The GB power system has a growing transmission network problem. This can be summarised as follows:

“BESS may be a no-brainer solution from a network perspective… but that doesn’t ensure a robust investment case”

- Offshore wind is the dominant source of new GB generation capacity

- New wind connection is focused in Scotland & Northern England

- GB demand is focused in the South of England

- Transmission lines are increasingly constrained moving power north to south

- New transmission lines are very slow & expensive to build.

Batteries (BESS) are likely to be a big part of the answer to this problem. They can absorb large volumes of surplus energy in periods of high wind output. BESS is also relatively quick & cheap to deploy versus transmission upgrades.

In today’s article we look at the factors driving BESS revenue uplift from system constraint management services. We also summarise an approach for quantifying revenue uplift.

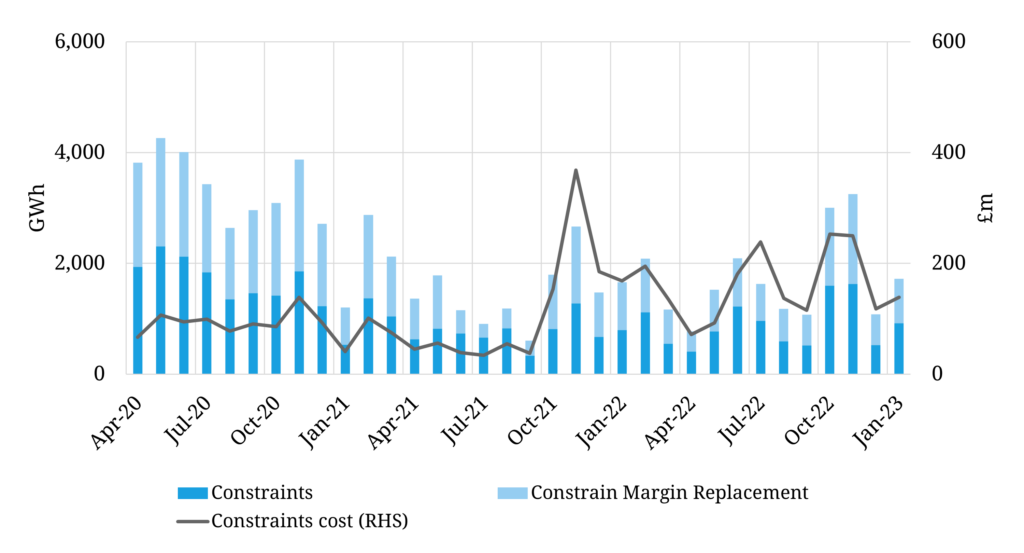

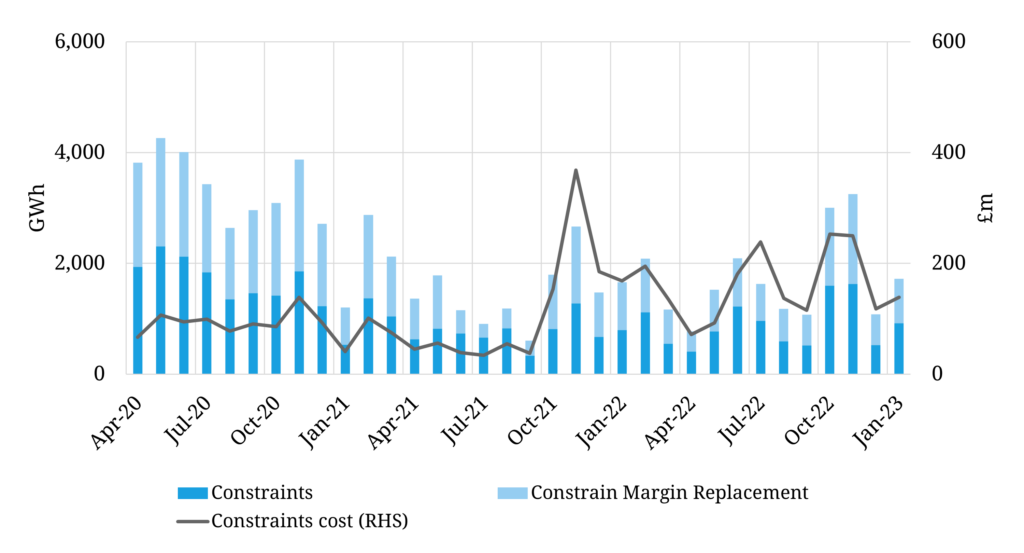

The constraint problem in numbers

The easiest way to grasp the magnitude of the GB constraint management problem is via the costs required to address it. Chart 1 shows how GB system operator balancing costs have evolved since 2020 and how constraint management costs (light green bars) have been a key driver of this increase.

Chart 1: GB system balancing costs

Source: Timera Energy, NGESO

2022 saw balancing costs of £3billion incurred in the Balancing Mechanism (BM) alone, up 150% y-o-y. Costs are increasing as result of rising wind & solar penetration, thermal asset closures and higher power prices.

