In recent years, the phenomenon of counterintuitive power flows has emerged as a striking example of the growing complexities in the European power market. These flows—where electricity moves from higher-priced regions to lower-priced ones—challenge traditional logic. Yet, they play a crucial role in reducing costs for consumers and enhancing overall socio-economic welfare across interconnected markets.

At the heart of this dynamic is the EUPHEMIA algorithm, which underpins Europe’s market coupling framework. By optimising socio-economic welfare, EUPHEMIA accounts for physical grid constraints and operational requirements, balancing market efficiency with grid reliability.

This article explores the key drivers behind counterintuitive flows and examines the operational challenges and opportunities they create for market participants.

What are counterintuitive flows?

Counterintuitive flows occur when power flows contrary to what basic economic logic would dictate—moving from regions with higher electricity prices to regions with lower prices. At first glance, this seems inefficient. However, in many cases, these flows achieve the primary goal of EUPHEMIA: maximising socio-economic welfare by minimising the total cost of power generation/consumption and transmission constraints across the interconnected Price Coupling Regions (PCR).

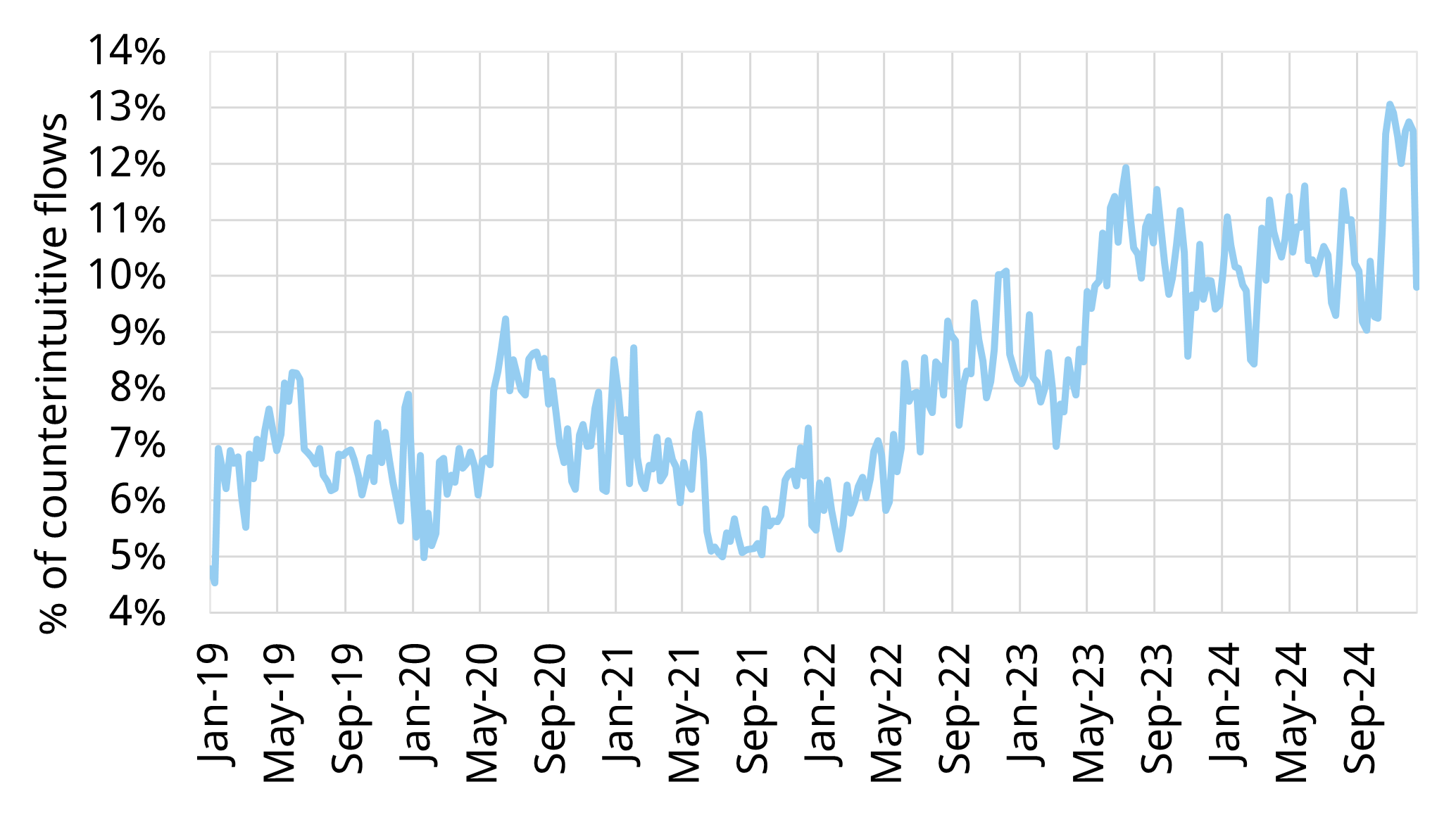

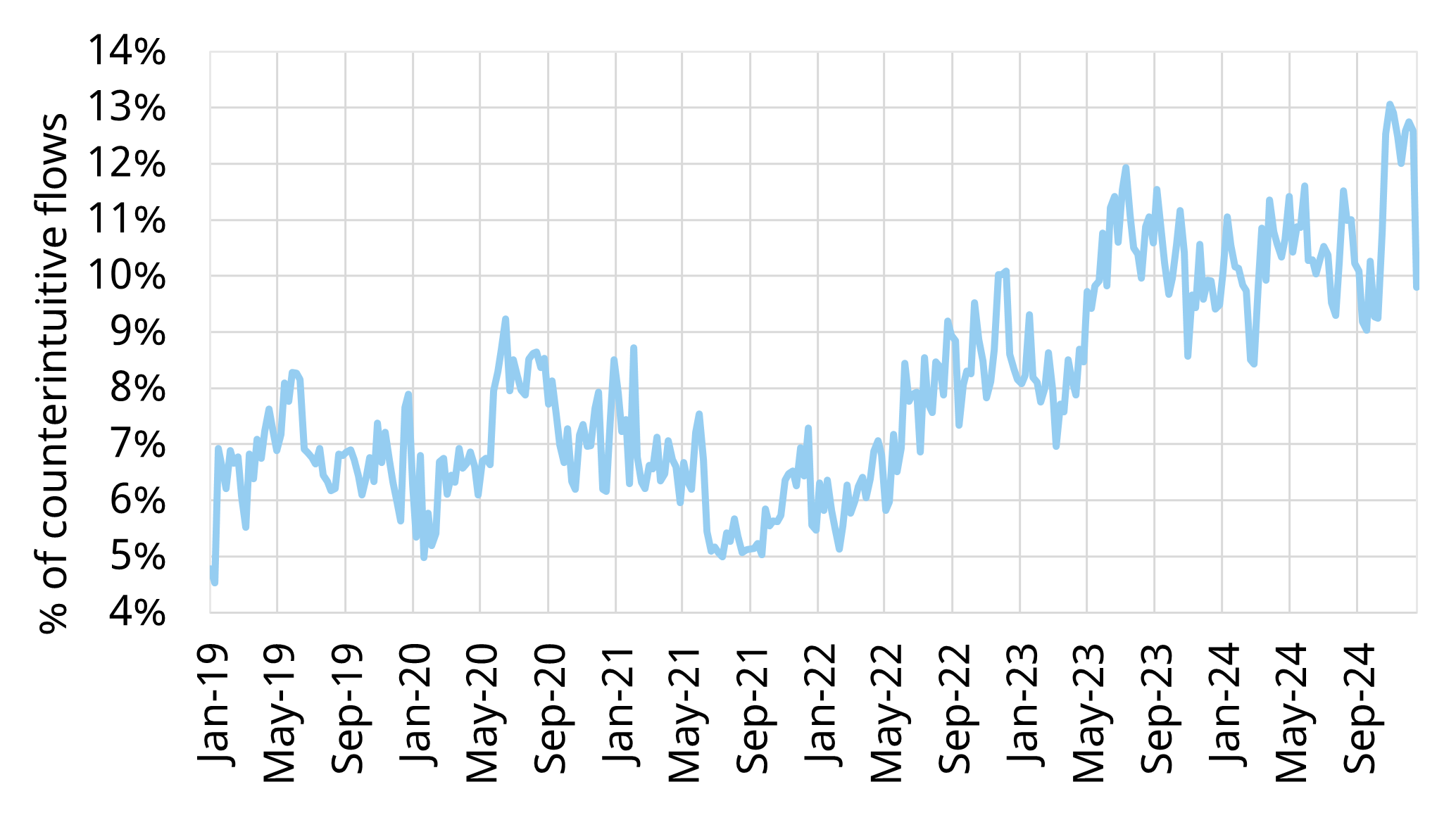

Chart 1: Evolution of the counterintuitive flows percentage on all commercial schedules in the main European continental power market.

