Atlantic LNG charter rates drop to seasonal low in September

Snapshot

19 Sep 2024

Atlantic LNG charter rates drop to seasonal low in September

1 min

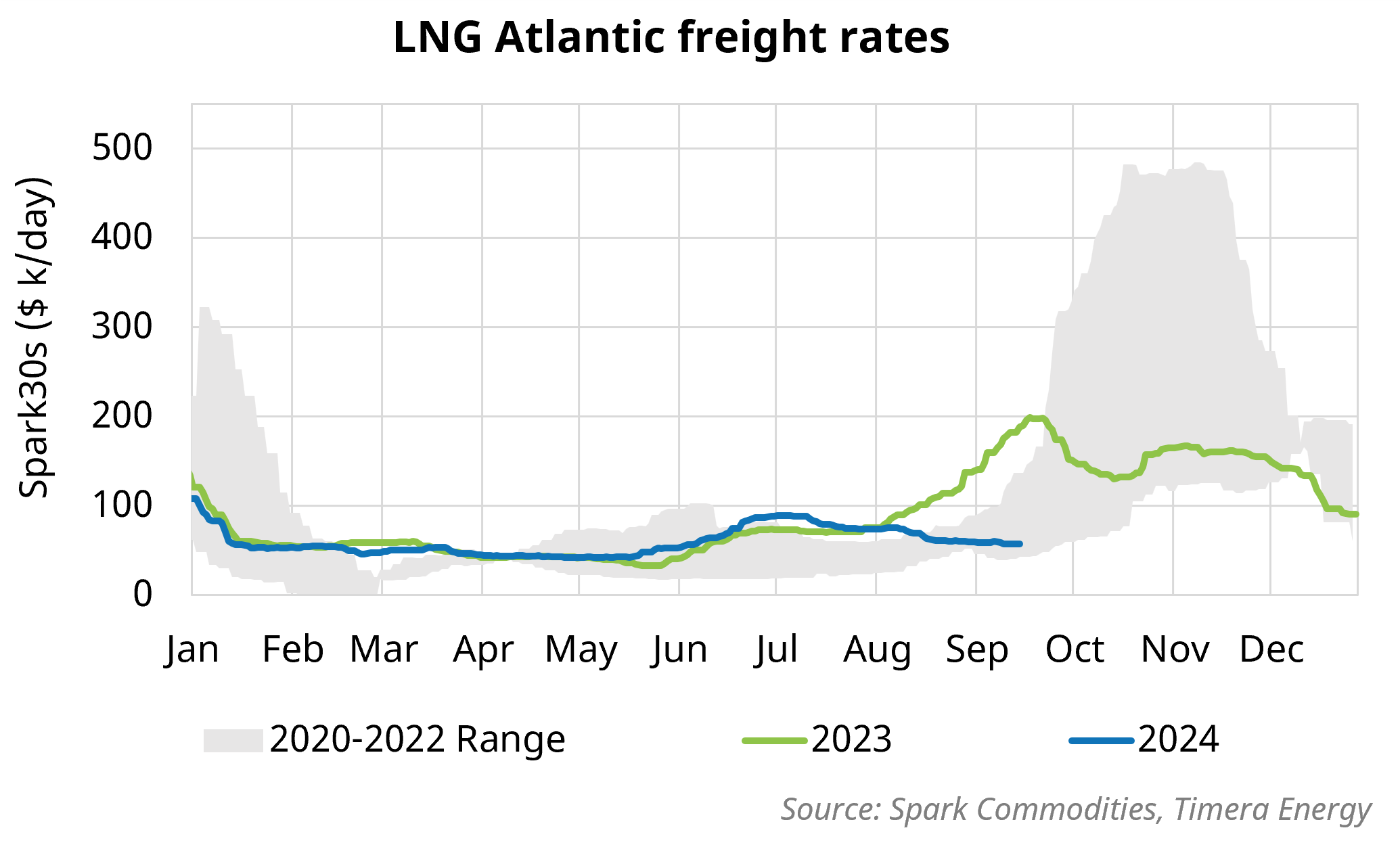

LNG spot charter rates have fallen to a seasonal-low, with the Spark Atlantic spot freight assessment sitting at ~57$k/day as of mid-September.

This seasonal weakness has been largely driven by two factors: