3 key markets are leading battery deployment in Europe: GB, Germany & Italy. BESS deployment across these 3 markets alone could reach 45-50GW by 2030.

There are some common value drivers across all markets, but investors also face some significant differences in risk/return dynamics across each market.

Santander hosted a BESS investor session in London last week with a range of leading storage investors & optimisers attending. David Stokes (Timera MD) gave a presentation exploring revenue stack differences across key European markets.

In today’s article we line these 3 markets up ‘head to head’ and look at BESS revenue stack performance in 2024 (vs the last 3 years).

Key drivers of BESS revenue stack in 2023-24

There are some important common drivers across all European power markets that have shaped BESS revenue stack performance across the last 3 years.

All markets generated exceptional BESS returns in 2021-22 driven by a parallel:

- Gas crisis – gas market tightness given Russian supply cuts

- Power crisis – power market tightness given e.g. major French nuclear outages.

All markets then suffered declining BESS returns across Q1 2023 – Q1 2024 due to:

- Falling gas prices – as the crisis eased and demand was weak

- Weak power demand – significantly driven by response to the crisis

- Adverse winter weather conditions – e.g. mild temperatures, unhelpful wind conditions.

A recovery in BESS revenues has been underway since Feb 2024, as gas prices have recovered & weather conditions normalised. Rising price volatility (& negative prices) from increasing RES penetration have also been an important factor supporting revenue recovery.

Let’s look at how the 2024 revenue recovery is evolving across each of the 3 markets.

