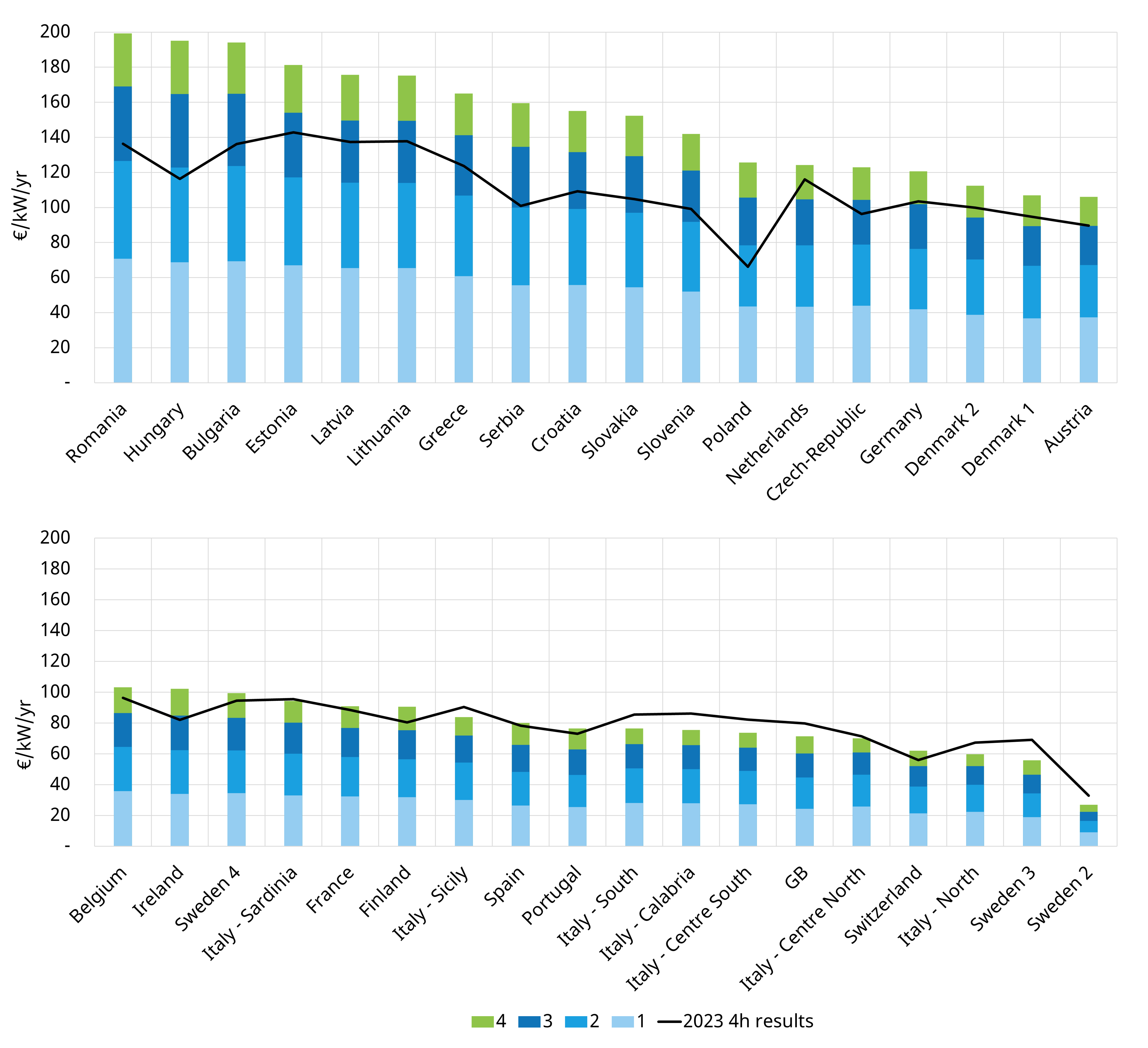

In Chart 1 we show ranked BESS day-ahead revenue capture across European power markets in 2024 (vs 2023).

Chart 1: Day-Ahead BESS revenue capture in 2024 (vs 2023)

Source: Timera Energy, ENTSOE, Epex; Note value calculations assume a simple D-A arbitrage capture strategy with visibility across a monthly horizon (efficiency 85%) - analysis only covers D-A value not Within-Day and other revenue streams.

The European power market in 2024 has been shaped by a combination of volatile gas prices, extreme weather patterns, and rising renewable penetration. These factors have significantly impacted Battery Energy Storage System (BESS) revenues, driving notable variations across different markets.

