“5 key markets illustrate divergence in BESS value capture”

Stand out BESS returns in Germany & the Netherlands. A surge in negative prices in Spain. A sharp divergence of BESS price shape capture in GB & Italy. 2025 is revealing some key differences in BESS value capture dynamics across Europe.

Arbitrage value capture structurally underpins the investment case for BESS assets. There are two key components of arbitrage returns

- Price shape capture in Day-Ahead auction

- Price volatility capture via re-optimisation of BESS flex in intraday & balancing markets.

In today’s article we focus on the former. We set out evolution of D-A price shape capture in 2025 across 5 key European markets where capital deployment by BESS investors is currently hottest.

A tour of returns across key BESS markets & 5 key takeaways

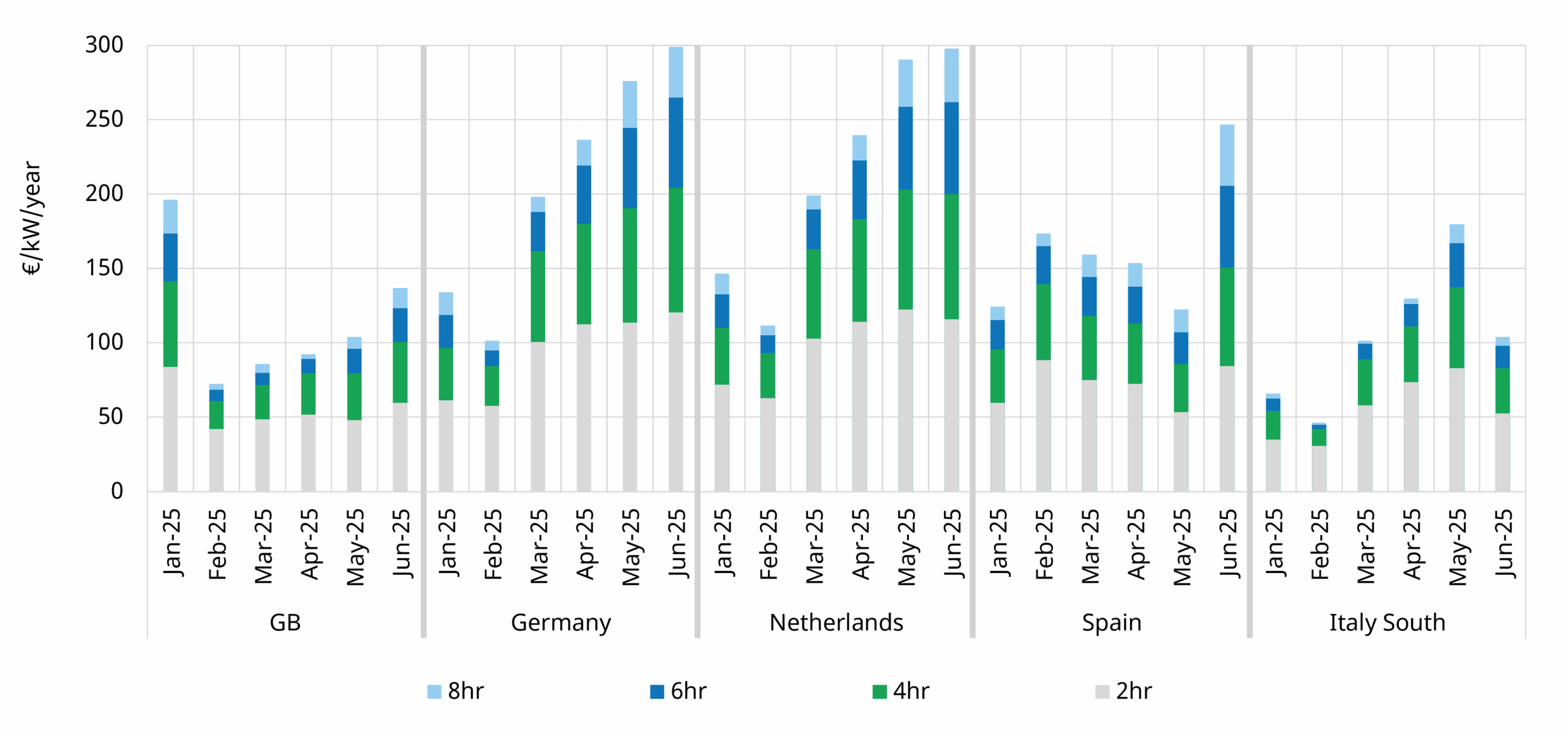

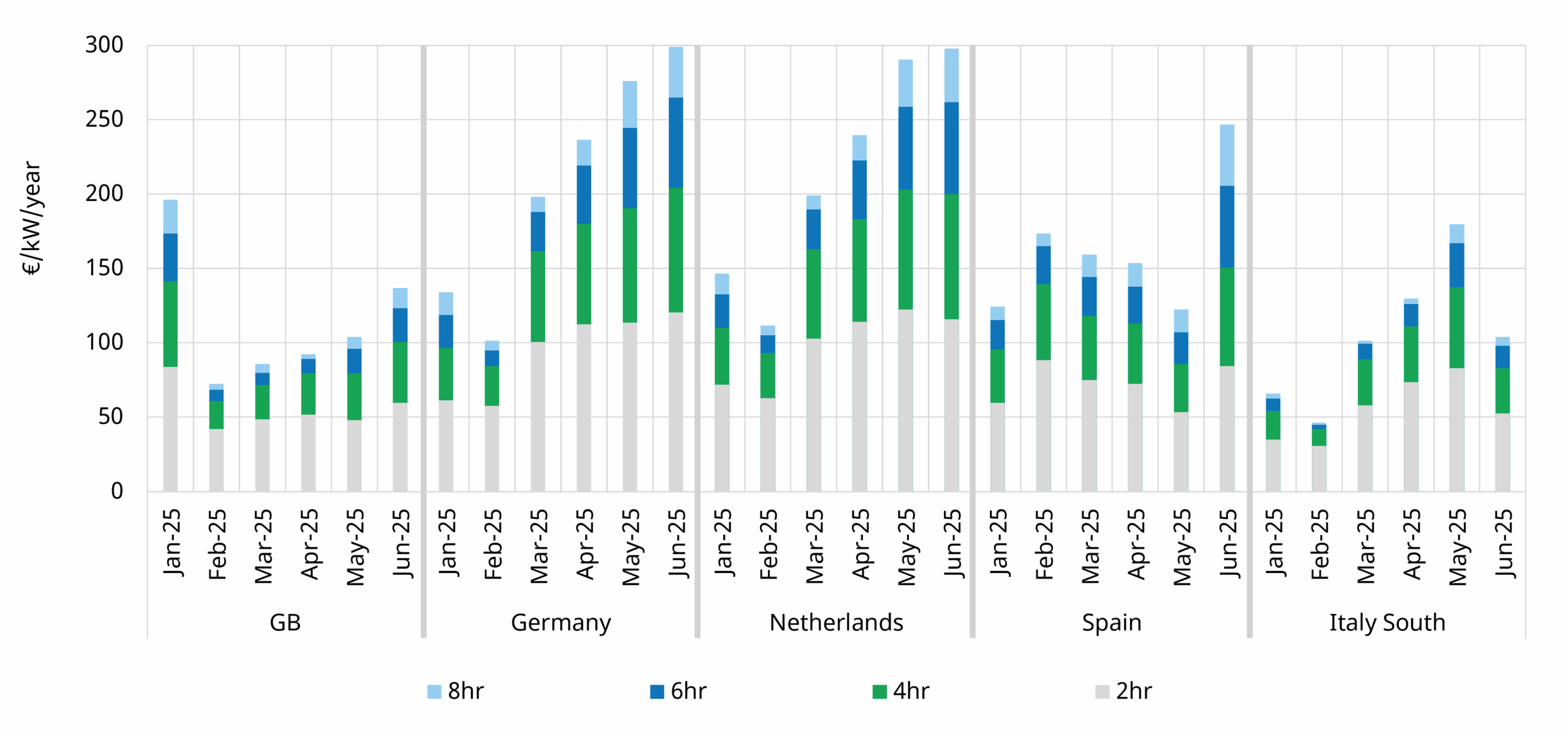

Let’s dive straight into the action with Chart 1 which shows monthly D-A price spread capture across our 5 key European markets.

Chart 1: Annualised monthly Day-ahead arbitrage value capture by duration in 2025

Source: Entsoe, EPEX, Timera Energy; Note value calculations assume a simple D-A arbitrage capture strategy with visibility across a monthly horizon (efficiency 85%) - analysis only covers D-A value not Within-Day and other revenue streams.

A summary of 5 key takeaways:

1. NW Europe leads shape capture

Germany, Netherlands have structurally higher D-A returns, which increase across summer. This is being driven by high RES penetration, particularly the solar ‘duck curve’ impact on price shape. These dynamics are reflected in strong investor & offtaker interest in these markets (with relatively attractive terms on tolls, floors & other hybrid structures to protect downside). Similar dynamics happened also in Belgium which is highly interconnected with these two markets.

2. D-A returns in GB & Italy impacted by gas flex

GB & Italy have attractive BESS capacity agreements (via the Capacity Markets & MACSE). However large flexible gas plant fleets relative to renewable penetration act to dampen D-A price spreads & associated BESS arbitrage value capture. Intraday & balancing market value capture is also an important addition to D-A value for GB BESS, particularly in periods of more high or low wind output.

