LNG vessel spot charter rates have exploded since late September. If you are not in the business of chartering boats you may be tempted by an obvious question… ‘who cares?’

Spot charter rates have much broader market implications. The delivery of LNG cargoes is increasingly being optimised against spot price signals. Margin opportunities in moving LNG between regions depends on the cost of transportation. This means that shipping cost differentials have become key drivers of LNG flows & regional price spreads, as well as LNG portfolio value opportunities.

LNG flows have also been the primary driver of European gas market supply & demand dynamics across the last year. Forward market pricing points to this continuing across 2020-21. And European LNG import levels also determine the volume of surplus gas absorbed by European power markets via switching.

The upshot of this interconnected market logic is that quite a few people care what happens to charter rates. In today’s article we take a look at why rates have soared and what the market impact may be.

The charter rate rollercoaster

Most of the global LNG shipping capacity is under term charter to portfolio players. This means there is typically only relatively small volumes of capacity available on a spot basis e.g. for traders wanting to take advantage of arbitrage opportunities.

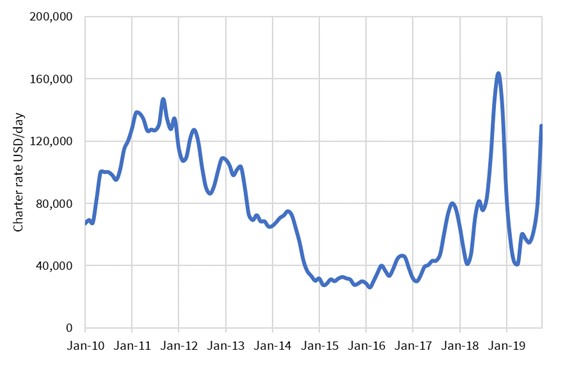

Limited spot liquidity exacerbates the price impact of any adjustments to supply and demand. This can be seen in Chart 1 which shows the evolution of spot charter rates this decade.

The Fukushima disaster in 2011 caused a sharp rise in charter rates as incremental shipping capacity was required to move large volumes of LNG to Japan as nuclear plants closed. Tightness then eased into mid-decade as a wave of new vessels were commissioned.

Charter rates surged again in 2018 as new liquefaction projects came online and cargos were diverted from Europe to Asia (with longer average voyage times). This was a short lived phenomena as Asian demand softened in Q4 2018 and large volumes of LNG flowed back into Europe.

The 2019 charter rate surge

Spot charter rates have quickly surged from below $50k per day this summer to above $130k per day by mid October. This translates into roughly 1.20 $/mmbtu cost increase for a spot charter voyage from US to Asia (assuming round trip costs).

So what is behind the move? A key catalyst has been the US sanctions slapped on state-owned Chinese shipping company Cosco for breaching Iranian oil sanctions. This has effectively ‘blacklisted’ a number of vessels operating under long term charter e.g. from Tangguh in Indonesia, Bintulu in Malaysia and the North West Shelf in Australia. The sourcing of replacement vessels in the spot market has driven up rates.

Four icebreakers used to transport LNG from the Yamal peninsula were also impacted by sanctions, given a Teekay JV with a Chinese company owned by Cosco. But this issue was resolved last week via an ownership restructure that circumvented the sanctions.

The Cosco issues have grabbed headlines but there are a couple of other factors behind the recovery in charter rates:

- Contango: Both TTF and JKM forward curves are in steep contango (rising forward prices) across the next two months. This reflects market normalisation from very weak prices across the summer. Curve contango is encouraging cargo owners to use LNG vessels as floating storage i.e. you get paid for delaying delivery of the cargo given rising prices.

- Distances: As new US export volumes come online, they are increasing average shipping distances, particularly if the LNG is flowing to Asia. This effectively increases utilisation of the global vessel fleet, acting to tighten supply and support charter rates.

Market impact: 3 factors to watch

The market impact of higher charter rates depends on whether the current surge is temporary and if not how higher rates will impact LNG flows. Three factors to consider:

- Work arounds: The Teekay solution for the Yamal icebreakers is a good illustration of the commercial incentives to develop work around solutions to allow vessels to continue operating. If this logic extends to other vessels impacted then the Cosco element of the problem may be a more temporary impact.

- Asian demand: Given tightness in the shipping market is linked to distances, the volume of cargoes flowing to Asia is important. Asian LNG demand has been weak so far across 2019, but may pick up into winter. The extent to which this happens should support charter rates into 2020. If demand remains weak then higher volumes of LNG are likely to continue to flow into Europe.

- US export economics: Netback prices on US export supply are impacted by higher charter rates. Higher rates increase US LNG shut in price levels. They also favour the economics of moving LNG to closer markets (e.g. Europe vs Asia).

We will keep an eye on the evolution of charter rates and the knock on impact on markets via our Snapshot column.