“Drivers of locational revenue capture are here to stay”

BESS revenues in GB remained under pressure for Q1-Q3 2024. Market volatility was relatively subdued driven by lower gas prices and benign weather & renewable output conditions.

However the onset of winter has seen a marked improvement in BESS revenue performance. A winter gas price rally, improved Balancing Mechanism (BM) access and utilisation, and elevated wind volatility have combined to support higher BESS returns since Dec 2024.

In this article, we explore which batteries have led the revenue recovery over winter 2024/25, and how batteries in England and Scotland are adopting different strategies in response to their unique market and locational dynamics.

Which GB batteries are top performers?

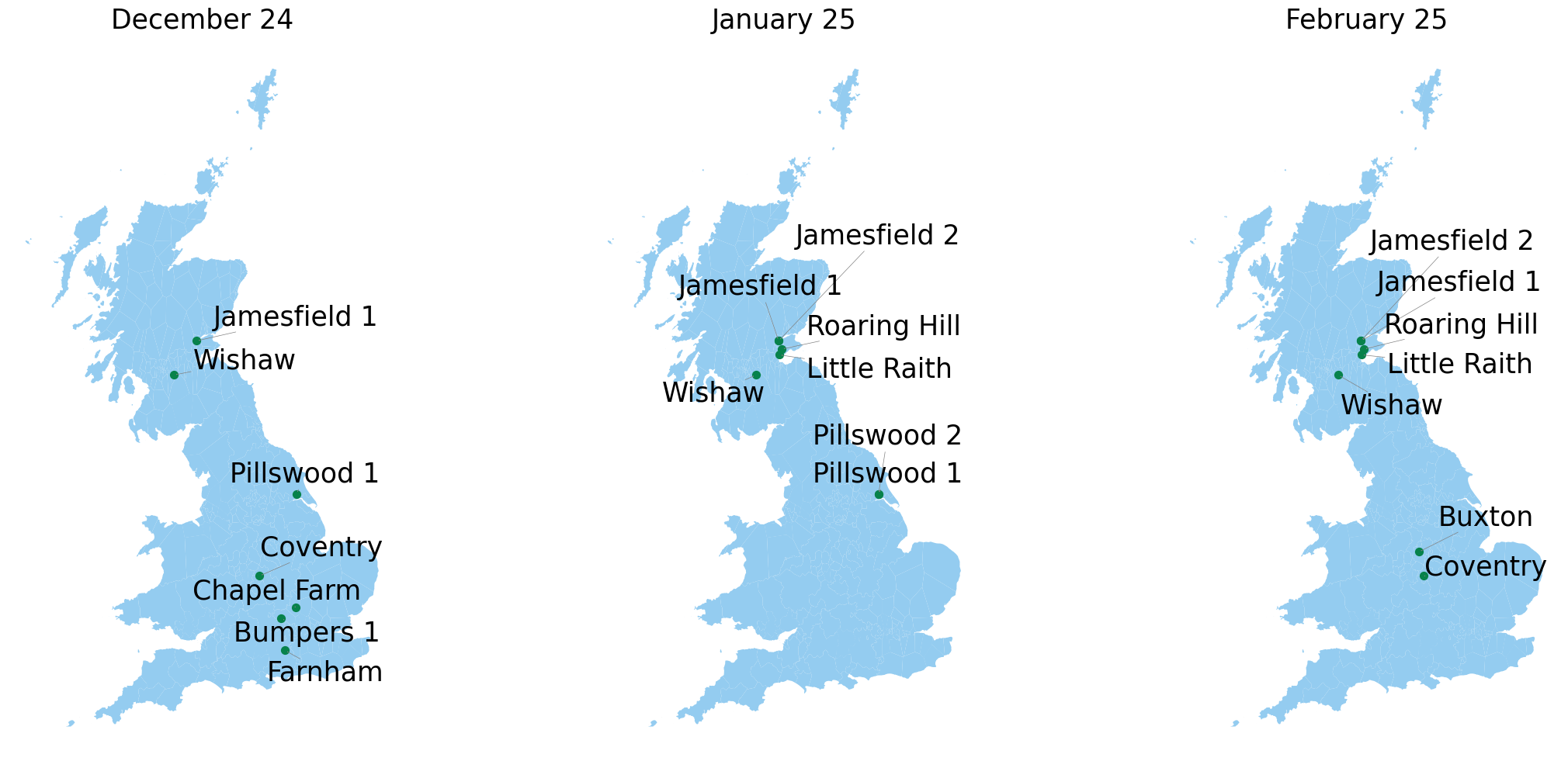

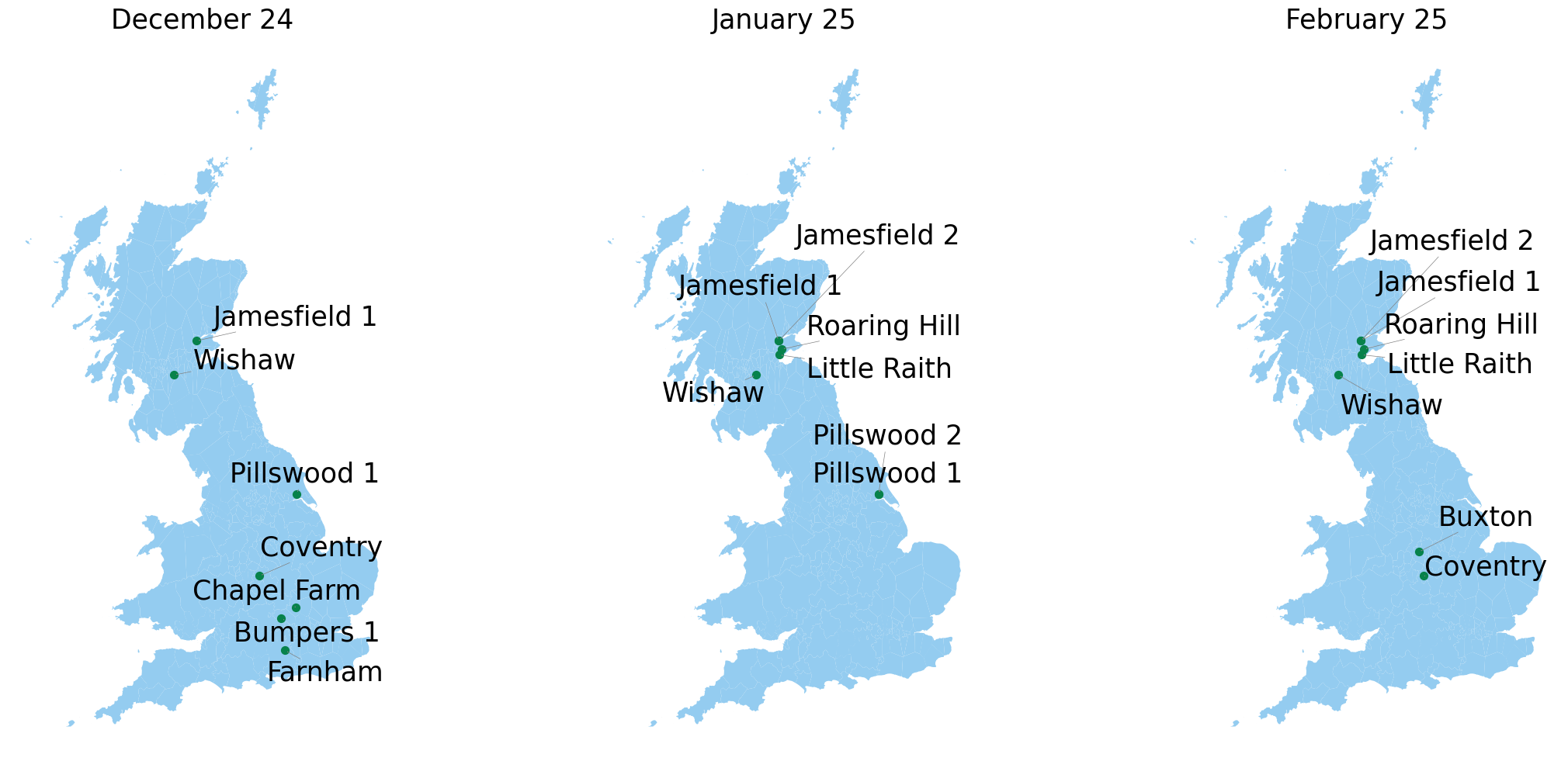

Let’s start with a review of the top 10 performing GB BESS assets (2 hour duration) across the 3 peak winter months (Dec24 to Feb25). This illustrates how English BESS performance was dominant earlier in the winter, with a shift towards Scottish BESS as winter progressed.

Diagram 1: Top performing GB batteries (Dec 24- Feb25)

