Consider a scenario. Gas prices break down this summer as Europe is awash with surplus gas. Power prices follow given gas as a marginal fuel. Yet by Christmas prices surge higher as Europe is forced into a bidding war for available LNG with Asia.

“This is not a market for forecasting outcomes”

Have we lost the plot? Let’s be clear – this is not our forecast outcome. To be even clearer – this is not a market for forecasting outcomes. Any sensible analysis starts with a healthy respect for uncertainty… by trying to understand what could happen rather than what ‘should’.

Let’s explore the drivers behind what could be a volatile 2023 and set out a framework that may help to better understand and navigate it.

Storage is currently key

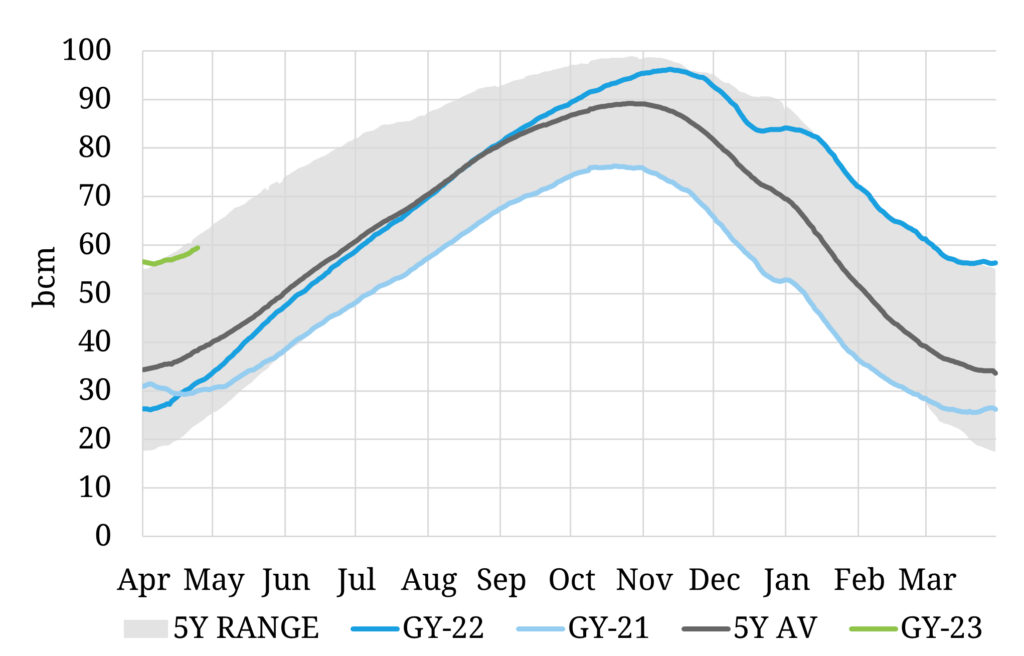

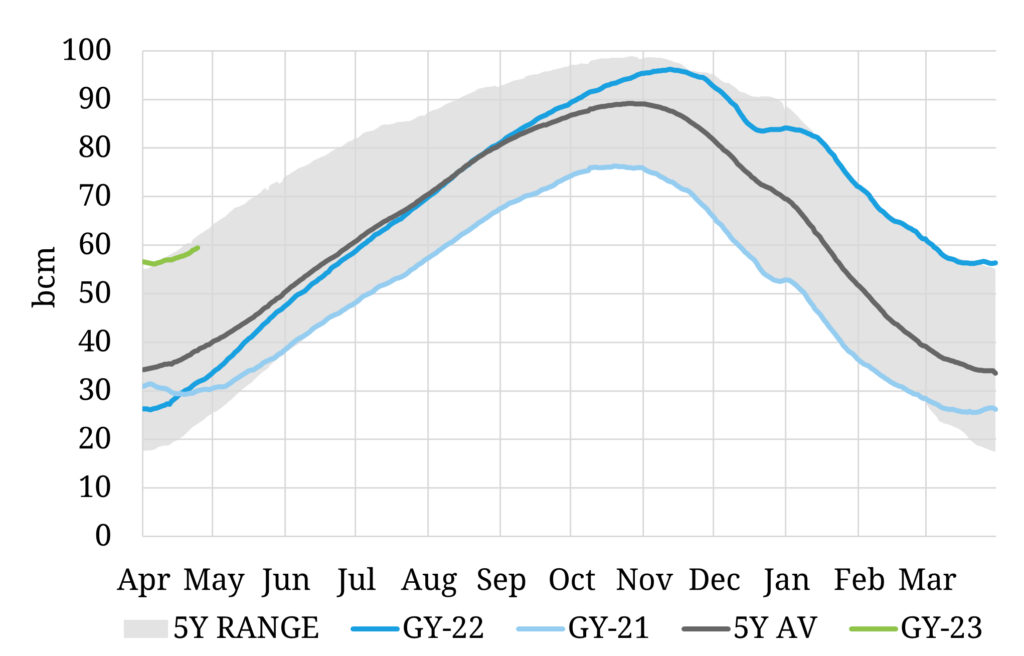

Storage mandates and mild weather saw Europe exit winter with very high gas storage inventory levels. Chart 1 shows inventories sitting at the top of the 5 year range as we enter the summer injection season.

