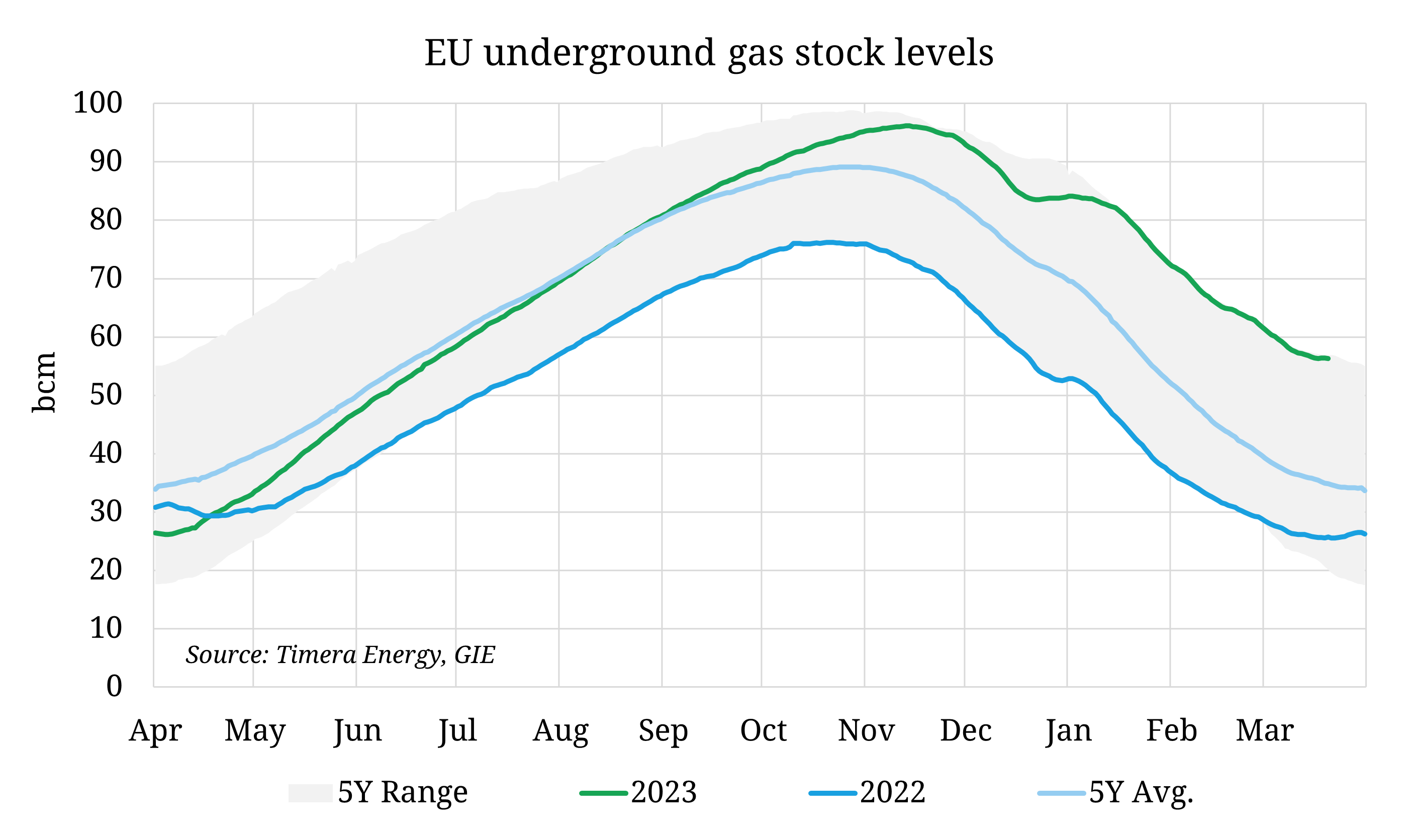

EU gas stocks sit at the top of the 5-year range at ~56% full as we reach the end of Winter 2022. This is a 30.5 bcm (120%) increase from year-ago levels, and close to the record high seen entering Summer 2020. Strong injections over Summer 2022 saw gas stocks reach 95% full on the 1st Nov, 19.3 bcm above year-ago levels and above the 80% mandated storage target as Europe prepared for a winter with significantly lower Russian pipeline imports. A combination of demand cuts across the continent and record-high LNG deliveries offset Russian pipeline losses, helping maintain a significant storage buffer.

Elevated end-of-winter inventories reduce injection demand over the coming summer, catalysing lower prices as the market seeks to incentivise the return of some demand. Risks remain for the following winter, given milder than normal temperatures were a primary driver of European demand losses this winter (number of heating degree days across the EU’s 7 largest markets from Oct-Dec was 16% below 2021. This cannot be counted on again next winter, meaning demand cuts and record-high LNG import levels must be maintained amidst a backdrop of limited global supply growth this year.