Source: Timera, Renewable Planning Database

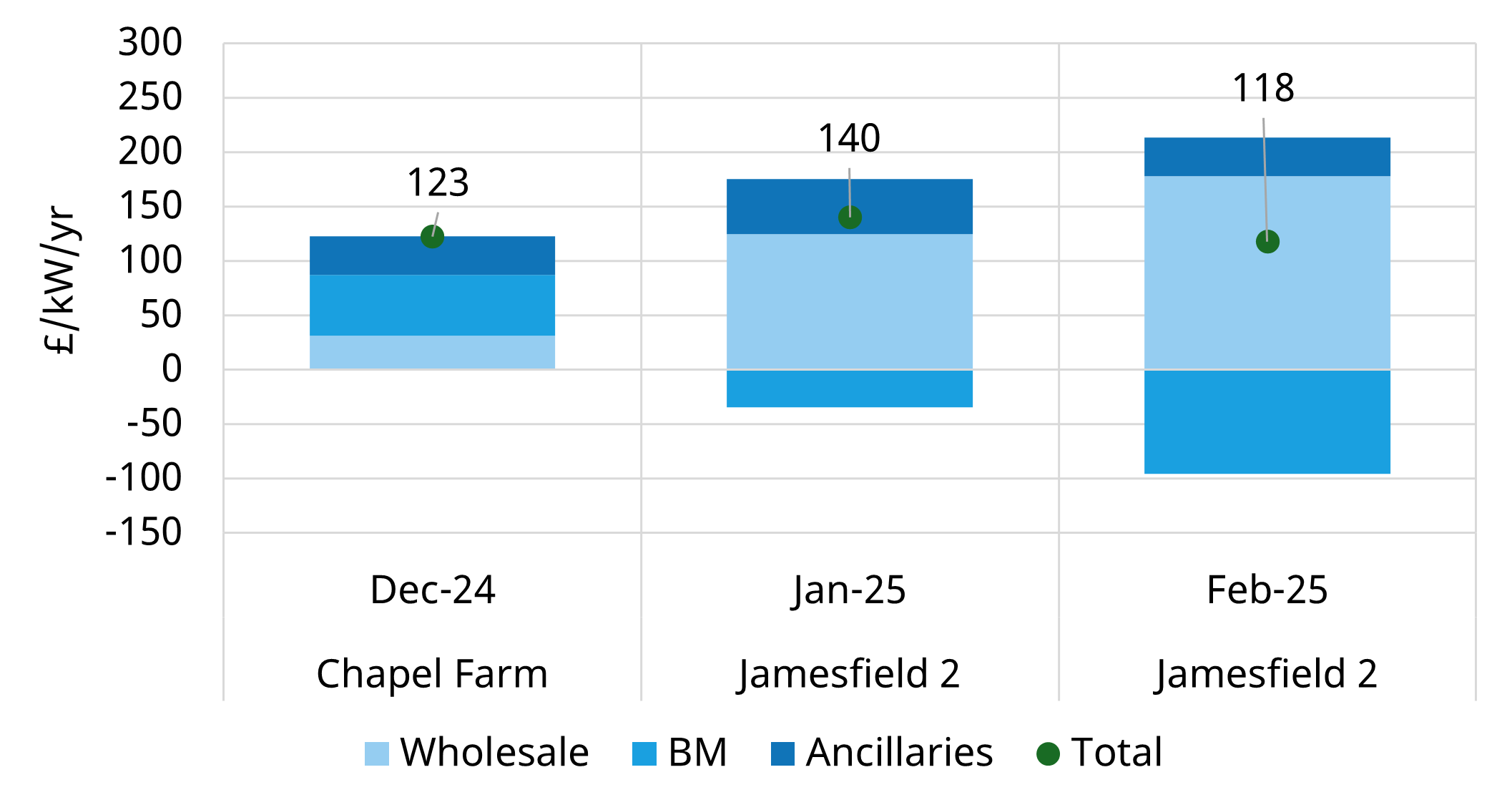

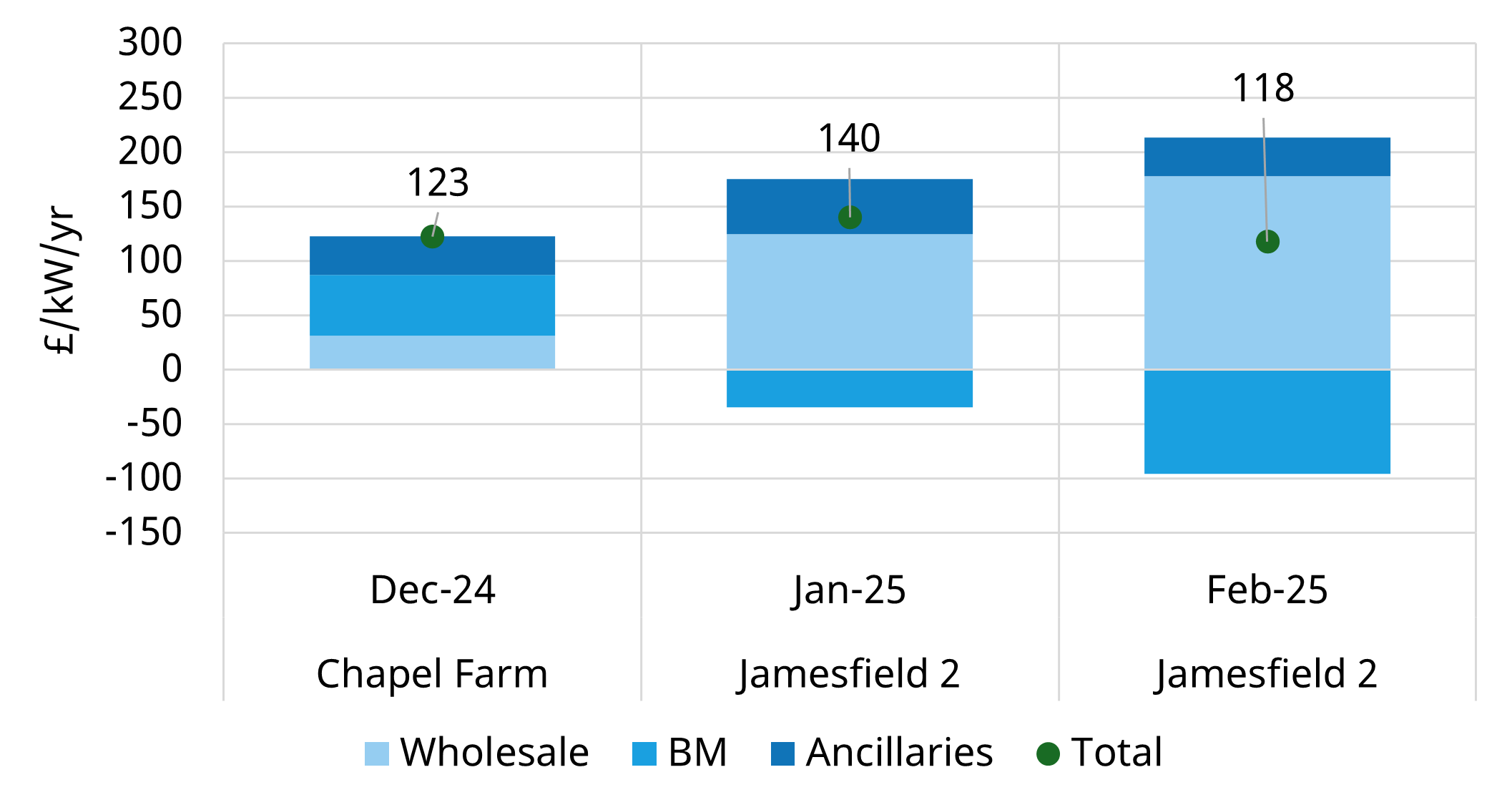

Chart 1 illustrates the changing composition of BESS revenue stack across the 3 months.

Chart 1: Revenue breakdown of top performing battery (Dec24-Feb25)

Source: BMRS, NESO, EPEX, Timera; Note we do not show intraday revenue uplift in Chart 1 as this is more difficult to objectively benchmark across specific assets.

Factors driving winter revenue capture

A bit of colour on factors impacting BESS revenue performance across these months.

December 2024: English batteries dominate the revenue leaderboard, with tighter system margins driven by colder weather and elevated gas prices. These conditions created strong opportunities for BM offer acceptances for assets located near demand centres and away from constraint boundaries. Batteries in the Midlands and South capitalised on their strategic grid positioning, capturing high BM revenues.

