This decade has been a tough one for owners of flexible midstream gas assets such as storage, pipelines & regas terminals. Asset returns have been hit by a post financial crisis overhang of supply flexibility in the European gas market. At the same time, market drivers are structurally altering the risk/return profile of midstream assets.

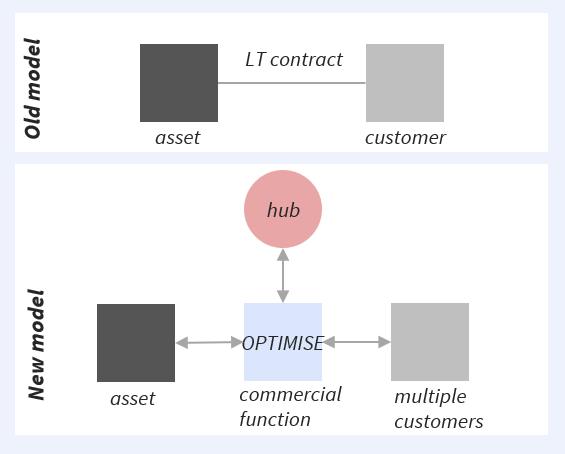

But as is often the case, commercial strength is born from adversity. Midstream asset owners are improving returns by evolving commercial models and optimising margin & costs.

A combination of sharper commercial strategies and recovering market fundamentals is set to underpin midstream value recovery into next decade.

In this article we set out:

- 3 structural market trends supporting European midstream asset value

- 3 resulting commercial trends impacting midstream asset value capture

- 5 ways asset owners are responding to boost value capture.

While 1. applies generally across all midstream assets, our coverage of 2. and 3. focus on flexible TPA exempt assets.

3 structural market drivers supporting midstream value

Energy markets are cyclical in nature. Several years of tough conditions and low investment tends to set up a market recovery. But in addition to cyclical factors there are three structural drivers of a recovery in the value of European gas supply flexibility across the next 5 years:

- Import dependency: European domestic production is in structural decline. This means the European gas market is becoming more dependent on longer import supply chains e.g. LNG imports and Russian pipeline flows from Western Siberia. Longer response times increase market price volatility and the frequency and magnitude of price shocks.

- Power sector swing: Gas fired power plants are set to play an increasingly important flexibility provision role over the next 5 years. Regulatory driven closures of nuclear, coal and lignite plants will increase gas plant load factors. In parallel, the requirement for flexibility is set to rise with a substantial increase in intermittent wind & solar output. The increased ramping of gas-fired power plants depends on supply flexibility from the gas market.

- Ageing infrastructure: European midstream gas infrastructure is ageing. Yet investment in both maintenance and renewal capex for midstream assets has been relatively low this decade given weak market price signals. Infrastructure outages and retirements are likely to increase as a result into next decade.

These drivers are underpinning a gradual recovery in flexibility price signals since 2016. This recovery has been more pronounced in the UK market with the closure of Rough. But TTF volatility has also been rising in 2018.

These structural market drivers are supporting several key commercial trends impacting midstream value capture.

3 commercial trends impacting value capture

The market drivers described above are resulting in important trends in the way TPA exempt midstream asset owners are capturing value. These are summarised in Table 1 below.