Chart 1: European gas storage inventories

Source: Timera Energy, GIE

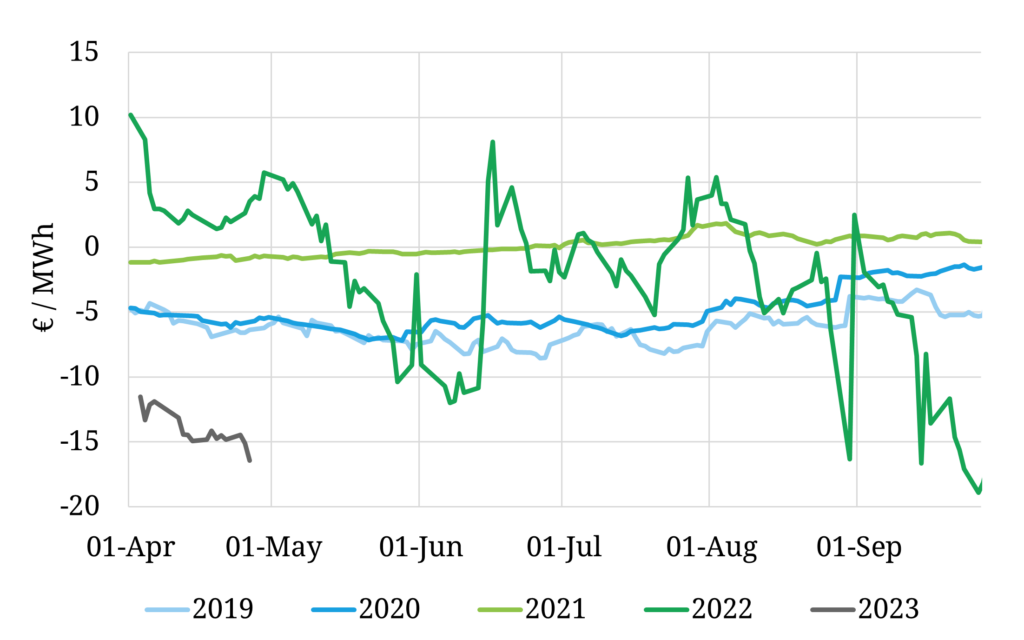

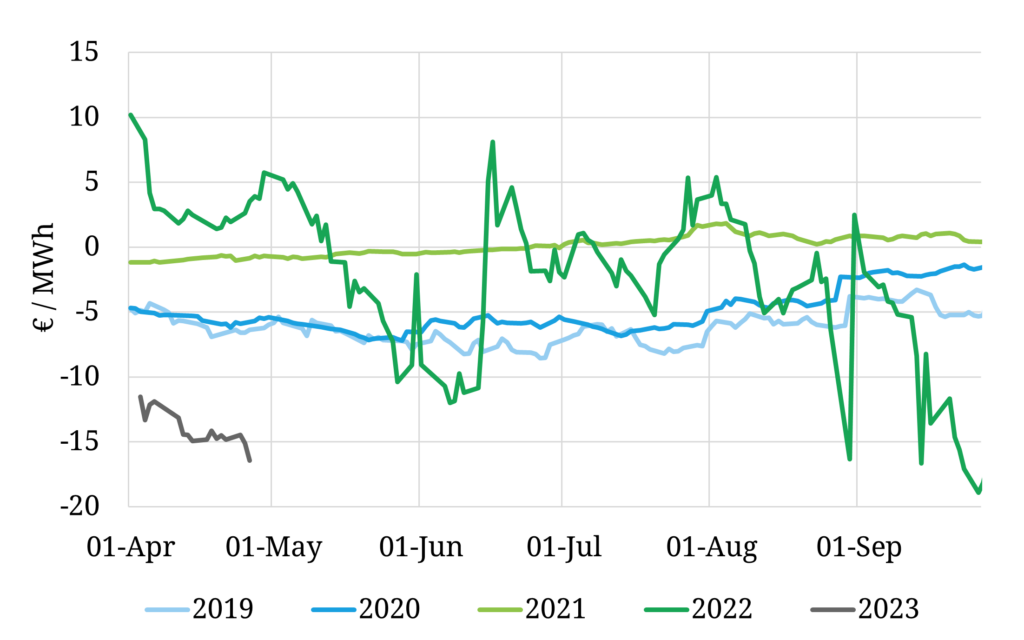

Storage inventories can be an important driver of within-year gas prices. This is illustrated by Chart 2 where we show the TTF Month-Ahead vs Winter price spread for each of the last 5 years, a key benchmark for the incentive for storage capacity owners to inject gas for the coming winter.

Chart 2: Month-Ahead TTF price vs Winter price

Source: Timera Energy, ICE

Before we come to why the Month-Ahead vs Winter spread is currently at such a steep discount in 2023, let’s look back across the last 4 years as context:

- 2019 – 20: ‘normal’ pre-crisis spread behaviour, with a relatively stable 5-10 €/MWh spread discount, reflecting steady injection demand to fill storage sites for winter (with some spread convergence as winter approaches)

- 2021: a year of very low storage inventories (see Chart 1) with Gazprom not restocking its storage facilities; injection demand across the summer was dampened by tight prompt prices vs winter (with the spread even swinging to a premium late summer)

- 2022: huge spread volatility given the crisis with e.g. a Jun-Jul surge in spreads as storage mandates came in and Russia cut Nordstream supplies, swinging to a strong discount into the winter as storage inventories approached ‘tank tops’.

Enough history, what is happening in 2023? With storage inventories already at very high levels, month-ahead prices are at a very steep discount relative to winter (more than 15 €/MWh)… and this is increasing.

Why are prices falling?

Europe is currently very well supplied with gas, at least into summer. Two important factors are driving this:

- Unusually low storage injection demand given high starting inventories, reflecting reduced storage flex given mandated volumes

- Structural demand losses & delayed industrial demand response after the extreme conditions of 2022.

As a result, prompt gas prices are falling to induce the price response needed to balance the European gas market. The most important source of price response is the diversion of flexible LNG cargoes to Asian buyers. There are also some sources of European price response e.g. remaining power sector switching, further demand response from industrial buyers and injection demand from fast cycle storage facilities.

