A new Spanish government took shape in late 2019, with climate change & decarbonisation central to its policy platform. 2020 was a year of talking and planning. But across the last 6 months the focus has transitioned to hard targets and tangible policy support.

“Conditions are quickly falling into place for Spain to challenge the UK’s leadership in battery deployment.”

Spain has set aggressive new renewables targets:

- 50GW of installed wind capacity by 2030 (~23GW increase from today)

- 39GW of solar capacity by 2030 (~28GW increase from today)

Renewable capacity deployment is being underpinned by the new REER scheme which started in Jan 2021, awarding 12 year PPAs through an auction process.

The Spanish policy focus has now shifted to the flexibility required to support a low carbon transition. In Feb 2021, Spain announced a 20GW by 2030 storage target (~12GW increase from today). This represents a huge push for storage, with batteries set to dominate.

In today’s article we look at the rapidly evolving tailwinds behind storage investment in Spain, as well as some of the challenges investors face.

New capacity market announced

The Spanish government announced the proposed structure of its new capacity market last week. This will be the central mechanism that supports investment in flexible capacity.

A quick summary of the capacity market structure:

- Two types of auction

- Main auction: 5 year contracts to deliver capacity in a range of up to 5 years after the auction

- Adjustment auction: 1 year contracts to refine volumes from the main auction closer to delivery.

- Pay as bid auctions run by the System Operator (Red Electrica) to meet firm capacity targets

- Max 500g/kWh CO2 emissions limit for existing capacity; Max 0g/kWh CO2 for new capacity.

The proposed structure is out for consultation until May, following which the government is anticipated to implement the market and announce the first auction (by ministerial order). It is likely that there will be one or two transitional auctions before the market is fully implemented (as was the case e.g. in Italy).

There are a couple of key differences between the proposed Spanish market structure and other European capacity markets:

- New build support is limited to zero carbon capacity, effectively excluding gas-fired capacity.

- The ‘paid as bid’ structure (vs as ‘paid as cleared’ in other European markets) is set to send sharper & more differentiated price signals and focus asset owners on bidding to true cost.

The capacity market represents a lifeline for existing Spanish CCGTs which have struggled across the last 3 years as previous capacity price support was slashed. But the big winner looks to be storage, particularly batteries, given the exclusion of new build gas capacity.

Spanish capacity mix & pricing dynamics

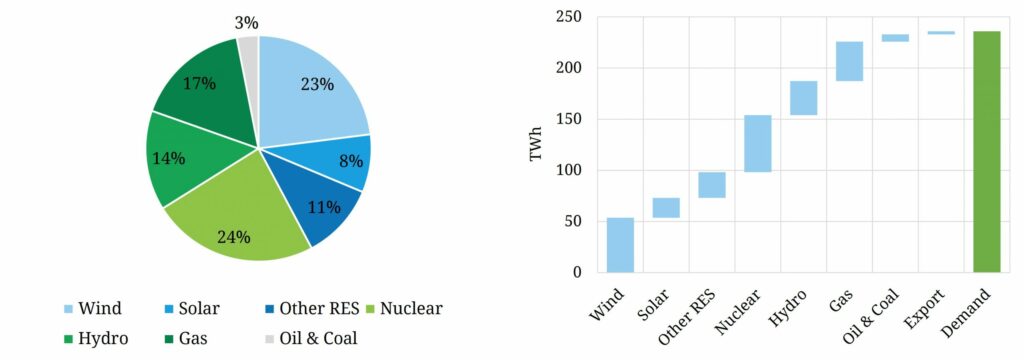

To understand the role that batteries will play in Spain it is useful to look at the generation mix (summarised in Chart 1).

The low variable cost section of the Spanish stack has historically been dominated by nuclear capacity, with wind & solar capacity now growing fast again. The ‘Other RES’ category on the chart is predominantly biomass & waste. Spain also has about 5 GW of CHP capacity, with associated ‘must run’ constraints.

Gas, hydro and remaining coal capacity dominate price setting. Hydro generation plays an important role in Spain, both from an energy & flexibility provision perspective. Hydro output can vary significantly from year to year depending on rainfall (e.g. 15-40 TWh range). Spain also has 8GW of pump storage capacity which plays an important longer duration storage role.

CCGT capacity is an important driver of marginal pricing. Its role depends on the hydro balance and the relative economics of gas vs coal. But with rapid coal plant closures and carbon prices above 45 €/t, the influence of coal in Spain is quickly diminishing.

Returns on Spanish batteries are influenced by wind & solar driven low priced periods and thermal & hydro driven high priced periods. Rapid growth in intermittent renewable output and retirement of thermal plants are also set to drive price volatility higher.

Spain has historically had a wholesale price floor at 0 €/MWh. This is now being modified to -500 €/MWh in line with other European markets (announced Dec 20). Although very low prices have not been prevalent in Spain to date, this should help battery returns as renewable penetration increases at pace across this decade.

The Spanish battery proposition

The new capacity market is a potential game changer for Spanish storage. A base tranche of revenue from a capacity contract is key to underpinning an investable margin stack. Removing direct competition from new CCGTs and gas peakers is a big boost for batteries in securing capacity contracts.

The other potential source of this base income tranche is for collocated batteries via the REER renewable PPA auctions. A range of rule constraints (e.g. storage can only charge from colocated RES not from the grid) means that batteries didn’t feature in the first round of REER auctions. But there is strong policy pressure to adapt the REER rules to make these more friendly for collocated storage.

There are a couple of important challenges that remain for batteries in Spain, for example, access to balancing market revenues and reform of network charging rules to prevent double charging. But the policy tailwinds are strong given the pivotal role that Spain has marked for storage as a source of flexibility.

Beyond this, the conditions are in place to support a structural rise in wholesale battery margins e.g.

- Large wind & solar rollout

- Retirement of conventional thermal capacity

- Relatively low volumes of interconnection

- Plans for rapid electrification of other sectors (e.g. transport, heat, industry)

- Strong colocation potential, particularly with solar PV

The Spanish power market has historically fallen short of supporting a viable battery investment case. But conditions are quickly falling into place for Spain to challenge the UK’s leadership in battery deployment.