Welcome back to our first feature article of the year. We kick-off the year with a set of 5 potential surprises to watch for on the radar screen in 2018. Usual caveat – these are surprises to take into consideration, not predictions to anticipate.

1. A setback for LNG prices?

Commodity price strength may continue to surprise in 2018. In particular, oil looks to have broken out of its 40 – 60 $/bbl trading range of the last two years. Commodity demand is being driven by China but also supported by healthy economic & manufacturing growth across most global economies.

Asian spot LNG prices have doubled across the last 6 months, rising above 11 $/mmbtu. Behind this was a surge in Chinese LNG demand to 37 mtpa in 2017, up 40% year on year. A number of factors have aligned to support Chinese demand including a strong policy shift to gas, rising coal prices, colder Q4 weather, strong economic growth and lower H1 spot LNG prices.

So it seems reasonable to assume LNG prices will continue to strengthen in 2018… doesn’t it? We’re not so sure. There is a risk that momentum behind the drivers of Chinese demand growth weakens in 2018. This is particularly the case if China’s 2017 policy shift to gas captured much of the ‘low hanging fruit’ from residential heating & industrial production.

As new supply continues to ramp up from Australian and US producers, a slower pace of Chinese demand growth could erode the LNG market tightening trend of H2 2017. That may support the re-convergence of Asian and European spot prices.

2. Blockchain transformation takes off

We wish you good luck if you want to convert your savings into bitcoin in 2018. But the blockchain technology behind bitcoin could radically change energy markets. 2018 may be the year the blockchain moves from the fringe to the centre of energy industry debate.

Blockchain is a technology that supports ‘peer to peer’ transactions. It is supported by the distributed storage of data across multiple users. As such, blockchain fundamentally challenges the conventional approach of centralised data storage e.g. via an exchange, a payment system or a grid operator. It also facilitates real-time multilateral trading at very low cost.

The energy industry is enormously data intensive. This provides powerful incentives to adopt blockchain technology, for example:

- Transaction costs: Blockchain efficiency has the potential to crush energy transaction costs. With an eye on this, BP & Shell are leading a push to set up a blockchain based energy trading platform by the end of 2018.

- Security: Cyberterrorism is rapidly becoming a key threat to energy systems, whether physical (e.g. grids) or financial (e.g. exchanges). Blockchain is effectively un-hackable and removes the risk of attack on a central data repository.

- Connectivity: Blockchain supports a much broader range of decentralised energy transactions, e.g. facilitating the purchase & sale of electricity from distributed solar & wind and EV charging.

- Disintermediation: The flexibility and transparency of blockchain encourages direct peer-to-peer dealings. Blockchain’s responsiveness and efficiency in doing this breaks down barriers for fully optimising smart grids, demand side response & distributed generation.

3. Reality check for UK batteries & engines

There has been enormous momentum behind investment in UK distribution connected reciprocating engines and batteries in 2016-17. This been supported by a rapidly evolving requirement for flexible capacity as well as falling costs of capital and technology.

While battery cost reductions continue at pace, they are last year’s story. The focus for battery developers in 2018 may shift from costs to revenues, as short duration lithium-ion batteries start to become a victim of their own success.

Frequency response revenues present the biggest risk for battery economics. More than 500MW of batteries already have capacity agreements. At least as much again are likely to receive agreements in this year’s auction. 2018 may be the year when UK frequency response prices start to buckle under the weight of new battery supply. Battery capacity market revenue was also dealt a blow in Dec 17 with more penal derating factors.

Competitive pressure may also rise for UK gas engine developers in 2018. Business model focus has shifted to wholesale market and balancing mechanism (BM) revenues, given the rapid decline in triad revenue by 2020. But 4-5 GW of new peaking capacity over the next 3 years raises the risk of a surprise erosion in prompt energy & BM margin.

4. Big step towards global hub based gas market

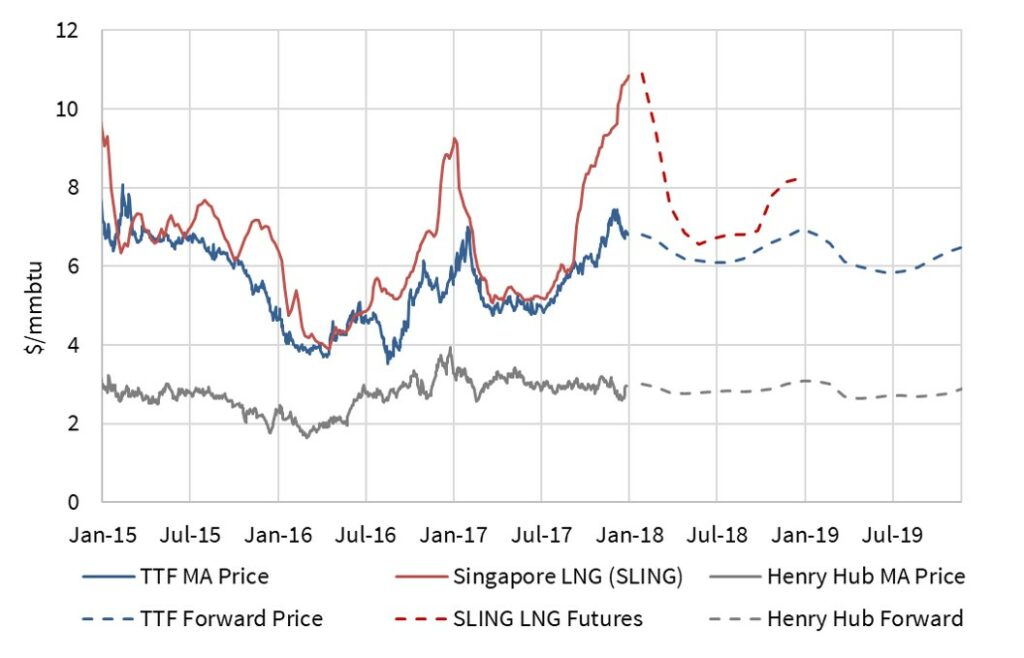

Legacy long term gas contract positions will ensure that oil-indexation remains in Europe and Asia for many years to come. But the relevance of oil-indexation is being rapidly overrun by the penetration of hub prices. This is creating greater spot price signal connectivity across the world’s regional gas markets as illustrated in Chart 1.