“PPAs have a value cost versus a merchant case, but improve project bankability”

Solar capture prices are falling across Europe as rapid PV rollout deepens the midday price trough, particularly through summer months.

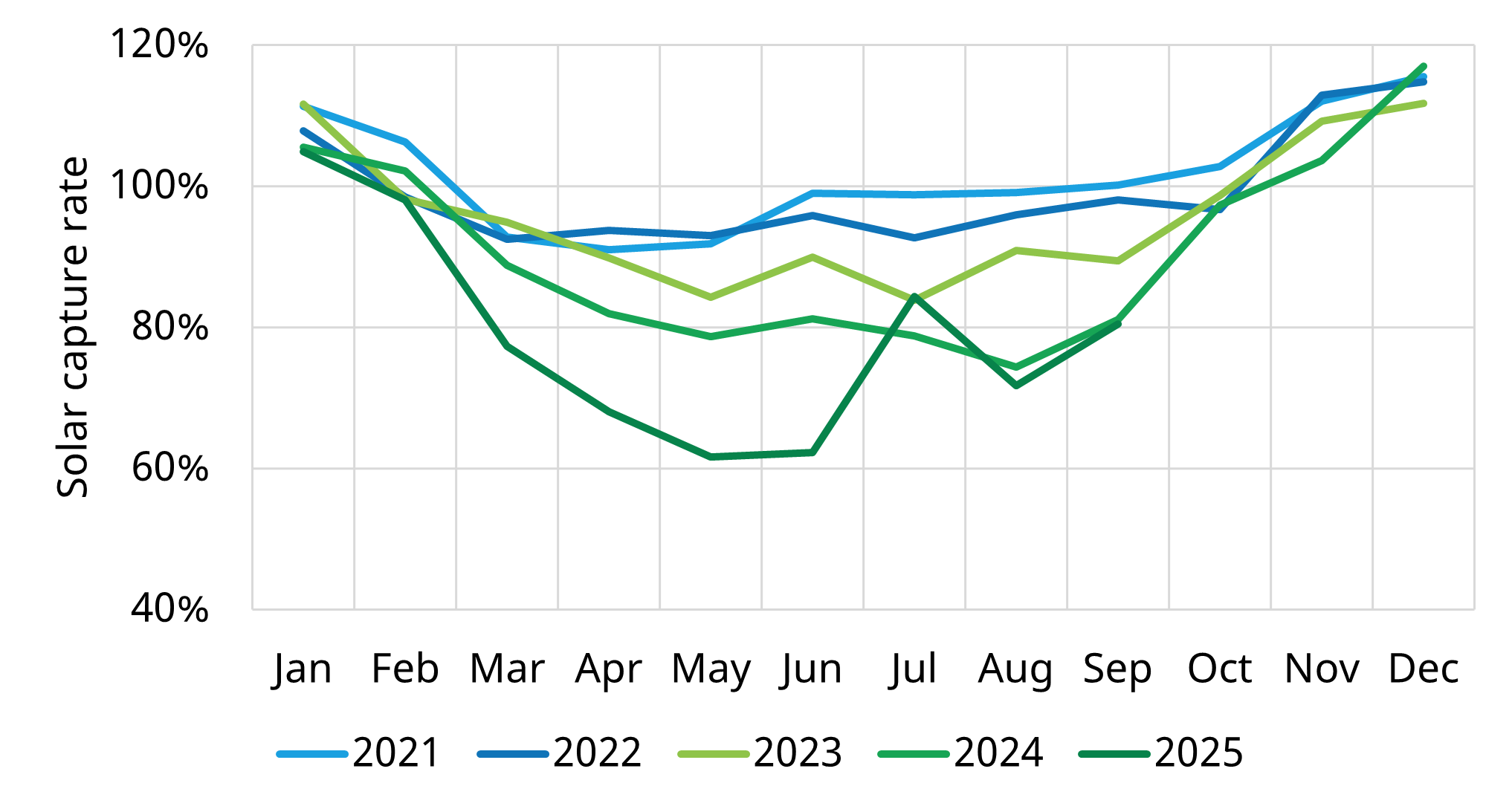

