Gas storage assets are Europe’s first line of defence against further supply disruptions. Storage has never played a more critical role in maintaining security of supply in the European gas market.

“2021 storage margin capture dwarfs historical levels… but translating this into asset value impact is not that simple’

Unprecedented gas market volatility has driven a surge in storage asset margins across the last year. Gas portfolio managers are focusing on storage as a key source of flexibility and risk protection given extreme market conditions.

Policy makers are also focused on the importance of gas storage as insurance against Russian supply cuts and a disorderly breakdown of the European gas market.

This environment would appear to create powerful tailwinds for storage asset value. In today’s article we set out why it’s not this simple.

3 drivers of higher storage margins

Over the last 9 months extreme gas market stress has impacted three important storage value drivers:

- Price levels: prices have surged increasing the value of gas inventories

- Price volatility: huge volatility has increased the opportunity to capture value from inter-temporal price spreads

- Price correlations: historically observed correlation between prices of different forward market contracts has broken down creating additional value from optimising storage flex.

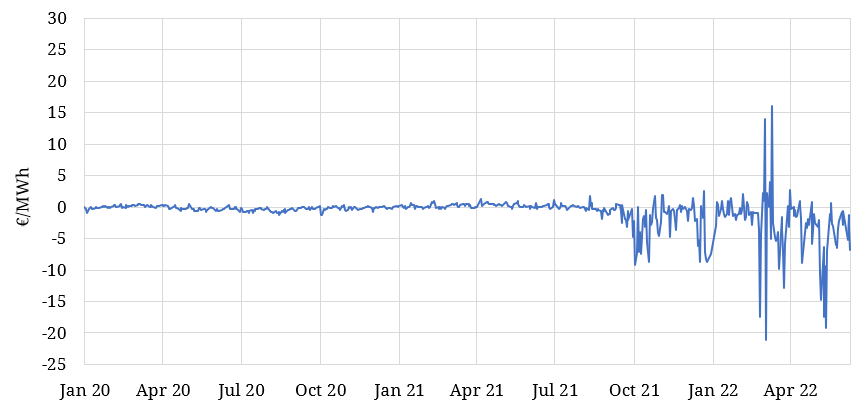

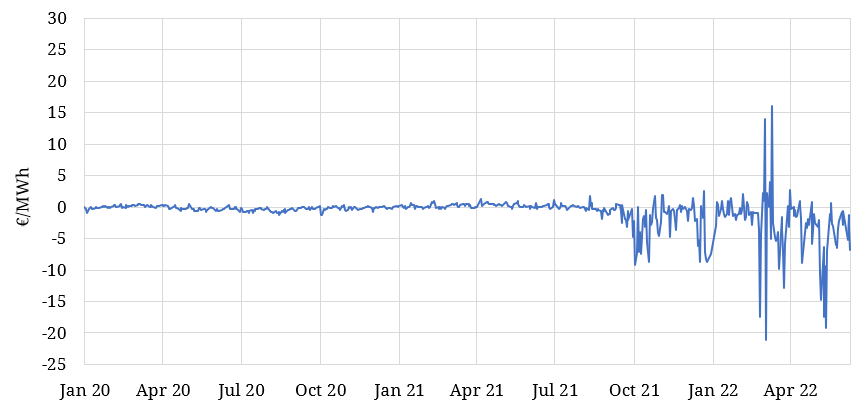

Chart 1 illustrates surging price volatility and breakdown in correlations. It shows a series of day-ahead vs month-ahead price spreads at TTF, a benchmark for prompt storage value capture. The start of a regime shift can be seen from Q3 2021 as the European gas market tightened. This was then amplified by the Russia-Ukraine conflict in Q1 2022.

Chart 1: TTF day-ahead vs month-ahead price differentials (daily)

Source: Timera Energy, ICE

Explosion in gas storage margins

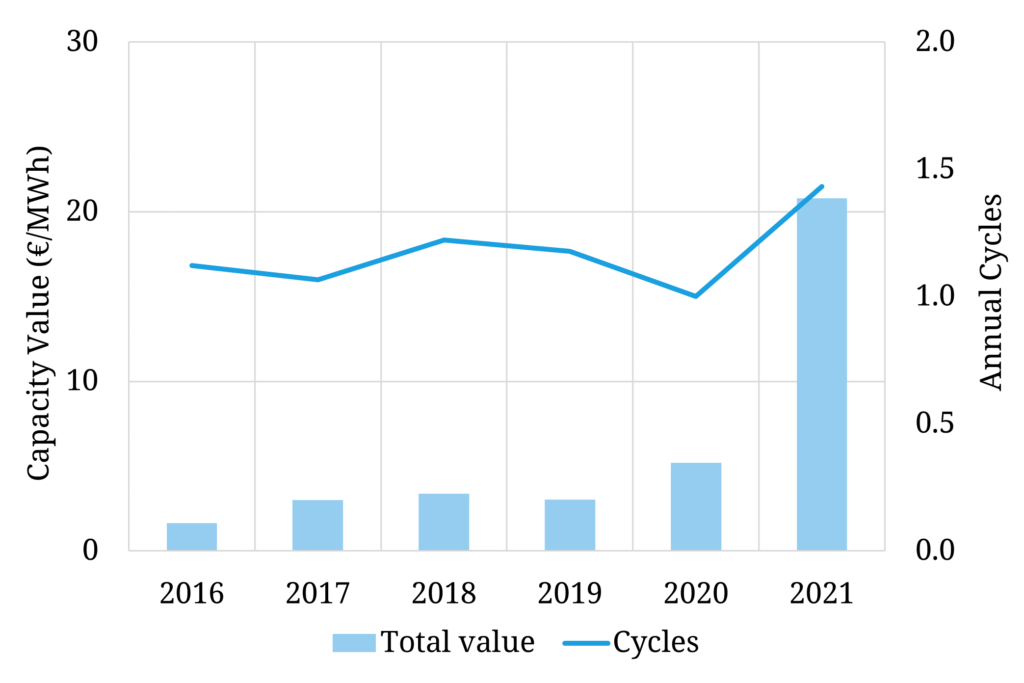

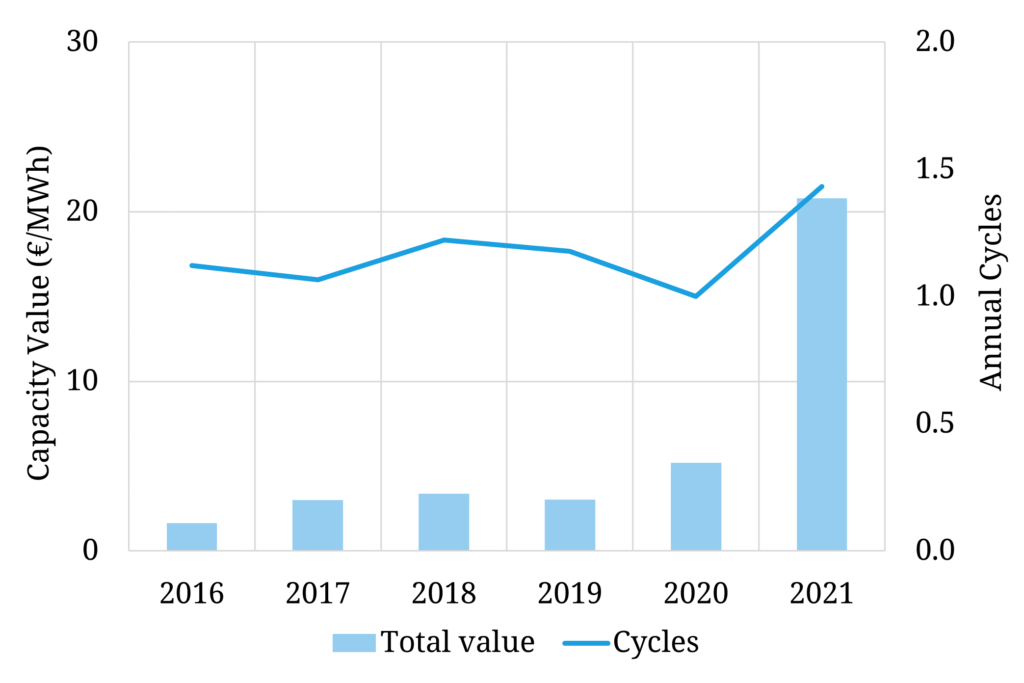

Chart 2 illustrates how the three drivers above have caused a surge in storage margins across the last year. The chart shows backtesting analysis across the last 5 storage years of storage value capture for a generic 180 day cycle seasonal facility connected to the TTF. Storage years run from April to March, so e.g. the 2021 year covers margins from 1st Apr 2021 to 31st Mar 2022.

