‘UK commits to decarbonise electricity system by 2035’ – UK government (BEIS) Oct 7th 2021

There are plenty of details required to understand what this statement really means, but it can only be interpreted as a big acceleration in the UK’s decarbonisation timeline. This new goal reflects the simple reality that the 2050 net zero target depends on decarbonisation of the electricity system in the 2030s.

”Decarbonising the UK’s electricity system represents a second industrial revolution”

There is undoubtedly politics in play ahead of the UK hosting the COP26 climate summit in Glasgow later this month. There is definitely some ‘wriggle room’ for Boris on the interpretation of ‘decarbonisation’. But we should know more across the next 3 weeks, with the government promising further details ahead of the COP26 summit.

However there is enough in the announcements to date to for us to start getting to grips with what the target may mean for markets and asset values. In today’s article we take a look at the impact of closing all fossil capacity by 2035 and 5 key implications for the UK power market if this is to happen.

Can renewables keep pace with gas closures?

Simple answer: No. However that doesn’t mean that decarbonisation by 2035 is impossible, it just implies a requirement for enormous investment in new flexible capacity.

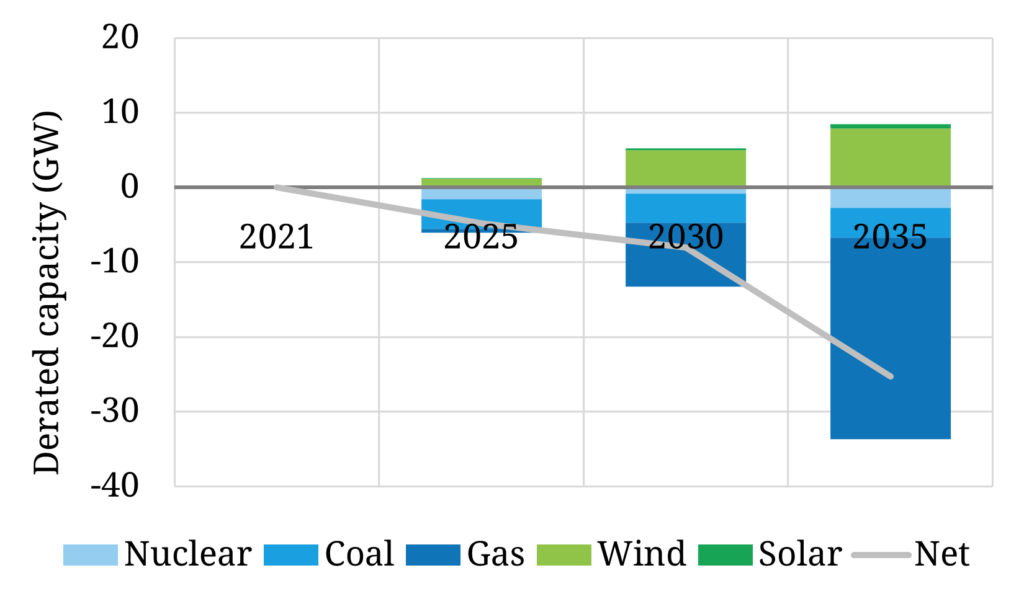

A way to objectively assess the renewable vs thermal closure capacity deficit is shown in Chart 1.

Rather than layering on subjective or scenario based assumptions, Chart 1 shows the following simple comparison:

- Derated wind & solar capacity volume additions required to meet the government’s current 2030 RES target (with extension to 2035 based on similar growth rate trajectory)

- Derated capacity reductions from the closure of all coal by 2025, all CCGTs by 2035 and nuclear plants based on regulatory scheduled closure dates.

The chart does not capture (i) any new build capacity, which acts to reduce the deficit or (ii) any increases in peak demand as other sectors electrify (e.g. EVs, heat industry), which acts to increase the deficit.

So to be clear it is not a scenario or a prediction of future capacity shortfall. It is a mechanical calculation that highlights the scale of the difference between derated renewable build and thermal asset closures. In numbers that deficit rises to around 25GW by 2035.

Let’s now consider a summary of 5 implications of the 2035 target and implied RES vs thermal deficit.

1.Large increase in renewables build

The 2035 target clearly requires a substantial acceleration in renewables build on top of what are already challenging 2030 targets

- The heavy lifting is likely to be done by offshore wind & solar, with rapid scaling of support for offshore wind farms & transmission infrastructure key

- Additional incentives may be required for solar, including targeting colocation with storage

- There is major transmission network investment required to address constraints, particularly in Scotland & East Anglia (where offshore wind networks come onshore)

- Storage & electrolysers may play an important role in managing constraints

- The government is likely to attempt to back BECCS (biomass with CCS) technology, but may face an uphill battle given its controversial climate credentials.