Three key trends have defined the year:

- Warm winter & weak gas prices (early 2024): A milder-than-expected winter across Europe led to reduced heating demand, lowering gas consumption and narrowing price spreads. This dampened Day-Ahead volatility, limiting early-year BESS revenues.

- High renewable penetration in summer: Record-high solar PV output resulted in steep midday price troughs, followed by late-afternoon peaks driven by gas-fired generation. These widening intraday spreads created lucrative Day-Ahead opportunities for BESS assets.

- Late-year Dunkelflaute shocks & gas volatility: A colder-than-average Q4, coupled with extended periods of Dunkelflaute (low wind and solar availability), spurred higher power & gas prices. The resulting price volatility widened Day-Ahead power spreads, benefiting BESS assets.

Where did BESS revenue changes occur?

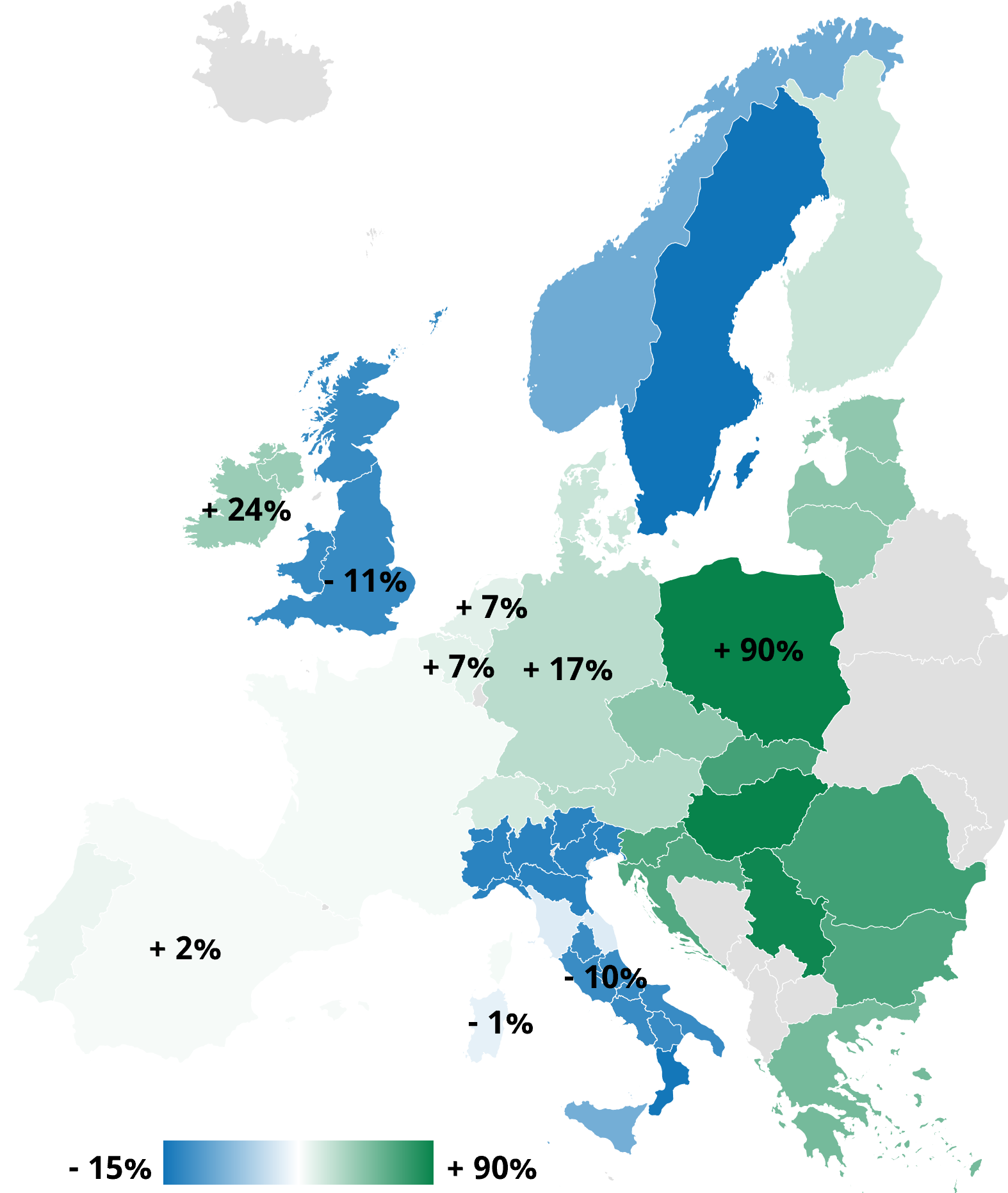

Chart 2 examines the 2023 vs 24 year on year Day-Ahead BESS revenue trends across Europe, with a focus on market-specific developments in major Western and Eastern European markets. The percentage changes in revenues reflect 4-hour battery systems.

