"There are 3 factors to watch that could signal a broader commodity price rally"

Crude oil is the primary benchmark for global energy prices. Copper is a key benchmark for base metals prices, as well as the most important raw material enabling the energy transition.

The prices of both these commodities have recently broken out of a two year downtrend. In today’s article we take a brief look at what is behind these moves and whether it may have implications for a broader recovery in commodity prices.

The economic backdrop

Three key economic drivers across the last two years have been:

- Rising global interest rates & cost of capital

- Higher than historical average inflation (particularly in the services sector)

- Weaker economic activity & industrial production (despite relatively strong employment data).

These factors helped drive a period of commodity price declines, from what had been very elevated levels in 2021-22 given Covid stimulus and supply chain disruptions. However the global recession widely expected across 2023 never arrived (despite some key areas of economic weakness e.g. China & European industry).

The set up in 2024 is shaping to be somewhat different:

- Central banks are signalling interest rate cuts (most importantly the US Federal Reserve in what is an election year)

- Economic activity & industrial production appears to be showing some early signs of recovery (supported by relatively high levels of fiscal stimulus globally)

- Inflation is showing signs of reappearing (after moderating across the last 12 months).

These conditions could mark a turning point where real interest rates fall (via a combination of rate cuts & rising inflation), providing monetary stimulus tailwinds to support ongoing fiscal stimulus.

If this transpires, it is likely consistent with a broader recovery in global commodity prices. Are oil & copper markets starting to anticipate this?

Brent break out?

Chart 1 shows the ICE front month Brent crude contract breaking a two year downtrend.

Rising crude prices this year have so far been more focused in the front 6 months of the futures curve. This near term market tightness has been accompanied by some increase in longer dated Brent prices, but at a much slower rate. As a result the Brent curve has moved into strong backwardation (front contracts at a premium to long dated ones).

Rising Brent prices are consistent with demand recovery in 2024, supported by e.g. signs of recovery in global freight volumes. However there are important supply side factors in play also.

Global oil demand is running at about 102 million barrels per day (mbpd). Saudi Arabia, Russia & the US account for about 40% of supply and their production volumes have a key influence on marginal pricing.

OPEC+ (with key players Saudi & Russia) have recently reaffirmed extension of production cuts this year, a factor which is helping to support the recent price rally. However these cuts are to some extent being offset by relatively strong US production, running at around 13 mbpd (albeit with some Storm Heather interruptions in Q1 2024).

Breaking a downtrend on a chart does not in itself confirm global demand recovery, but it does warrant keeping a closer eye on crude prices as a potential flag for broader commodity price recovery.