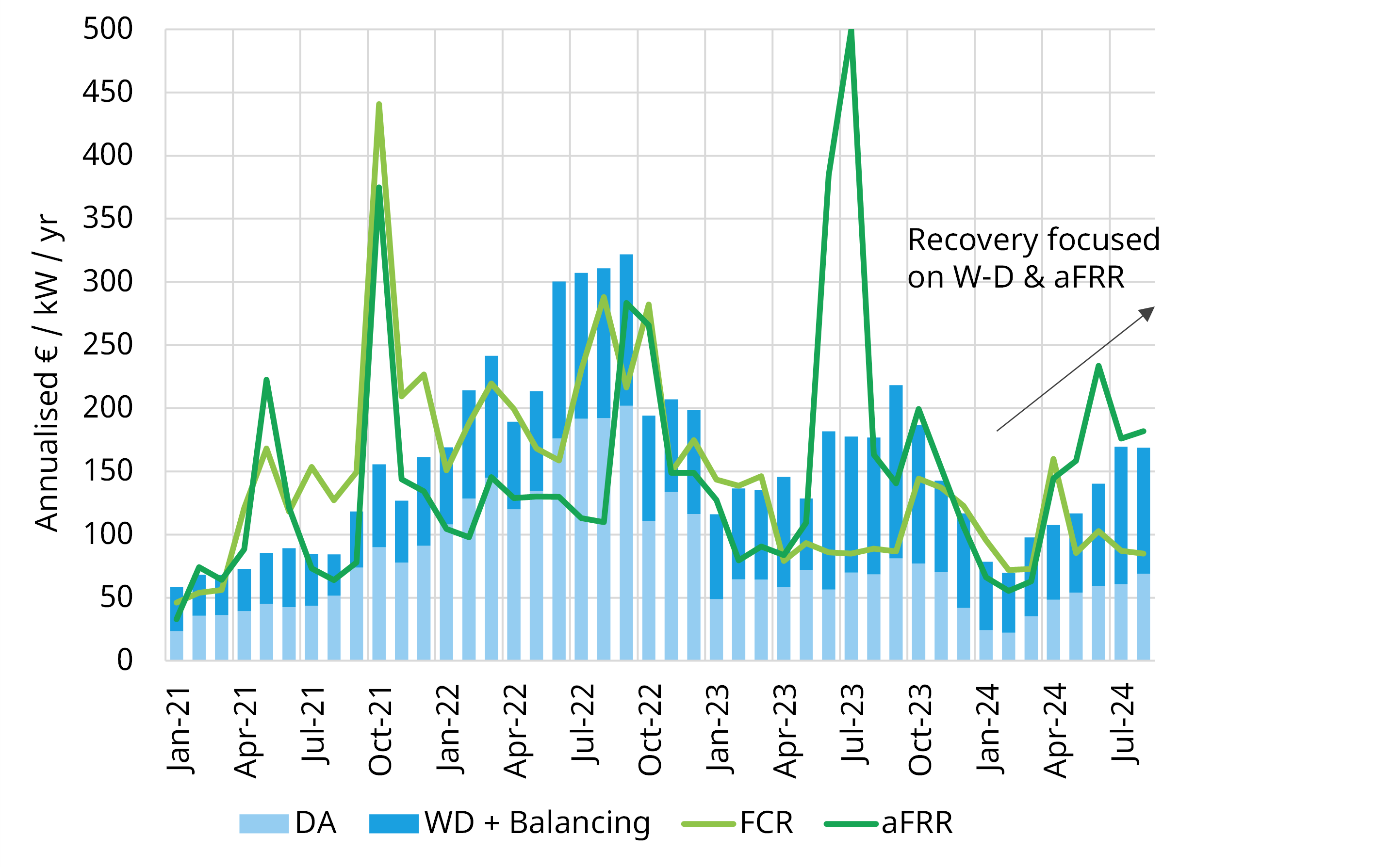

Germany – a sharp recovery

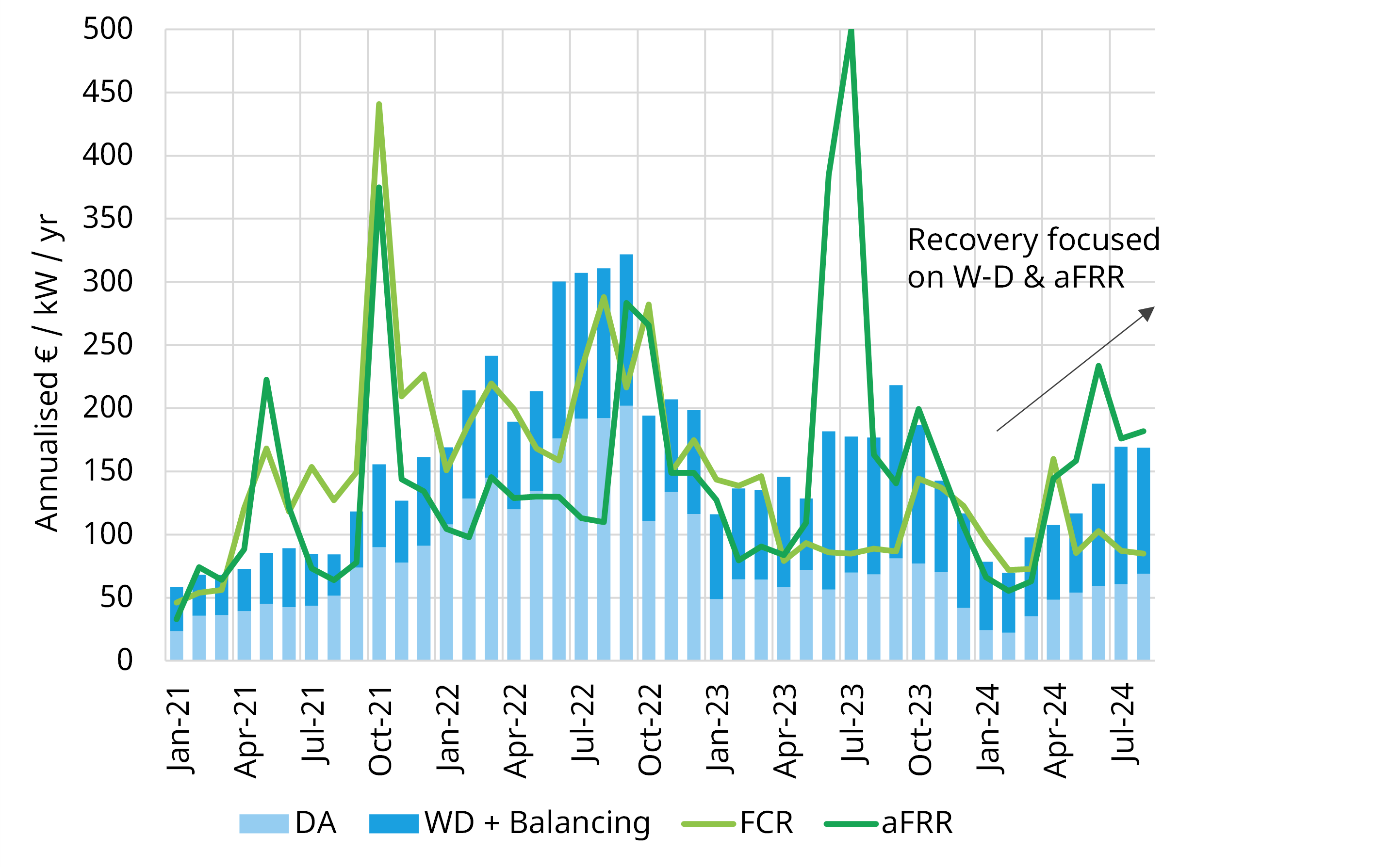

Q1 2024 was challenging for German BESS, with achieved revenues plunging below 100 €/kW/yr as a mild winter & weak gas prices took hold, as shown in Chart 1.