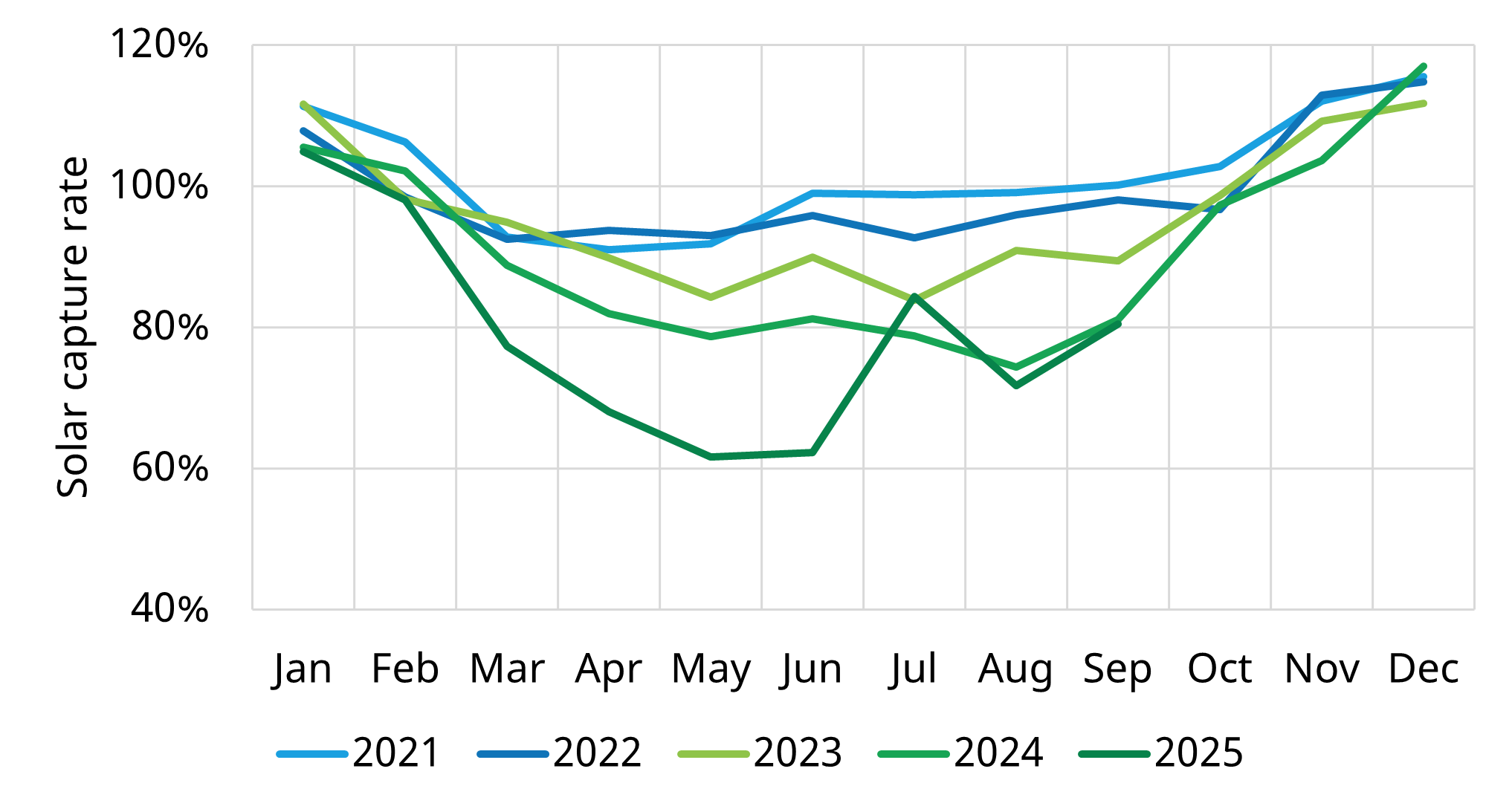

As significant volumes of new capacity come online, solar generation increasingly dominates the supply stack during sunny daytime hours. This is pushing down power prices and in turn reducing the capture rates achieved by PV assets as shown in Chart 1.

Chart 1: Historical solar capture rates in Germany

Source: Timera Energy, EPEX

Although price-responsive demand technologies such as BESS can help mitigate these effects, deployment of these assets is not scaling fast enough to materially offset the downward pressure on daytime prices from solar.

Investors looking to BESS to support value

This weakening capture environment is reshaping investment decisions. Investors and lenders are placing greater weight on contracted revenue certainty, particularly where merchant downside risk is rising faster than expected. As a result, attention is shifting towards co-located solar and BESS, where storage can mitigate exposure to low daytime prices.

There are also strong incentives for co-location from the battery’s perspective, with a key driver being grid connection efficiency. Many BESS projects are now added onto existing solar sites to take advantage of established connections, reducing costs and avoiding the grid connection queue that new standalone projects would otherwise face.

In several markets (e.g. Germany, Spain & GB) grid queues stretch to over 200GW for standalone BESS, meaning the projects may face multi-year delays. Co-location avoids these bottlenecks and enables faster route-to-market for storage.

BESS colocation supports hybrid PPAs

These factors are accelerating momentum behind hybrid PPAs, which combine guaranteed pricing for solar with structured offtake for co-located batteries. For the solar component, hybrid PPAs help stabilise revenues as capture rates decline. For the BESS, they create an offtake channel while still allowing some merchant optimisation through ancillary services and arbitrage.