Chart 2: 4 hour BESS revenue changes y-o-y 2023 vs 24

Source: Timera Energy, ENTSOE, Epex; Percentage difference between Day-Ahead revenues for 4hr BESS computed as described in chart 1 description. Green colours represent YoY % increase, while blue colours represent YoY % reduction in Day-Ahead revenues for 4hr BESS.

Let’s take a tour around key European BESS markets.

Western Europe: Established markets stabilising / recovering

- Great Britain: Day-Ahead BESS revenues declined marginally by ~10% in 2024. Despite occasional price spikes driven by low wind output, an increase in installed battery capacity dampened volatility, capping peak spreads. Wind power overtook gas as GB’s primary electricity source, contributing to more frequent negative pricing.

- Germany: A 17% revenue increase was driven by summer solar oversupply and late-year Dunkelflaute volatility (Impact of German Dunkelflaute on flex asset value). Grid congestion between northern and southern Germany remains a key challenge, amplifying Day-Ahead spreads and reinforcing BESS value.

- Italy: A 10% revenue decline was recorded in most zones mainly due to abundant flexible hydro generation availability in the North. Centre North and Sardinia zones were an exception, registering almost same 2023 Day-Ahead potential revenues due to the frequent interconnection constraints faced on the between zones caused by maintenance events on SACOI and SAPEI interconnectors and by lower NTC constraints defined by Terna.

- Spain: Revenues remained largely flat due to high internal from hydro and gas capacity. Spain’s rapid solar expansion increased midday negative pricing events, benefiting BESS in the summer, but the higher volatility coming from North West Europe had a limited impact on Iberia due to limited cross-border transmission capacity.

- Belgium & The Netherlands: Both markets saw modest revenue increases (~5-7%), with growing solar output widening Day-Ahead price differentials. These markets saw patterns highly correlated respectively with France and Germany also due to the impact of Flow Based Market Coupling (FBMC) (Flow-based market coupling & counterintuitive flows in Europe)

- Ireland: The highest revenue growth in Western Europe (+24%) was seen in Ireland, where a small, historically gas-reliant system experienced high volatility, in part due to supply shortages and an ageing gas fleet. BESS benefitted from strong interconnection dynamics with Great Britain, where wind generation fluctuations drove Day-Ahead price swings.

Eastern & Central Europe: Surging revenues, but with low market depth

- Poland: A major emerging BESS market, Poland saw the largest YoY growth in Day-Ahead BESS revenues. The increase in price volatility is not just due to its expanding RES capacity, but also due to grid constraints coupled with allocation constraints, FBMC and Western price volatility that all together have enhanced potential arbitrage revenues. Poland’s capacity market represents an additional interesting income source for BESS and we have seen a strong increase in client interest here.

- Other Central-Eastern European markets: These markets have been the most profitable markets in Europe on a Day-Ahead market basis. They are all part of the Core Capacity Calculation Region (Core CCR), share common dynamics: rising renewable penetration, limited interconnection capacity, and the adoption of FBMC. As wind and solar capacity expands, within-day price spreads are widening, benefiting BESS operators. However, restricted cross-border transmission capacity leads to localized price volatility, further amplifying BESS arbitrage opportunities. It is important though to note that all these markets are subject to relatively rapid cannibalisation risks due to the limited market depth available to BESS acting as market makers.

What lies ahead?

We finish with 3 factors to consider that are likely to shape BESS revenue capture across the next few years:

- Rising price volatility, but revenue compression risks: While higher renewable penetration increases volatility, greater installed BESS capacity can reduce peak spreads, compressing revenue opportunities with market depth an issue in smaller countries.

- Evolving market dynamics: New capacity mechanisms (MACSE in Italy and other Capacity Markets) and market reforms (Day-Ahead 15-minutes granularity from June and more uniform ancillaries) will shape future revenue opportunities for BESS.

- Interconnection bottlenecks shaping price spreads: Markets with limited interconnection will continue to see more extreme price swings, supporting strong BESS revenues. Interconnectors increasingly represent a major structural value driver for power flexibility investors to look at. They are also a crucial element to consider in assessing market depth of specific countries.

We provide bespoke consulting services to BESS investors across Europe. We also offer BESS subscription services for GB, Germany & Italy. For further details or to obtain a sample copy of our material, feel free to reach out to our Power Director Steven Coppack steven.coppack@timera-energy.com.