The most acute GB transmission network constraint is the Anglo-Scottish border (B6 zonal boundary). This is getting steadily worse as more offshore wind is connected in Scotland, resulting in a rising incidence of periods low & negative power prices.

This is attracting the focus of battery investors who see the potential for significant revenue uplift from providing constraint management services in the Balancing Mechanism. To better understand this value opportunity, we set out some key takeaways below from our work quantifying revenue uplift analysis for BESS investors.

Drivers of BESS constraint revenue uplift

At the simplest level BESS assets can earn incremental revenue from bidding into the Balancing Mechanism (BM) to soak up surplus energy to alleviate system constraints.

For example, a battery connected in Scotland can be called to charge during periods of system constraint, to help absorb excess wind generation.

There are broadly two ways flexible assets can access value in the BM:

- Energy actions: providing non-locational energy flex to help balance energy on the system

- System actions: locational flex to help manage system constraints.

The marginal price of BM system constraint actions is typically set by the marginal cost of assets providing this flexibility, currently dominated by the curtailment of wind assets.

Wind assets receiving Renewable Obligation (RO) support will typically bid to provide curtailment flex at deeply negative prices given the opportunity cost of lost RO certificates from reducing generation. The RO rolls off later this decade, however wind assets with CfD contracts also play an important role in setting system BM prices.

The amount of constraint revenue uplift for a BESS asset is driven by 4 key factors summarised in Table 1.

Table 1: Key drivers of system BM revenue uplift for BESS

In addition to real time revenue capture in the BM, there are longer term sources of contractual revenue uplift available to batteries providing system support services. National Grid’s pathfinder projects for constraint management, inertia & reactive power are a key example. These are used to avoid pre-emptively curtailing generation, and instead allow National grid to trip-off the contracted units post-fault.

As an example, pathfinder contracts were awarded to 15 wind farms (1.6GW) for B6 constraint management in 2024/25. To date battery volumes targeting constraint revenues are still relatively small, although one 50MW battery has previously been successful in the 2023/24 pathfinder. That is set to change fast across the next 5 years.

Quantifying BESS constraint revenue uplift

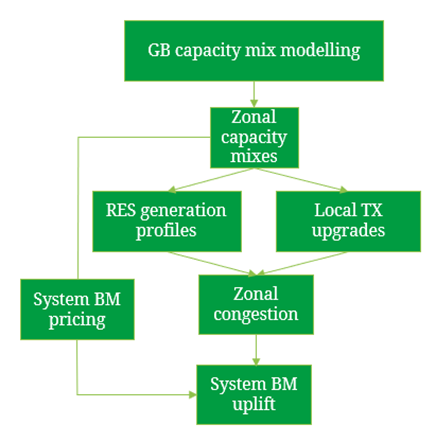

We are supporting some of the largest BESS development projects in Scotland and Northern England. In order to do this we have developed the approach summarised in Diagram 1 that aims to balance detailed analysis with transparency & pragmatism.

A simple explanation of these steps:

- GB balance: project GB market wide demand & capacity mix evolution (e.g. to 2050)

- Zonal balance: project specific zonal (e.g. B6) demand & capacity mix evolution

- Zonal congestion: analyse the depth, breadth and frequency of zonal congestion to estimate theoretically available uplift for BESS e.g. undercutting system constrained wind.

- System BM pricing: project marginal pricing dynamics of system BM actions for relevant zone

- Stochastic BESS modelling: we then re-parameterise our stochastic battery optimisation model, to account for system BM actions consistent with zonal congestion and pricing.

The last step is key as it allows proper merchant optimisation of battery dispatch while accounting for specific zonal system BM actions.

It is important that constraint revenue uplift analysis is integrated into BESS optimisation. This is because system BM actions act to constrain full merchant revenue capture.

5 factors for BESS investors to consider

The impact of constraint management actions on the investment case for BESS make these projects significantly more complex to analyse than regular battery projects.

In Table 2 we summarise 5 issues we think are worthy of in-depth analysis when building an investment case for a battery targeting constraint management revenues.

Table 2: 5 considerations for BESS investors on constraint revenue

From a system management perspective it is a ‘no brainer’ to use batteries as a tool to alleviate congestion. But there is no guarantee that this translates into a compelling investment case for individual battery projects.

A robust investment case for a constraint management focused battery project should be underpinned by a quantitative set of answers to the five questions in the table.

Interested in the European battery investment landscape? See details of our upcoming webinar below.

Timera EU battery investment webinar

Webinar registration link – register here

- Date: Thurs 20th Apr (2-3pm BST, 15-16 CEST)

- Title: “Targeting battery value” – revenue stack, opportunities & challenges for BESS investors across EU

- Content:

- Ranking BESS investment potential across EU markets

- BESS revenue stack structure (energy arbitrage, ancillaries, capacity)

- Evolution of key price signals & revenue drivers

- Investment challenges (e.g. policy, network charging)

- Key BESS investment case drivers