Chart 1: German 2hr BESS revenue performance

Source: Timera BESS dispatch optimisation model backtest

However German BESS assets have seen a sharp revenue stack recovery across Q2-Q3, with revenues back above 150€/kW/yr levels in Q3. This recovery has been supported by strong intraday market volatility and real-time aFRR energy prices.

Growth in summer solar output has been a key driver of system stress & higher revenues, particularly on higher wind output days. This has been an important factor behind a strong increase in negative German power prices which we explore in more detail with charts here.

A combination of low residual load and high solar has led to higher FCR and aFRR prices across the middle of the day. Low prices mean generators which usually provide downward flexibility are not running, driving up ancillary service price signals to incentivise alternative flex.

The Q2-Q3 recovery in German BESS revenues is supporting a recovery in offtake floor & toll levels and driving strong investor interest in acquiring & developing projects.

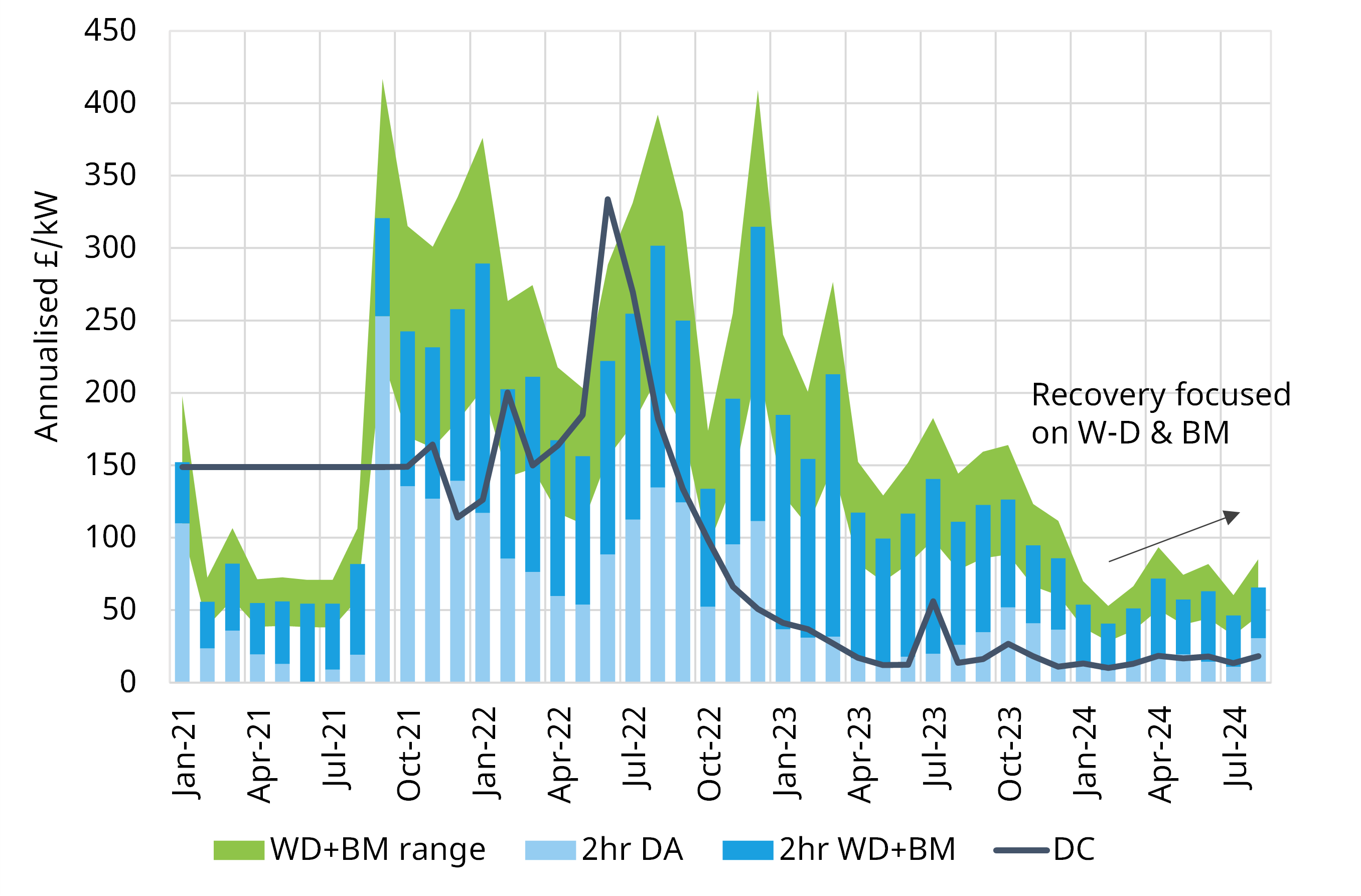

GB – a more cautious recovery

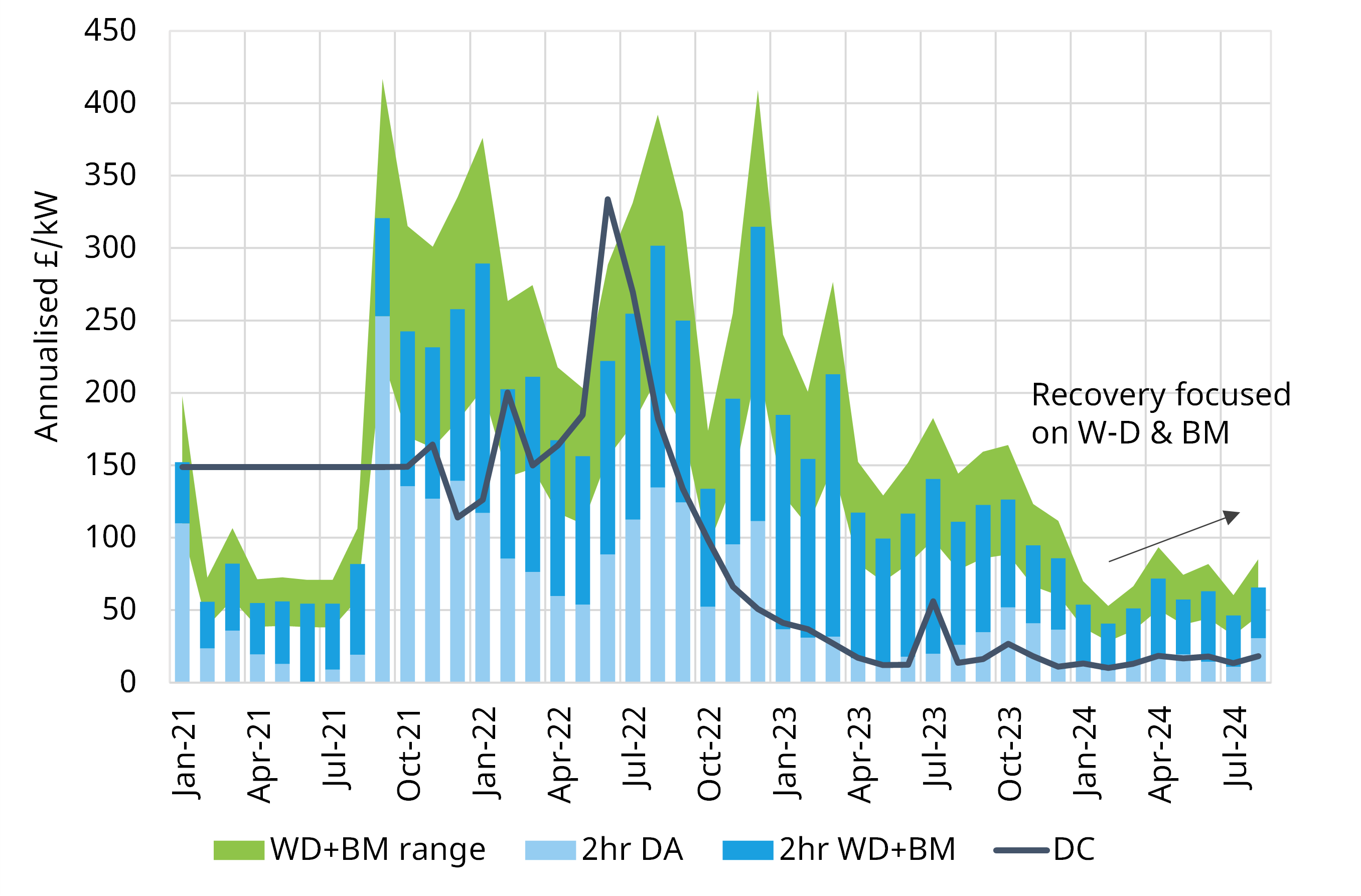

If German BESS found Q1 2024 challenging, it was even tougher for GB BESS assets. Revenues slumped below 50 £/kW/yr as shown in Chart 2, causing issues with offtake price floors and debt service coverage.