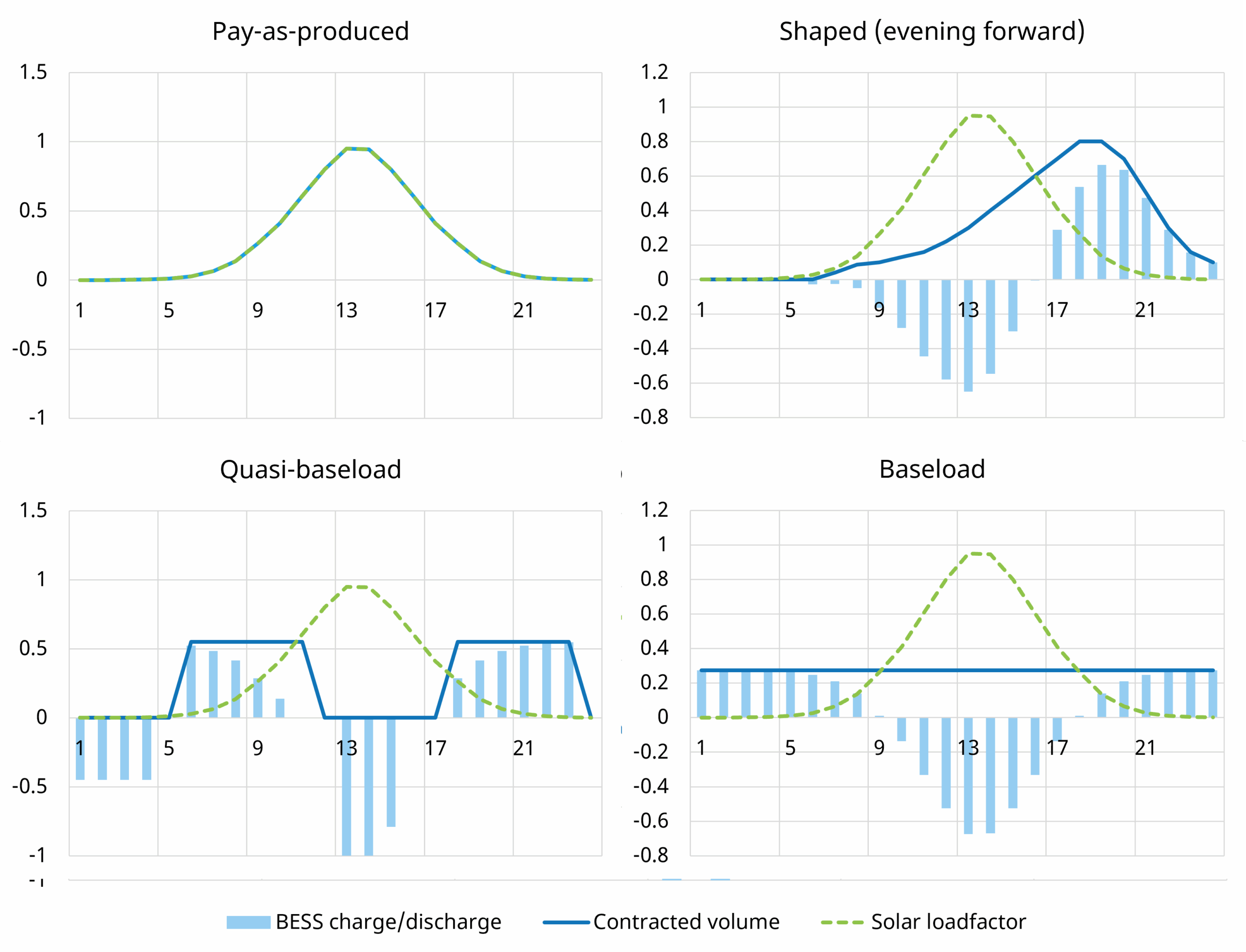

Importantly, hybrid PPAs allow for more diverse contract structures than traditional pay-as-produced solar PPAs. Storage flexibility enables shaped products, evening-delivery blocks, or quasi-baseload profiles, depending on the offtaker’s portfolio requirements.

While many deals still anchor around pay-as-produced for the PV, shaped and baseload hybrids are gaining traction because they allow offtakers to hedge a more predictable profile. More complex structures – such as quasi-baseload profiles – remain early-stage, but are becoming increasingly feasible as co-located BESS scales, and are particularly attractive for offtakers such as utilities and traders.

Chart 2 show examples of the various PPA structure types against solar generation and the charge/discharge actions of the BESS required to meet contracted volumes.

Note: Negative BESS value represents charge action, positive represents discharge. Charts have been simplified for demonstrative purposes and BESS actions would be dependent upon asset duration and power price optimisation.

What these different structures share is a reallocation of risk: BESS flexibility enables hybrid PPAs to meet firmed profiles, while the PPA provides investors with price stability that pure merchant exposure cannot.

However, achieving this certainty usually comes at a discount to the modelled merchant case. This reflects deviation of battery operation from the optimal merchant profile.

