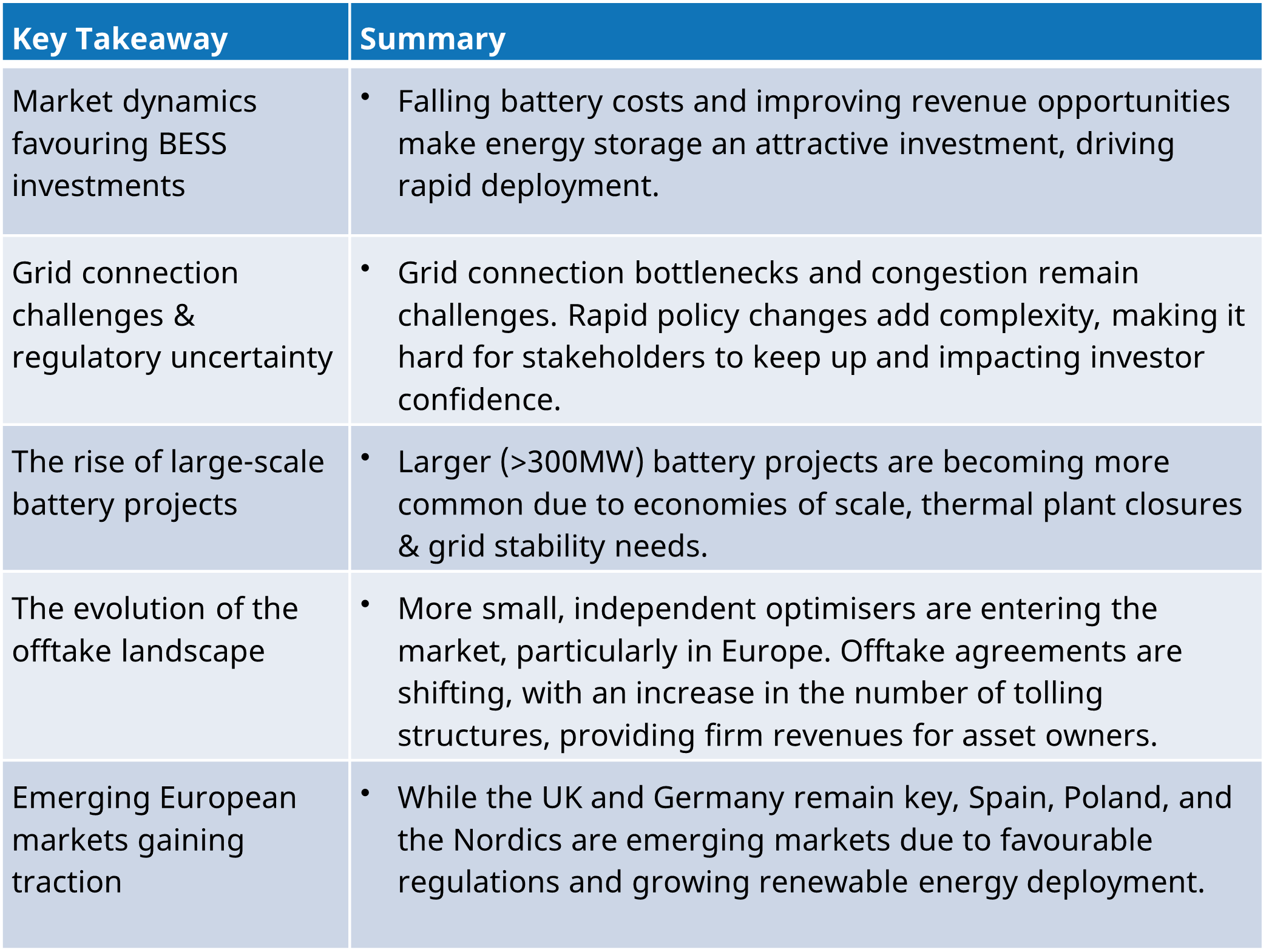

We attended the 2025 Energy Storage Summit in London last week, where industry leaders, investors, and developers gathered to discuss the evolving role of battery storage in Europe’s energy transition. The event highlighted key commercial, regulatory, and technological trends shaping the sector, summarised below:

- Market dynamics favouring BESS investments – Falling battery costs, coupled with improving revenue opportunities from ancillary services and market trading, are making energy storage an increasingly attractive investment. The influx of capital is driving rapid deployment across Europe.

- Grid connection challenges & regulatory uncertainty – Persistent bottlenecks in grid connection availability and rising network congestion present continued hurdles for energy storage deployment. While regulatory changes are expected & required, the pace, complexity & uncertainty of reform, are making it difficult for stakeholders to keep up, potentially impacting investor confidence in the short term.

- The rise of large-scale battery projects – The trend toward larger (>300MW) battery energy storage systems (BESS) is accelerating, driven by economies of scale, the retirement of large thermal plants opening up capacity, and the growing need for grid stability solutions.

- The evolution of the offtake landscape – A growing number of smaller, independent optimisers are entering the energy storage market, increasing competition and diversification in trading strategies. Offtake agreements are shifting toward tolling structures, offering asset owners more predictable revenues while allowing optimisers to capitalise on market volatility.

- Emerging European markets gaining traction – While the UK and Germany remain key markets, countries such as Spain, Poland, and the Nordics are attracting increasing attention due to favourable regulatory developments, growing renewables penetration, and evolving market opportunities.

If you would like to view the slides from our Power Director Steven Coppack’s presentation on Building a Bankable BESS Investment Case, please follow the link here. For more information on our transaction support and European power market & BESS modelling services, please feel free to reach out (steven.coppack@timera-energy.com).