Source: ENTSOE, Timera Energy

Key drivers of counterintuitive flows

Counterintuitive flows arise from the interplay of several mechanisms embedded in the market design and optimisation process. The primary drivers are:

- Explicit Transmission Capacity Allocation

- Allocation Constraints on Bidding Zones

- Flow-Based Market Coupling (FBMC)

- Other technical constraints (e.g. transmission line ramp constraint)

1. Explicit transmission capacity allocation

This occurs on the borders of bidding zones not included in the Single Day-Ahead Coupling (SDAC), such as Great Britain, Switzerland, and Serbia.

- These explicit auctions allocate cross-zonal capacities outside the EUPHEMIA optimisation, often leading to inefficient flows.

- Unlike flows implicitly optimised by EUPHEMIA, these flows do not contribute in increasing socio-economic welfare since they are not part of the coupled market’s welfare optimisation process.

2. Allocation constraints on bidding zones

Certain bidding zones impose additional constraints on net import/export positions setting upper and lower bounds to the potential net import/export of a bidding zone. These constraints address:

- System security: To maintain transmission capacity limits and ensure generation reserves to maintain power system security under multiple circumstances.

- Price stability: To avoid market distortions or to shield against extreme market events outside the borders (e.g., in Poland during 2022 energy crisis).

Notable examples include:

- Poland and Italy North, which frequently apply such constraints.

- Some Nordic bidding zones, where constraints ensure regional system stability.

These constraints, while necessary for grid security, contribute to counterintuitive flows as they impose limits that may not align with the pure economic merit order and system welfare.

3. Flow-Based Market Coupling

FBMC optimises grid utilisation by incorporating physical grid constraints directly into the EUPHEMIA optimisation framework.

Key Characteristics

- Linear Constraints: FBMC establishes a linear relationship between transmission capacities and net export/import positions for bidding zones, applied as constraints in the Single Day-Ahead Coupling (SDAC) auction.

- Contrast with NTC: The traditional Net Transfer Capacity (NTC) method applies simpler upper-bound constraints on cross-border transfer capacities without linking them to net positions. This often results in underutilised grid capacity, requiring TSOs to adopt conservative limits that hinder renewable energy penetration.

- Coexistence with NTC: Since FBMC’s introduction in June 2022 for Day-Ahead in the Core Capacity Calculation Region (CCR) and the Nordics’ transition in October 2024, regions like Iberia and Italy continue to use NTC. The coexistence of both methods increases the likelihood of counterintuitive flows, especially in highly interconnected zones.

- Revenue and Risk Implications: Counterintuitive flows incur financial losses by transferring power from higher-priced to lower-priced regions, impacting the risk-return profile of merchant line operators and complicating planning for TSOs and investors.

Advantages of FBMC

- Higher Grid Utilisation: Essential for supporting increased renewable penetration.

- Enhanced Welfare: Improves socio-economic outcomes by reflecting the physical realities of the grid.

Challenges of FBMC

- Counterintuitive Flows: The complexity of FBMC constraints increases their occurrence.

- Price Volatility and Political Impact: Regional price spikes may raise political and operational concerns (e.g. Sweden in late 2024).

FBMC’s strengths lie in its ability to optimise grid efficiency and welfare, but its complexity introduces new challenges for stakeholders. Its role in driving counterintuitive flows is difficult to distinguish from the role of allocation constraints or other technical constraints, because FBMC constraints are optimised jointly with all the other constraints by EUPHEMIA.

Implications for the European power market

The rise of counterintuitive flows presents both opportunities and challenges:

- Improved Grid Utilisation: FBMC unlocks underused transmission capacity, supporting the integration of renewables and reducing overall system costs.

- Operational Complexity: Market participants face greater challenges in predicting flows and prices, increasing the importance of robust analytical techniques for forecasting and risk management which are more and more based on advanced solutions mainly based on fundamental modelling and wider regional understanding (i.e. pan-European stochastic stack models).

- Efficiency vs. Simple Explainability Trade-Off: While FBMC increases socio-economic welfare, its complexity introduces operational uncertainties and fosters energy policy turmoil compared to the simpler NTC approach.

