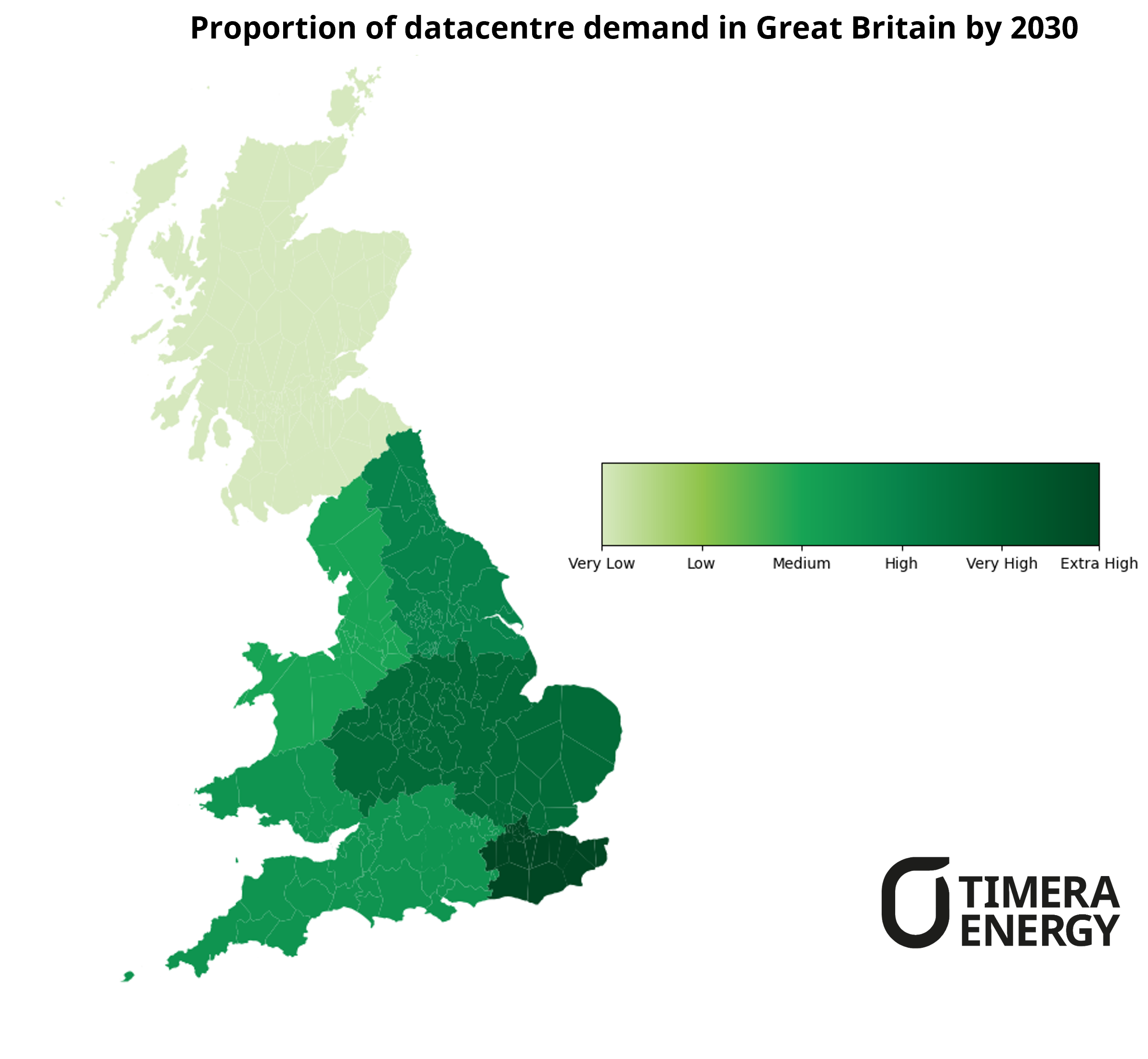

What is today a relatively small demand share (~5 TWh, <2% of total demand) could expand to 8–10% by 2030 mostly dominated in England as shown in the chart. This shift is already reshaping project decisions for example, the recent pivot at Teesside from blue hydrogen development to a large-scale data centre.

Limited planned buildout in Scotland is feeding directly into policy design. Government proposals for Scotland specific power price incentives reflect the need to absorb surplus wind generation and reduce curtailment volumes.

Operators of these data centres require high availability baseload supply, which variable renewables struggle to offer on a standalone basis. This is driving an increased focus on firm capacity solutions, from gas fired plants leveraging private wire configurations to allow grid fee rebates offsetting pressure from tightening spark spreads, as well as hybrid configurations combining renewables and storage under innovative PPA structures. Focus shifts to hybrid PPAs as solar capture prices plunge – Timera Energy

Alongside the opportunity created for flexible assets by accelerating data centre demand, there is also growing diversity in how projects are engineered and contracted, which introduces additional complexity. Investors must assess value and risk across these structures under increasingly dynamic power market conditions. Timera has supported multiple clients in addressing these challenges, applying our stochastic modelling framework to quantify risk and returns across a broad set of asset types and commercial arrangements.

If you would like to understand more about our power market offering, please reach out to Sam Kayne, Senior analyst, sam.kayne@timera-energy.com.