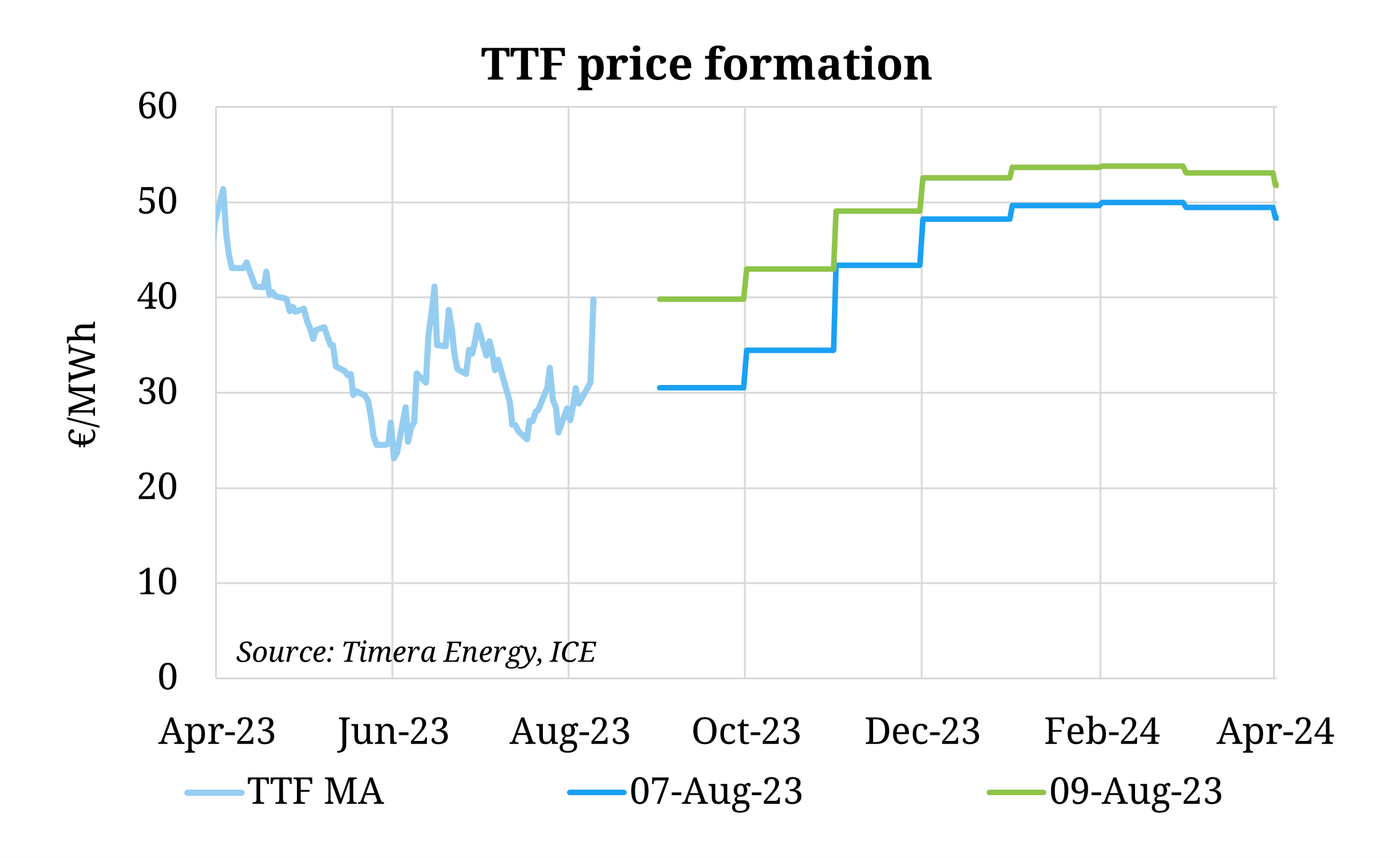

TTF month ahead prices surged significantly (~33%) yesterday, buoyed by reports of potential strikes by workers at Chevron and Woodside’s Australian LNG facilities (comprising around 10% of global LNG supply). Despite the minimal available storage space remaining in Europe, the rally underscores the lack of global flexibility in the current regime, driving high volatility (likely exacerbated by short covering) and the risk of asymmetric upside leading into the winter period.

The risk of a move away from the current European summer oversupply also saw a tightening of the Sep – Nov contango by 3.6 €/MWh yesterday, reducing the incentive to carry floating LNG into the winter months or inject it into Ukrainian storage.

We will explore both (i) the near term gas market contango and (ii) the winter outlook in an upcoming feature blog article series.