We have supported dozens of battery projects through investment case development across UK, NW Europe, Italy & Spain. What is the number one concern that investment committees have in approving projects? Margin cannibalisation by other batteries.

“The threat of battery cannibalisation is often misunderstood and overstated”

This is a rational concern. The requirement for the shorter duration balancing services that lithium-ion batteries provide is not unlimited. Battery saturation and erosion of returns is a key risk factor that needs to be properly understood & quantified.

However the threat of cannibalisation is often misunderstood and overstated. Let’s look at why.

Cell investment: running to stand still

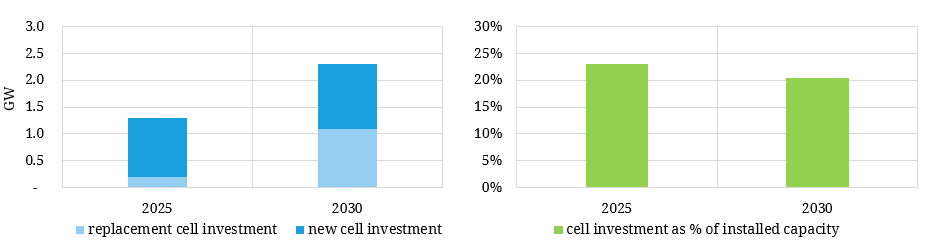

As new wind & solar capacity comes online, there is a continuous requirement for investment in new batteries to support system balancing. In addition ageing cells from existing battery sites need replacement as they degrade.

Generation assets typically have economic lives of at least 25-30 years, whether they be renewable or thermal. A battery site and balance of plant have a similar life span. But the life of battery cells is significantly shorter.

Battery cells degrade as they are cycled and require replacement after somewhere between 8 – 15 years (depending on technology & nature of cycling). Cells currently in operation (i.e. installed across 2015-20) are more likely to have lives towards the lower end of that range, given steeper cell capex declines & technology improvements incentivise earlier replacement.

Taking the UK market as a case study, we put show an illustrative estimate of the annual requirement for battery cell investment in 2025 & 2030 in Chart 1.