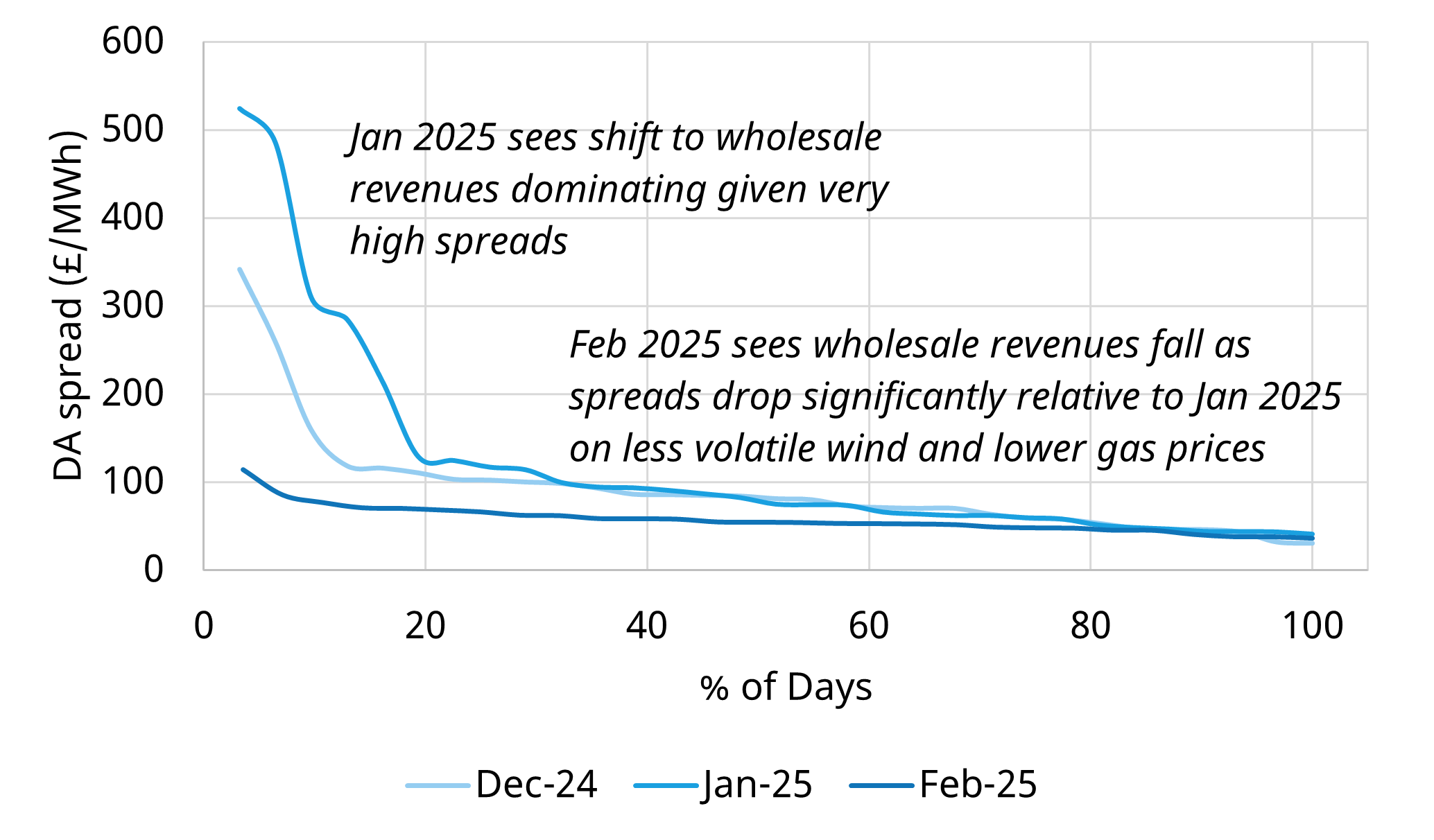

January 2025: Revenues shifted toward wholesale market optimisation, with arbitrage opportunities dominating as the primary value driver. Several Dunkelflaute events resulted in tight market conditions, triggering Capacity Market Notices (CMNs), an more serious Electricity Market Notice (EMN) and extreme spreads in both the day-ahead (DA) and intraday (ID) markets. Scottish batteries were particularly well-positioned in this environment, capturing wholesale value while also leveraging their location to benefit from high wind output days as they were frequently bid down in the BM to help manage local grid congestion.

February 2025: Wholesale spreads contracted, driven by a combination of falling gas prices and looser margins. This compressed price volatility limited arbitrage revenues for many BESS assets. However, some batteries reduced the impact of falling spreads by adapting their strategies—shifting toward greater emphasis on leveraging ancillary markets such as Quick Reserve & optimising BM activity.

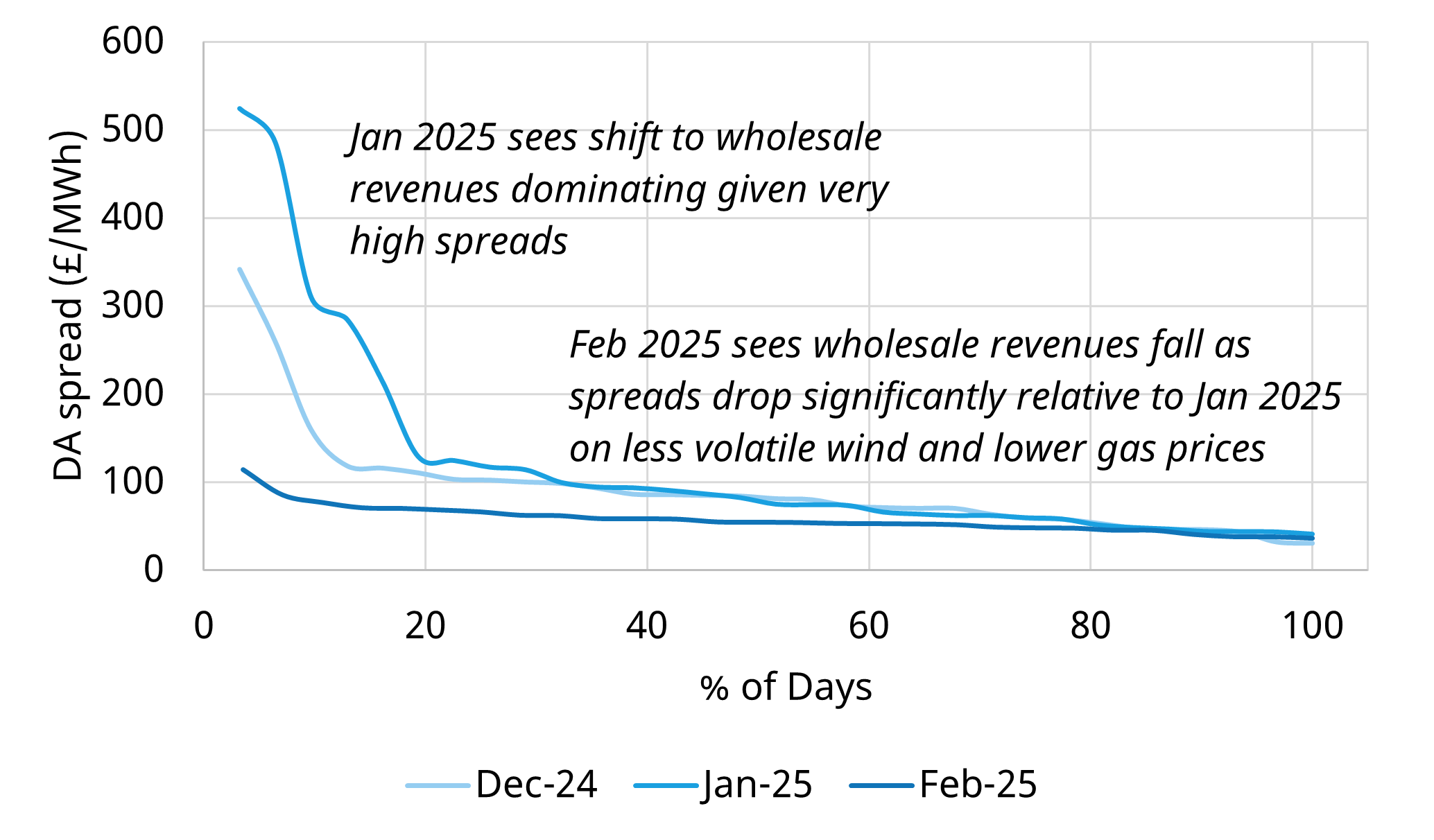

Chart 2 shows 1 hour price spread duration curves across recent months, illustrating the shift in revenue capture opportunities from Day-Ahead arbitrage.

Chart 2: Daily 1 hour day ahead price spread duration curve by month (Dec 24 – Mar 25)