2.Huge storage investment required

Given 1., storage represents a key fast response source of balancing & load shifting, albeit a net consumer of energy

- Accelerated deployment of batteries will be required to cover shorter duration requirements (e.g. 1 – 8 hour)

- The Climate Change Committee are projecting 18GW of battery capacity by 2035 but this may need to be higher

- Longer duration technologies (e.g. 8 hrs plus) are a big gap that will likely require additional policy support to resolve

- Limitations with pump storage hydro sites are likely to see evolving storage technologies come into play (e.g. Compressed Air, flow batteries & the new iron-air battery technology)

- The other avenue for access to storage flex is via interconnectors e.g. expanding the links to hydro rich Norway, but current cap & floor policy support may be inadequate given structurally converging cross border prices.

3.Target implies Gas + CCUS in scale

Carbon capture & storage is still a nascent technology but the UK is leading European CCUS deployment

- Scaling of gas with CCUS strongly depends on efficient delivery of the UK’s CCUS clusters to provide cost effective transport & storage support infrastructure to enable CCUS power plant investment

- Closing (or repowering) unabated CCGT plants by 2035, will likely require at least 5 – 10 GW of new CCGT + CCUS, potentially up to 20GW

- Why? In a 2035 horizon there is simply no other scalable dispatchable generation technology to plug the energy & capacity gap left by retiring the UK’s almost 30GW of existing CCGTs

- Heroic storage deployment volumes do not solve this issue given storage is a net consumer (vs generator) of energy; some form of dispatchable generation is required to fill prolonged periods of low wind & solar output (as experienced across Europe in H2 2021)

- An important factor determining CCGT + CCUS volumes will be how much incremental nuclear capacity can be built beyond Hinkley C; the government may try another nuke (e.g. Sizewell or Wylfa) as well as trying to accelerate scaling of SMR technology.

4.Hydrogen required but not a silver bullet

- The major impact of hydrogen is likely to be focused beyond 2035 given the huge challenges in scaling cost effective production, but it is definitely an important piece of the puzzle

- Hydrogen will almost certainly remain an expensive fuel in 2035 which points to its power sector use being focused on peaking capacity

- The lowest hanging fruit is likely to be the repowering or conversion of gas engines to run on hydrogen

- The role of hydrogen as a generation fuel is also dependent on significant scaling of production by 2035

- Current electrolyser targets are relatively small in hydrogen production volume terms and green hydrogen depends on access to low cost power (easier to source over time as renewables penetration increases)

- Hydrogen’s contribution to the 2035 target therefore relies strongly on scaling of blue hydrogen via targeted support and development of the UK’s CCUS clusters.

5.Demand side engagement required

Maintaining stability in a decarbonised power system is going to be most challenging in periods of low or fluctuating wind & solar output; this is where demand side engagement is set to play a key role

- The ability to dynamically flex aggregated load sources across these periods will be critical for system balancing and managing prolonged lulls in RES output

- Most of the DSR volumes successful in the UK’s Capacity Market to date have been backed by engines & batteries behind the meter i.e. is not true DSR

- A new policy framework & incentives are required to fully engage DSR, including changes to Grid’s calling of flex and the role of distribution network operators

- New technologies are also likely to play a key role e.g. smart appliances / software, smart charging of EV batteries and eventually vehicle to grid flex

- There are substantial distribution network investment requirements for dynamics demand engagement to become a reality.

The scale & pace of investment required to decarbonise the UK’s electricity system represents a second industrial revolution.

Talk is cheap for politicians, particularly when they will be long retired in 14 years time. But the UK government appears to be anchoring its economic recovery plan around decarbonisation and investment in the north. And this is likely to produce an unprecedented set of opportunities for energy investors.

Timera is recruiting We are actively looking for new people to join the Timera team across a range of roles. Two specific ones we are currently targeting:

- Senior Analyst (Power) – strong practical knowledge of European power markets and value drivers of flexible assets, particularly storage & batteries.

- Senior Analyst (LNG) – strong experience of LNG portfolio commercial & value drivers / risk / analytics.

We offer very competitive packages as well as the ability to directly participate in company value upside. We offer significantly more flexibility & autonomy than other companies, covering e.g. location, work hours & remuneration structure.

Timera has an open, innovative & entrepreneurial environment and we work on a variety of stimulating analytical challenges across the rapidly evolving energy industry.

See here for more details https://timera-energy.com/careers/ or email us at recruitment@timera-energy.com