“Policy change unlocks value capture from 2 cycles a day”

The case for co-locating solar and battery storage is gaining fresh momentum in Germany. The value drivers are familiar — shared infrastructure, optimised grid usage, stacked revenues. But historically, co-located projects have struggled to scale, constrained by regulation and commercial complexity.

In Germany, grid connection queues are driving a resurgence. With connection delays stretching across years in some regions, co-locating storage with already grid-secured solar offers a pragmatic workaround.

Policy support tailwinds

Germany’s EEG (Renewable Act) subsidies & Innovation Tenders are reinforcing the trend, providing a dedicated mechanism to support co-located assets via tariff payments. However, these mechanisms come with a catch: current regulations prevent storage systems from charging electricity from the grid, limiting operational flexibility.

Under the Innovation Tender support scheme, BESS assets are unable to charge directly from the grid in an effort to ensure the subsidy is only paid for generation directly from renewable sources. This market design artificially hobbles the usefulness of the battery to both TSO and asset owner, limiting their ability to provide energy arbitrage services or aFRR. FCR is ruled out altogether given it is a symmetric service.

Until recently, the EEG subsidy design required asset owners to choose whether to operate as a “grey” battery (able to charge from the grid but forgoing subsidies), or a “green” one (restricted to solar-only charging but eligible for premiums). This binary configuration could only be changed every two months, limiting optimisation and commercial flexibility.

EEG amendments to lift charge restriction

The limitations for BESS under this previous arrangement have now been recognised. In January 2025, the government passed the Solar Peak Act, introducing more flexible treatment of battery charging under the EEG.

Under the new design, batteries will be able to operate in mixed mode — charging from both solar and the grid. Metering is used to calculate which output qualifies as “green” and is therefore eligible for subsidies. Implementation details, including how origin will be certified and compliance verified, are due from BNetzA by June 2026.