Source: EPEX, Timera

Strategies shift based on location

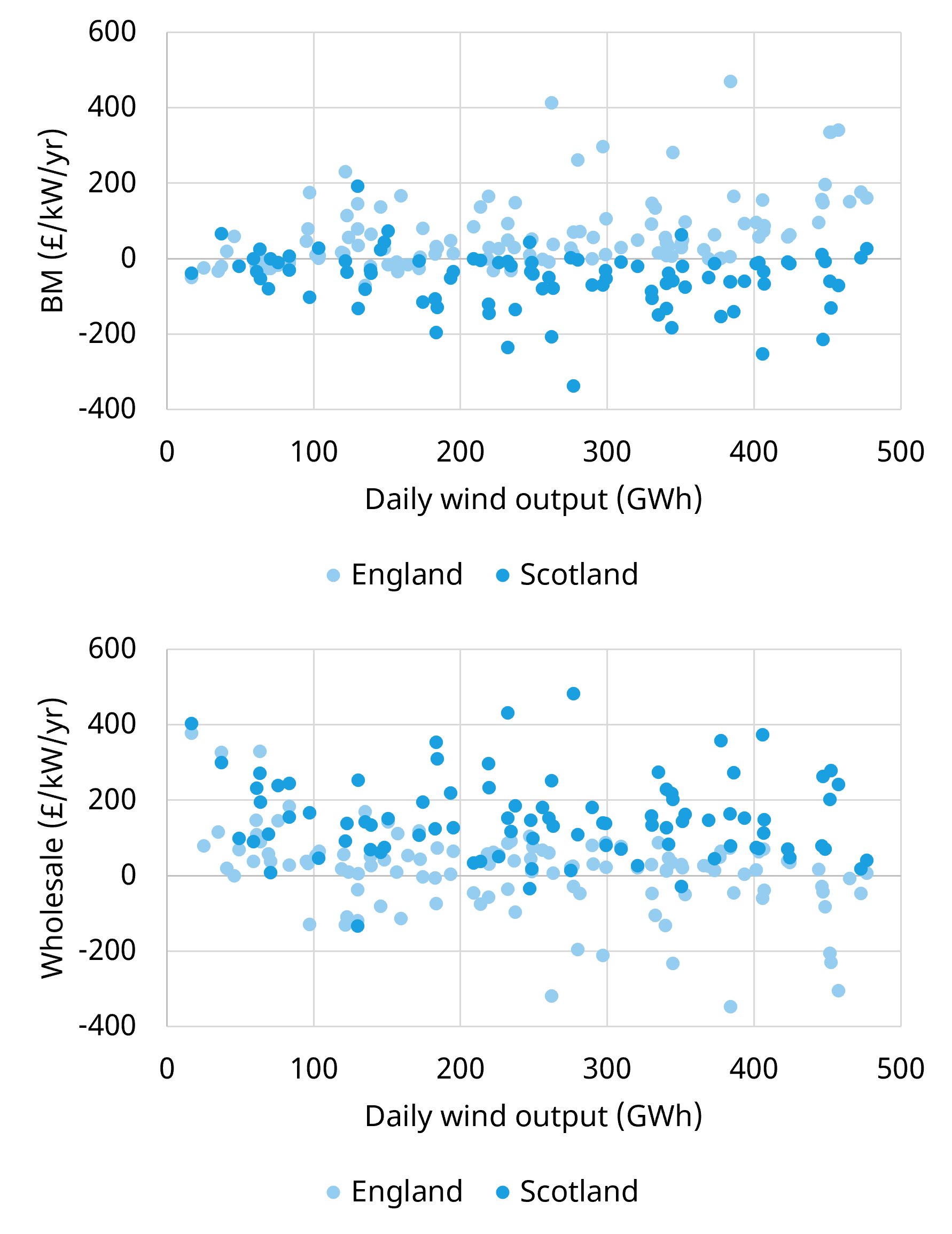

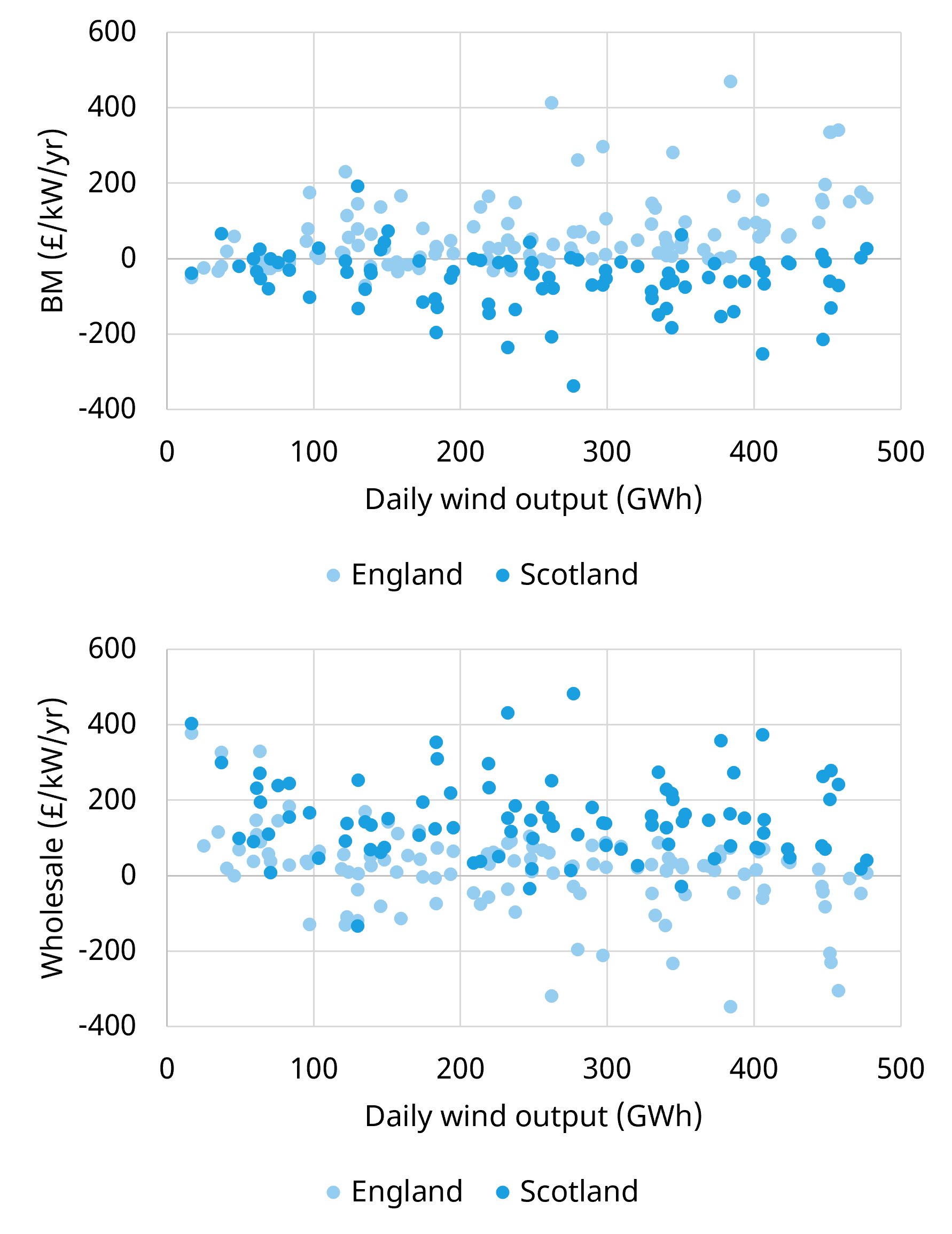

Recent months have highlighted how location is increasingly driving strategic divergence in BESS dispatch, particularly in the BM. By comparing daily annualised BM and wholesale revenues against total wind output for a Scottish and an English asset, a clear trend emerges:

- At lower wind levels, both Scottish and English batteries tend to see wholesale revenues dominate. This reflects tight system margins and elevated price volatility, which create strong arbitrage opportunities in the day-ahead and intraday markets. BM revenues during these periods tend to fall, as system balancing needs are more modest and there is less clear differences in strategy by location.

