“Changing flow patterns are changing asset value”

Flow patterns and value capture in the European gas market have changed substantially since Russian supply cuts in 2021-22.

We recently delivered a webinar on European flexible gas asset value in a post crisis world, focusing on pipeline, storage, and regas assets.

In this article we provide a summary of the key points discussed and a link to watch the webinar and view the slides.

Key Takeaways

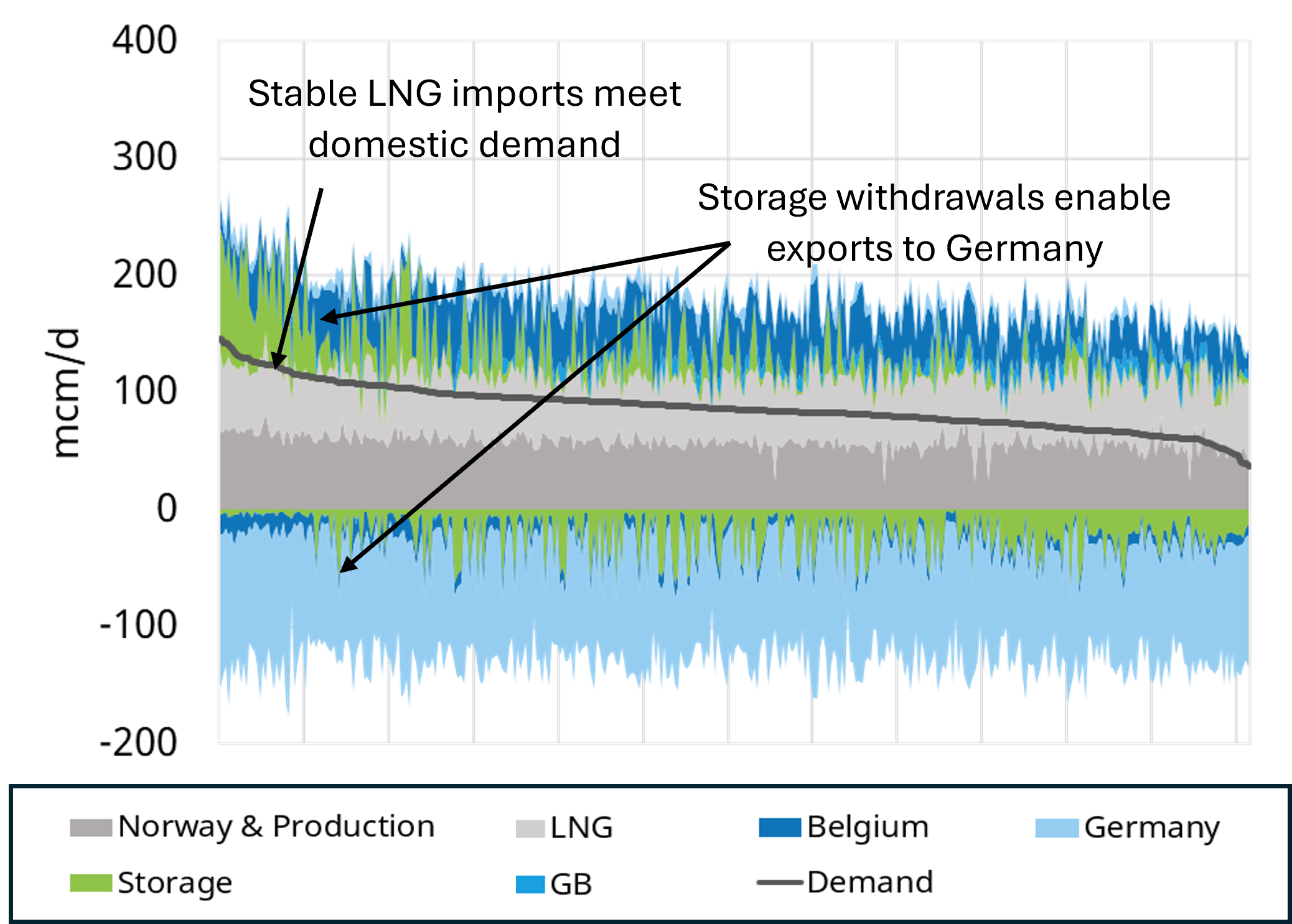

- Flow patterns and the use of supply flexibility have structurally changed since 2022 as a result of LNG replacing Russian imports.

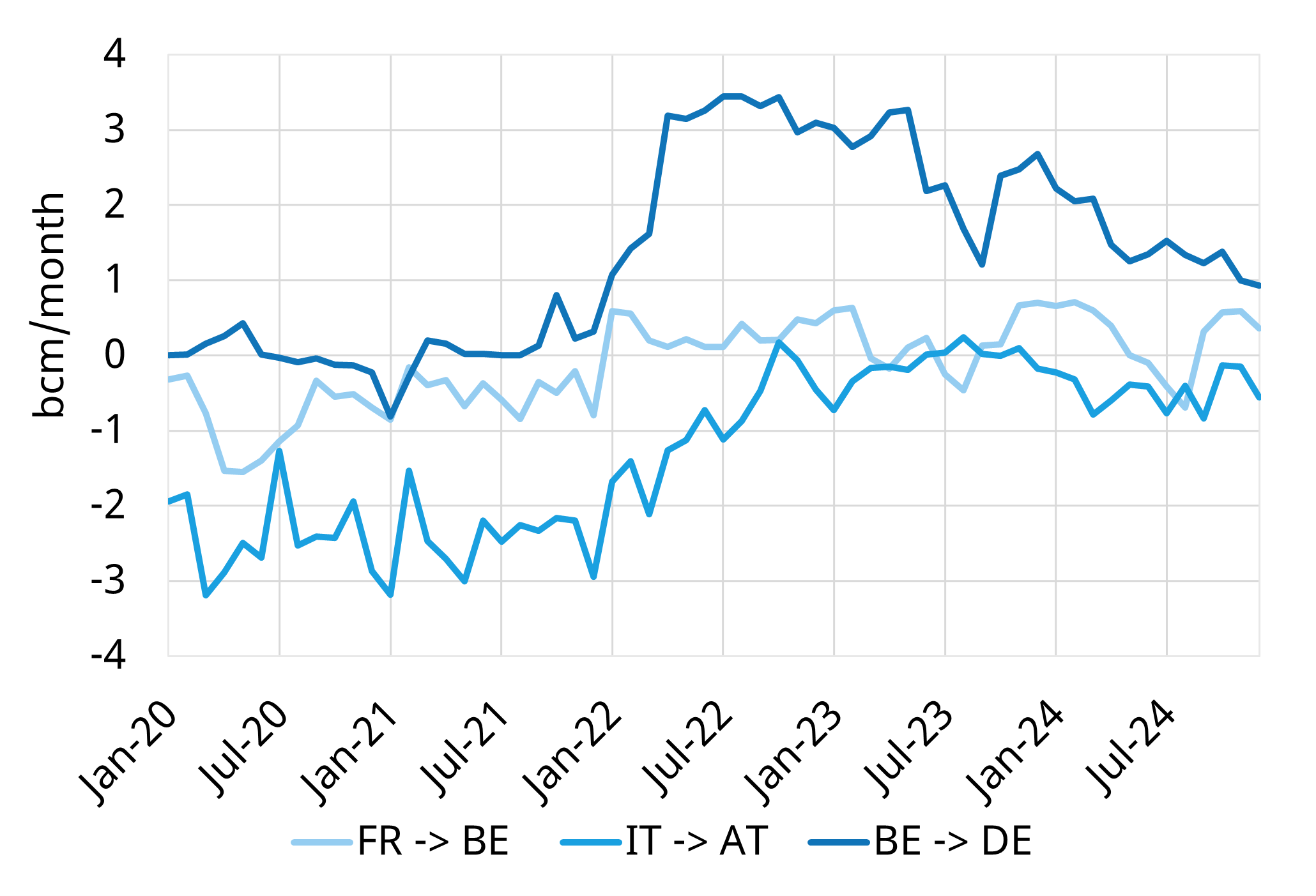

- Flow patterns now move from west-to-east vs previous east-to-west direction. Physically & commercially flexible assets are more able to adapt to this new market environment. An example of this shown in changes to interconnector flow in Chart 1.

- The prospect of a return of Russian gas flows to Europe and further changes to flow patterns is politically complex and holds a lot of uncertainty. It is important to consider scenarios in terms of both impact and likelihood.

- Government policies and regulatory dynamics can have big impacts on asset value, this seen most recently in the implementation of storage targets.

- Expectation of high demand to refill storages during summer 2025 sent Summer-Winter spreads positive in recent months, driving negative intrinsic value for storage facilities.

- This has created a challenging environment for capacity sales across Europe, with capacity either not selling or being sold at extremely low prices.

- Government subsidy schemes have been announced in Germany and most recently in Italy to support capacity sales and storage refilling.

- Importance of extrinsic value to asset revenues is increasingly relevant in these periods of shifting market fundamentals.

- This is triggering gas asset infrastructure owners, investors, and capacity owners to update valuations and challenge commercial strategies.

- We see this as a strong trend in our client work, with high demand for our analytical approach of stochastic modelling, quantifying extrinsic value & assessing uncertainty across all three types of flexible gas asset.

Watch the Webinar

Click here for a recording of the webinar.

Click here for a copy of the webinar slides.

Feel free to reach out to David Duncan (LNG & Gas Director) for a free sample copy of our Global Gas Report with more details on current drivers of LNG & European gas market pricing dynamics (david.duncan@timera-energy.com).