2025 has seen a bounce back in GB revenues following a tough 2024. As a benchmark, average 2hr BESS revenues have risen from ~55 £/kW/yr to ~ 85£/kW/yr in 2025 so far.

In this article we look at 5 key drivers and trends in the GB BESS market across 2025. We also challenge how these may evolve over the next 5 years given a substantial increase in new BESS capacity coming online.

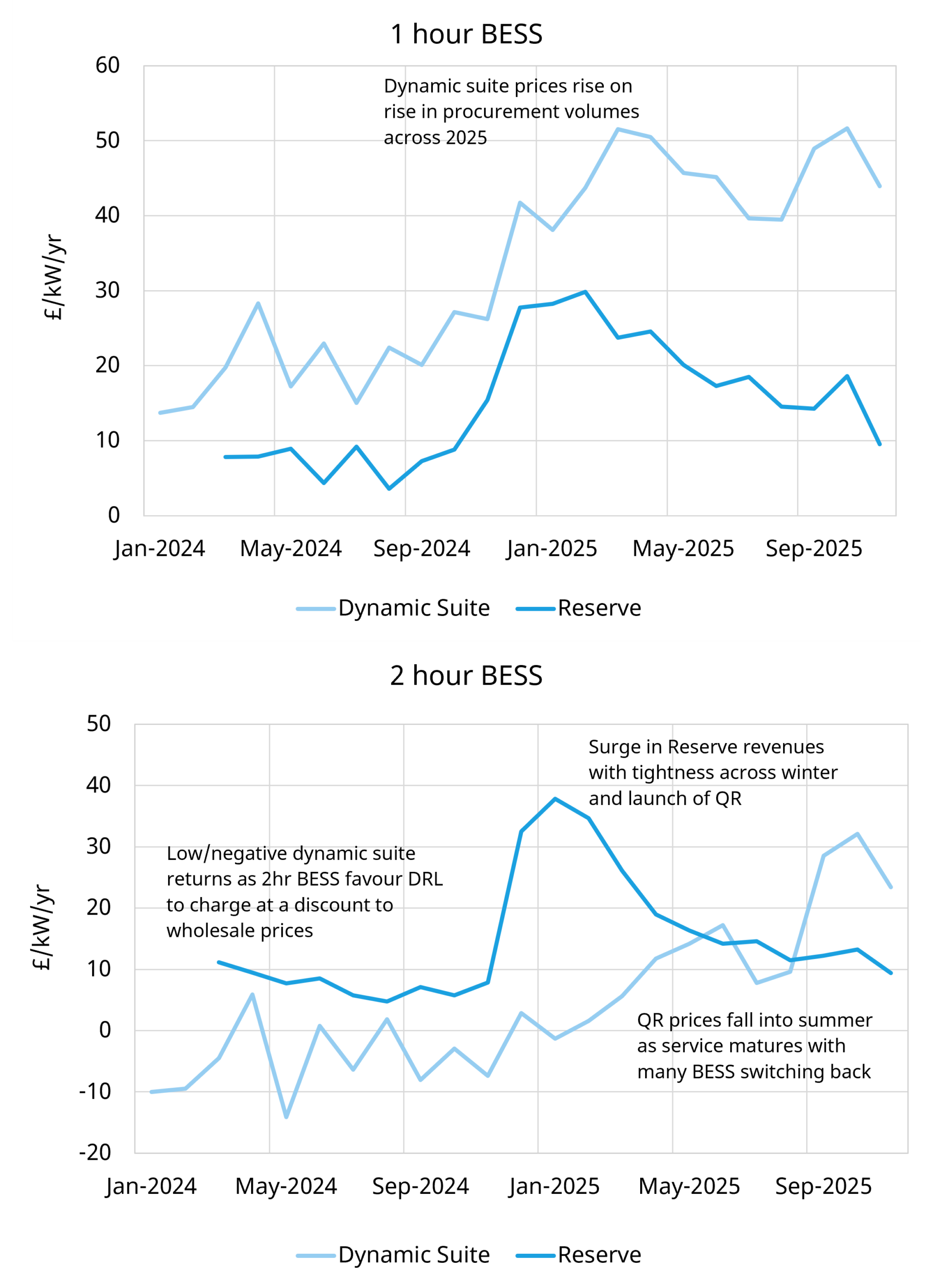

1. Ancillary revenues see a resurgence in 2025

Across 2025, BESS ancillary revenues have risen as shown in Chart 1, due to:

- Higher procurement volumes (~+1 GW from Dec-24 to Nov-25) following the launch of Quick Reserve (QR) and increased DR/DM requirements.

