“2026 is shaping up as a year where being wrong could be expensive”

Our first feature article in 2026 continues a long-standing Timera tradition: flagging five surprises that could catch energy markets off guard over the year ahead.

These aim to challenge prevailing market consensus, but are not predictions or forecasts. Think of them as risks to have on your radar screen – where a plausible but under-appreciated outcome could materially shift value & risk.

Let’s get into it.

1. Rapid global gas price convergence

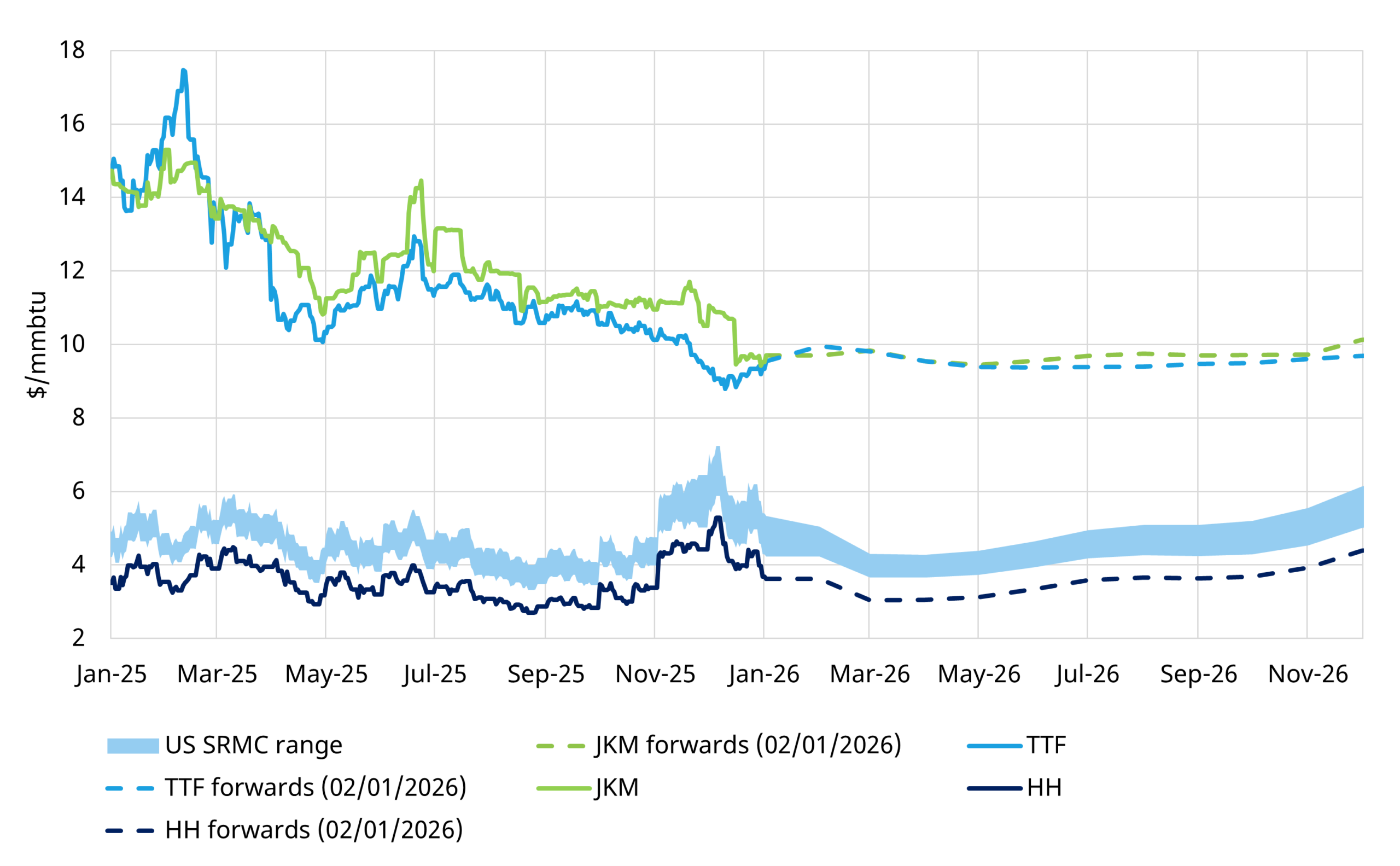

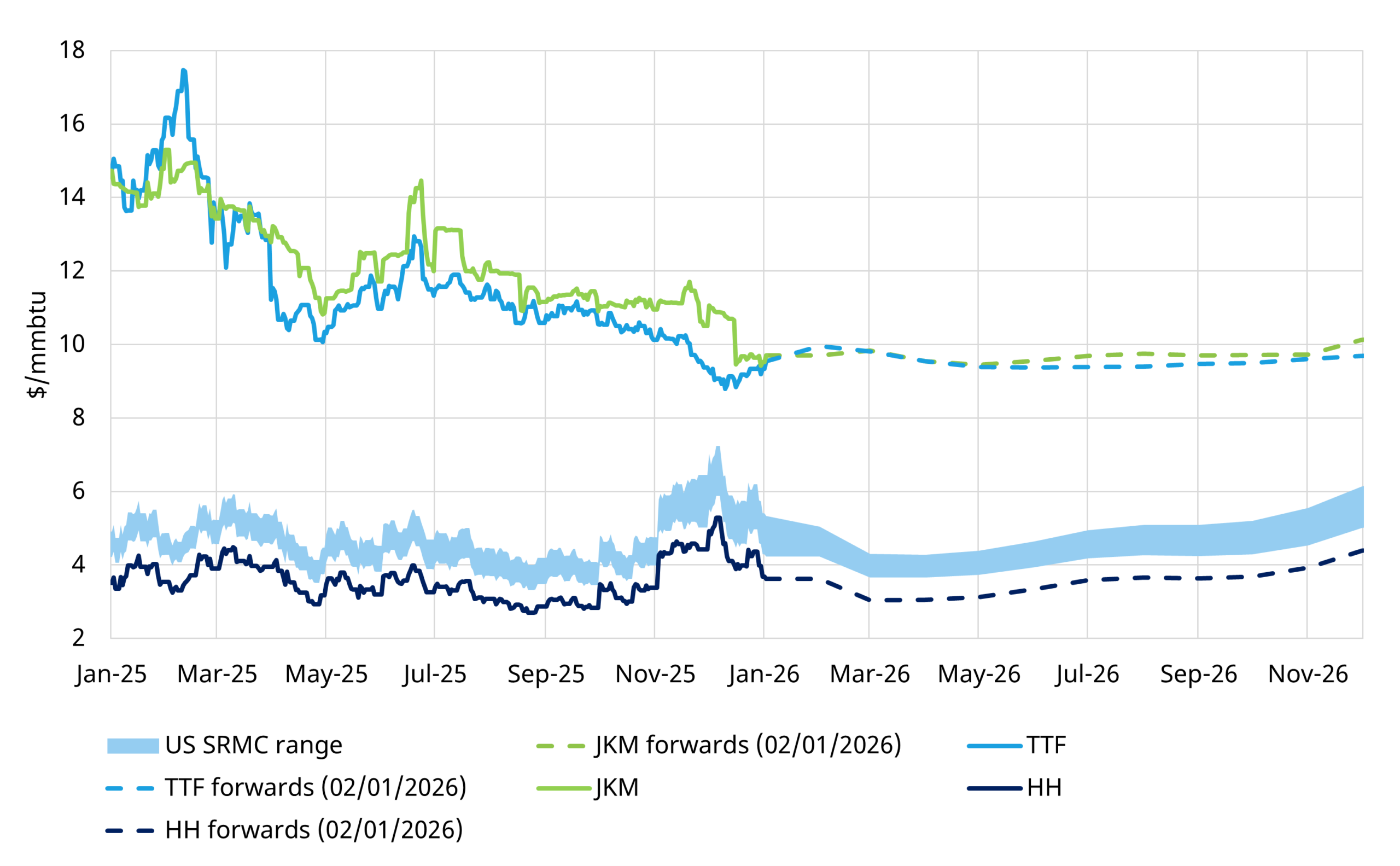

Accelerating ramp up of new LNG supply exerts decisive downward pressure on global gas prices. A sharp ramp-up in liquefaction capacity drives front-month JKM and TTF prices down below $7/mmbtu (c. €20/MWh). At the same time, a tightening US domestic gas market drives Henry Hub prices above $5/mmbtu, compressing global price spreads from both ends.