- As wind generation rises, we observe growing BM activity for assets across both regions. This aligns with greater grid balancing requirements — particularly due to thermal constraints and the increasing need to manage system flexibility.

However, it’s in high-wind scenarios that a split in strategy becomes clear as we show in Chart 3, which shows daily annualised revenues of Coventry (England) and Jamesfield (Scotland) across Dec24-Feb25.

Chart 3: Daily annualised revenue capture in BM (top panel) vs Wholesale (bottom panel - ex intraday)

Source: BMRS, EPEX, NESO, Timera; Note wind output here refers to pre-curtailment total wind Final Physical Notifications (FPNs)

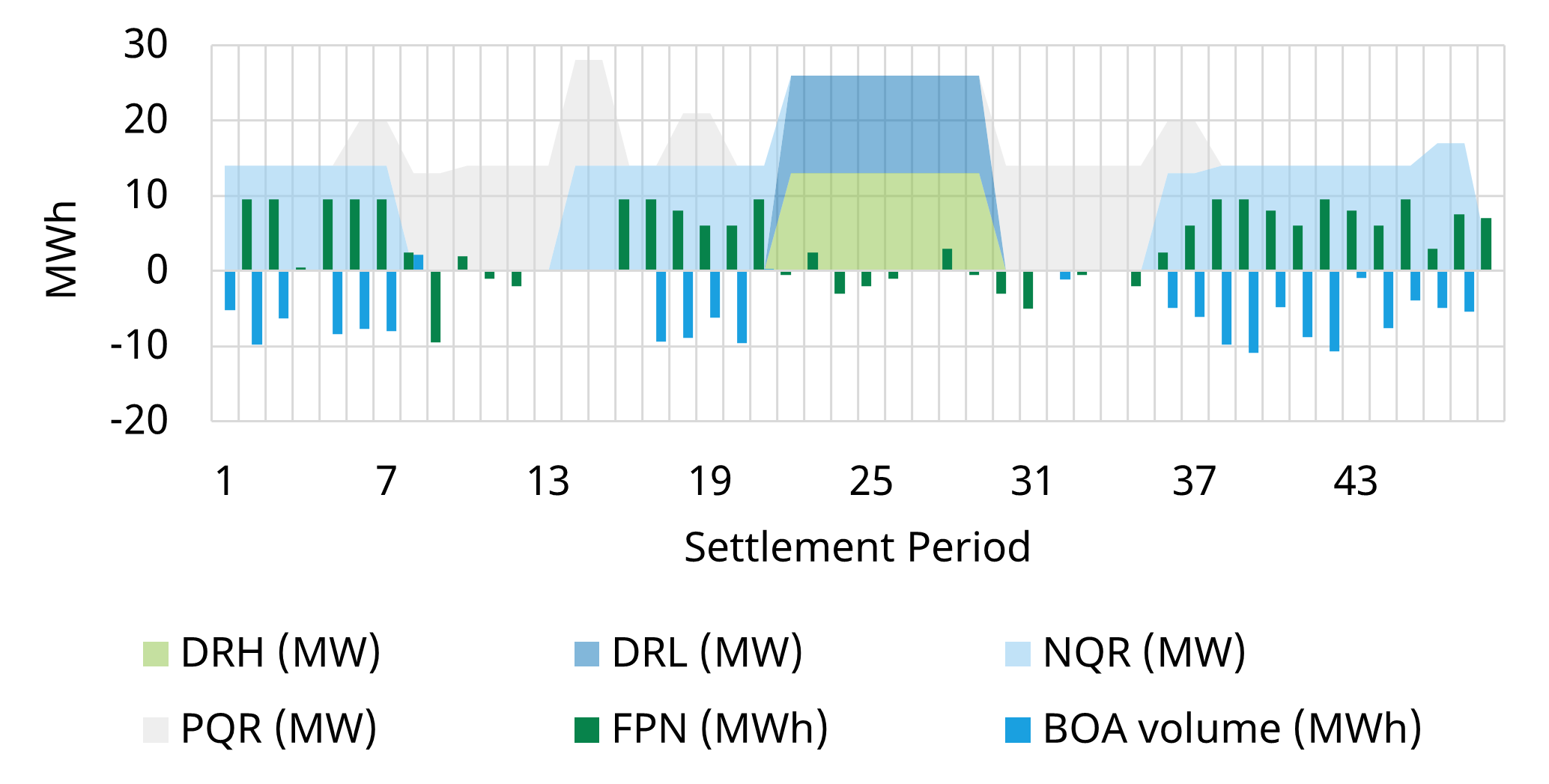

Scottish Strategy: Bid down dynamics behind constraints

Scottish BESS assets have increasingly adopted a strategy of sustained positive Final Physical Notifications (FPNs) during high wind periods. The rationale: with frequent thermal constraints on the B6 boundary and elsewhere, these batteries expect to be bid down in the BM, earning revenue by reducing output in a congested part of the system. These batteries price themselves competitively relative to large pump storage hydro units such as Foyers and Cruachan making them attractive options in the BM merit order (though limitations remain in BESS use for system actions). This has proven particularly lucrative as high wind output coincides with tight export capacity from Scotland to England.