Chart 2: GB 2hr BESS revenue performance

Source: Timera BESS dispatch optimisation model backtest

The revenue stack has recovered in Q2 – Q3 with gas prices & weather normalisation, but the recovery has been more muted than in Germany. This in part reflects greater BESS capacity on the system as well as a less pronounced impact of solar. It also reflects fully saturated GB ancillary service markets.

Day-ahead price spreads capturable by 2 hour duration BESS recovered from below 40 £/MWh in Feb to around 70 £/MWh in Aug. BESS revenues have also been supported by:

- a significant trend higher in BM volumes for BESS

- an increase in negative prices & intraday value capture.

Gas price levels and the pace of RES penetration growth are two key drivers to watch across the next 1-2 years.

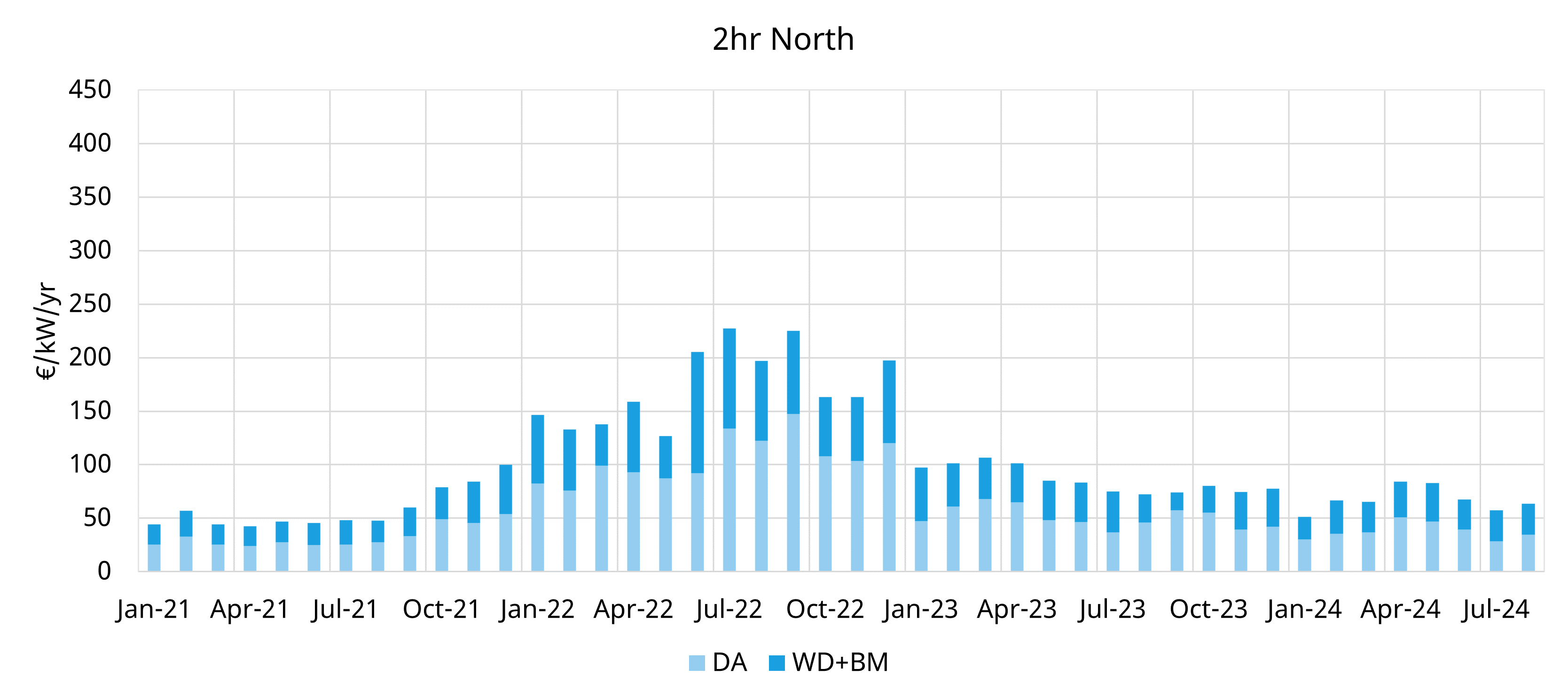

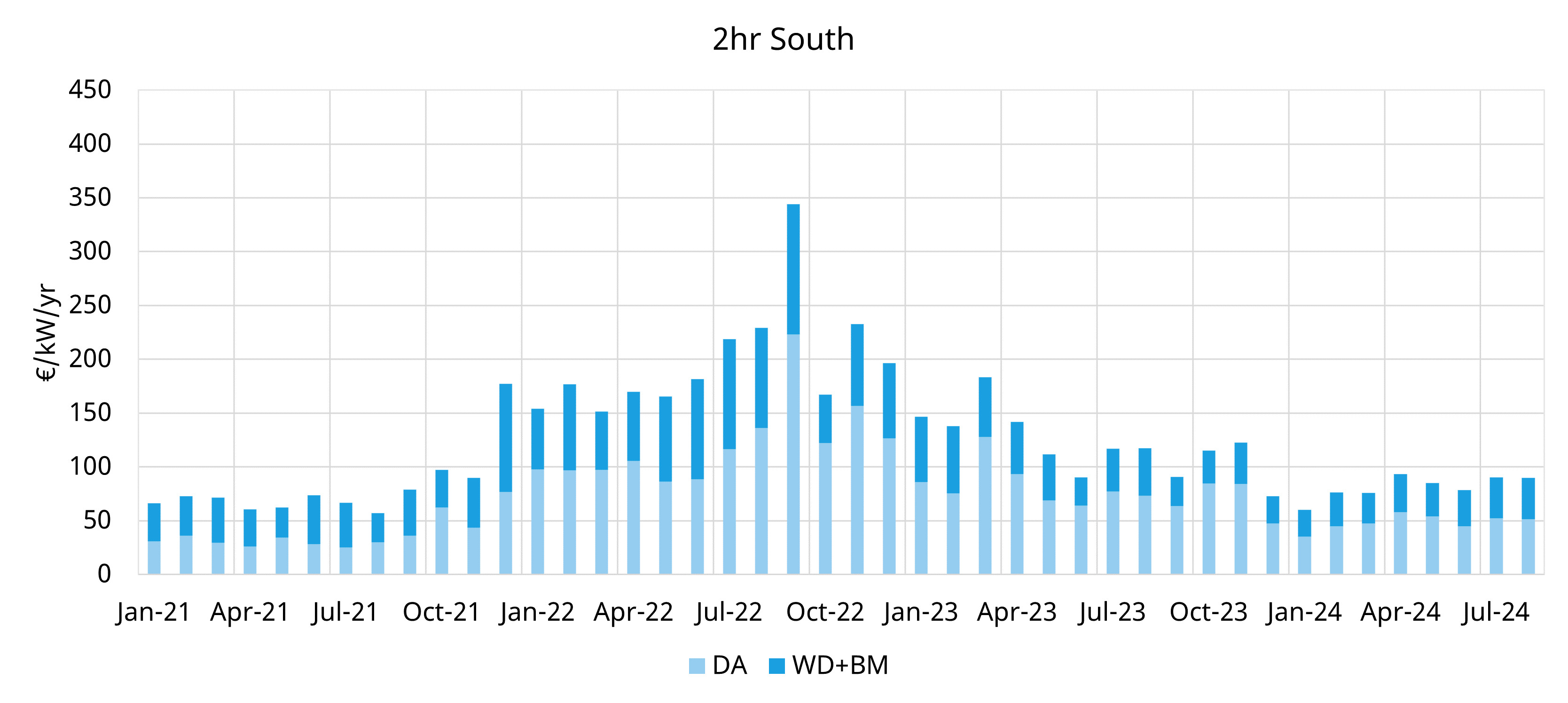

Italy – revenue divergence across zones

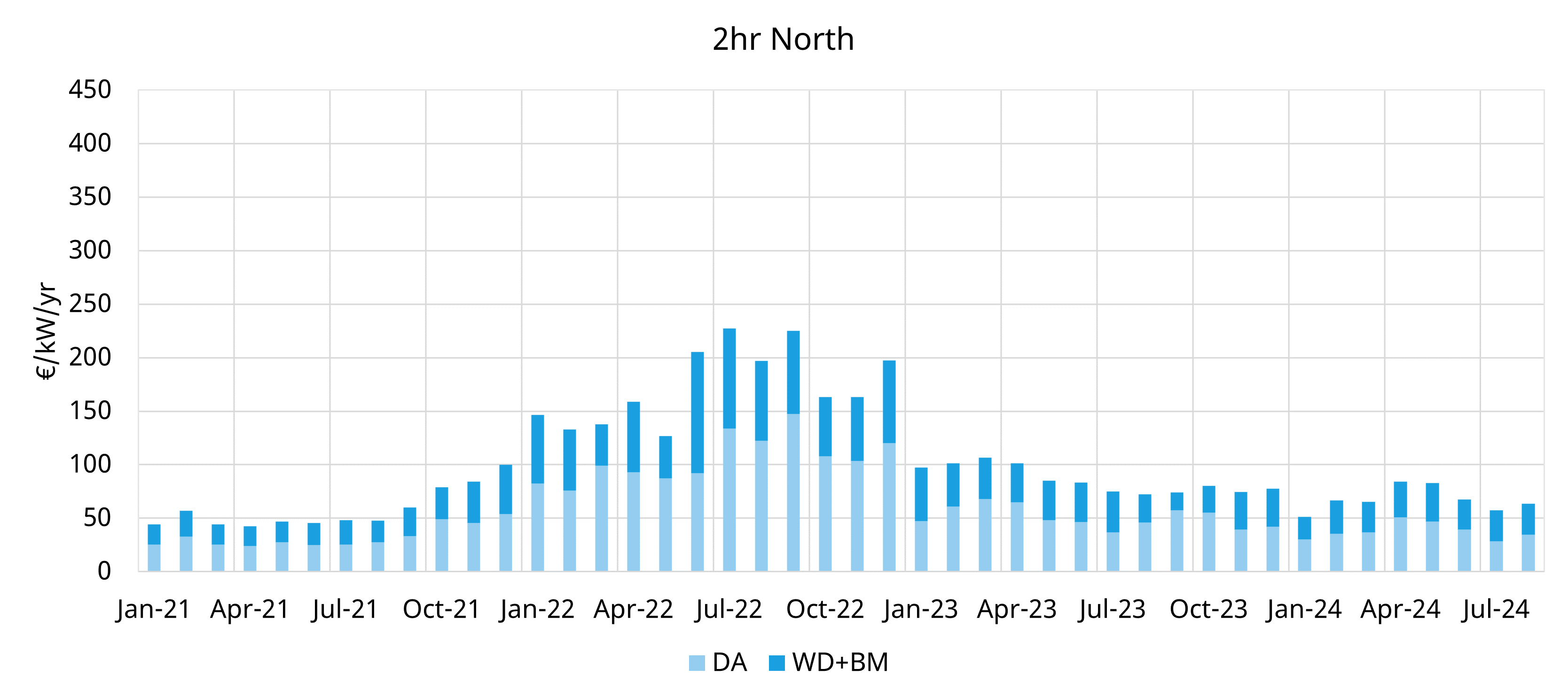

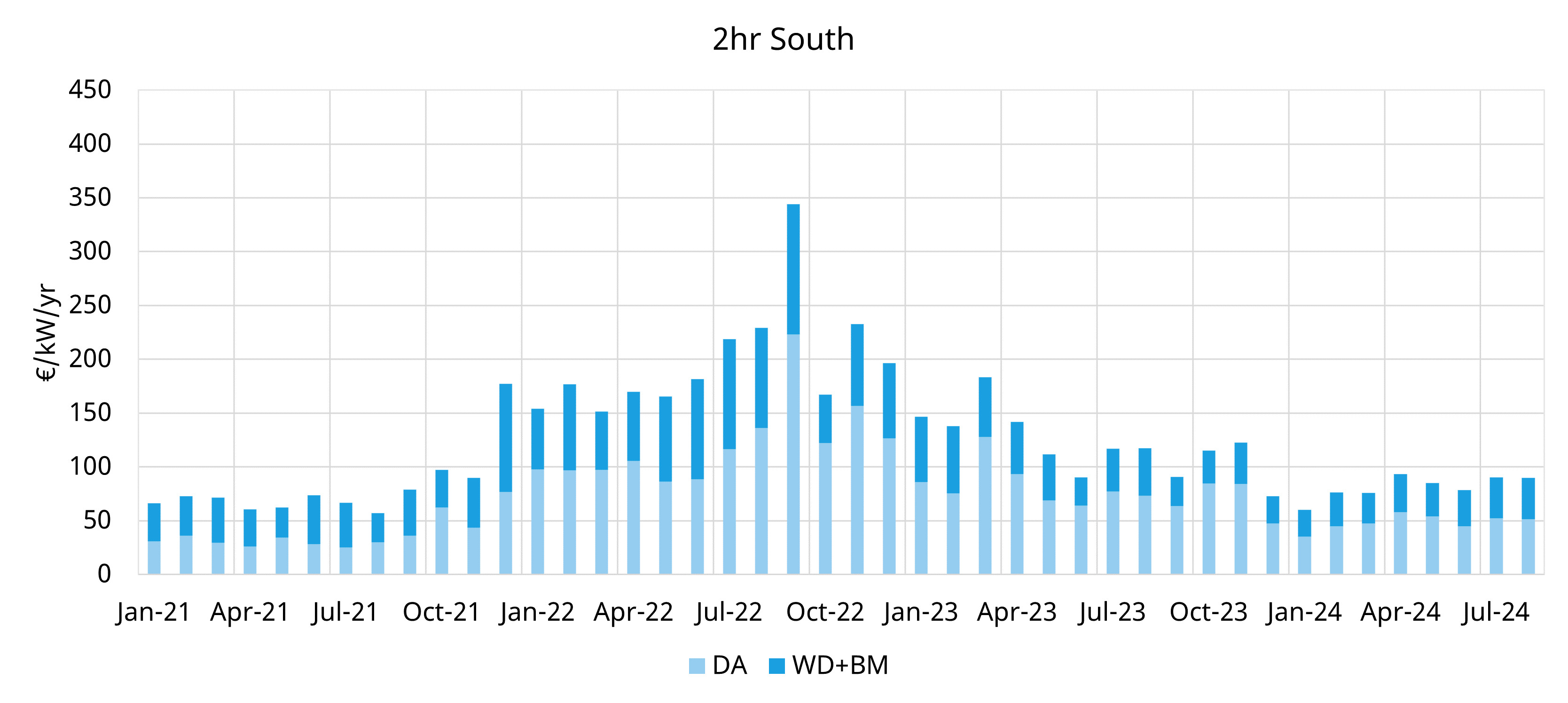

