“4 key drivers are shaping market & portfolio value evolution into 2025”

Our feature content this week is video based. You can meet some of the Timera power team in a recording of our recent ‘Germany vs Netherlands’ webinar focused on BESS investment case, pitfalls and offtake & financing conditions.

Click here for the slide pack from the webinar.

Click here to watch the webinar video recording.

Interested in some of the content covered? Here is a taster of a couple of excerpts from the webinar:

1. What caused BESS revenues to decline in 2023 & is a recovery underway?

We discuss key drivers of the 2023-24 BESS revenue stack contraction e.g. gas price & power demand declines. We explore differences between the DE & NL revenue stack and look at the Q2 2024 recovery and whether it is sustainable.

2. 3 key fundamental drivers underpinning BESS investment case

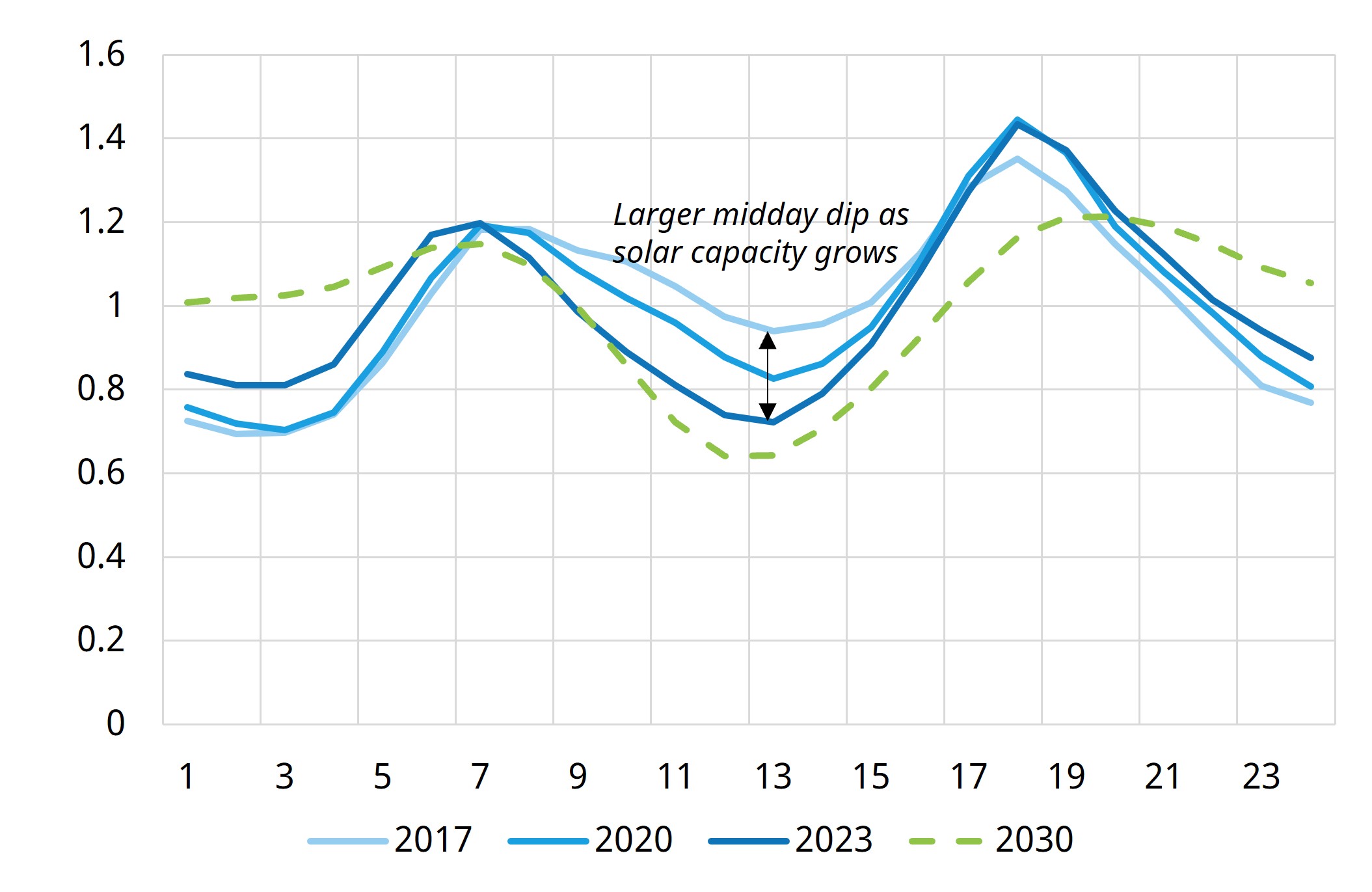

We discuss how wind & solar penetration, thermal closures & demand growth are driving the requirement for investment in BESS balancing flex. We also set out how pricing dynamics are changing to support BESS as RES penetration increases.

3. Contrast of German vs Dutch BESS investment case

We look at some common drivers drawing capital to both markets (e.g. revenue stack track performance). We also discuss some key challenges & differences e.g. NL grid fee reform & DE network access issues.

In addition we have a focused discussion on the state of play with BESS offtake & financing conditions.

For more details click on the links above to see the webinar pack and view the webinar.

Timera is recruiting

Given strong demand for our services, we are actively looking to recruit Analysts into our team.

See our Careers page for more information on available roles, life at Timera and how to apply.