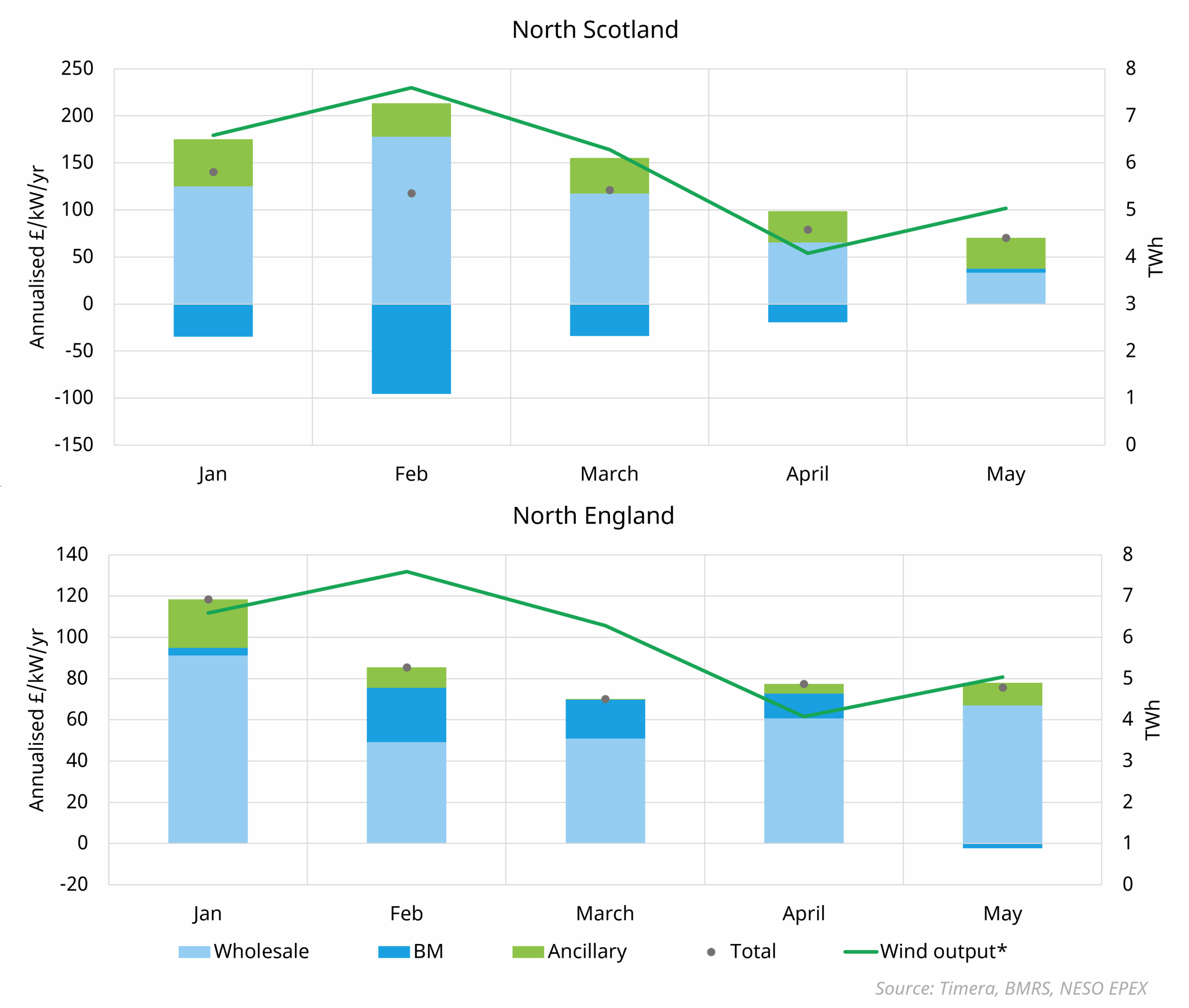

Wind output in GB has fallen sharply into spring with ~4TWh of wind (pre curtailment) in April relative to 7.6TWh in February. This has had a knock on impact on BESS revenues, with assets in some locations seeing a more significant impact than others.

In North Scotland, high wind in Q1 allowed for strong revenue s as proximity to constraint boundaries such as B4 alongside tactical use of Quick Reserve allowed for long periods of positive physical notifications with high BM activity. Some assets in the south were able to use the opposite strategy as NESO re balanced energy to account for generation bid down in the North (see recent blog: Analysis of the recent GB BESS revenue recovery – Timera Energy) However, as wind dropped across April and May this strategy was less fruitful, leading to many assets switching towards a strategy favouring Dynamic regulation rather than Quick reserve.

In North England, the revenue effect from low wind was more muted. Assets here lie south of Scotland’s highly constrained areas but still behind B7/B8 boundaries. These boundaries can limit full access to rebalancing opportunities tied to Scottish bid activity, meaning revenue sensitivity to wind dips is somewhat moderated but also caps the upside during periods of high wind.

Lower gas prices also weighed in on revenues given the strong link between gas prices and day ahead spreads, with gas often being the marginal price setting technology in GB. This continues the trend seen across recent years of a damper revenue environment in GB as wind output falls in summer while solar dominated countries such as Germany see spreads and therefore battery revenues grow into summer.

For further information on key drivers of BESS revenues in GB, do reach out for a redacted copy of our GB BESS subscription report. Please contact Arshpreet Dhatt at Arshpreet.dhatt@timera-energy.com