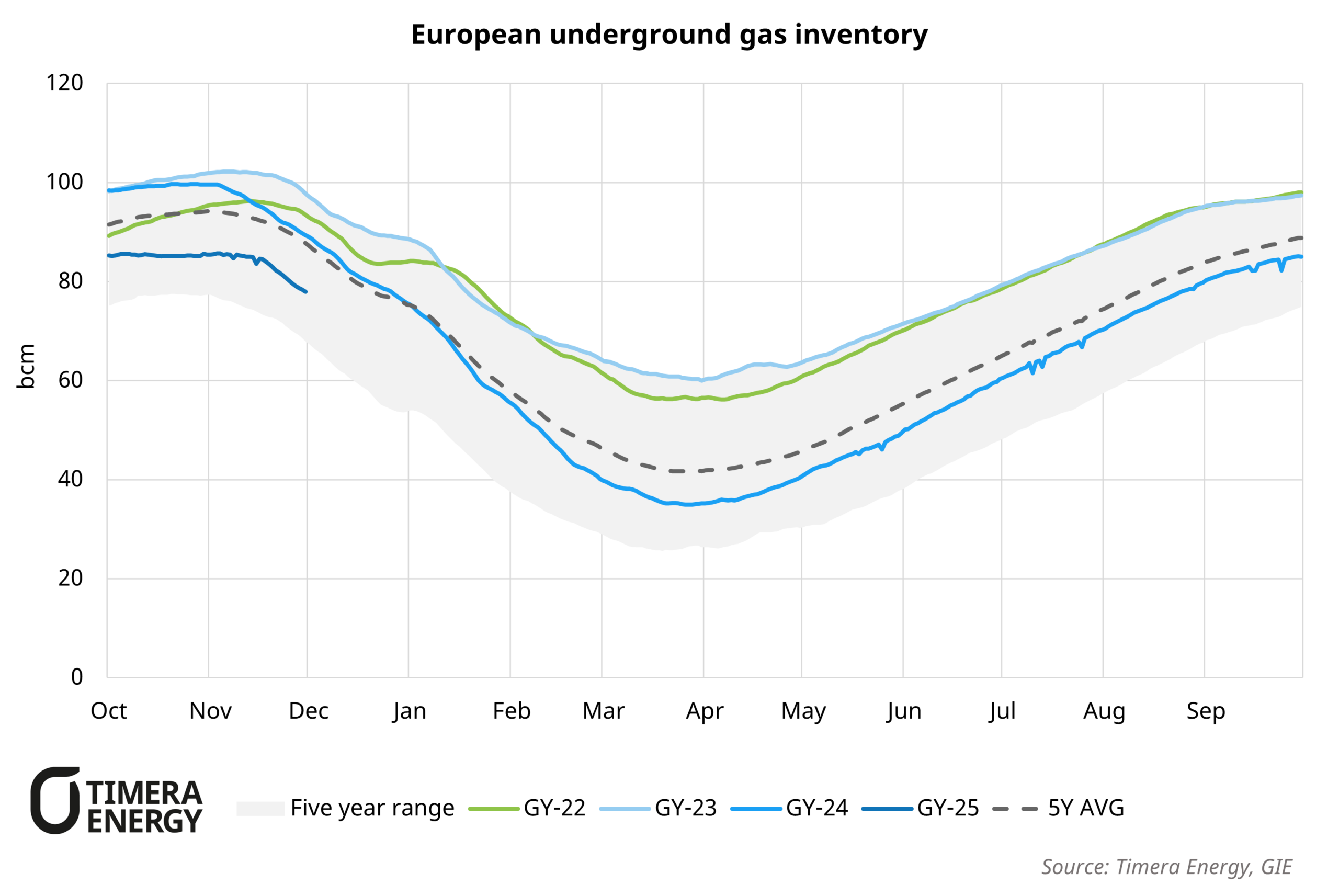

European underground gas storage inventories have slipped to 77.9 bcm, compared to 89 bcm at the same time last year. As a late November cold spell hit, the tightening and drawdown across Europe has not been uniform. The chart shows the drawdown across European storage as temperatures fell, with storage inventory in Germany falling by around 1.6 bcm (7%) over the past two weeks, driven by higher heating and gas for power demand. In contrast, milder conditions in Italy have kept Italian storage levels much higher with only 0.9 bcm (5%) of net withdrawals over the same period. This divergence increases the likelihood of wider intra hub spreads as winter progresses.

Despite strong withdrawals potentially signalling increasing tightness as we move through winter, the TTF price has moved in the opposite direction. Front month prices have eased from €31.8/MWh to €28.1/MWh since 18th November. This has in part been driven by European temperature forecasts normalising and on news of a potential Russia – Ukraine peace deal. However, it also reflects on the markets confidence in alternative sources of flexibility, particularly LNG inflows, being sufficient alongside the remaining storage cushion to balance further swings in demand.