- Added risk premia in bids as NESO tightens enforcement of commercial non-delivery of services in early 2025, particularly after very high QR revenues seen across Q1-25 which we discussed in one of our previous articles: Analysis of the recent GB BESS revenue recovery – Timera Energy

Ancillary strategy has also become more locational with Scottish 2 hour BESS prioritising reserve products to stay available for Balancing Mechanism (BM) congestion, while non-Scottish 2 hour BESS favour Dynamic Regulation led strategies to access cheaper charging than in the wholesale market.

Over the next few years, with further regime changes e.g. market rule alignment between Balancing Mechanism Units, BMUs and non-BMUs (e.g. Applicable Balancing Services Volume Data ABSVD treatment), potential locational ancillary procurement, and a large ~20 GW BESS pipeline to 2028/29, ancillary prices are likely to decline and play a more complementary role to BM and wholesale trading strategies.

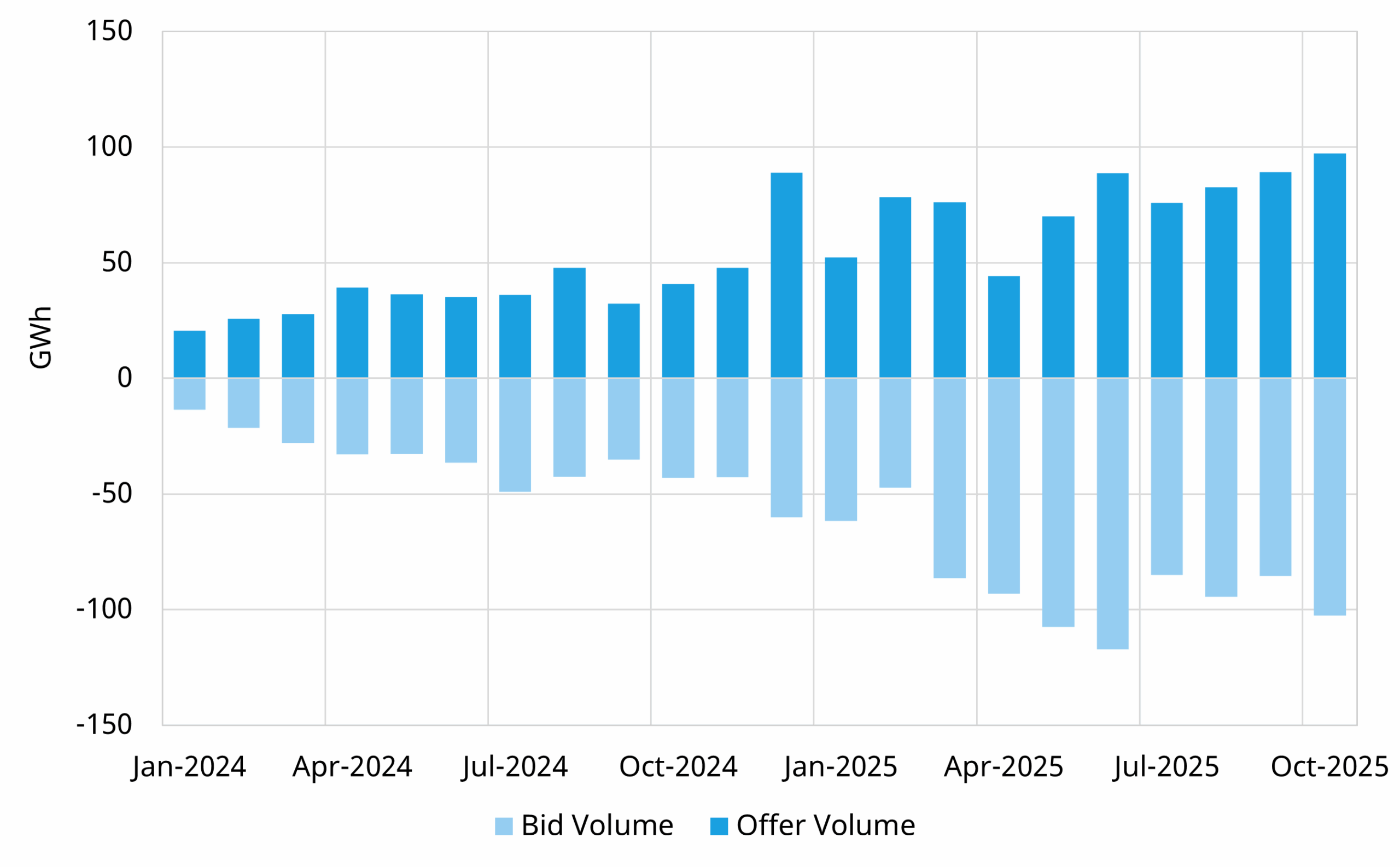

2. BM volumes start to plateau after launch of OBP

Following the launch of OBP in late 2023, BESS acceptance in the BM has increased markedly versus early 2024, opening up new trading strategies and revenue opportunities for GB BESS through 2025.

As we move into late 2025, BM acceptance volumes appear to be plateauing, or at least growth is moderating. This is consistent with the fact that certain BM actions are inherently less suited to BESS, for example longer duration (>2h) actions where non–duration limited assets are required.

Looking ahead to 2026, the rollout of the recently approved GC0166 will give full visibility of state of charge of BESS to NESO (currently restricted to 30 mins) and will push BESS another step towards skip rate parity and likely open up further revenue upside.

The BM is also a major driver of locational differentiation in BESS trading strategy, with Scottish assets increasingly monetising congestion via higher bid acceptance, while non-Scottish assets tend to focus more on offers. Zonal pricing dead in GB, but location still drives value – Timera Energy