Italy is a zonal market and BESS location is much more important than in NW European markets. We model Italian BESS at a fully zonal level and in Chart 3 we show BESS revenues for the North & South zones (2 of the 6 zones).

Historical and projected revenue numbers for all 6 zones are available in our new Italian BESS investment package (across a range of durations of BESS assets) – if you would like a free sample of our report & analysis see more details below this article.

Chart 3: Italian 2hr BESS revenue performance

Source: Timera BESS dispatch optimisation model backtest

BESS revenue capture in the North is typically lower than in the South (& on the islands). This is a result of high flexibility available in the North (e.g. flexible hydro, pump storage & CCGTs) which dampen day-ahead price spreads.

Liquidity on the intraday market is still very low compared to Germany & GB. However this is set to grow significantly from next year with the Integrated Scheduling Process (ISP) at 15 minutes and the introduction of more 15 minute cross border products on XBID and 15 minute granularity (MTUs) on intraday auctions. RES penetration growth will also support intraday liquidity.

The MSD market (for balancing & ancillaries) is starting to play a more important role in creating incremental BESS value on top of Day-Ahead spreads, after BESS participation in MSD kicked off earlier this year.

Secondary Reserve value dropped sharply in late 2023 to early 2024 due to Italian participation in the EU aFRR platform (Picasso). However a number of technical issues saw Italian aFRR participation suspended from March 2024 which has led to a partial recovery in Secondary Reserve value.

MSD value saturation since 2022 has mainly affected the MSD ex-ante market segment, but with a greater impact on CCGTs and other conventional assets than for BESS.

It is important to note that in addition to energy arbitrage revenue in Italy, very lucrative 15 year fixed price MACSE or Capacity Market contracts are also available to underpin the BESS revenue stack.

5 revenue drivers across next 1-2 years

Last winter was a tough environment for BESS revenues after a spectacular 2021-22. A solid recovery is underway since the trough in Feb 2024, although the pace & nature of the recovery varies across markets.

Let’s finish with 5 key revenue drivers to watch across the next couple of years

Table 1: BESS key revenue drivers to watch

We explore all of these factors in more detail in the latest releases of our BESS products for GB, Germany & Italy.

Timera Italian BESS investment product

We are launching an Italian BESS investment package that includes:

- A comprehensive & flexible BESS investment tool with revenue projections to 2050, revenue distribution data (e.g. P10, P90), degradation & cycling data across multiple durations and all Italian zones

- Zonal Italian power market price, supply & demand projections to 2050

- A comprehensive Italian BESS investment case report covering MACSE / CM bidding strategy and key BESS investment value drivers.

For further details and a sample copy of the report, feel free to contact Alessio Cunico (Senior Analyst) alessio.cunico@timera-energy.com or Steven Coppack (Power Director) steven.coppack@timera-energy.com.