The result is rapid global LNG price convergence, with JKM and TTF falling to the upper end of the US LNG shut-in range, reflecting variable shipping cost differentials (see current shut in range levels shown in Chart 1). US LNG export contract margins shrink, and LNG portfolio strategy focus shifts away from contracting new supply and towards value optimisation of existing positions, particularly extrinsic value of portfolio flexibility.

Lower gas prices relative to crude and coal significantly improve LNG competitiveness in Asia, reinvigorating demand growth as prices move lower.

Chart 1: JKM & TTF vs US SRMC (shut-in range)

Source: Timera Energy, ICE, CME

2. Storage investment focus surges as RES returns decline

Storage investment focus broadens significantly from standalone BESS asset development. Asset owners increasingly prioritise integrated RES + BESS business models, driven by rising demand for firm power purchase agreements – particularly from data centres – and by colocation advantages such as accelerated grid access in congested markets like Germany.

Investor focus on RES + BESS projects is also supported by declining power prices and weakening capture rates eroding standalone RES asset returns (particularly for solar assets). This drives increasing concerns around RES concentration risk in investor portfolios, pushing investors and developers to favour integrated RES + BESS projects as a means of diversifying portfolio exposure.

Increasing maturity in BESS financing supports a sharp rise in large scale (500MW+) BESS assets, particularly from converted coal sites with advantaged existing connections.

At the same time, capital deployment into long-duration energy storage (LDES) accelerates as solar penetration deepens and support frameworks mature.

3. A European M&A transaction frenzy

2026 becomes a record year for European power and gas asset M&A. Activity is driven by an alignment of forced sellers, changing portfolio risk profiles and entry of new capital.

State-driven utility divestments – including German sales of Uniper and SEFE – combine with strategic portfolio reshaping such as EDF’s divestment of its Edison stake. At the same time, data-centre-led demand drives acquisition of generation infrastructure to secure long-term power supply.

Interest in thermal power assets also resurges, as investors refocus on flexibility and security of supply as RES penetration increases.

