The Brexit ‘Leave’ vote was a genuine market shock. On the day of the referendum, markets were pricing in a more than 80% chance that the ‘Remain’ vote would prevail. The surprise result has been reflected in financial market volatility since votes were counted on Friday 24th June. This volatility has in turn fed through into energy markets.

It is difficult to draw strong conclusions on the impact of Brexit given the level of uncertainty that remains. Two key sources of this uncertainty are:

- The nature of the new relationship that the UK will negotiate with the EU (and other major trading partners)

- The impact of the UK exit decision on the future stability of the EU, and potentially more broadly on global growth

It will likely take months rather than weeks for clarity to emerge on these. However there are some important observations that we can already make about the way that markets are reacting to Brexit.

In today’s article we compare movements in key prices impacting European energy markets ‘1 day after’ the referendum with ‘1 week after’. This does not help to divine the future. But it does demonstrate some important market relationships. We finish the article by considering the broader consequences of Brexit for UK and EU energy policy.

Market impact: 1 day vs 1 week

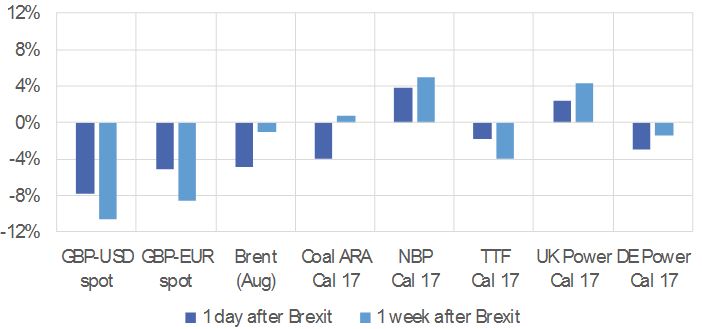

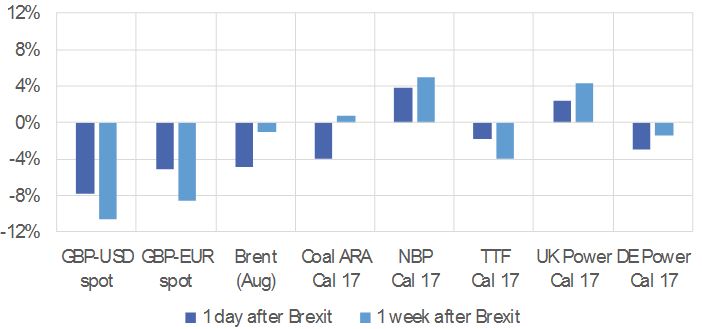

Chart 1 shows the percentage price impact of Brexit on different markets, based on market closing prices ‘1 day after’ and ‘1 week after’ Brexit (June 24th vs July 1st).

Chart 1: Post Brexit percentage change for key prices driving European energy markets

Source: Timera Energy (using ICE, EEX & ECB data)

Currencies

The foreign exchange (FX) market is the headline barometer for the Brexit market reaction, given currency movements reflect a broad range of factors such as capital flows, interest rate movements and macroeconomic conditions.

The British pound (GBP) fell sharply straight after the referendum and has continued to fall. This reflects a rise in political and economic uncertainty in the UK as a result of the Brexit vote. But it also reflects the Bank of England’s indication mid last week that it plans to pursue further monetary expansion (quantitative easing) this summer, a factor that should act to depreciate the pound.

Chart 1 shows GBP has fallen more against the USD than the EUR. This reflects the fact that the Brexit result has also weakened the EUR and driven a general ‘flight to safety’ towards the world’s reserve currency the USD.

FX implied volatility, particularly for GBP currency pairs, has risen substantially over the last month as a result of the Brexit referendum. FX risk exposures in energy portfolios have increased accordingly.

Oil and coal

Prices of globally traded commodities such as oil and coal weakened sharply 1 day post Brexit result. This was driven partly by a stronger USD (consistent with the negative correlation between commodity prices and the dollar). But price weakness also likely reflected market concern over the potential for broader fallout from Brexit to weaken global growth and therefore commodity demand.

It is interesting to note that 1 week later, coal and oil prices had recovered back to pre-Brexit levels. This was consistent with a broader recovery in global commodity and share markets as last week progressed. These moves were not mirrored in FX and bond markets, where Brexit damage in the form of weaker GBP and lower interest rate yields remained a week after the event. This divergence in market reactions suggests that global markets are anticipating more central bank monetary easing (which places downward pressure on currencies and bond yields) to dampen the impact of Brexit.

European gas markets

Currencies play a very important role in driving the Brexit impact on gas hub prices. NBP is a GBP denominated market (with gas contracts traded in p/th). TTF is a EUR denominated market (with gas contracts traded in EUR/MWh). Yet high volumes of interconnection capacity ensure relatively tight arbitrage in price differences across the English Channel.

NBP gas prices look like an anomaly in Chart 1. NBP continued to rise in GBP terms as last week progressed even, while TTF continued to decline. But this almost entirely reflects a weakening GBP against the EUR. In EUR terms, UK gas prices have fallen by similar percentage terms as TTF prices.

The impact of GBP volatility on NBP prices since the onset of Brexit may have important implications for hub liquidity. The GBP currency exposure implicit in NBP gas positions will likely provide further support for the ongoing strengthening of TTF liquidity at the expense of NBP.

European power markets

We have used the UK and Germany to illustrate the power market impact of Brexit in Chart 1. The fall in Cal 17 German power prices 1 day after Brexit, reflected the fall in ARA coal prices, given prices are predominantly set by coal plants. But German power prices recovered with coal prices as last week progressed.

The rise in UK power prices reflects the dominance of CCGT plants in setting prices. In other words weaker GBP, means higher NBP gas prices and higher power prices (all else being equal).

But as is the case for NBP gas prices, if we consider UK power prices in EUR terms they are much more stable. The healthy spread between UK and Continental power prices has weakened slightly since the referendum. But the majority of the impact of EUR-GBP exchange rate fluctuations is neutralised through adjustments in fuel prices.

Brexit and UK energy policy

Taking a step back from the market and considering the impact of Brexit over an asset investment horizon, UK energy policy is another area that has come into focus over the last week. It is clear that there will be a period of political fallout in the UK following the referendum, including perhaps a new election. The Conservative party will take on new leadership as well as a revised policy platform. These will likely shape the UK’s approach to negotiating EU extraction regardless of an election, given the Labour party is in disarray. But from a UK energy policy perspective there are unlikely to be any major shifts.

The UK has been relatively autonomous in its shaping of energy policy to date, given a domestically driven policy platform to liberalise and decarbonise. It has also typically been a leader rather than a follower in facilitating liquidity, promoting competition and implementing market design changes (e.g. the UK’s 2014 capacity market implementation, which ironically has been the only one accepted by the European Commission so far).

Brexit is also unlikely to derail the EU vision for a ‘single energy market’. The EC’s big policy push for greater cross-border interconnection and inter-market compatibility is driven by security issues for gas (especially a fear of Russia) and by grid balancing concerns for power. Both worries are EU-membership-neutral, and the EC will continue to promote maximum interconnection across the greater European region. This includes the UK, which is the EU’s second biggest energy market and very significant provider of gas import capacity and general liquidity, whether it is in or out of the EU.

But most importantly, the UK government is well aware of the infrastructure investment challenge it faces over the next 5 years to maintain security of supply across power and gas markets. If anything Brexit should only strengthen the government’s willingness to support investment in UK infrastructure.

Article written by David Stokes and Olly Spinks