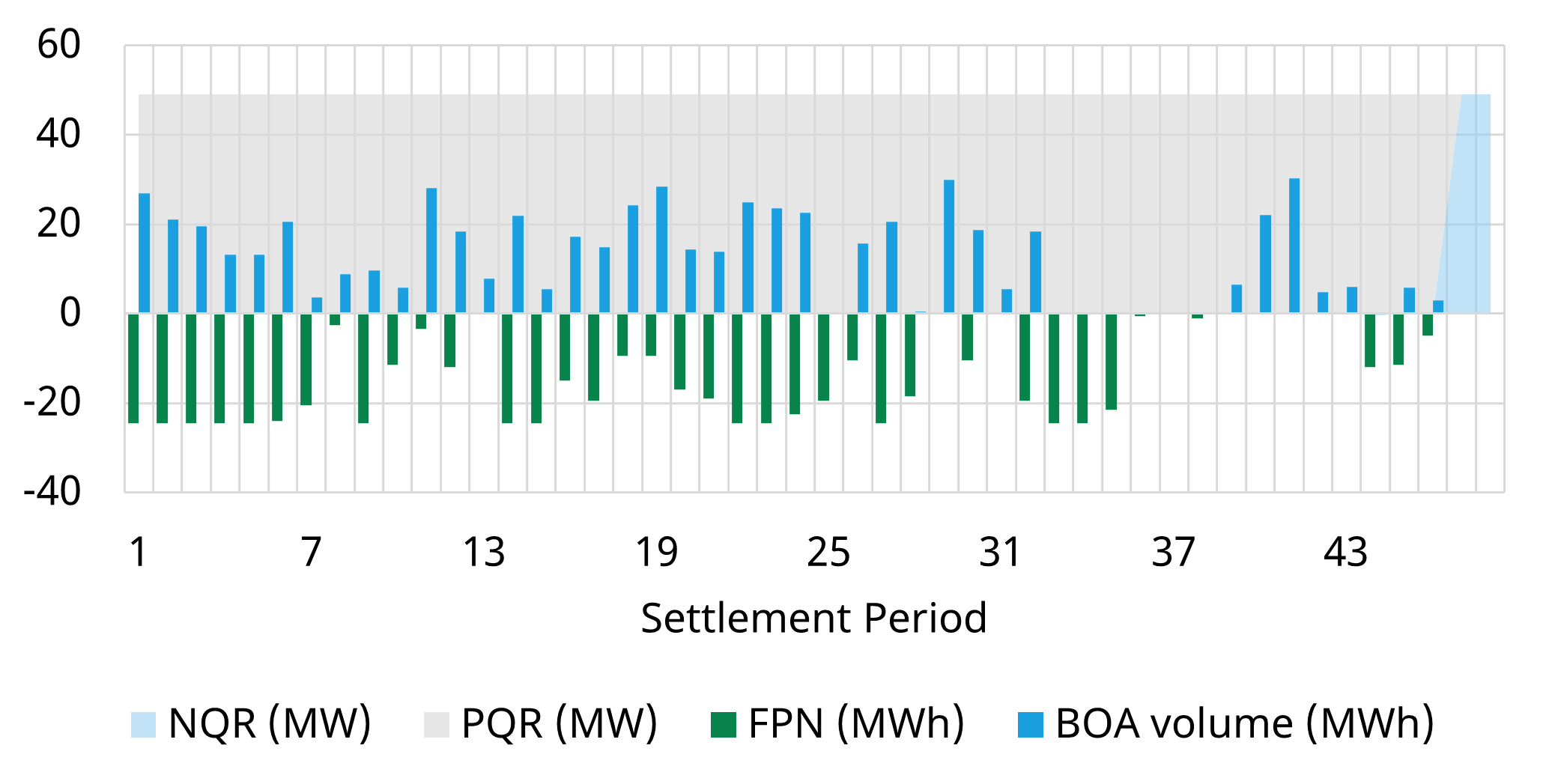

English Strategy: Offering on to rebalance the system

Conversely, some English batteries are taking the opposite approach. They schedule long periods of negative FPNs, anticipating that they will be offered on in the BM to rebalance energy displaced by bid-down actions in Scotland. These batteries often price competitively against mid-merit gas units (e.g. CCGTs), positioning themselves as cost-effective rebalancing tools when generation is curtailed further north.

The role of Quick Reserve

Adding to this locational divergence, the emergence of Quick Reserve products has enabled 2hr batteries to further leverage these strategies:

Scottish batteries (such as Jamesfield) have taken on multiple Negative Quick Reserve (NQR) contracts, aligning with their long positive FPN strategy. These assets expect to be bid down due to constraints, and the reserve commitment enhances their position without requiring additional cycling.

Chart 4 shows consistent NQR contracts throughout the day allowing for many hours of consecutive positive Final Physical Notifications (FPNs) to be submitted which are subsequently cancelled out via bids in the BM.

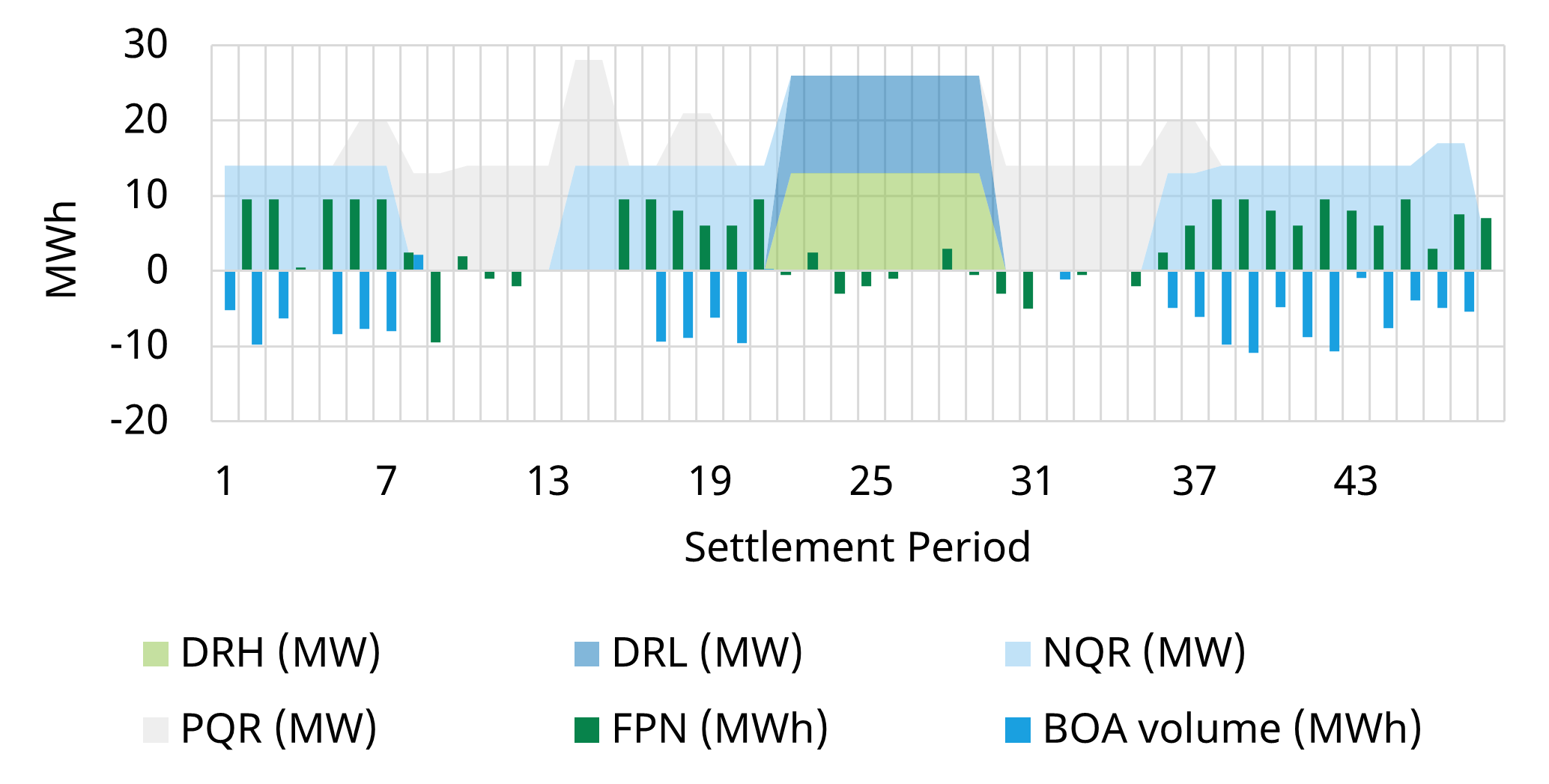

Chart 4: Jamesfield (Scotland) BESS dispatch profile 21st Feb 25 (a high wind day)

Source: BMRS, NESO, Timera; This chart includes FPNs, ancillary contracts in Dynamic Regulation High/Low (DRH/L), positive/Negative Quick reserve P/NQR) and Bid Offer Volumes (BOA Volumes).