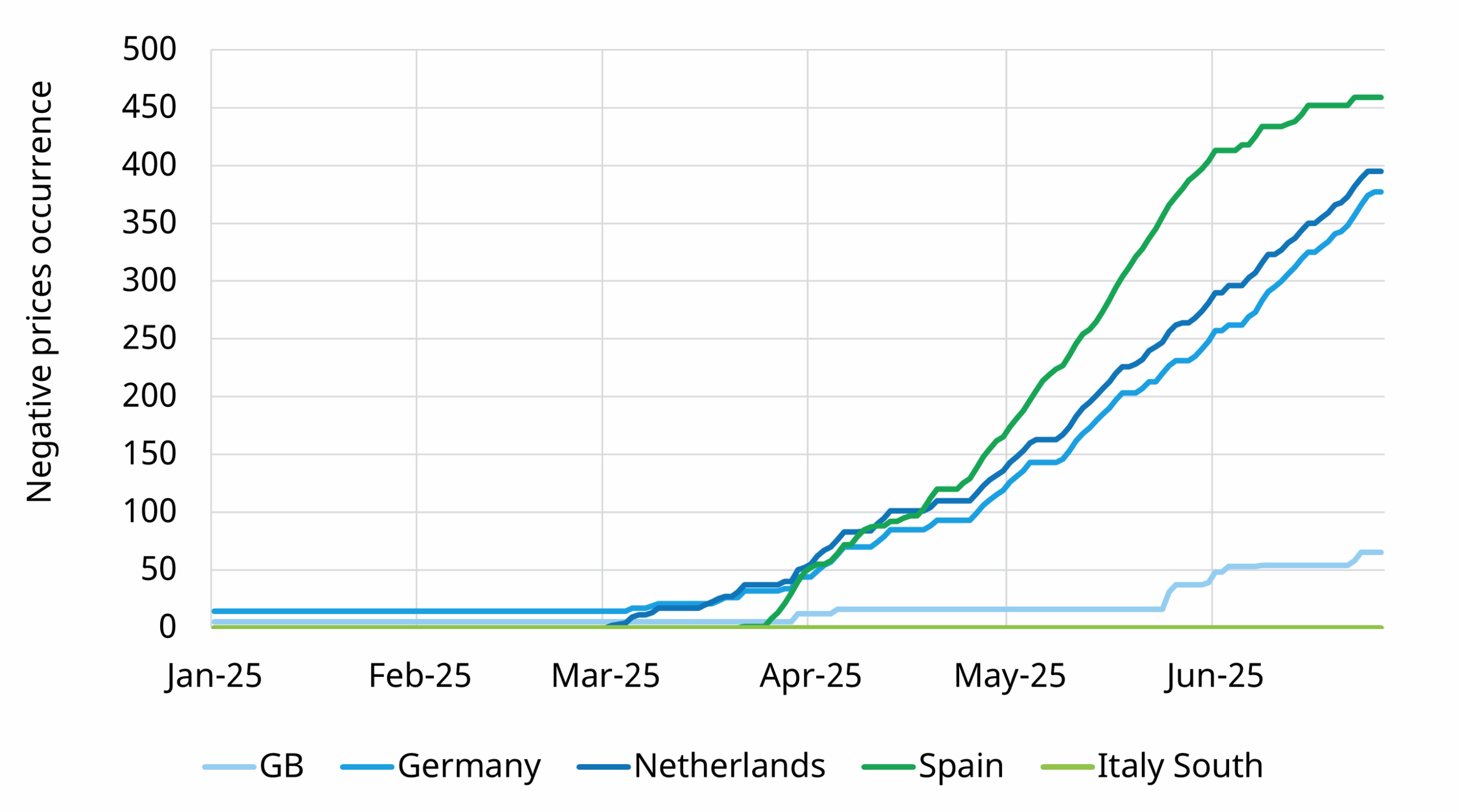

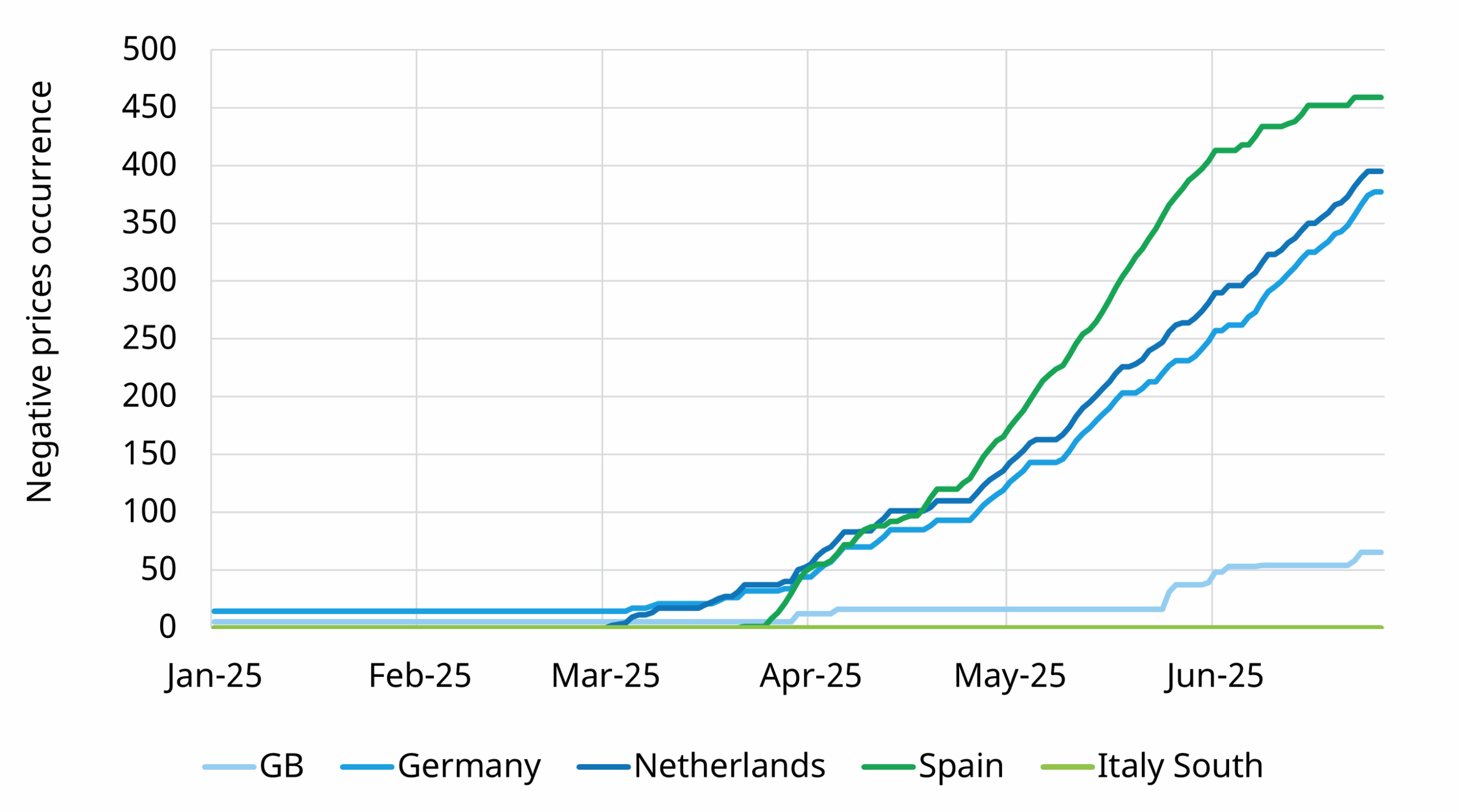

3. Low / negative prices an important driver

Higher price periods in tight markets are a key source of value for BESS. But low / negative prices are increasingly contributing to D-A shape capture. Chart 2 shows the cumulative growth in negative prices hours across 2025 across our 5 focus markets.

Chart 2: Cumulative negative prices occurrences

Source: ENTSOE, Timera Energy

Spanish negative prices are surging in 2025 – we come back to this below. Aside from Spain, the impact of RES penetration in driving low prices in Germany & Netherlands is clear in the chart. This is in stark contrast to GB & Italy where flexible gas fleets dampen price shape.

4. Spain is emerging as a key new opportunity for BESS

The Spanish market in 2025 is being dominated by the fallout of April’s catastrophic system outage. Higher system operator mandated running of CCGTs as well as robust hydro balances and solar penetration are contributing to a surge in low / negative prices. But the most interesting angle for BESS investors is movement on the policy front where momentum is finally shifting in favour of support for batteries.

What about duration returns & LDES?

Chart 1 illustrates another important conclusion about the value of BESS duration. The incremental value capture from adding BESS duration beyond 4 hours declines quite significantly given current RES penetration levels.

This is consistent with a current BESS investor focus somewhere between 2 & 4 hours of duration depending on the market & policy backdrop. This is set to extend over time as (i) RES penetration increases (ii) thermal assets close & (iii) cell costs decline.

LDES is increasingly in focus from a policy perspective e.g. the UK’s cap & floor mechanism for LDES and Italian MACSE auctions. But the duration dynamics in Chart 1 highlight the importance of adequate policy support frameworks to underpin investment.

Want more analysis & investment insights?

We have subscription service products for GB, Germany, Netherlands & Italian BESS investors. Feel free to reach out to our Power Director Steven Coppack (steven.coppack@timera-energy.com) if you would like more details or free sample material.