Chart 2: Seasonal storage margin backtesting analysis

Source: Timera rolling intrinsic storage model. Achievable margin estimated by executing a rolling intrinsic strategy against actual forward market prices, including wide bid/offer spread in 2021 to account for transactions costs & poor liquidity.

The 2021 bar on the chart is so large it somewhat disguises the fact that backtested gas storage margins have been in a steady uptrend since 2016. This has been the result of a structural increase in price volatility.

Our backtesting analysis estimates that achievable margin in the 2021 storage year is over 400% higher than in 2020.

This analysis carries an important caveat given extreme European gas market stress since Q3 last year. This has created some acute challenges for storage capacity owners in monetising value:

- Poor market liquidity and very high margin calls have impacted ability to forward hedge exposures (we have accounted for this to some degree with very high transaction costs in the backtesting analysis).

- Price calibration of models used to manage storage assets has been very challenging given unprecedented pricing dynamics create issues with exposure calculations & valuation.

That said the conclusion of the backtest is clear. 2021 storage margin capture dwarfs historical levels. This is consistent with very high levels of realised P&L across European storage trading books.

What makes current high storage returns even more remarkable is they are being achieved against a backdrop of negative seasonal price spreads (i.e. zero intrinsic value) and a forward curve in steep backwardation (creating a negative carry cost on inventory).

Storage asset investment implications

Market events of the last 9 months have sparked a surge in commercial activity around European gas storage. Traders and gas portfolio managers are looking to buy capacity to manage risk and enhance portfolio supply flexibility. Storage operators are looking to sell incremental capacity to monetise value.

From an investment perspective, market volatility and surging margins are triggering asset owner strategy reviews and in some cases asset sales. Storage assets today have a very different risk profile to a decade ago, particularly as long term contracts expire. On the other side of the bid/offer spread, private equity and strategic buyers are looking to acquire assets (conditional on price).

Despite very high current storage asset margins there are several key challenges for storage asset owners and investors summarised in Table 1.

Table 1: 5 challenges faced by storage asset owners / investors

These challenges may be the catalyst for an increase in storage transaction flow across the next two years. Some of the current holders of storage assets may no longer be natural owners given a rapidly shifting market & regulatory risk profile.

Triggering transaction flow?

For the last couple of years we have flagged the potential for an increase in midstream gas asset transaction flow. Many midstream assets were developed and owned as either:

- Infrastructure investment plays – with regulated or long term contracted revenues underpinning earnings stability, supporting infrastructure fund investment.

- Core portfolio assets – with vertically integrated utilities integrating midstream flexibility within portfolios.

The accelerating pace of energy transition, expiry of long-term contracts and extreme market risk is triggering strategic reviews across a range of midstream asset owners.

Some storage owners want to retain assets but are targeting more effective ways to monetise value and manage risk. But a number of owners are making for the exits given a rapid shift in asset risk profile & role of midstream assets within utility business models.

Two examples of recent storage sales processes are:

- TAQA (Abu Dhabi investment co.) running a sales process for the 4.3bcm Dutch Bergermeer storage facility (although TAQA has subsequently decided to retain this asset)

- RWE looking to divest its 2.7bcm portfolio of Czech storage assets.

There is also the possibility of the owners of older storage sites choosing to cut and run. The current very high value of cushion gas may be enough to induce closure instead of investing in major capex to extend asset lives.

Who are the natural buyers of storage assets?

- Strategic players who place a high value on physical flex and have the ability to monetise it

- Private equity capital with risk profiles better aligned to the current market & regulatory environment.

The challenge for both buyers and sellers is heightened uncertainty around what price level asset transactions may clear.