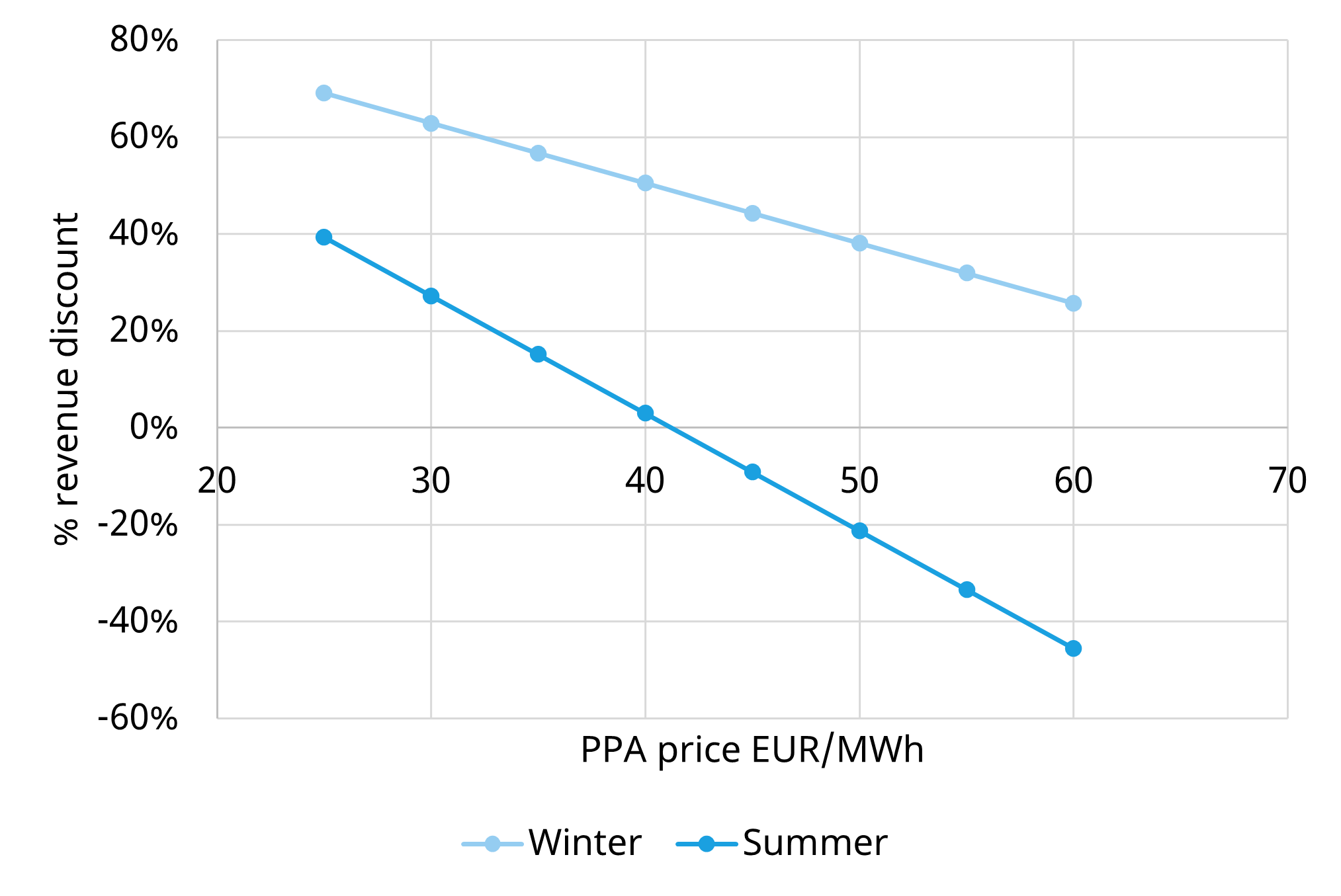

Fixed-price PPA levels for solar often sit below central merchant projections as illustrated in Chart 3. Yet the trade-off can be commercially rational: guaranteed revenue significantly improves bankability, particularly as capture prices are expected to fall further with continued PV growth. We have been working with clients to quantify this trade off.

The chart shows the relative discount of solar margins under different PPA fixed prices (pay-as-produced) relative to the merchant case averaged across a 25-year horizon. Due to the lower capture prices in summer, the PPA case becomes more profitable at just 40EUR/MWh while in winter the PPA margins are at a 25% discount to merchant even at 60EUR/MWh fixed price.

The merchant-vs-PPA decision increasingly hinges on financing requirements and risk appetite. While merchant exposure offers upside potential, PPAs shield projects from deepening price cannibalisation and enable bankable leverage levels. Hybrid PPAs, underpinned by BESS flexibility, are becoming an important tool for balancing these competing priorities.

For more information on our analysis of PPAs and co-located BESS investment in Europe, contact Lucienne Hill Smith, Senior Analyst, at Lucienne.hill.smith@timera-energy.com.