The 2022 energy crisis highlighted the critical role of flexible capacity. As wind & solar volumes grow, these need to be balanced by flexibility to maintain an orderly power market.

“Western Europe alone is likely to see 50-70 GW of BESS investment by 2030”

2022 also exposed the fact that many European countries have an inadequate policy framework to support investment in flexible capacity. As a result… flexibility is suddenly a key focus.

Europe is now fighting two major battles in parallel: (i) decarbonisation & (ii) independence from imported energy. And policy makers and investors realise that huge investment in flexibility is a key requirement to win both.

Battery (BESS) investment outside the UK has been slow to date. But a combination of shifting policy winds, ESG focused capital and a surge in BESS revenues is driving strong investment momentum in 2023.

In today’s article we survey the European BESS investment landscape. We look at BESS growth potential, focus markets, project challenges & how investors are deploying capital.

EU BESS landscape in numbers

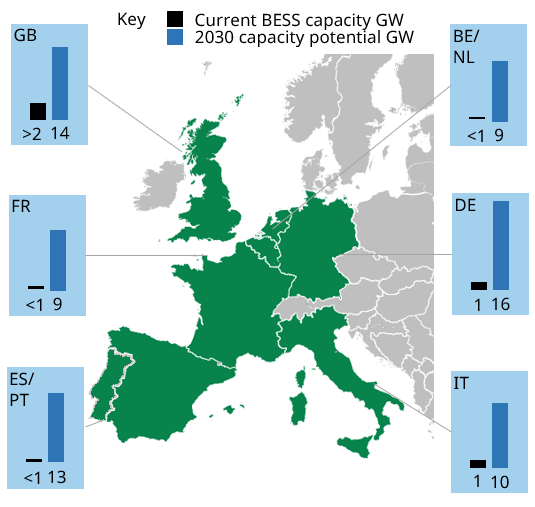

Grid scale battery deployment across Europe recently reached a total of 5GW, with almost half of this in the GB market. Western Europe alone is likely to require at least 50-70 GW of grid scale BESS investment by 2030 to support RES capacity growth.

In Chart 1 we set out 2030 growth potential across 6 key markets.

It should be noted that the 2030 growth potential numbers in the chart represent the upper end of our projected range estimates for BESS capacity installed by end of 2030.

If you are sceptical that BESS scaling can happen this fast then it’s worth considering the latest UK capacity auction which saw 5GW of BESS capacity committed for delivery in a single capacity year (2026-27). This illustrates how fast BESS capacity can scale given the right policy framework and market price signals.

Which markets are set to lead BESS growth

Italy is currently in second place behind the GB market when it comes to BESS growth. This reflects two key policy support mechanisms that have underpinned BESS development to date:

- 15 year capacity agreements in the Italian Capacity Market (with relatively favourable derating factors)

- 5 year ‘Fast Reserve’ contracts with 20-60 €/kW/yr payments for frequency services

There is also further BESS specific policy support in progress as well as favourable reform of intraday, ancillary & balancing markets.

The rest of the EU’s power markets have lagged GB & Italy with BESS investments occurring more on an opportunistic basis e.g. supported by specific network services contracts. We explore below the issues that have been hampering broader investment. However the energy crisis and resulting policy shift is seeing momentum building quickly across a number of other EU power markets.

Germany is set to see a surge in BESS investment as RES deployment accelerates & thermal assets continue to close. Spain also has strong potential once clarity is provided on its new capacity market and the remuneration of reserve services. Belgium & Netherlands are smaller markets but set to benefit from RES growth and the synchronisation of secondary reserve (aFRR) markets across Europe.

For all this optimism there are a number of practical challenges that remain for BESS investors.

BESS investment hurdles & how they are being overcome

BESS scaling across EU markets has been hampered by a combination of policy issues (e.g. network charging rules) & inadequate stackable revenue. We summarise 5 key challenges in Table 1.

Table 1: 5 key challenges facing EU BESS investors

While these issues have slowed BESS development to date, they are being addressed on multiple policy fronts with new urgency since the energy crisis began.

Ancillary & balancing market reform will be a big driver supporting BESS revenue stacks across the next 3-5 years. Secondary reserve (aFRR) markets are being synchronised across Europe (under Project PICASSO) creating a deeper revenue opportunity for BESS assets to provide ancillary & balancing services e.g. this will enable BESS assets in the Netherlands to access revenue from providing flex services to the German market.

The energy crisis has also driven a structural increase in energy arbitrage revenues available to BESS assets across European markets. This is helping to build investor confidence in deploying capital against a backdrop of strengthening policy tailwinds.

EU BESS land grab is underway

The GB market illustrates some of the challenges investors face when BESS scaling takes off. Site, planning & connection bottlenecks can quickly appear, creating hurdles for investment.

This reflects the fact that not all BESS sites are created equal. Good sites are driven by a combination of factors such as revenue stream access, connection, network charging burden & colocation potential with renewable & EV infrastructure.

Successful growth in some markets (e.g. Southern Europe) also depends on strong partnerships (e.g. policy, developer & offtake) and specialist local knowledge.

In 2023 we have seen a sharp increase in clients engaging us to support EU BESS growth strategy & investment case development. The key focus markets to date are Italy, Germany, Spain & Benelux.

This reflects the start of a ‘land grab’ underway to establish which players will dominate BESS portfolio growth across the next 5 years by gaining access to the best markets and sites. And growth will not be linear. Its taken 7 years to get to 5GW of grid scale BESS in Europe. The next 7 years should deliver at least 50GW.

Our free European Battery investment webinar is on Thursday this week.

Timera EU battery investment webinar

Webinar registration link – register here

- Date: Thurs 20th Apr (2-3pm BST, 15-16 CEST)

- Title: “Targeting battery value” – revenue stack, opportunities & challenges for BESS investors across EU

- Content:

- Ranking BESS investment potential across EU markets

- BESS revenue stack structure (energy arbitrage, ancillaries, capacity)

- Evolution of key price signals & revenue drivers

- Investment challenges (e.g. policy, network charging)

- Key BESS investment case drivers