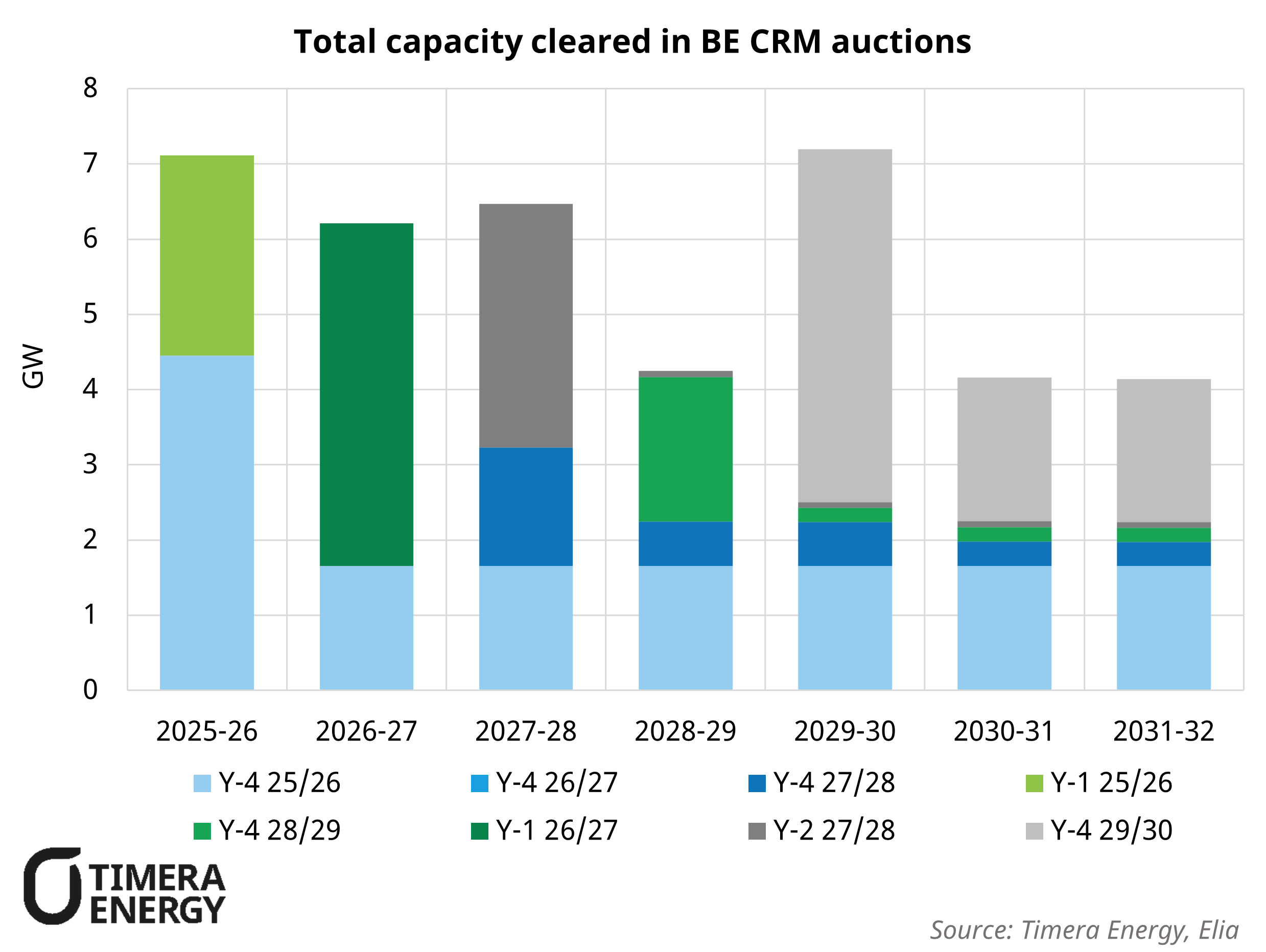

Belgium ran three CRM auctions last week (Y-4 2029/30, Y-2 2027/28, and Y-1 2026/27), with prices remaining close to last years auctions with Y-4 clearing at a weighted average of €27.3k/MW/yr vs €28.0/MW/yr in Y-4 2028/29 (pay-as-bid). Ongoing rule adjustments continue to favour storage, including exemptions from the ‘payback’ mechanism. From 2025, DSR will be exempt from scarcity paybacks, with BESS to follow once Belgian legal changes take effect, further enhancing value.

Batteries again dominated new build awards, securing over 500 MW of de-rated capacity across the three auctions. In total, around 1.6 GW of new-build BESS is now contracted to deliver by 2029/30.

A key development was Belgium’s first Y-2 auction, introduced by Elia to bridge the gap between the Y-4 and Y-1 rounds and better suit development timelines of assets like BESS. With demand set above available supply, bids fully cleared at a weighted average of €25.1k/MW/yr. This enabled CCGTs to lock in revenue early, leaving only ~1 GW left to procure for next year’s Y-1 auction.

Looking ahead, Belgium’s CRM design continues to lean BESS friendly, though its small system size and growing pipeline raise saturation risks. Merchant value remains compelling, supported by volatile imbalance pricing and high RES penetration driving strong day ahead spreads.

Timera Energy has deep experience in modelling and supporting investment in Belgium and other European markets using a stochastic modelling approach that provides a realistic view of asset optimisation and investment risk. Our framework can capture market specific nuances such as liquidity constraints in smaller systems like Belgium. If you’d like to learn more about our modelling capability, feel free to reach out to our Power Director, Steven Coppack (steven.coppack@timera-energy.com).