4. BESS ancillary saturation and price slump

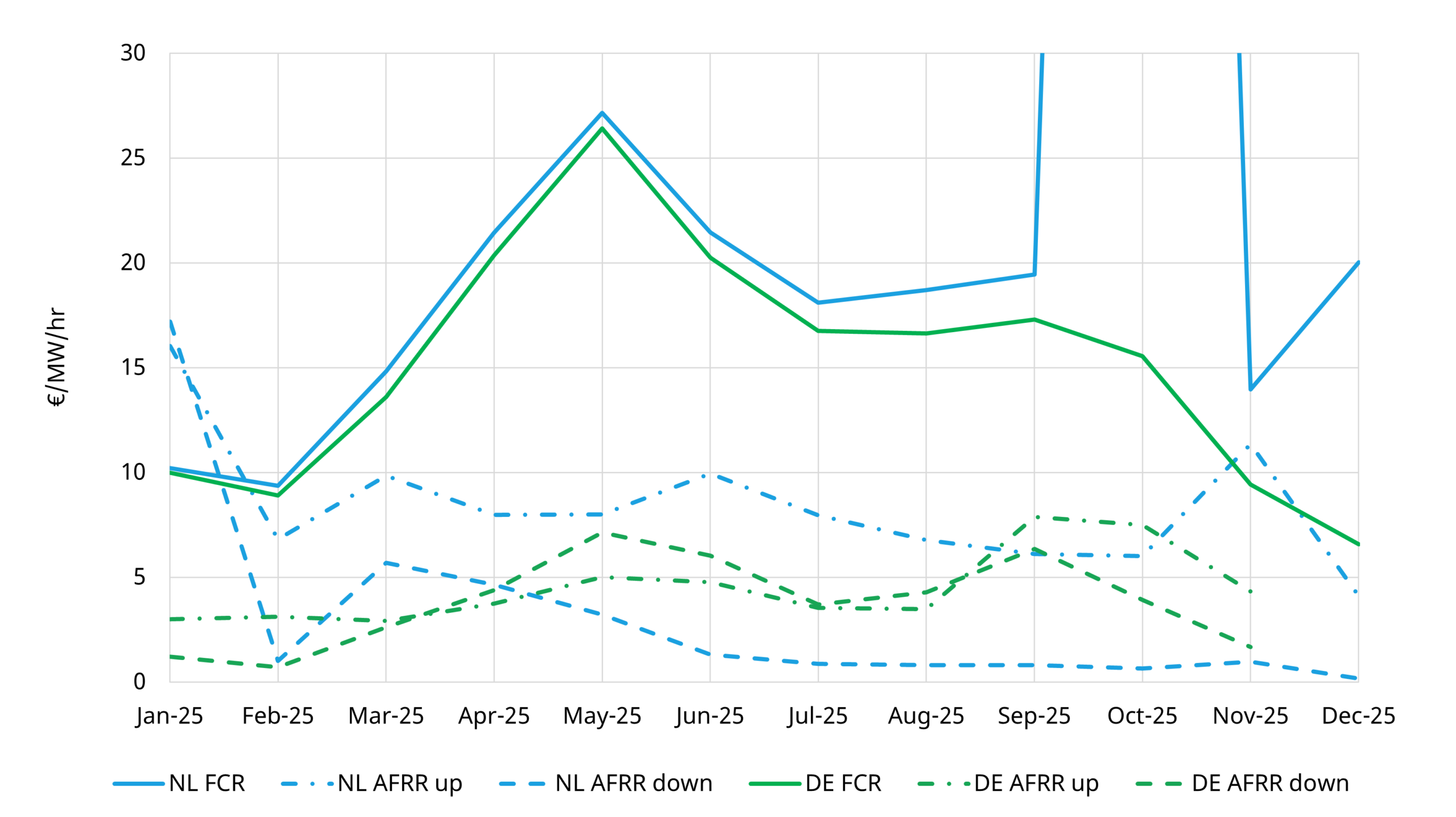

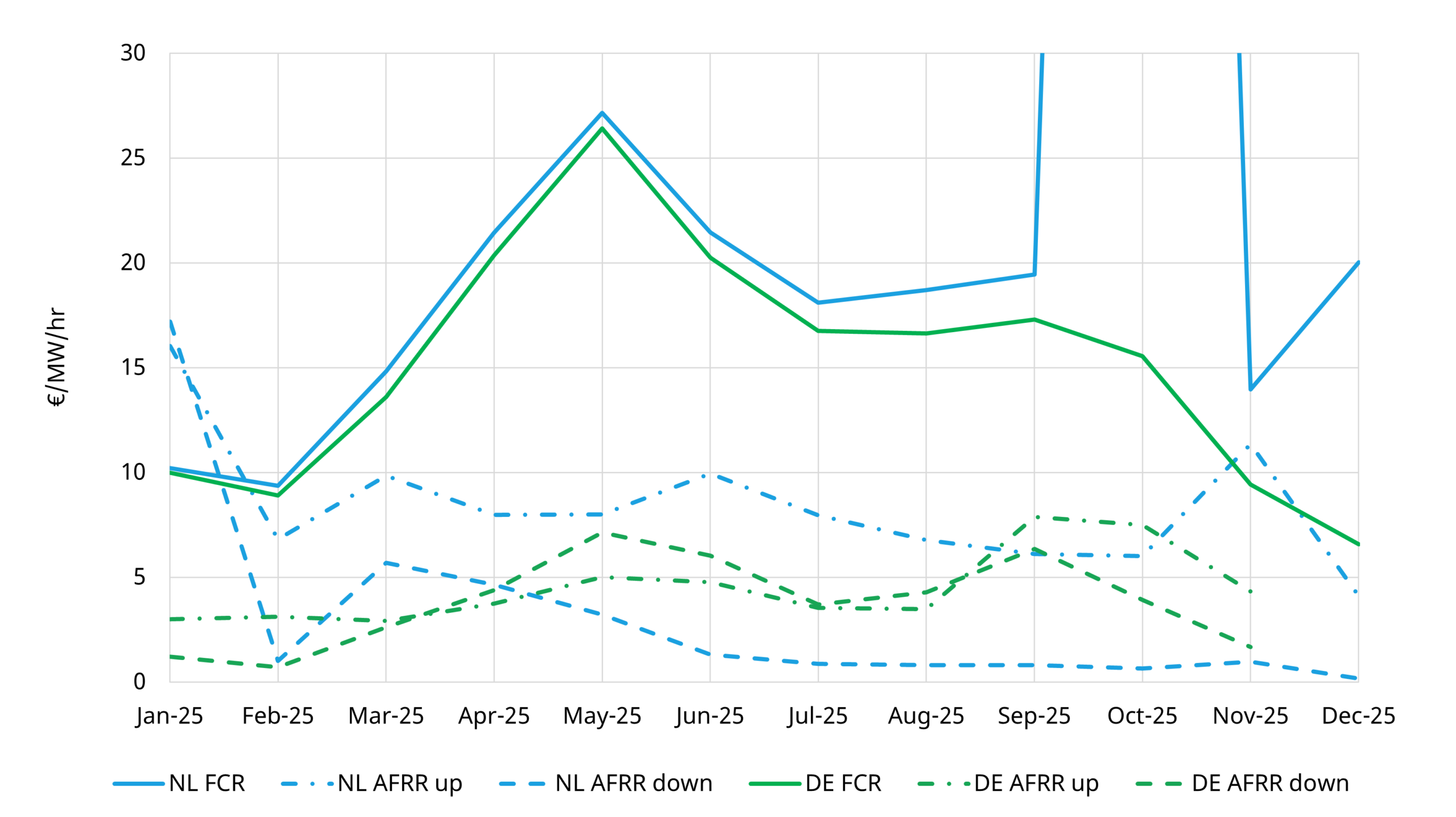

Rapid battery build-out across north-west Europe pushes BESS capacity structurally above demand for key ancillary services such as FCR and aFRR. The consequence is a sharp ancillary price decline, particularly in Germany, the Netherlands and Belgium, with prices falling back to levels that reflect the risk-adjusted opportunity cost of energy arbitrage.

In some markets, ancillary prices fall by up to 50% versus 2025 levels (shown in Chart 2). This does not undermine the overall BESS investment case, but it does fundamentally change where returns are earned. Value shifts firmly towards merchant arbitrage across day-ahead, intraday and balancing markets, with increasing performance differentiation driven by optimiser capability rather than asset ownership alone.

Chart 2: Ancillary prices in Germany & the Netherlands

Source: ENTSOE, Regelleistung

5. Demand strength above all expectations

Finally, demand surprises to the upside. European gas & power consumption rebounds more strongly than anticipated, led by an industrial resurgence – particularly in Germany – and by higher power sector gas burn as falling gas prices undercut coal.

In parallel, Chinese commodity demand returns with force, supported by government stimulus measures and feeding through into stronger LNG and oil consumption. Lower spot LNG prices reinforce this trend, triggering unexpectedly robust demand response across broader Asian markets.

This also supports a substantial move higher in the ratio of Brent to JKM/TTF prices, with major commercial implications for LNG portfolios.

The surprises we set out above point to a year of significant energy market opportunities and risks. We wish you all the best in navigating these (& many more) surprises in 2026! And feel free to reach out to us if you would like to catch up.

Want to discuss these or other market & value drivers?

Feel free to reach out to our team:

Or you can meet us in person at LNG 2026 (2nd – 5th Feb in Doha), or the Energy Storage Summit (24th – 25th Feb in London).