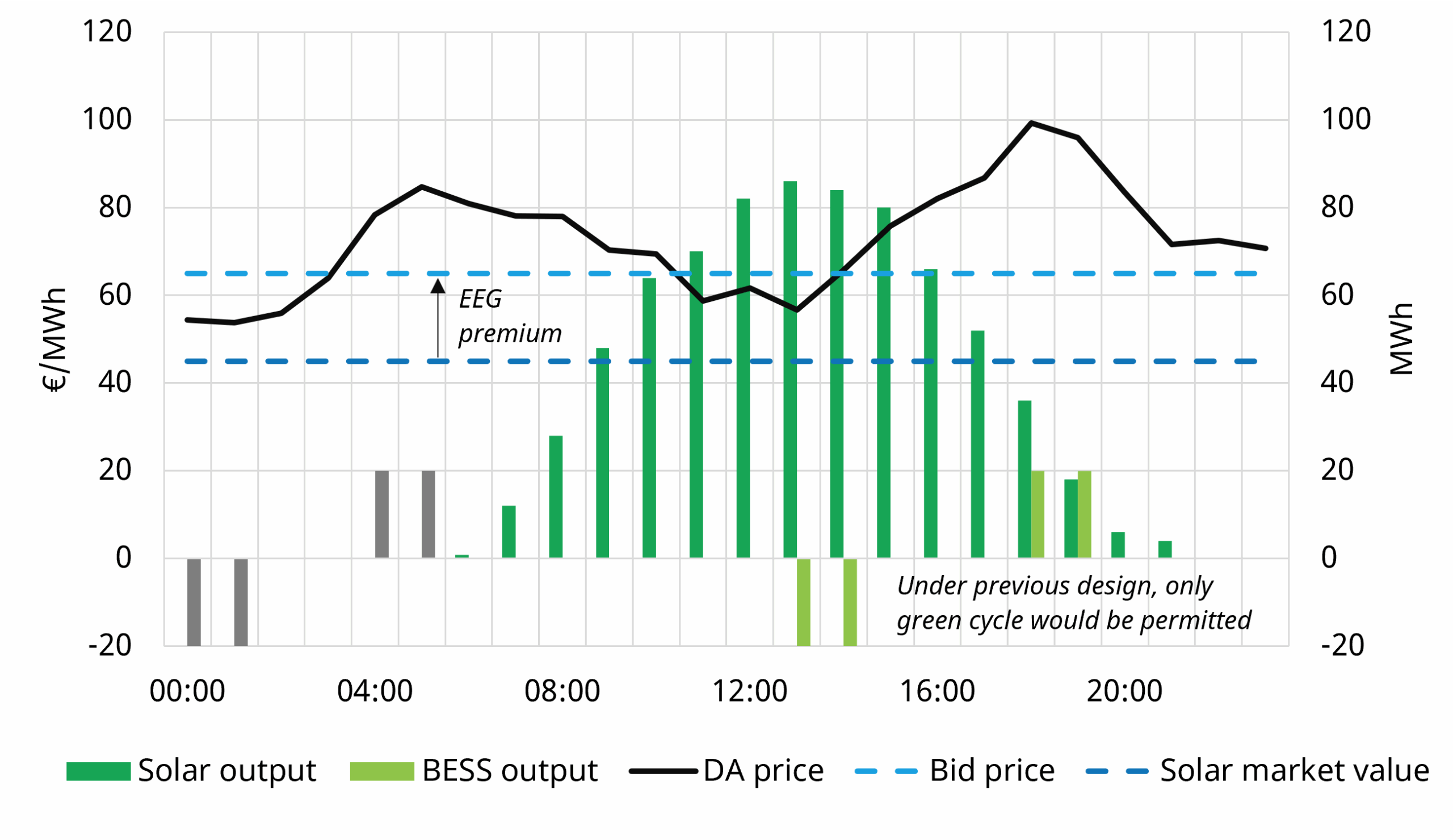

In Chart 1 we illustrate the value uplift from the new EEG subsidy design.

Under the previous EEG design only the light green charge & discharge cycle shown in the chart would have been allowed. Under the new EEG design, the BESS asset does 2 cycles, one in the morning and one over evening peak:

- Morning discharge (grey bars) is from grid-charged energy and not eligible for EEG premium

- Evening discharge (light green bars) is from solar-charged energy and is eligible for the premium.

While the Innovation Tender rules (which override the Solar Peak Act of the EEG for this specific mechanism) still prohibit grid charging, the legislative shift of the EEG signals broader support for BESS — and may pave the way for future adjustments to hybrid market frameworks.

Flexibility is rising up the policy agenda

Germany’s power market is facing increasing stress under the weight of rapid renewable buildout. As solar and wind outputs grow, so too does the system requirement for flexibility.

To date, policy and market frameworks in Germany have lagged behind in the support of batteries. Innovation Tenders offered a stepping stone for co-located assets, but imposed rigid rules that constrained storage from accessing key value streams like price arbitrage and ancillary services.

This is now changing. The Solar Peak Act, as well as the recent grid fee exemption extension represent an important pivot. These acknowledge that to support a renewables-led system, flexible assets must be allowed to operate flexibly. Lifting the grid charging ban is a clear signal — and while implementation details remain in flux, the direction of travel is positive.

Way forward for BESS investors

For BESS investors and developers these changes are building a stronger foundation for investment cases. Co-located projects benefit from cost synergies and grid access advantages. As policy catches up with system needs, the investment case is improving — with batteries increasingly positioned as strategic enablers of Germany’s energy transition.

Germany’s evolving support for co-located BESS reflects a wider European trend: flexibility is rising up the agenda, but policy approaches vary. Italy is backing standalone BESS through MACSE auctions, while Spain is incentivising co-location with solar via PERTE and regional support schemes. Across markets, the strategic role of storage is no longer in question – it’s how best to unlock storage scaling that remains the key focus.

If you are interested in more details on our German BESS subscription service and a free sample copy of our latest report and investment tool, feel free to reach out to Lucienne Hill-Smith (lucienne.hill.smith@timera-energy.com).