Doctor Copper on the move

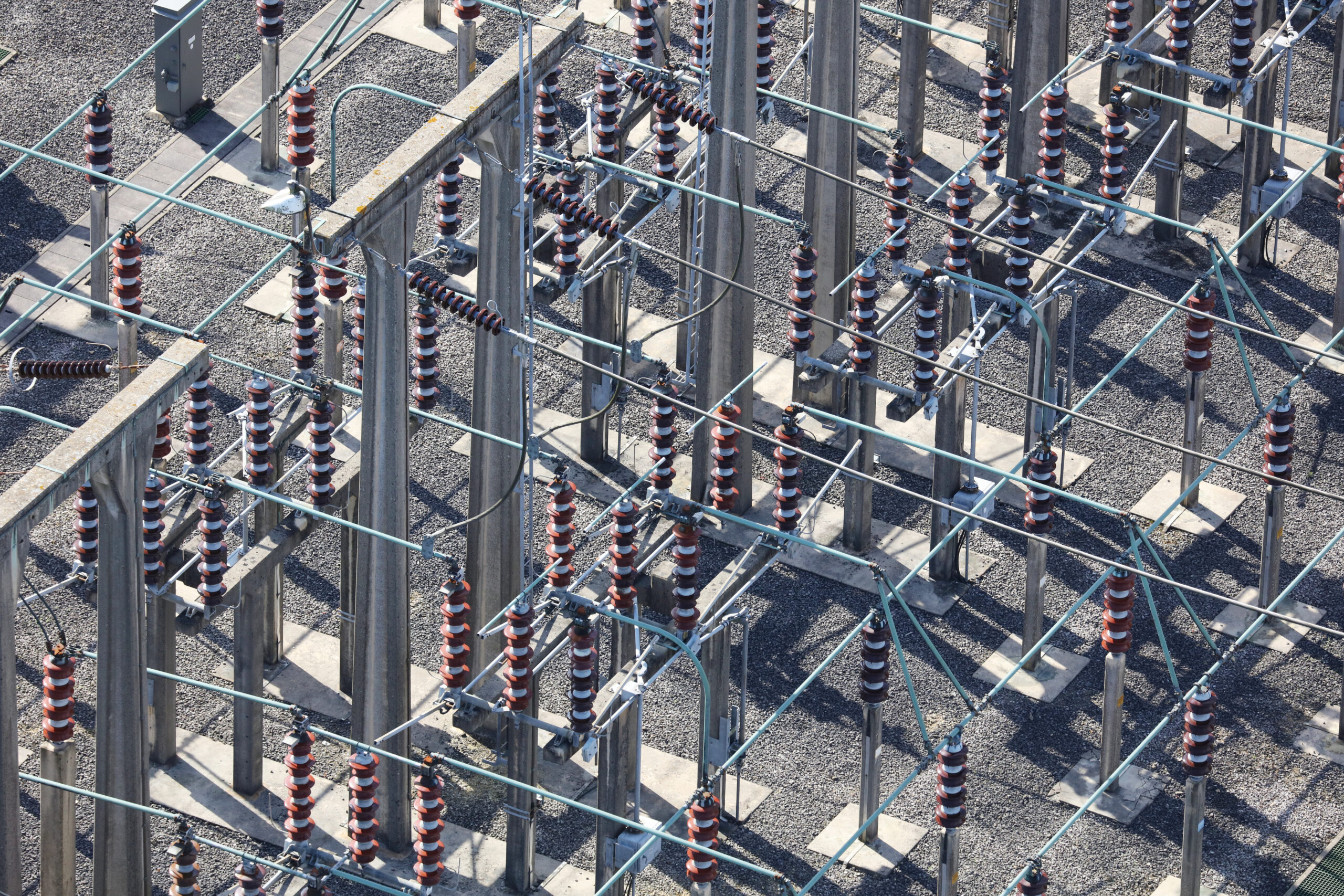

Copper is affectionately known as Doctor Copper given its ‘PhD abilities’ in predicting turning points in global economic conditions, as it is a key raw material for construction, industry, EVs and broader energy infrastructure.

Chart 2 shows the copper price also breaking a two year downtrend and rallying in Q1 2024.

As with oil, the copper price rise is driven by supply factors as well as strengthening demand (e.g. Chinese refinery output cuts), but rising copper prices still deserve some attention. As well as its broader ‘predictive’ qualities, copper is particularly relevant for capex costs of power infrastructure projects e.g. renewable & storage projects, interconnectors & transmission upgrades.

3 factors to watch for a broader recovery

Rising crude and copper prices are so far just an early flag. Three factors to watch that could signal a broader commodity price recovery:

- Strength in other key global commodities e.g. coal, iron ore

- A sustained rally in long dated Brent futures e.g. across 2025 contracts

- Recovery in economic growth, industrial & freight activity.

The most important commodities to watch from a European power & gas market perspective are those driving switching levels, particularly coal & carbon prices. These have both shown signs of a nascent recovery across Mar & Apr 2024, but have a lot more work to do in order to signal a more sustained recovery.

Join our LNG webinar “Focus on flex”

Topic: “Focus on flex” – how changing market dynamics are shifting LNG contract flex value

Time & access: Thurs 18th Apr 09:00 BST (10:00 CET, 16:00 SGT)

Registration: Pre-registration required (access is free); webinar registration link – register here

Scope:

- How global supply & demand shifts are driving the recent fall in gas & LNG prices

- Impact of the changing conditions on LNG contract flexibility value

- Drivers of contract flex value, including intrinsic vs extrinsic value

- Demonstrating how flex value is shifting via (i) US contract case study (ii) Brent indexed Asia DES sale

Any Qs please contact david.duncan@timera-energy.com