English batteries (such as Coventry) have pursued Positive Quick Reserve (PQR) contracts, reinforcing their negative FPN strategy. With Scottish generation frequently curtailed, these English assets anticipate being offered up

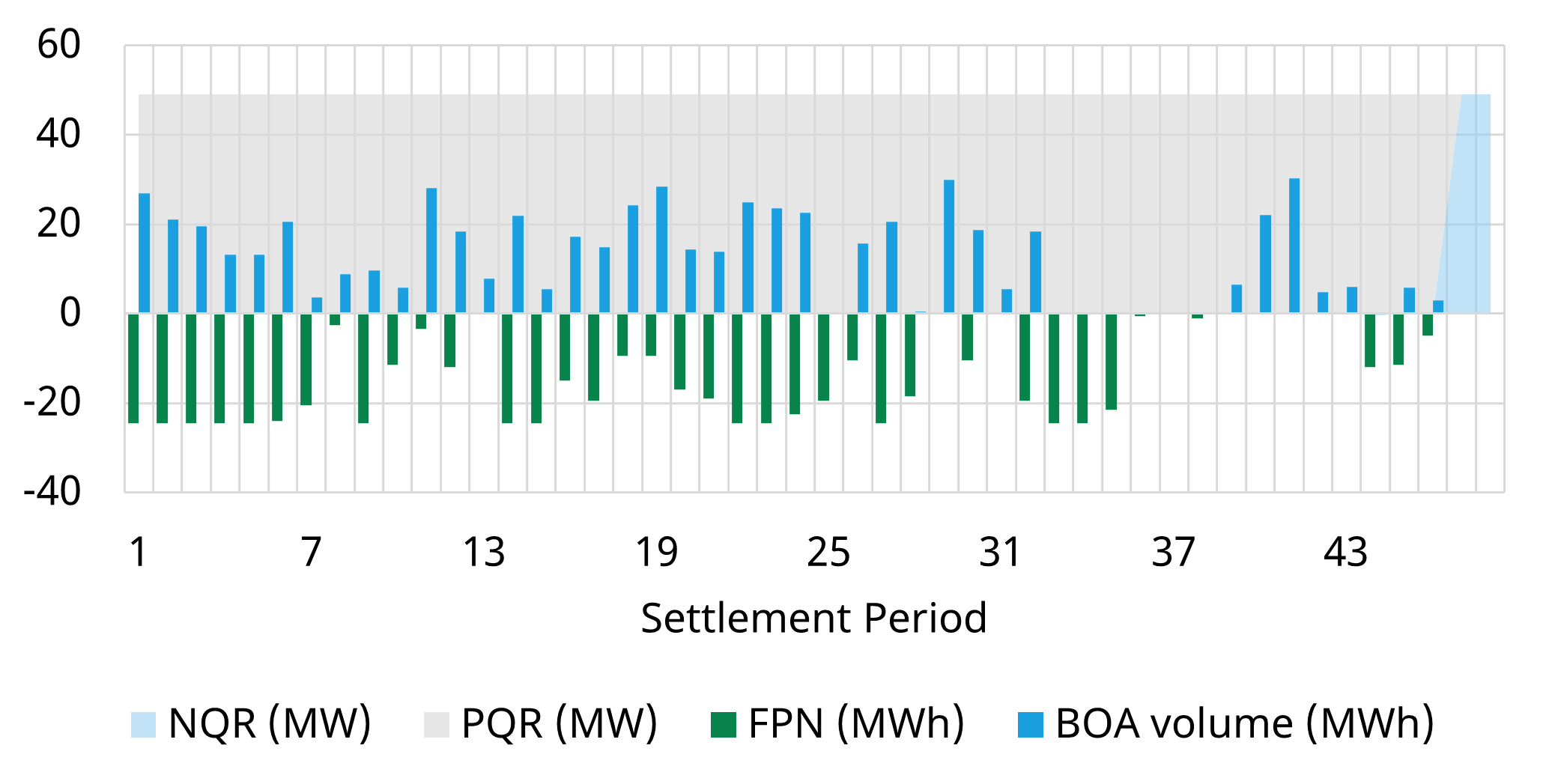

Chart 5 shows consistent PQR contracts throughout the day allowing for many hours of consecutive negative Final Physical Notifications (FPNs) to be submitted which are subsequently cancelled out via offers in the BM.

Chart 5: Coventry (England) BESS dispatch profile 21st Feb 25

Source: BMRS, NESO, Timera; This chart includes FPNs, ancillary contracts in Dynamic Regulation High/Low (DRH/L), positive/Negative Quick reserve P/NQR) and Bid Offer Volumes (BOA Volumes).

Locational revenue differences here to stay

What makes Quick Reserve especially attractive is that it allows batteries to earn revenues without necessarily cycling while also securing additional income from the QR contract itself. As the FPNs are cancelled out by opposite actions in the BM, the asset avoids throughput while still capturing value.

These tactical uses of the BM and reserve products have been highly effective under current rules, though it’s widely expected that market design reforms will close some of these loopholes.

Additionally, the potential introduction of zonal pricing under REMA would shift the balance of price signals from the Balancing Mechanism into the wholesale market. This transition may reduce the effectiveness of some current BESS strategies, particularly those geared toward exploiting real-time BM volatility in highly constrained areas.

Still, the core takeaway remains: even as market rules and arrangements evolve, location will continue to shape BESS revenue capture strategy.

Scotland faces structural dynamics of high wind output and constraints. England faces high demand and rebalancing needs concentrated in the South. These structural drivers underpin regional differences in how batteries operate and capture revenue… and they are here to stay.

Sample copy of our latest GB BESS report?

We have more detailed analysis of topics above and a broad range of analysis of other BESS value drivers, market & revenue projections in the Q1 GB BESS Report we have just published as part of our GB BESS subscription service.

Reach out to Arshpreet Dhatt (Senior Analyst) if you would like a free sample copy of the Q1 Report (arshpreet.dhatt@timera-energy.com).

Join our webinar on the key considerations for BESS investors ahead of the first MACSE auction.

Topic: Timelines, guidelines & commercial considerations for BESS investors targeting 1st MACSE auction in Sep 2025

Time & access: Fri 11th Apr 10:00-10:30 CET (09:00-09:30 GMT)

Registration: Pre-registration required (access is free); webinar registration link – register here

Coverage:

- Timeline & key requirements into Sep 2025 auction

- BESS capacity procurement volumes

- Zonal / locational drivers

- Latest on MACSE investment route implications

- Bidding strategy considerations for investors