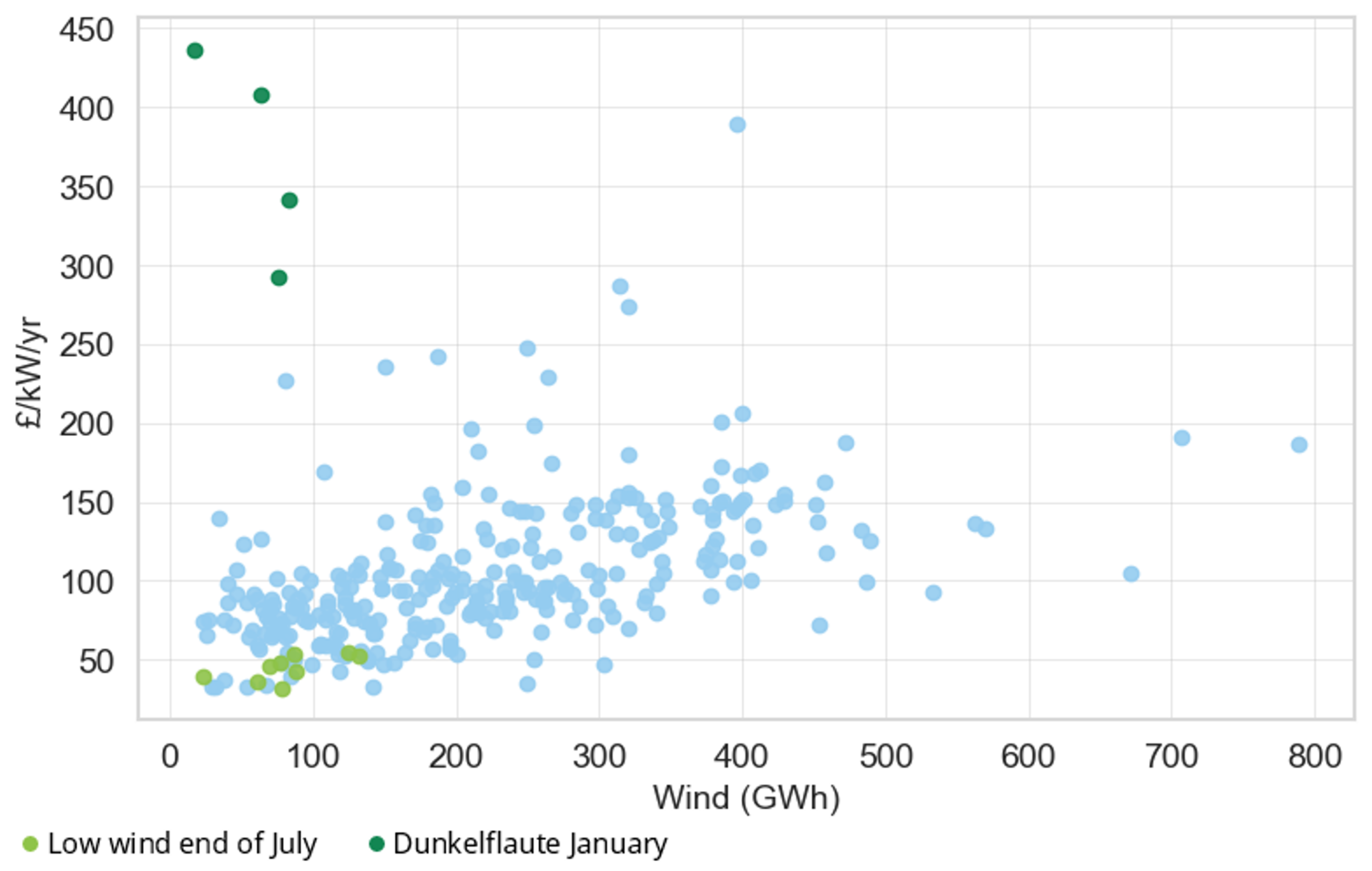

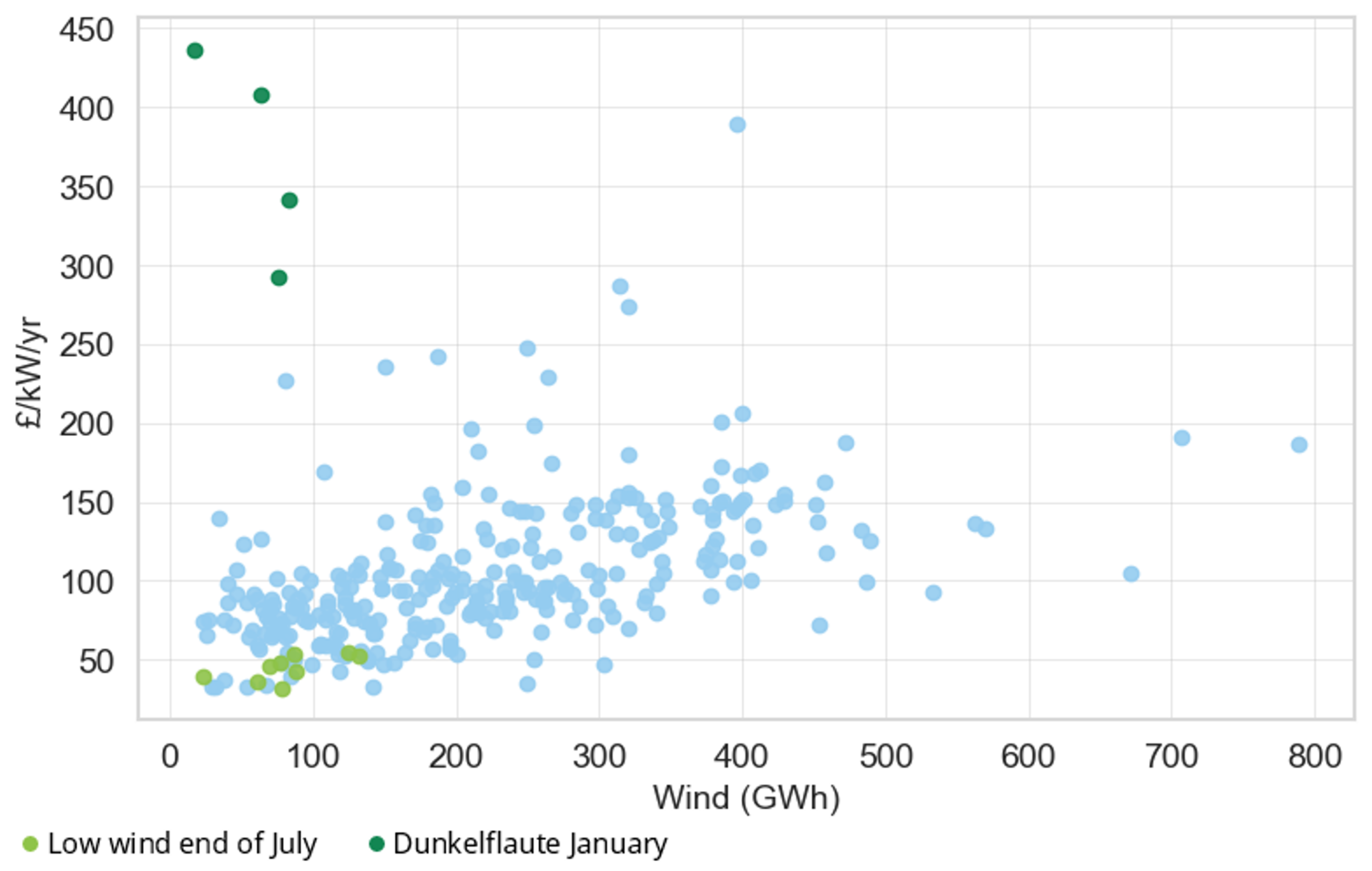

3. Low wind periods can boost or dampen BESS revenues

Chart 3 shows a clear positive relationship between daily wind output and GB BESS value, with higher wind generation typically associated with higher revenues.

Chart: Daily average 2hr BESS revenue vs wind output (across 2025)

Source: Timera, NESO, EPEX

However, low wind periods can still create very different outcomes depending on system margins as was seen across 2025.

In January 2025, Dunkelflaute conditions combined with tight margins to drive high spreads and very high BESS revenues. However in late July similar low wind conditions coincided with looser margins and gas on the margin for most of the day, muting volatility and resulting in much lower revenues. See further detail here: GB BESS revenues fall across summer from ~90 £/kW to ~55 £/kW – Timera Energy .

