Battery investors in the GB market have harvested extraordinary returns across 2021-22. However as we enter 2023 the GB battery revenue stack is undergoing a structural transition with value rapidly shifting from ancillary services to energy arbitrage.

“A rapid revenue stack shift is underway from ancillaries to energy arbitrage”

The transition to energy arbitrage has important implication for BESS risk / return dynamics, monetisation strategy and financing. Today we explore what the BESS investment case looks like ‘beyond ancillaries’ with a video recording & slide pack from our recent webinar, enabling you you to meet some of the Timera power team members.

Links to the show

Click here for the ‘Beyond ancillaries’ slide pack from the webinar.

Click here to watch the ‘Beyond ancillaries’ webinar video recording.

A teaser of some of the content

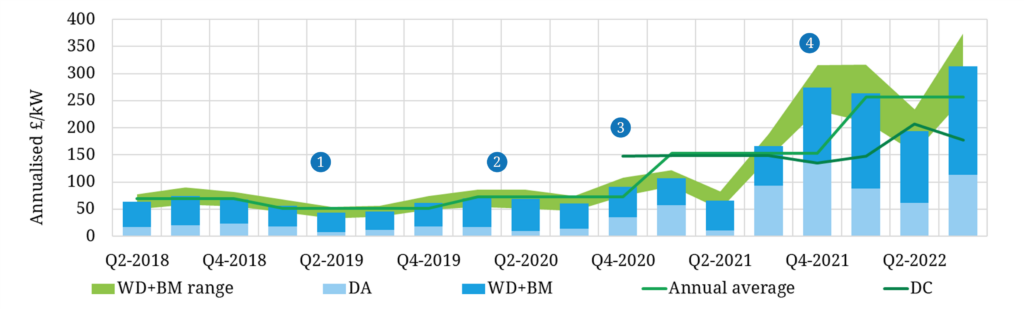

We look at an energy arbitrage focused backtest of just how much GB BESS asset returns across the last 2 years versus the tougher period across 2018-19, see Chart 1. We then discuss key value drivers of the BESS revenue stack as ancillary services saturate across 2023 and energy arbitrage dominates value going forward.