Europe was already facing an unprecedented energy shock before the Ukraine war. Across the last 4 weeks this shortage of molecules and electrons has morphed into a major geopolitical & security crisis.

“The Ukraine war has ignited a parallel focus on resiliency, security of supply and energy independence”

Europe’s dependency on imported hydrocarbons, particularly from a hostile Russia, has been laid bare. This is creating seismic shifts in both the energy policy & energy market landscape. The rules are changing and fast.

In today’s article we look at what are likely to be 5 enduring impacts of the current crisis.

1.Prioritisation of resiliency

Up until the current energy shock, Europe’s primary energy policy focus has been on decarbonisation. The Ukraine war has ignited a parallel focus on resiliency, security of supply and energy independence.

The immediate implications of this are policy intervention to target resiliency, even at the expense of higher near term emissions. This includes:

- Extensions of coal asset lives (e.g. the potential for a new German coal plant reserve)

- Nuclear life extensions (e.g. Belgium delaying nuclear exit by 10 years)

- Gas storage inventory mandates (e.g. Germany & Italy targets, as well as a proposed 80% 1st Nov EU storage mandate)

- Demand reductions – the practicalities of which are much less clear, at least across a 3 year horizon

- Increasing European domestic oil & gas production (to the reasonably limited extent possible).

Beyond these immediate measures, Europe faces a much larger problem. In a world of fracturing supply chains and rising geopolitical tensions, energy independence is becoming much more strategically important. Europe can’t achieve hydrocarbon independence (like the US), but it can accelerate its transition to low carbon energy to reduce import dependence.

2.Acceleration of energy transition

Europe is attempting to shift its hydrocarbon demand to friendlier sources (e.g. buying LNG from the US). But the clearest path to greater energy independence is to push a faster transition to local low carbon resources.

Some of the more obvious target areas are:

- Accelerating deployment of renewables (i.e. tap strong wind & solar resource base)

- Leading innovation of energy system flexibility & balancing technologies e.g. storage & demand side flex

- Leading global development of hydrogen & bio-gas supply chains (e.g. plan for a new Norway – Germany hydrogen pipeline)

- Targeting gas demand reduction (on top of already aggressive Fit for 55 goals)

- Implementing clear incentives & standards for energy efficiency.

There is strong pan-European political support for accelerated action. The key constraint is how it will be funded. But the current crisis is acting as a catalyst for a more open fiscal stance and more coordinated EU action, potentially even via jointly funded programs (e.g. eurobonds).

Russia, price inflation, climate change & jobs sit at the top of the political agenda. Energy transition is being painted as a solution to all four.

3.Pivot to LNG

The inconvenient reality for politicians is that the energy transition will take years (in many areas decades). In the meantime Europe is structurally dependent on gas, for example as a marginal fuel in the power sector, to fuel key industries & to heat homes. At least 30% of this gas currently comes from Russia.

As we set out last week, a pivot away from Russian gas is effectively a pivot towards LNG, at least across the 2020s. This is sparking a renewed focus on LNG import infrastructure & supply contracts such as:

- New LNG terminals (e.g. 2 Baltic terminals in Germany & potential FSRUs in Italy)

- Contracting of new LNG supply (e.g. last week’s German deal with Qatar and broader EU announcement on US LNG)

- Potential alleviation of import flow constraints (e.g. Spain/France interconnectors, increased UK export flow and the potential to swap North African supply from Spain to Italy & backfill via LNG).

There is a very fast moving policy debate in the European gas market at the moment. It pays to be careful what you believe. European politicians appear to be trying to outbid each other in an attempt to reduce Russian gas dependency (e.g. EU two thirds reduction in Russian gas demand in 2022; German independence from Russian gas by 2024, Europe by 2027).

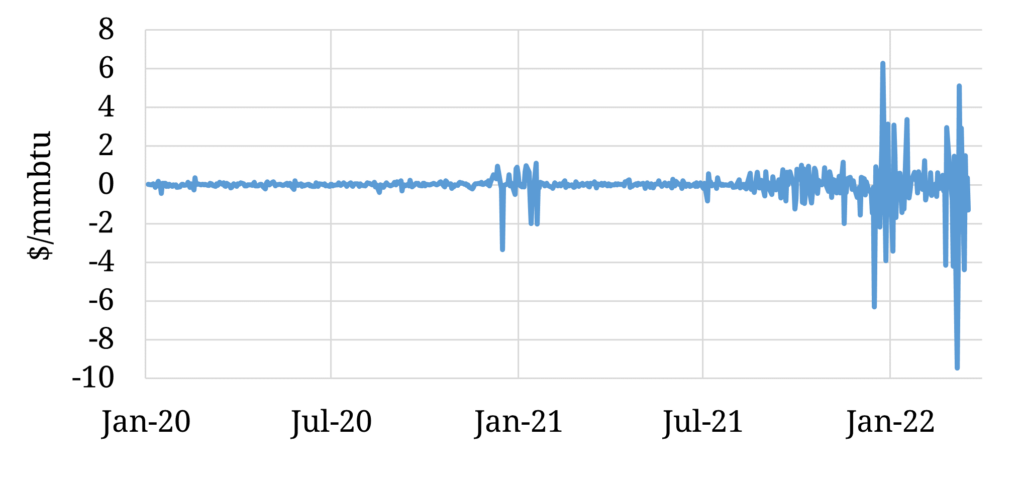

Many of these targets are fanciful in anything but a ‘cook the books’ sense. But they illustrate a very purposeful momentum to transition from Russian gas that will practically be achieved by Europe playing a bigger role in the LNG market. We set out the case for this LNG market regime shift last week as Europe & Asia dynamically compete for LNG cargos. This is well illustrated via the recent surge in volatility of the JKM vs TTF price spread shown in Chart 1.