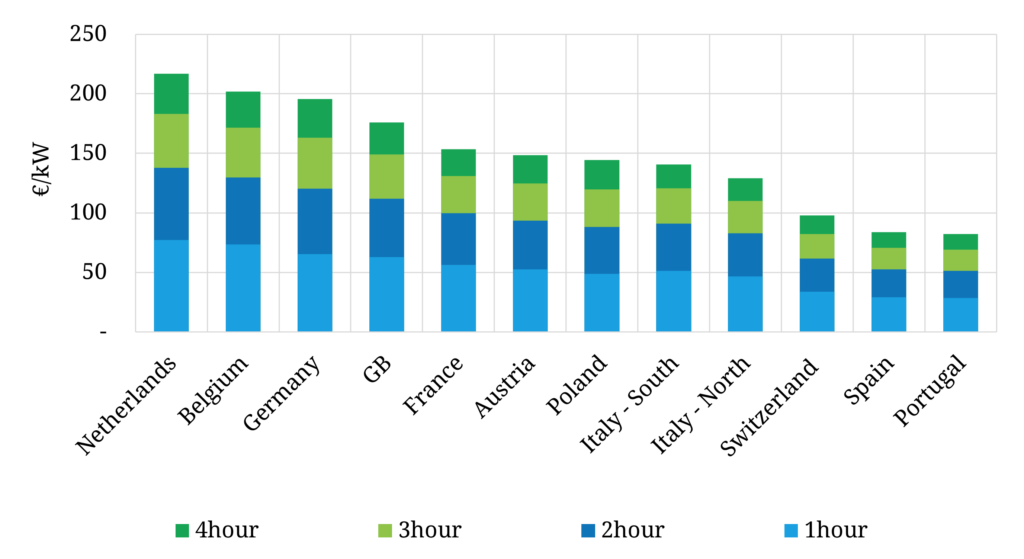

We start with analysis of BESS D-A arbitrage capture across Western European markets in the 2022 crisis year, shown in Chart 1.

The light blue bars at the bottom of the chart show D-A value capture for 1 hour duration BESS. The different coloured bars stacked above show the incremental value capture for additonal hours of BESS duration (up to 4 hours of duration).

Chart 1: Day-ahead arbitrage BESS value capture in 2022

Source: Timera Energy; Note value calculations assume a simple D-A arbitrage capture strategy with visibility across a monthly horizon (efficiency 85%) - analysis only covers D-A value not Within-Day and other revenue streams.

BESS returns soared in 2022 as the energy crisis gripped Europe. The primary factors driving high value capture were:

- High gas prices driving up peak power prices, widening price spreads captured by BESS (we explain this important driver in more detail in Diagram 1 below)

- Power market stress driving high power price volatility, lifting intraday, balancing & ancillary revenues.

Chart 1 shows Germany, Netherlands, Belgium & GB were the most lucrative D-A arbitrage markets for BESS in 2022. This was driven by:

- High-RES penetration, especially wind, creating frequent price swings and negative prices creating arbitrage opportunities

- Gas price levels & volatility being most extreme across NWE (given gas network constraints after Russian supply cuts).

In contrast, Spain and Portugal’s arbitrage returns were distorted by the Mecanismo Iberico feed in tariff which reduces the cost of gas to power plants, acting to reduce Iberian day-ahead price spreads.

2023 was a different story.

2023 – BESS arbitrage returns in a softening market

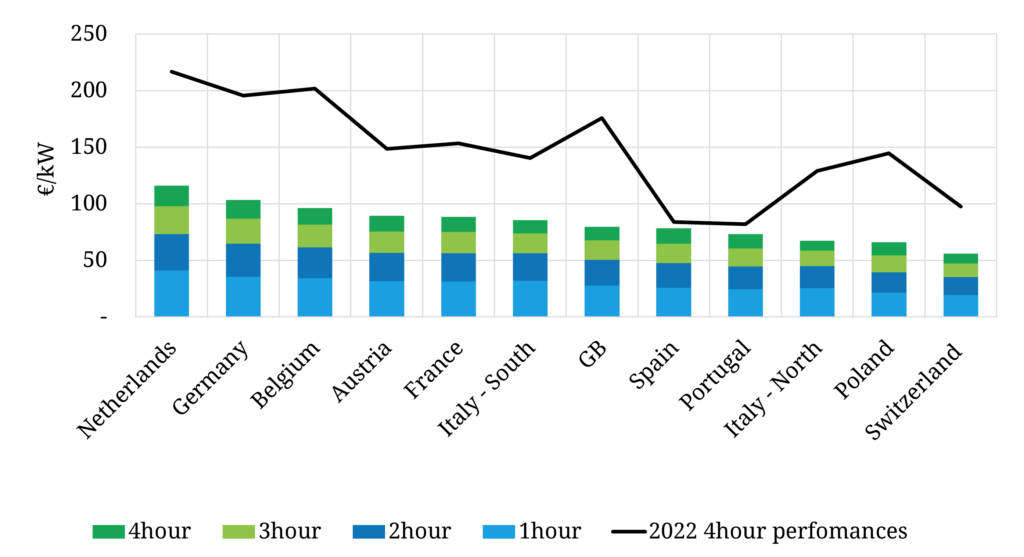

In Chart 2 we show the same ranking of BESS D-A arbitrage returns for 2023 (compared to the 4 hour duration total value capture from 2022 – the black line).