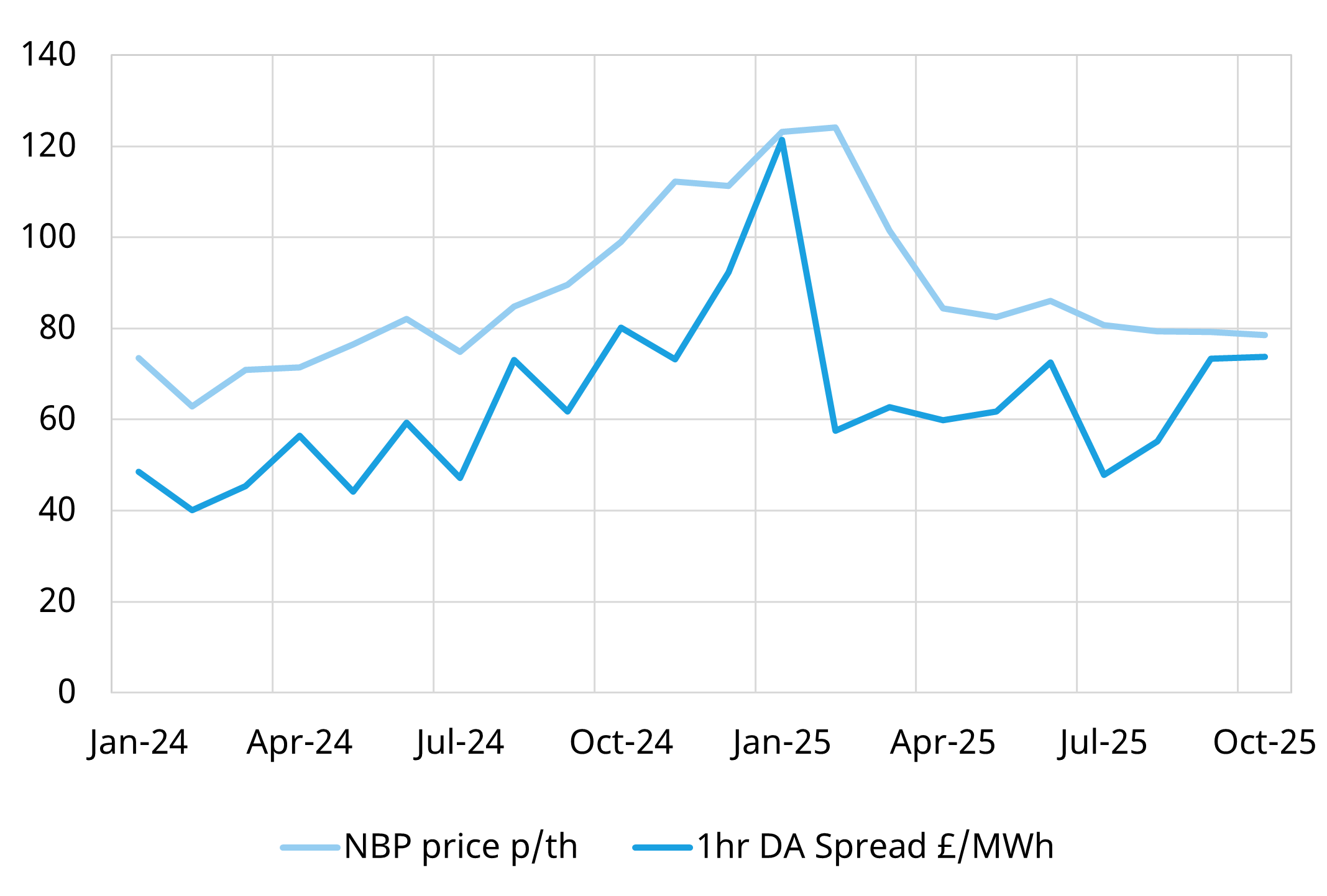

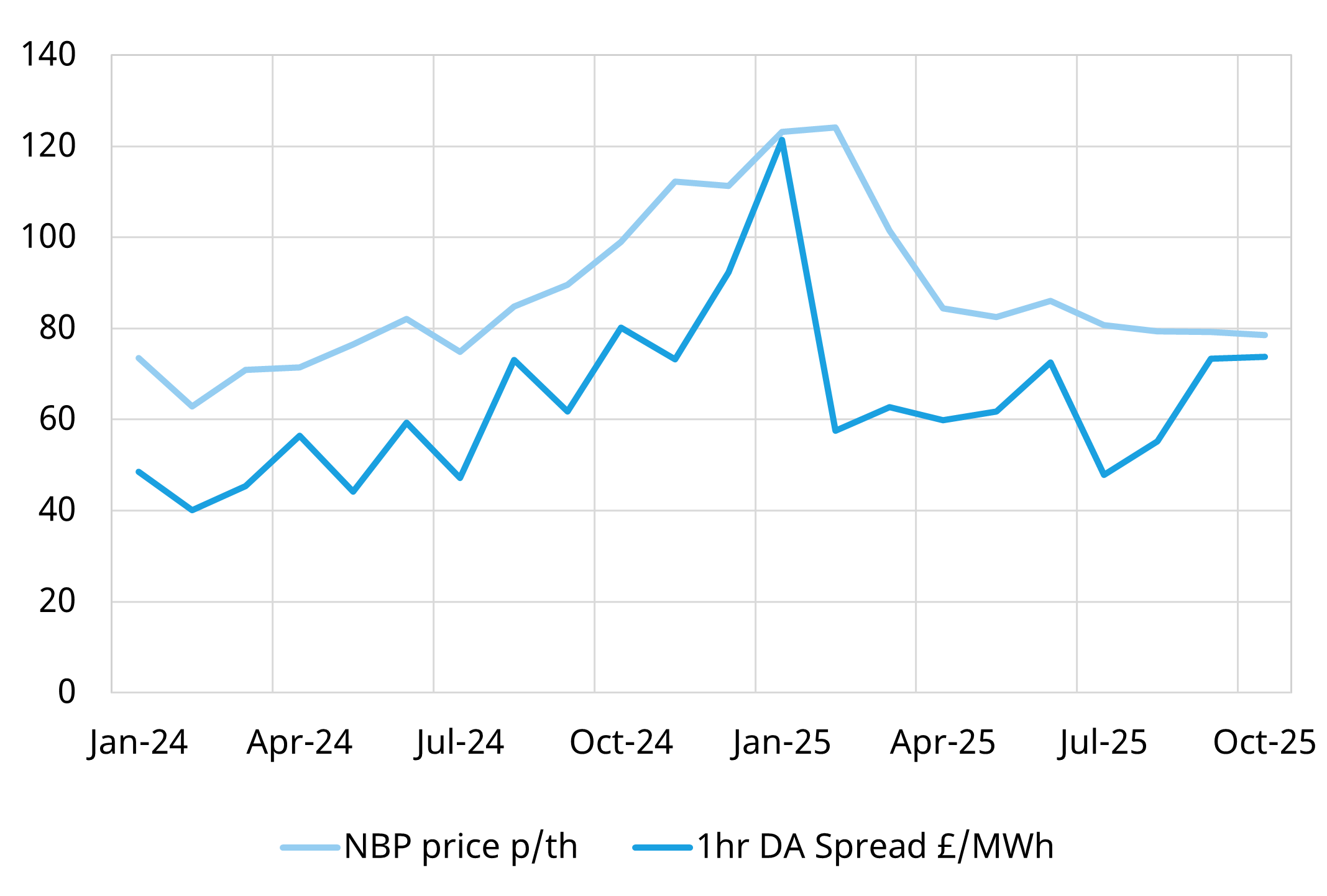

4. Gas price impact remains important

Chart 4 illustrates how gas prices continue to anchor 1 hr DA spreads with higher gas prices a driver of higher spreads observed in 2025 relative to H1 2024.

Chart 4: NBP vs DA 1hr spreads in GB

Source: ICE, EPEX, Timera

Gas still plays a core role in the GB market providing around 27% of GB generation in the last year. As we move into winter, cold snaps could trigger spikes in gas prices and volatility that BESS can leverage to boost revenues, while further out, a significant increase in global LNG supply is expected to put downward pressure on gas prices and, in turn, on spreads.

5. GB BESS transaction activity ramping up

Transaction activity in the GB BESS market slowed through H1 2025. Investors (i) awaiting clarity on the zonal pricing decision and (ii) as grid connection reforms began to bite with the launch of TMO4+ and a new gated, location-quota based regime.

Following the rejection of zonal pricing earlier this year, we’ve seen activity pick up again, with a wave of large projects raising debt and taking FID. Regulatory uncertainty is however still a source of concern, with Gate 2 results expected, TNUoS grid fee reform on the horizon and further changes to the Capacity Market (CM) to come.

Timera GB BESS services

At Timera, we use our proprietary stochastic modelling framework to project revenues for BESS and other flexible assets across European power markets, an approach that is becoming increasingly important as renewable penetration rises and volatility grows.

If you’re an investor looking to navigate the GB market and want modelling of risk adjusted returns, reach out to Arshpreet Dhatt, Senior Analyst (arshpreet.dhatt@timera-energy.com) and we can provide a redacted copy of our GB BESS subscription report.