Seasonal storage demand & power sector switching are relatively elastic mechanisms (responsive to price). But when these are near exhausted, demand response becomes much less elastic i.e. much larger swings in price are required to clear the market. The LNG market in particular has a number of logistical constraints across a 1 – 3 month horizon that can hamper price response.

If prices continue to fall across the summer and a steep gas curve contango opens up into winter, LNG vessels may be used as floating storage facilities (adding upwards pressure on LNG charter rates given it ties up shipping capacity).

Into winter & beyond

The drivers of downwards pressure on prices we set out above are strongly focused within 2023. A plunge in gas prices this summer has little relevance for market balance this winter if storage sites are full (& cheap summer gas can’t be injected to use in winter). That is why winter TTF prices are holding up relatively well, anchored by the power sector switching channel.

It is also why a cold snap this winter combined with anaemic Russian flows, could drive a sharp rise in prices, particularly if Europe is forced into an LNG bidding war with Asia (again… not a forecast, just a plausible outcome).

These dynamics reflect the ‘new normal’ in a post-crisis gas market, with knock-on effects into power markets. Inelastic price response is set to play a much more important role setting prices, given loss of Russian supply flexibility, storage constraints and declining power sector switching as coal plants retire.

That means higher market volatility. It also means higher value accruing to flexible gas & power assets and LNG supply chain flexibility.

Meet Timera at Flame, Amsterdam

Luke Cottell will be in Amsterdam this week at the Flame conference across 2-4 May. Please reach out to Luke ( ✉ luke.cottell@timera-energy.com ) if you are interested to connect in person to discuss:

- gas & LNG market fundamentals & value drivers

- key focus areas of client work

- other gas related topics.