Counterintuitive flows in Europe: general trends

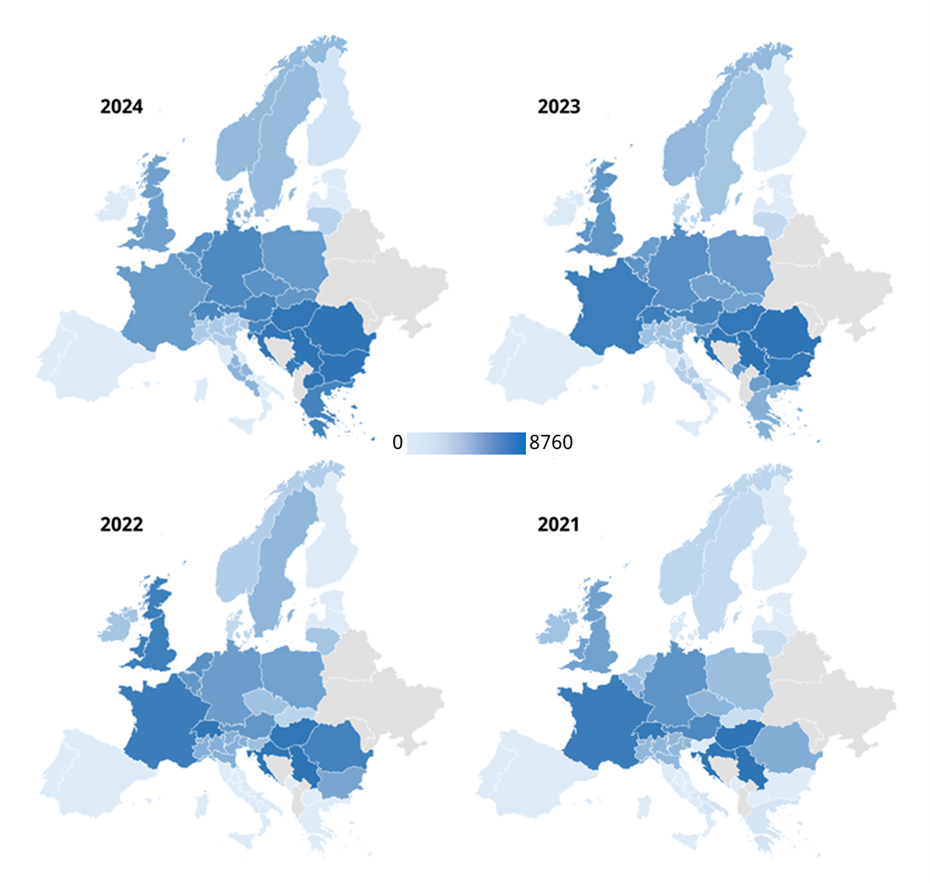

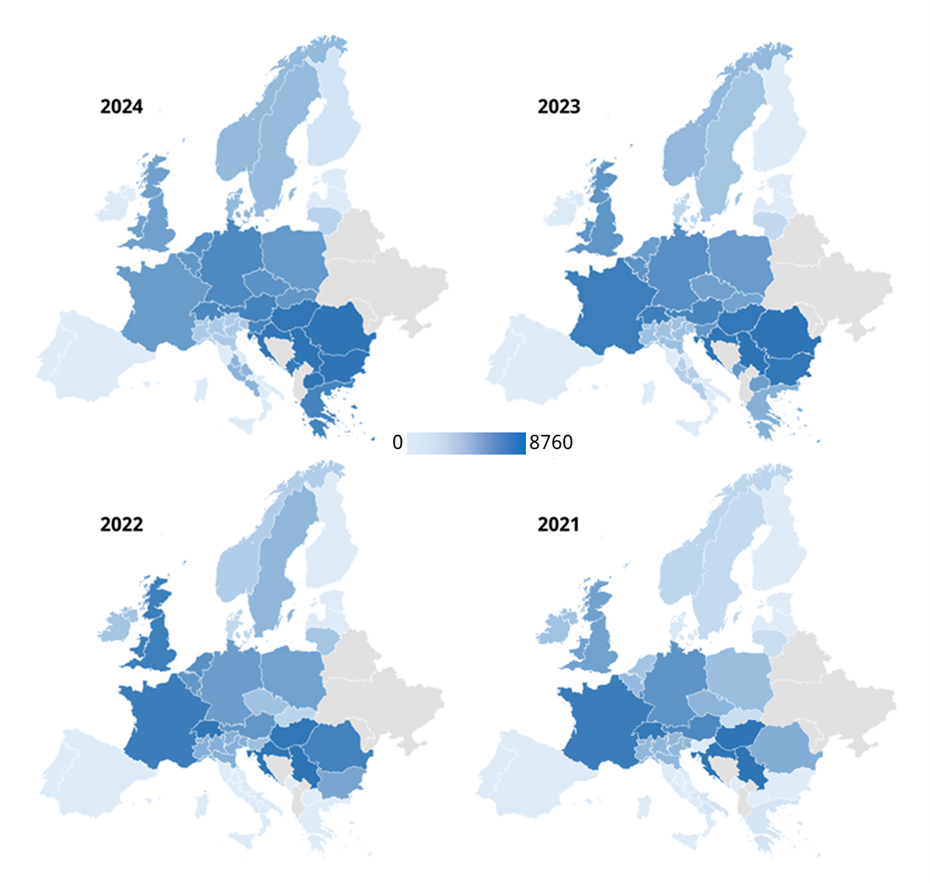

Chart 3: Number of hours per year with counterintuitive flows at the borders of the country/bidding zone.

Source: ENTSOE, Timera Energy

- Increasing events in Eastern Europe after launch of FBMC in Core CCR in 2022, highlighting current insufficient transmission capacity in the region and creating high intrinsic and extrinsic value for flexibility.

- High structural events frequency in countries which are not part of SDAC, like GB and Switzerland, highlighting market inefficiencies caused by explicit transmission capacity allocation auctions.

- Increasing events in the Nordics, especially in the bidding zones directly connected with the continent.

- Less frequent events in the NTC areas which are poorly interconnected with FBMC zones, e.g. Iberia and Italian zones excluding North.

- France frequent counterintuitive flows are mainly driven by explicit allocations on the borders with Switzerland and GB, while in Germany borders with Switzerland, Poland, Netherlands and Czech Republic are the main causes.

- Historically, counterintuitive flows frequency in Italy was high in the South zone, but after Greece integration in the SDAC at the end of 2020 such frequency dropped in the South zone and they increased in the Centre-South zone. The frequency of events in the North zone remains relevant and constant due to allocation constraints and because of FBMC indirectly impacting explicit capacity allocation on the borders with France, Austria and Slovenia.

Looking Ahead

Counterintuitive flows are an inherent outcome of Europe’s drive toward a more interconnected, renewable-dominated power system. As renewable penetration increases and grid constraints become tighter, such flows are expected to grow in frequency and complexity.

Plans to expand Flow-Based Market Coupling (FBMC) to additional countries will amplify these dynamics. The next key targets include Italy North and Ireland, with the upcoming France-Ireland Celtic Interconnector expected to enhance integration. Meanwhile, Switzerland is set to align with the EU internal electricity market legislation following a landmark agreement with the EU in December 2024. Thus, implicit auctions will likely replace explicit ones on Swiss borders over the coming years.

