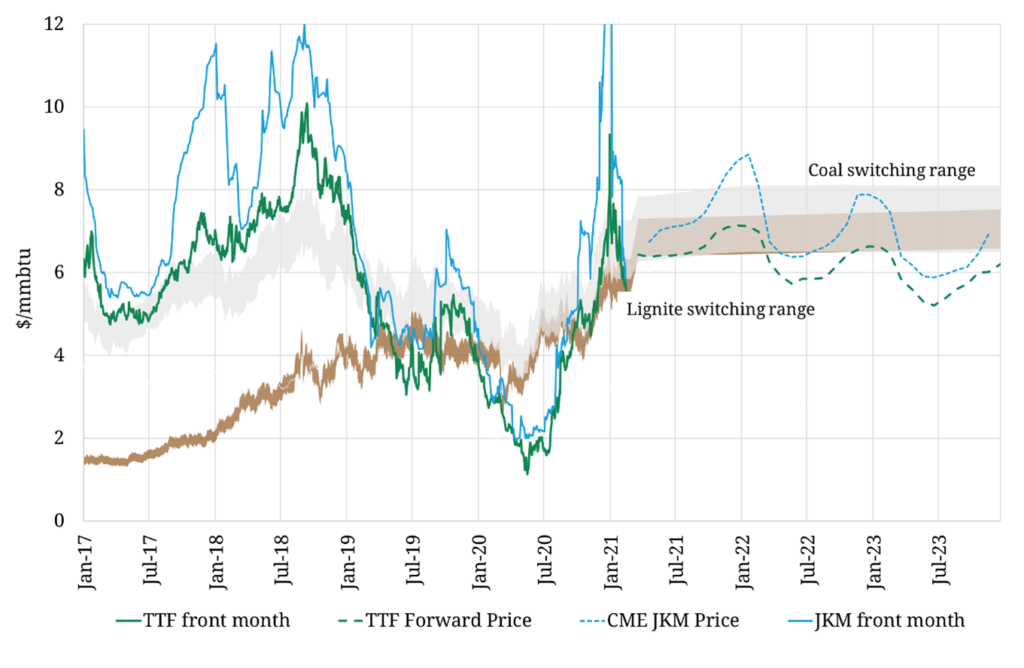

European gas prices are driven by the competitive dynamics between gas and coal plants. As a result, the 80% surge in carbon EUA prices since Nov-20 is pulling European gas curves higher. European power & Asian LNG prices are following suit, given they are anchored by TTF.

“As carbon prices have surged in 2021, lignite & coal plants are competing to set switching levels…

…driving TTF & JKM prices higher”

As carbon prices rise, coal fired plants become less competitive relative to CCGTs. This supports gas fired generation, increasing gas demand and causing upward pressure on hub prices.

Switching levels, at which tranches of coal fired plants displace gas, act as a key driver of TTF pricing dynamics. But switching levels are a moving target. As coal & carbon prices have increased in 2021, switching levels are also marching higher.

In today’s article we look at the impact of rising carbon prices on switching levels and gas prices. We also set out why the sensitivity of TTF to rising carbon prices is increasing in 2021.

What is going on with carbon prices?

Carbon prices have risen at a blistering pace across the last year. EUA prices are up 190% from the Covid low (last Mar), 80% since last Nov and more than 30% this year, currently trading around 42 €/t.

Increasing prices are a market reaction to a concerted EU policy push to ramp up emissions reductions. This was reflected in the increase in 2030 emissions target to 55% (vs 1990) in Q4 2020, as well as ongoing discussions to further ramp up reductions.

Part of the move higher in EUA prices has been driven by a surge in demand from non-compliance entities, loosely termed as ‘speculative buyers’. This for example includes funds & financial institutions ‘front-running’ compliance demand (e.g. from power generators) in the anticipation of selling for a profit into rising prices across Phase 4 (2021-30).

There is also evidence of compliance buyers (e.g. European utilities) purchasing EUAs on a forward basis to try and lock in positive margins on coal & lignite assets.

Despite the current momentum behind carbon prices, a continuing surge is not a one-way bet. Rising carbon prices are pushing forward generation margins on coal & lignite plants into negative territory, which will likely induce generators to unwind EUA hedges. There are also potential headwinds from UK buyers unwinding EUA positions once the UK ETS offers a viable alternative.

But whether rising or falling, carbon prices are having a substantial impact on European gas prices (and in turn power prices).

Switching levels driving up TTF

Chart 1 shows current forward market implied switching ranges for coal & lignite plants, as well as their historical evolution. The Coal Switching Range (CSR) is show in grey and the Lignite Switching Range (LSR) in brown.