Chart 2: Day-ahead arbitrage BESS value capture in 2023

The first observation is that the level of D-A arbitrage revenues fell 30-50% vs 2022 levels. The cause of this was a reversal of the two factors we set out above that drove up BESS revenues in 2022:

- 2023 saw a huge decline in gas prices (60-70%), pulling down peak power prices and D-A power price spreads

- Power market tightness eased substantially (e.g. driven by a recovery in French nuclear availability), causing an easing in the extreme levels of power price volatility seen in 2022.

Despite these very different market conditions, North-West Europe remained the most attractive area for BESS arbitrage value capture in 2023, particularly in Germany, Netherlands & Belgium.

The stronger performance of these markets across both 2022-23 is consistent high volumes of RES capacity (e.g. 45% of German generation from wind & solar in 2023) relative to more limited volumes of flexible capacity in these markets. High levels of interconnection are causing Germany to ‘export volatility’ to neighbouring markets.

There was also a recovery in value capture in Iberia as the impact of the policy mechanism eased with lower gas prices. However, higher volumes of flexible gas & hydro capacity in Italy & Iberia act to somewhat dampen volatility levels vs NW Europe.

The value capture dynamics shown in the charts above are consistent with a continued strong BESS investor focus on the high renewable penetration NW European markets. The other market attracting strong interest from favourable BESS support policy is Italy (as we set out recently) where BESS will be key to enabling a rapid increase in solar penetration. Spain may be next as policy support takes shape there.

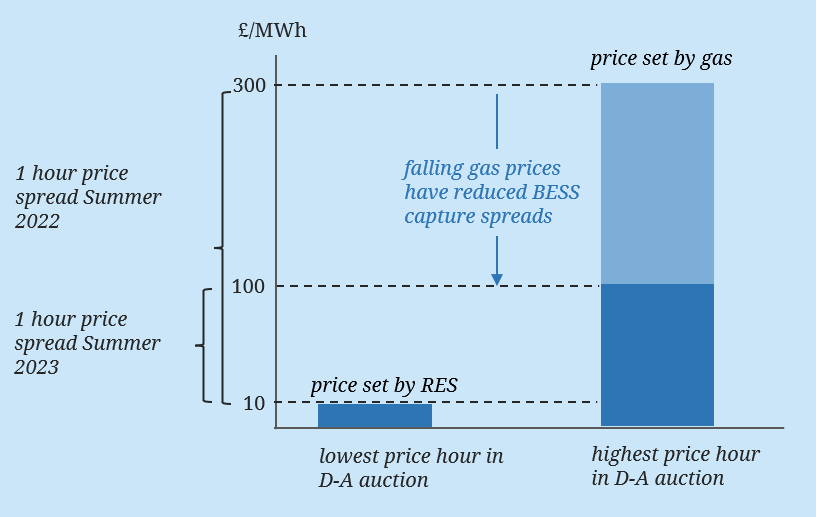

Why are gas prices an important driver of BESS price spread capture?

Before we move on to some takeaways for BESS investors, we want to clarify why gas prices are having such an important influence on BESS asset revenue capture.

Gas prices directly drive power price intraday spreads and volatility given gas-fired power plants are the dominant ‘price setting’ capacity across European power markets. Gas-fired plants are particularly important for setting peak prices, which drive BESS revenue capture from storage discharge.

We illustrate this in Diagram 1 which shows the scale of the impact of lower gas prices on D-A price spreads in Summer 2023 vs 2022.

Diagram 1: How gas prices impact BESS revenue capture

This is why it is important for BESS investors to pay attention to gas market dynamics and to factor these into investment case analysis. It is also why we use a sophisticated global gas market model, that captures the strong influence of the LNG market on European hub prices, to analyse gas price evolution to feed into our BESS investment case analysis.

5 takeaways for BESS investors into 2024

Let’s finish with 5 takeaways for consideration based on our analysis above and the current market state of play:

- Our analysis above shows two important factors driving BESS returns:

- Gas price levels (& volatility)

- Level of RES penetration vs available flexible capacity (differs across markets)

- North-West European markets are showing the strongest arbitrage returns for BESS given high RES penetration & retiring thermal assets

- Despite a significant decline in arbitrage revenues in 2023, BESS returns in NW Europe still look attractive over an investment horizon, particularly in Germany where intra-day value uplift is strong

- Strong policy momentum in support of BESS is being implemented in Southern Europe to enable solar balancing, most prominently in Italy but with Spain set to follow

- Robust BESS investment case development needs to factor in a robust analysis of the evolution of gas market dynamics given impact on BESS arbitrage returns.

If you want to meet us in person and discuss our views in more detail, we will have a stand & be presenting at the Energy Storage Summit in London 20-21st Feb (see details below) or feel free to reach out via email.

Timera sponsoring & presenting at 2024 Energy Storage Summit

Our Power Director, Steven Coppack, will be speaking on:

BESS Investment Case in Germany & Italy

- Factors driving BESS investment momentum in DE & IT

- How the DE & IT investment cases differ from GB

- Revenue stack breakdowns for DE & IT

- Market access, offtake & financing

- Key investment risks

It would be great to catch up face to face if you are coming along. You can find members of our team at Stand 85 in the main room – or feel free to contact Steven steven.coppack@timera-energy.com.