To navigate these evolving market conditions, participants must deepen their understanding of FBMC and leverage advanced analytics. This knowledge will be critical for optimising the intrinsic and extrinsic value of power assets and financial options.

Key Value Drivers Influenced by FBMC

- Geographical Spread Option Value: FBMC shapes price spreads between bidding zones, creating opportunities to capture value financially through forward positions on regional price spreads or physically with interconnectors.

- Time Spread Option Value: By influencing intra-day price volatility, FBMC enhances value opportunities for storage assets and supports value for the upcoming forward market for time-shifting products (e.g., introduced in Italy alongside MACSE).

- Energy Vector Conversion Option Value: Price volatility drives the formation of Spark and Dark Spreads, enabling thermal assets to capitalise on these opportunities.

As FBMC becomes more widespread, mastering its nuances will become a key competitive edge for European market operators, directly impacting asset valuations and market strategies.

Conclusion

Counterintuitive flows may seem paradoxical, but they are a fundamental aspect of Europe’s evolving power market. By optimising for socio-economic welfare, EUPHEMIA effectively manages the trade-offs between grid constraints, market efficiency, and renewable integration.

Harnessing advanced analytics and stochastic fundamental modelling of the pan-European power market—while accounting for FBMC and other drivers of counterintuitive flows—is increasingly crucial. Such tools enable market participants to unlock value in day-to-day operations and strategically plan for the medium to long term. These capabilities will be vital for staying competitive in a complex and interconnected energy market where the value of analytics can only increase.

Timera Energy is sponsoring & presenting at the 2025 Energy Storage Summit on 17-19th February in London.

We will have a stand & meeting room at ESS and our Power Director, Steven Coppack, will be speaking on:

Building a Bankable BESS Investment Case

- Cross market BESS investment case comparison

- Revenue stack state of play + 3 key structural drivers

- Innovation in BESS offtake & financing

- Quantifying & managing downside risk

- Key challenges in building a bankable investment case

It would be great to catch up face to face if you are coming along – feel free to contact Steven steven.coppack@timera-energy.com.